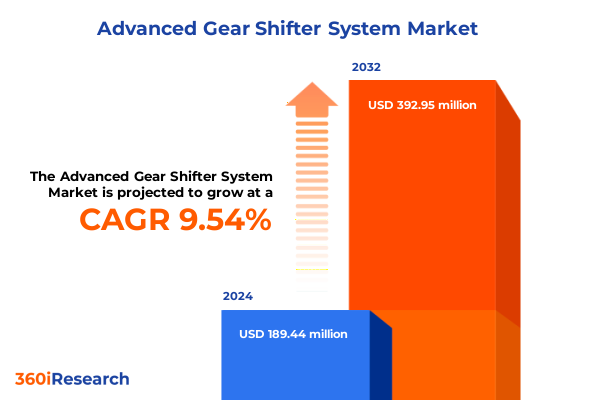

The Advanced Gear Shifter System Market size was estimated at USD 206.38 million in 2025 and expected to reach USD 231.50 million in 2026, at a CAGR of 9.63% to reach USD 392.95 million by 2032.

Introducing the Advanced Gear Shifter System: Unlocking Precision Control and Efficiency for Next-Generation Vehicles with Unparalleled Responsiveness

The global automotive landscape is experiencing an unprecedented wave of innovation, driven by electrification, autonomy, and digital integration. At the heart of this transformation lies the advanced gear shifter system, which has evolved beyond mechanical linkages into a sophisticated interface combining electronic controls, software algorithms, and user-centric design. As vehicles transition to hybrid and fully electric powertrains, shifter systems demand greater precision, reliability, and seamless integration with vehicle electronics to ensure both performance and safety.

Bridging the gap between driver intentions and powertrain response, the modern gear shifter system now incorporates push-button and rotary dial technologies alongside traditional levers, offering enhanced ergonomics and customization. This shift reflects the broader industry emphasis on user experience, where tactile feedback and intuitive controls play a pivotal role. Consequently, OEMs and tier-one suppliers are investing heavily in R&D to deliver solutions that meet stringent regulatory requirements, support advanced driver assistance systems, and align with the digital cockpit environment. In this context, understanding the core dynamics of the advanced gear shifter system becomes critical for stakeholders aiming to navigate the evolving mobility ecosystem and secure future success.

Unveiling Transformation in Transmission Technology and Market Dynamics that Redefine Vehicle Performance and Drive System Integration Strategies

Over the past decade, transmission technology has undergone a profound metamorphosis, reshaping how drivers interact with vehicles and how powertrains deliver torque. Continuous variable transmissions (CVTs) and dual-clutch transmissions (DCTs) have gained traction for their ability to combine efficiency with responsive gear changes, challenging the dominance of conventional automatic and manual systems. At the same time, electronic shift wires have emerged as a transformative innovation, decoupling driver inputs from mechanical linkages and enabling features such as shift-by-wire and electronic park engagement.

Beyond hardware advancements, integration with advanced driver assistance systems (ADAS) and over-the-air software updates has redefined shifter functionality. Push-button and rotary dial modalities offer automakers the flexibility to redesign interior layouts, enhance cabin ergonomics, and deliver a futuristic driving experience. This convergence of mechanical and digital domains not only meets consumer expectations for luxury and convenience but also supports OEMs in optimizing manufacturing and assembly processes. With the rise of e-mobility, gear shifter systems now serve as a critical interface for regenerative braking strategies and drive mode selection, making them indispensable to the modern vehicle architecture. These shifts underscore the need for a comprehensive analysis of the market landscape, encompassing technological trends, regulatory influences, and competitive dynamics.

Assessing the Multifaceted Consequences of 2025 United States Tariffs on Gear Shifter Components and Their Strategic Implications for Manufacturers

In early 2025, the United States government implemented a series of tariffs targeting imported automotive components, including sensors, actuator assemblies, and electronic shift modules integral to advanced gear shifter systems. These policy measures aimed to strengthen domestic manufacturing but have introduced complex cost pressures across global supply chains. Suppliers have faced increased material costs and longer lead times, prompting many to reevaluate sourcing strategies and invest in local production facilities within North America.

Consequently, manufacturers have accelerated partnerships with regional suppliers in Mexico and Canada to mitigate financial impact and ensure uninterrupted component flow. The imposition of tariffs has also influenced contract negotiations with OEMs, leading to more robust clauses around price adjustments and risk sharing. These developments have spotlighted the importance of supply chain resilience, driving investments in inventory buffering and dual sourcing models. While some suppliers have absorbed the additional costs to maintain competitiveness, others are leveraging automation and process optimization to offset margin erosion. Looking ahead, the evolving tariff landscape remains a critical variable for strategic planning, underscoring the need for continuous monitoring of trade policies and proactive engagement with regulatory stakeholders.

Extracting Deep Insights Across Technology Modalities Vehicle Classes Distribution Channels and Critical Components for Tailored Market Positioning

Understanding the advanced gear shifter system market requires a nuanced appreciation of multiple segmentation dimensions. From a technology standpoint, the space encompasses traditional manual and fully automatic systems alongside continuously variable transmissions that offer seamless ratio changes and dual-clutch configurations for rapid gear shifts. Electronic shift wires represent a pivotal sub-segment, where push-button and rotary dial mechanisms deliver a digitally governed alternative to mechanical levers. Each modality addresses distinct consumer and regulatory demands, from cost-effective simplicity to high-end customization.

Vehicle type further differentiates market dynamics, spanning two-wheelers and passenger cars-ranging from compact hatchbacks to full-sized SUVs-all the way to off-road and commercial platforms. Within commercial vehicles, heavy-duty trucks confront unique torque management challenges, whereas light-commercial vans prioritize ease of use and reliability. On the passenger side, hatchbacks focus on urban maneuverability, sedans balance comfort and performance, and SUVs demand durability and off-road capability. This diversity compels suppliers to tailor their offerings to specific chassis architectures and end-use scenarios.

Distribution channels add another layer of complexity, as original equipment manufacturers retain direct relationships with tier-one suppliers, while the aftermarket bifurcates into offline service centers and burgeoning online platforms. Offline channels leverage established dealer networks for maintenance and warranty support, whereas online retailers cater to DIY enthusiasts seeking rapid delivery of customizable shift modules. Finally, component segmentation reveals critical roles for actuators, control modules, lever assemblies, linkages, and sensors. Within the sensor domain, position sensors monitor gear status with high precision, and pressure sensors ensure hydraulic actuation aligns with driver inputs. Integrating these insights across technology, vehicle type, distribution, and components empowers stakeholders to identify niche opportunities and drive targeted product development.

This comprehensive research report categorizes the Advanced Gear Shifter System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Component

- Vehicle Type

- Distribution Channel

Navigating Regional Demand Variances and Strategic Growth Opportunities in the Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics play a decisive role in shaping demand and innovation trajectories for advanced gear shifter systems. In the Americas, strong adoption of push-by-wire technology within electric and hybrid vehicles has catalyzed supplier investments in North American production hubs. Regulatory incentives for domestic sourcing have further accelerated localized manufacturing partnerships, creating a robust ecosystem for next-generation transmission interfaces. Meanwhile, aftermarket growth is notable across both online and offline channels as vehicle owners seek upgrades for performance and customization.

Across Europe, the Middle East, and Africa, stringent emissions standards and a sustained focus on performance have driven demand for dual-clutch and continuously variable transmissions. Legacy manual systems persist in emerging markets, though gradual modernization efforts are encouraging the uptake of electronic gear selectors. Tier-one suppliers in EMEA benefit from proximity to leading automotive OEMs, fostering innovation in sensor technologies and integration with digital cockpits.

The Asia-Pacific region exhibits unparalleled momentum, powered by high vehicle volumes in China and India and a booming two-wheeler sector. Mass-market hatchbacks and entry-level sedans increasingly incorporate electronic shift modules to meet consumer expectations for modern driving experiences. At the same time, local OEMs are forging joint ventures with global suppliers to build manufacturing capacity and adapt products to regional driving conditions. This convergence of scale and innovation positions Asia-Pacific as a critical growth engine for the advanced gear shifter ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Advanced Gear Shifter System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Market Leadership Innovations and Competitive Positioning of Leading Gear Shifter System Manufacturers Across the Industry Landscape

The competitive arena for advanced gear shifter systems is dominated by a mix of global conglomerates and specialized tier-one suppliers, each leveraging core competencies to capture market share. Leading manufacturers such as ZF Friedrichshafen have introduced integrated shift modules that consolidate actuators, linkages, and sensors into a single compact unit, optimizing installation and reducing weight. BorgWarner has focused on electronic shift-by-wire solutions with advanced software controls, enhancing shift quality and enabling customizable drive modes on premium vehicle platforms.

Japanese suppliers like Aisin Seiki and JATCO continue to innovate in the dual-clutch and continuously variable transmission segments, delivering systems renowned for durability and fuel efficiency. Meanwhile, Schaeffler’s sensor and actuator technologies cater to both OEM and aftermarket channels, emphasizing modular designs that simplify maintenance. Continental has pursued strategic partnerships with tech firms to integrate shift modules into broader vehicle connectivity ecosystems, aligning with digital cockpit initiatives.

Smaller specialists are also making impact through targeted innovations in position and pressure sensing, enabling faster calibration and predictive diagnostics. These companies often collaborate with academic institutions to refine sensor algorithms and explore next-generation materials. The varied approaches across incumbents and challengers underscore a vibrant competitive landscape, where agility, technological differentiation, and strategic alliances define market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Advanced Gear Shifter System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Seiki Co., Ltd.

- ATSUMITEC Co., Ltd.

- Boneng Transmission Co., Ltd.

- BorgWarner Inc.

- Continental AG

- Delta Kogyo Co., Ltd.

- Denso Corporation

- Eissmann Automotive Deutschland GmbH

- Faurecia SE

- FICOSA Group

- Flender GmbH

- Fujikiko Co. Ltd.

- JTEKT Corporation

- Kongsberg Automotive

- Kuayue (Group) Co.,Ltd.

- KÜSTER Holding GmbH

- Leopold Kostal GmbH & Co. KG

- Lumax Industries Limited

- M&T ALLIED TECHNOLOGIES.CO.,LTD.

- Magna International Inc.

- Magneti Marelli S.p.A.

- Nexteer Automotive Corporation

- Ningbo Gaofa Automobile Control System Co., Ltd.

- Orscheln Products LLC

- Robert Bosch GmbH

- Sanjeev Group

- Schaeffler AG

- Sila Group

- SL Corporation

- Stoneridge, Inc.

- TOKAIRIKA,CO, LTD.

- Winzeler, Inc.

- ZF Friedrichshafen AG

Actionable Strategic Roadmap for Industry Leaders to Capitalize on Technological Advancements and Market Shifts in Gear Shifter Systems

To thrive in this dynamic environment, industry leaders must adopt a multi-pronged strategy focused on technological advancement, strategic sourcing, and customer-centric solutions. Prioritizing R&D investment in electronic shift-by-wire interfaces will deliver the precision and adaptability required by electric and autonomous vehicle architectures. By collaborating with software developers and cybersecurity experts, manufacturers can embed robust protocols that safeguard against potential vulnerabilities and support over-the-air firmware updates.

Simultaneously, mitigating tariff impacts calls for expanding regional production footprints and diversifying supply bases. Establishing additional assembly lines or forging joint ventures in key trade agreement zones can streamline logistics and reduce cost exposure. Furthermore, deepening relationships with OEMs through co-design initiatives ensures that product roadmaps remain aligned with emerging vehicle platforms and consumer expectations.

From a go-to-market perspective, companies should embrace digital channels for aftermarket sales, leveraging online configurators and predictive maintenance tools to enhance customer engagement. Integrating data analytics across distribution networks can uncover untapped service opportunities and inform targeted marketing campaigns. Finally, pursuing selective mergers or strategic investments in sensor and software startups can accelerate time to market for advanced functionalities, reinforcing a leadership position in the rapidly evolving gear shifter domain.

Detailing Rigorous Research Methodology Combining Primary Interviews Secondary Data Analysis and Proprietary Validation Protocols

This analysis combines primary research conducted through in-depth interviews with senior engineers, product managers, and procurement specialists at OEMs and tier-one suppliers. These discussions provided qualitative insights into technology adoption timelines, design challenges, and strategic priorities. Secondary research encompassed a review of trade association publications, regulatory guidelines, and technical whitepapers to contextualize regulatory impacts and emerging standards.

Data triangulation was performed by cross-referencing information from multiple sources, including public filings, patent databases, and expert commentary. Proprietary validation protocols ensured the reliability of supplier and component mapping, while scenario modeling helped assess the potential implications of tariff fluctuations and supply chain disruptions. To maintain objectivity, an advisory board comprising industry veterans reviewed key findings, refining assumptions and confirming alignment with market realities.

This rigorous methodology underpins the credibility of the insights presented, ensuring a balanced perspective that addresses both current market conditions and anticipated technological evolutions. Stakeholders can rely on these findings to inform strategic decisions, guide investment priorities, and shape product development roadmaps in a manner consistent with best practices in market research.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Advanced Gear Shifter System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Advanced Gear Shifter System Market, by Technology

- Advanced Gear Shifter System Market, by Component

- Advanced Gear Shifter System Market, by Vehicle Type

- Advanced Gear Shifter System Market, by Distribution Channel

- Advanced Gear Shifter System Market, by Region

- Advanced Gear Shifter System Market, by Group

- Advanced Gear Shifter System Market, by Country

- United States Advanced Gear Shifter System Market

- China Advanced Gear Shifter System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Summarizing Key Insights Emphasizing Strategic Imperatives and Future Outlook for Advanced Gear Shifter System Stakeholders

The advanced gear shifter system market stands at the intersection of mechanical engineering and digital innovation, propelled by automotive electrification, autonomy, and shifting regulatory landscapes. Key dynamics include the rapid adoption of electronic shift-by-wire technologies, the strategic realignment of supply chains in response to 2025 tariffs, and the imperative to meet diverse vehicle segment requirements through specialized component offerings.

Regional insights reveal differentiated growth trajectories, from the Americas’ focus on localized manufacturing and aftermarket expansion to EMEA’s performance-driven dual-clutch demand and Asia-Pacific’s high-volume entry-level vehicle production. Leading suppliers are cementing their positions through integrated modules, software partnerships, and strategic alliances, while newcomers leverage sensor innovations to gain footholds.

For industry stakeholders, navigating this complex landscape demands a forward-looking approach that balances investment in technological R&D, agile supply chain strategies, and customer-centric go-to-market models. Embracing data-driven decision making and fostering collaborative partnerships will be instrumental in capturing the opportunities presented by evolving vehicle architectures and consumer preferences. The confluence of these factors underscores a period of unprecedented transformation, offering substantial rewards for those who align their strategies with the market’s dynamic trajectory.

Connect with Ketan Rohom to Secure Comprehensive Gear Shifter System Insights Drive Competitive Advantage and Inform Strategic Decision Making Today

For readers ready to deepen their understanding of the advanced gear shifter system market and access comprehensive data, connecting directly with Ketan Rohom, Associate Director of Sales & Marketing, offers a seamless pathway to acquire the detailed market research report. Engaging with Ketan unlocks exclusive insights tailored to strategic priorities, helping stakeholders capitalize on emerging technological trends and mitigate tariff‐related challenges.

By reaching out, prospects can receive personalized guidance on how the report’s findings align with their business objectives, from optimizing component sourcing strategies to identifying high-growth vehicle segments. Ketan’s expertise ensures that each organization gains actionable intelligence designed to support investment decisions, product development roadmaps, and partnership opportunities. Act now to secure this vital resource and maintain a competitive edge in the rapidly evolving gear shifter system landscape.

- How big is the Advanced Gear Shifter System Market?

- What is the Advanced Gear Shifter System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?