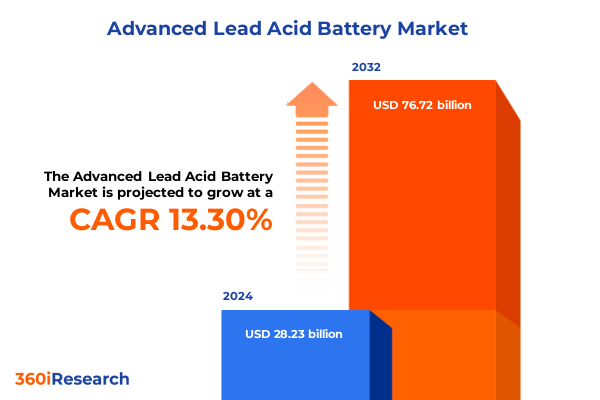

The Advanced Lead Acid Battery Market size was estimated at USD 31.93 billion in 2025 and expected to reach USD 36.12 billion in 2026, at a CAGR of 13.33% to reach USD 76.72 billion by 2032.

Unveiling the Strategic Imperatives and Foundational Market Drivers Shaping the Future Outlook of Advanced Lead Acid Battery Solutions

The world’s growing reliance on resilient and cost-effective energy storage solutions has brought advanced lead acid batteries into sharper focus as a vital technology underpinning critical infrastructure. As industries diversify their energy portfolios to encompass both traditional backup power and sustainable storage applications, the role of mature yet continually evolving chemistries like lead acid has expanded beyond conventional boundaries. This growth reflects a convergence of factors, including rising demand for reliable off-grid power, an intensified focus on lifecycle sustainability, and the imperative to balance performance with affordability.

In recent years, manufacturers have intensified research efforts to improve charge acceptance, cycle life, and depth of discharge characteristics without compromising the inherent recyclability that defines lead acid systems. Novel electrode designs, such as thin-plate pure lead and carbon-enhanced variants, have extended service intervals and reduced total cost of ownership. At the same time, advancements in container materials and separator technologies have improved resistance to vibration, temperature extremes, and overcharge conditions.

Consequently, the advanced lead acid battery market now intersects with diverse end-use sectors, ranging from telecommunications network backup and uninterruptible power supply (UPS) systems to emerging applications in renewable energy integration and hybrid electric vehicles. This intersection highlights the technology’s adaptability and underscores its continued relevance within an increasingly electrified global economy. Collectively, these foundational drivers set the stage for a deeper examination of the transformative shifts and competitive imperatives defining the advanced lead acid battery landscape today.

Exploring the Pivotal Technological and Market Transitions Redefining Performance Standards within the Advanced Lead Acid Battery Ecosystem

A suite of transformative trends is reshaping the advanced lead acid battery market, with technology developments and strategic realignments driving a new era of performance and application diversity. On the technological front, carbon additives incorporated into negative plates have emerged as a critical innovation, accelerating recharge times and enhancing partial state-of-charge operation. In parallel, thin-plate pure lead designs have elevated energy density and extended service life, narrowing the gap with competing chemistries while maintaining the inherent sustainability of lead-based systems.

Moreover, advancements in digital monitoring and smart battery management systems have introduced real-time diagnostics that optimize charge cycles and predict maintenance needs. These data-driven solutions not only reduce downtime for critical infrastructure but also enable remote management capabilities that are increasingly vital for distributed renewable energy installations and off-shore telecommunications sites. At the same time, manufacturers are leveraging automated production techniques to improve quality control and reduce per-unit manufacturing variability, reinforcing the reliability of products destined for mission-critical applications.

Emerging market dynamics further underscore transformational shifts. The convergence of renewable energy growth with electrification mandates has spurred deeper cooperation between battery producers and solar inverter manufacturers, creating integrated energy storage solutions tailored for residential, commercial, and industrial customers. In parallel, evolving end-user expectations around sustainability have accelerated closed-loop recycling programs, compelling both original equipment manufacturers and aftermarket suppliers to adopt circular-economy principles. These shifts collectively signal a market in the midst of rapid modernization, driven by a relentless pursuit of higher efficiency, resilience, and environmental stewardship.

Assessing the Comprehensive Consequences of the 2025 U.S. Tariff Measures on Supply Chains, Manufacturing Costs, and Sectoral Sustainability Trends

The cumulative impact of recently enacted U.S. tariff measures has introduced significant cost pressures across the advanced lead acid battery value chain. On April 2, 2025, the Administration implemented a universal 10% tariff on all imports, accompanied by reciprocal levies targeting 60 trading partners to address perceived unfair trade practices. This broad increase has raised the cost of imported raw materials and components, compelling domestic producers to reassess sourcing strategies and cost structures.

Further compounding these dynamics, effective March 4, 2025, additional tariffs under the International Emergency Economic Powers Act imposed a 25% duty on imports from Canada and Mexico, alongside a 10% to 20% levy on Chinese goods. Given that key inputs-such as purified lead oxide, antimony, and sulfuric acid-are often sourced through cross-border supply chains, manufacturers have faced material cost escalations and logistical complications. As a result, many industry participants have intensified efforts to develop domestic material processing capabilities and to negotiate long-term supply agreements that circumvent high-tariff jurisdictions.

In response to these cumulative duties, strategic mitigation measures have gained traction. Producers are expanding in-house recycling facilities to reclaim lead and acid from end-of-life batteries, thereby reducing dependency on imported chemicals. Additionally, some manufacturers are leveraging bonded warehouse operations and foreign-trade zone strategies to defer or minimize tariff impacts. While these approaches introduce operational complexity, they represent critical adaptations that safeguard cost competitiveness and support the long-term viability of the domestic advanced lead acid battery industry.

Uncovering Deep Cycle, Standby, Aftermarket, OEM, and Application Insights to Illuminate Advanced Lead Acid Battery Segmentation Strategies and Industry Relevance

Advanced lead acid batteries exhibit nuanced performance characteristics across diverse cycle life requirements and channel dynamics, demanding a segmentation lens that captures multiple dimensions of market demand. In high-duty scenarios where consistent deep discharge performance is paramount, deep cycle variants have garnered attention for renewable storage and microgrid applications. Conversely, standby configurations continue to underpin telecommunications infrastructure and emergency backup systems, where infrequent discharge events necessitate robust float-service reliability.

Equally critical are the distinct pathways through which batteries reach end users. An OEM sales channel that embeds batteries within original equipment allows manufacturers to tailor form factors, terminal arrangements, and factory-integrated management systems to specific customer requirements. In contrast, aftermarket supply chains address replacement cycles, facilitating swift battery roll-ins and supporting service providers tasked with minimizing critical-power downtime.

Applications further diversify the market landscape. Within the electric vehicle segment, a trifurcation into pure battery electric vehicles, hybrid systems, and plug-in hybrids reflects varied performance tradeoffs between energy density and cost. Beyond mobility, solar energy storage installations leverage advanced lead acid solutions to balance affordability with off-grid self-sufficiency, while telecommunications networks rely on stable float-service operation to guarantee uninterrupted connectivity. UPS deployments in data centers and health-care facilities emphasize both rapid discharge capabilities and long calendar life. The interplay of these application imperatives underscores the importance of segmentation insights that guide product innovation, targeted marketing, and channel development strategies.

This comprehensive research report categorizes the Advanced Lead Acid Battery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology Type

- Battery Construction

- Voltage Class

- Application

- Sales Channel

Delving into Regional Market Dynamics across the Americas, EMEA, and Asia-Pacific to Illuminate Strategic Pathways in Lead Acid Battery Deployment

Regional dynamics in the advanced lead acid battery market reveal distinct geostrategic drivers and investment priorities across the Americas, EMEA, and Asia-Pacific. In the Americas, a robust automotive sector and expansive telecommunications networks have historically underpinned strong demand for both deep cycle and standby battery solutions. United States policymakers’ focus on domestic energy storage incentives has further stimulated interest in locally sourced batteries, aligning with broader objectives to enhance supply chain resilience and reduce carbon footprints.

Meanwhile, Europe, the Middle East, and Africa present a mosaic of market conditions, from Europe’s emphasis on sustainable transport and grid stabilization to the Middle East’s rapid digital infrastructure rollout and Africa’s need for off-grid electrification. These diverse end-user requirements have encouraged suppliers to develop modular product lines capable of meeting stringent European environmental regulations while remaining cost-competitive in emerging African and Gulf Cooperation Council markets.

Asia-Pacific continues to be a powerhouse in lead acid battery manufacturing, supported by large-scale raw material extraction and established heavy-industry clusters. Government programs incentivizing renewable energy adoption in countries like India and China have catalyzed deep cycle battery growth, while the region’s substantial telecom network expansion has sustained high volumes of standby battery demand. As a result, Asia-Pacific has become both a leading production hub and a dynamic consumption market, with an ongoing emphasis on technology licensing and international joint ventures.

This comprehensive research report examines key regions that drive the evolution of the Advanced Lead Acid Battery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Competitive Strategies, Innovations, and Collaborations Driving Leading Players in the Advanced Lead Acid Battery Industry Ecosystem

Major players in the advanced lead acid battery sector are pursuing differentiated strategies focused on technology innovation, vertical integration, and strategic partnerships. Among these, leading manufacturers have ramped up investments in thin-plate pure lead production lines to deliver higher cycle life and superior energy density. Concurrently, some global suppliers are forging alliances with materials technology firms to co-develop proprietary carbon additive formulations that accelerate recharge times and improve partial state-of-charge performance.

Several industry incumbents are also integrating closed-loop recycling operations to reclaim lead and sulfuric acid, thereby reducing raw material expenses and reinforcing sustainability credentials. Others have established advanced research centers dedicated to next-generation grid storage solutions, where hybrid chemistries and modular system designs are evaluated under real-world operating conditions. Beyond internal R&D, these companies are engaging in cross-sector collaborations-linking battery producers with renewable energy developers, electric vehicle manufacturers, and telecom service providers-to co-innovate and expedite product validation cycles.

Collectively, such strategic moves underscore a broader trend toward ecosystem thinking, where success is increasingly determined by collaborative networks and end-to-end value-chain integration. As market competition intensifies, these approaches are helping industry leaders secure differentiated offerings, strengthen customer loyalty, and create pathways for long-term revenue growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Advanced Lead Acid Battery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amara Raja Batteries Ltd.

- CAMEL GROUP CO., LTD.

- Clarios

- Coslight Technology International Group Co., Ltd.

- Crown Battery

- CSB Energy Technology Co., Ltd.

- Daramic, LLC,

- Discover Battery

- East Penn Manufacturing Company

- Enersys

- Exide Industries Limited

- FIAMM Energy Technology S.p.A.

- First National Battery

- FURUKAWA BATTERY CO., LTD.

- Gridtential Energy, Inc.

- GS Yuasa International Ltd.

- HOPPECKE Carl Zoellner & Sohn GmbH

- Leoch International Technology Limited Inc

- MK Battery

- NorthStar AGM Batteries

- Ritar International Group

- Trojan Battery Company, LLC by C&D Technologies, Inc.

- Zhejiang Narada Power Source Co., Ltd.

Empowering Industry Leaders with Actionable Strategies to Navigate Disruptions, Enhance Resilience, and Drive Sustainable Growth in Advanced Lead Acid Batteries

Industry leaders seeking to capitalize on emerging opportunities in the advanced lead acid battery market must adopt proactive strategies that enhance flexibility and drive efficiency. One critical recommendation is to invest in advanced materials research, focusing on next-generation electrode additives and separator technologies that extend cycle life and improve charge acceptance. By partnering with academic and laboratory institutions, organizations can accelerate innovation cycles and reduce time-to-market for breakthrough products.

In parallel, companies should strengthen supply chain resilience through geographic diversification of raw material sources and the expansion of in-house recycling capabilities. These actions can mitigate exposure to import tariffs and global trade disruptions while underpinning broader sustainability objectives. Moreover, integrating digital battery management systems across product lines will enable predictive maintenance and remote diagnostics, empowering customers to optimize performance and reduce total cost of ownership.

Furthermore, fostering close collaborations with OEMs, renewable energy project developers, and telecom operators can streamline product customization and enhance end-user engagement. Such partnerships open channels for joint pilot deployments and system-level validations, solidifying value propositions in complex applications. Finally, engaging proactively with regulatory bodies and industry associations can influence policy development-particularly around recycling incentives and trade regulations-ensuring that the advanced lead acid battery sector remains both competitive and compliant.

Exploring Rigorous Qualitative and Quantitative Research Approaches That Underpin the Credibility and Depth of the Advanced Lead Acid Battery Market Analysis

This research leverages a multi-method approach to ensure analytical rigor and comprehensive coverage of the advanced lead acid battery market. The process began with extensive secondary research, drawing on a wide array of published materials including government reports, industry white papers, and peer-reviewed journals to map the technology landscape, identify key applications, and assess regulatory frameworks. At the same time, proprietary databases were consulted to compile detailed company profiles, technology roadmaps, and supply chain configurations.

Building on this foundation, a robust primary research program was conducted, featuring in-depth interviews with executives, technical experts, and procurement managers across battery manufacturers, system integrators, and end-user organizations. These conversations provided firsthand perspectives on market dynamics, investment priorities, and competitive positioning. To enhance validity, findings were cross-validated through an expert panel comprising academic researchers, industry consultants, and policy analysts, ensuring that divergent viewpoints were reconciled and data points were thoroughly triangulated.

Finally, qualitative insights and quantitative data were synthesized through rigorous analytical frameworks, generating both thematic narratives and structured comparative assessments. Quality control measures, including peer review and editorial audits, were implemented throughout the process to guarantee accuracy and coherence. The result is a deeply informed, objective, and decision-oriented report designed to support stakeholders at every level of the advanced lead acid battery value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Advanced Lead Acid Battery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Advanced Lead Acid Battery Market, by Technology Type

- Advanced Lead Acid Battery Market, by Battery Construction

- Advanced Lead Acid Battery Market, by Voltage Class

- Advanced Lead Acid Battery Market, by Application

- Advanced Lead Acid Battery Market, by Sales Channel

- Advanced Lead Acid Battery Market, by Region

- Advanced Lead Acid Battery Market, by Group

- Advanced Lead Acid Battery Market, by Country

- United States Advanced Lead Acid Battery Market

- China Advanced Lead Acid Battery Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Synthesizing Key Insights and Forward-Looking Perspectives to Reinforce Strategic Decision Making for Advanced Lead Acid Battery Market Stakeholders

Throughout this executive summary, we have traced the multifaceted evolution of the advanced lead acid battery market, from foundational drivers and technological breakthroughs to regulatory influences and competitive battlegrounds. The introduction underscored the ongoing relevance of lead acid systems within an ever-diversifying energy landscape, while subsequent sections illuminated transformative shifts in materials science, digital integration, and collaborative innovation.

The analysis of U.S. tariff impacts highlighted the complex interplay between trade policy and supply chain strategies, revealing how cost pressures have catalyzed domestic recycling initiatives and alternative sourcing models. Segmentation insights shed light on the distinct performance requirements and channel dynamics that shape demand across deep cycle, standby, OEM, and aftermarket contexts, as well as applications ranging from electric vehicles to critical telecom infrastructure. Regional perspectives further emphasized the importance of tailoring approaches to the unique market conditions of the Americas, EMEA, and Asia-Pacific.

In synthesizing these insights, it becomes clear that success in the advanced lead acid battery industry requires a balanced focus on technological innovation, strategic partnerships, and resilient operations. Looking ahead, stakeholders who align R&D investments with emerging sustainability imperatives, fortify supply chain flexibility, and cultivate ecosystem-wide collaborations will be best positioned to capitalize on growth opportunities. This conclusion sets the stage for actionable recommendations and strategic planning that can guide organizations toward sustained competitive advantage.

Engage with Ketan Rohom to Secure Comprehensive Advanced Lead Acid Battery Market Intelligence and Propel Strategic Growth with Expert Guidance

I invite you to partner with Ketan Rohom, Associate Director of Sales & Marketing, to explore how our in-depth market research can inform your strategic planning and competitive positioning in the advanced lead acid battery sector. By engaging directly with Ketan, you will gain access to a comprehensive suite of insights, customized data analyses, and expert guidance tailored to your organization’s unique challenges and objectives. Connect with Ketan to secure your copy of the full market research report, unlock exclusive executive briefings, and receive personalized recommendations that will empower your team to drive innovation and growth. Take the next step now and leverage industry-leading intelligence to stay ahead of evolving market dynamics and deliver sustainable value to your stakeholders.

- How big is the Advanced Lead Acid Battery Market?

- What is the Advanced Lead Acid Battery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?