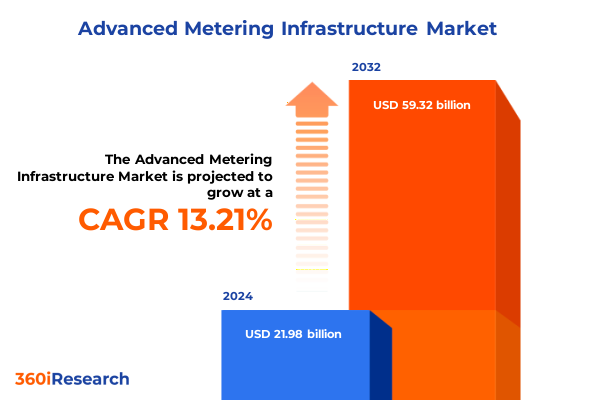

The Advanced Metering Infrastructure Market size was estimated at USD 24.59 billion in 2025 and expected to reach USD 27.51 billion in 2026, at a CAGR of 13.40% to reach USD 59.32 billion by 2032.

Setting the Stage for Smart Utility Transformation through Advanced Metering Infrastructure Insights for Strategic Decision-Making and Operational Excellence

Advanced Metering Infrastructure (AMI) is reshaping the global energy landscape by enabling two-way communication between utilities and end users while delivering real-time insights into consumption patterns. As traditional metering systems give way to intelligent networks, utilities can optimize load management, streamline operations, and enhance grid reliability. This convergence of digital technology with power delivery systems underscores a broader shift toward data-driven decision-making and supports decarbonization initiatives.

Over the past decade, rapid innovations in sensors, communication protocols, and analytics platforms have propelled AMI into the forefront of smart grid strategies. Regulatory mandates and incentives for grid modernization continue to gain momentum, compelling stakeholders to reassess legacy infrastructures. At the same time, heightened expectations for service quality and transparency are driving investments in advanced data management solutions that furnish actionable intelligence.

This executive summary provides a concise yet comprehensive overview of the key dynamics influencing AMI deployment. It highlights transformative market shifts, examines the implications of recent policy changes, and distills segmentation and regional insights. Designed for decision-makers and industry experts, this report delivers strategic takeaways and practical recommendations to inform your next steps in navigating the evolving AMI landscape.

Mapping the Evolution of Data-Driven Utility Ecosystems as Connectivity and Automation Redefine the Utility Infrastructure Landscape and Performance

The AMI landscape is undergoing a profound transformation as utilities transition beyond basic metering to embrace holistic smart grid frameworks. Connectivity innovations from low-power wide-area networks to IPv6-enabled mesh systems are enabling seamless interoperability across devices. Consequently, real-time data flows are informing dynamic load balancing, predictive maintenance, and demand response initiatives.

Concurrently, the rise of edge computing and cloud-native analytics platforms is accelerating the pace of insight generation. Utilities are moving from reactive troubleshooting to proactive asset management, leveraging machine learning algorithms to detect anomalies and forecast equipment failures. This evolution is complemented by an increased focus on cybersecurity, with stakeholders embedding multi-layered defenses into network management and meter data management software.

In parallel, shifting regulatory priorities around renewable integration and carbon reduction are reshaping deployment strategies. Policymakers are incentivizing distributed energy resource management through AMI-enabled interfaces, fostering greater consumer participation in energy markets. As a result, utilities are recalibrating their investment models to capitalize on emerging revenue streams from value-added services such as dynamic pricing and grid-edge virtualization.

Unpacking the Cumulative Consequences of United States Tariff Measures Introduced in 2025 on Advanced Metering Infrastructure Investments

In 2025, a series of tariff adjustments on imported electronic components and commodities imposed by the United States government raised procurement costs for AMI hardware manufacturers. These measures affected critical supply chains for meters, communication modules, and network equipment, prompting a re-examination of sourcing strategies. Given the increased duties on specialized metals and semiconductor devices, the landed cost of smart meter assemblies experienced an upward trajectory.

As a direct consequence, many utilities faced pressure to revisit procurement cycles and contract terms, negotiating longer lead times and exploring alternative suppliers. While some meter vendors absorbed a portion of the incremental costs to preserve pricing competitiveness, others accelerated efforts to localize production and diversify component footprints across multiple geographies. This strategic pivot alleviated exposure to a single supply region and stabilized delivery schedules.

Moreover, the ripple effect extended into operational budgets, compelling program managers to reprioritize project rollouts. In certain municipalities, installation deadlines were deferred to align with revised capital appropriations, whereas innovative financing models emerged to bridge funding gaps. Collectively, these responses underscored the importance of adaptable business models capable of withstanding external policy shocks and maintaining long-term deployment momentum.

Unveiling Critical Insights from Multi-Dimensional Segmentation Revealing How Components Communication Channels Applications and End User Profiles Shape Market Dynamics

Understanding the diverse dimensions that drive AMI adoption requires a holistic view of technology, service, and user parameters. When examining system components, hardware remains foundational, with multi-utility meters, smart electricity meters, smart gas meters, and smart water meters each tailored to specific resource management challenges. Services complement hardware deployment by offering consulting and integration frameworks, expert installation and commissioning guidance, and ongoing support and maintenance to ensure continuous performance and compliance.

Equally vital is the role of software, where cybersecurity modules safeguard network integrity, data analytics engines generate meaningful insights, meter data management platforms consolidate and validate readings, and network management tools orchestrate secure, efficient communications. Beyond system architecture, the choice of communication technology shapes network resilience and latency profiles, whether through cellular networks, Ethernet backbones, power line communication channels, RF mesh topologies, or specialized Wi-Sun protocols.

Application contexts further inform solution designs, as commercial facilities require granular consumption analytics, industrial sites demand robust operational uptime, municipal agencies focus on equitable resource distribution, and residential customers seek user-friendly portals. Finally, end users ranging from electric and gas utilities to multi-utility operators and dedicated water utilities each carry unique regulatory obligations, technical competencies, and service-level expectations. Synthesizing these segmentation lenses illuminates how tailored approaches drive successful AMI rollouts and sustained value realization.

This comprehensive research report categorizes the Advanced Metering Infrastructure market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Communication Technology

- Application

- End User

Exploring Regional Variations in Advanced Metering Infrastructure Adoption Across the Americas EMEA and Asia Pacific Driven by Policy and Technology Drivers

Regional dynamics play a pivotal role in shaping the trajectory of AMI adoption and underpin the differential pace of smart grid advancements worldwide. For the Americas, a combination of federal incentives, state-level mandates, and utility-led modernization programs has fostered widespread deployment of advanced metering systems. This region’s emphasis on data privacy regulations and grid resilience has driven the integration of secure communication backbones and robust data analytics platforms.

In Europe, the Middle East, and Africa, regulatory harmonization under the European Union’s Clean Energy Package and similar frameworks across emerging markets has standardized interoperability requirements and accelerated cross-border project collaborations. Here, decarbonization targets and the proliferation of renewable energy resources have placed a premium on software-driven network management capabilities and predictive analytics to balance distributed generation flows.

Shift to the Asia-Pacific region, and the narrative is defined by rapid urbanization, ambitious electrification campaigns, and a surge in public-private partnerships. Governments in key markets are deploying large-scale pilot projects to validate next-generation communication standards and embed cybersecurity-by-design principles. These initiatives are unlocking new business models for utilities, municipalities, and technology providers, ultimately forging a diversified ecosystem that advances AMI technologies while addressing regional priorities.

This comprehensive research report examines key regions that drive the evolution of the Advanced Metering Infrastructure market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players Driving Innovation and Competitive Strategies in the Advanced Metering Infrastructure Ecosystem for Sustainable Growth

Leading players across the AMI landscape are deploying competitive strategies that span technology innovation, strategic alliances, and service excellence. Global meter manufacturers are expanding their portfolios to include multi-utility platforms capable of capturing electricity, gas, and water data through a unified device. Simultaneously, network equipment vendors are integrating edge-compute capabilities to process critical analytics closer to the meter, reducing latency and enhancing system resilience.

Partnerships between hardware specialists and software innovators are driving the development of cloud-native meter data management and network orchestration suites. Meanwhile, global integrators are customizing consulting services to address local regulatory frameworks, supporting utilities through pilot deployments and full-scale rollouts. In parallel, cybersecurity firms are embedding advanced threat detection and response protocols into AMI solutions, catering to utilities’ growing concerns around grid security.

Service providers have broadened their offerings to include outcome-based contracts that align performance metrics with utility objectives, shifting from traditional time-and-material engagements to subscription-based models. These strategic moves underscore a collective shift toward holistic, end-to-end propositions that deliver greater operational agility and support the evolving needs of both utilities and their customers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Advanced Metering Infrastructure market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Capgemini SE

- DNV AS

- Eaton PLC

- EDF International Networks SAS

- Fluentgrid Limited

- General Electric Company

- Genus Power Infrastructures Ltd.

- German Metering GmbH

- Hitachi Ltd.

- Honeywell International Inc.

- Hubbell Incorporated

- International Business Machines Corporation

- Inventia Technology Consultants Pvt. Ltd.

- Itron Inc.

- Mitsubishi Electric Corporation

- Mueller Systems LLC

- Oracle Corporation

- Schneider Electric SE

- Sensus Solutions by Xylem Inc.

- Siemens AG

- Tieto Corporation

- Toshiba Corporation

- Trilliant Inc.

Strategic Roadmap with Actionable Recommendations to Enhance Operational Efficiency and Future-Proof AMI Investments against Emerging Challenges

Industry leaders should embrace a flexible architecture strategy that supports modular hardware upgrades and software scalability, enabling rapid adaptation to evolving regulatory and technical requirements. By prioritizing interoperability standards and open APIs, stakeholders can avoid vendor lock-in and foster a competitive supplier environment that drives innovation.

Investment in a layered cybersecurity framework is non-negotiable, with utilities instituting robust identity management, encryption protocols, and continuous threat monitoring across all network nodes. This defense-in-depth approach not only mitigates emerging risks but also builds customer and regulator trust in smart grid deployments.

To unlock the full potential of AMI data, organizations must cultivate analytics capabilities that integrate meter data with broader enterprise systems. Leveraging machine learning and predictive tools will enhance asset management, streamline dispatch planning, and support advanced demand response programs. In addition, utility leaders should engage proactively with policymakers to shape incentive structures that accelerate technology adoption and support pilot initiatives focused on distributed energy resource integration.

Finally, workforce development remains critical; equipping personnel with the skills to manage digital networks, analyze complex data sets, and navigate cybersecurity protocols will determine the long-term success of AMI investments.

Detangling the Rigorous Research Methodology Underpinning Data Integrity and Reliability in Comprehensive Advanced Metering Infrastructure Market Analysis and Insights

The research underpinning this study was conducted through a systematic combination of primary and secondary data collection. Primary insights were gathered via structured interviews with utility executives, technology vendors, industry consultants, and regulatory experts, ensuring a comprehensive range of perspectives. Secondary research involved a thorough review of policy documents, technical white papers, and peer-reviewed journals to validate market drivers and technology trends.

To ensure data integrity, raw inputs were subjected to a multi-stage cleansing and verification process. Quantitative data were cross-referenced with publicly available filings, regulatory reports, and patent databases. Qualitative inputs were triangulated through multiple expert consultations to minimize bias and confirm thematic consistency.

A rigorous segmentation framework was applied to organize findings across components, communication technologies, applications, and end users. Regional analysis incorporated socio-economic indices, infrastructure maturity scores, and regulatory maturity benchmarks to highlight local variations. The cumulative insights were synthesized into thematic matrices, supporting both strategic narrative development and actionable recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Advanced Metering Infrastructure market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Advanced Metering Infrastructure Market, by Component

- Advanced Metering Infrastructure Market, by Communication Technology

- Advanced Metering Infrastructure Market, by Application

- Advanced Metering Infrastructure Market, by End User

- Advanced Metering Infrastructure Market, by Region

- Advanced Metering Infrastructure Market, by Group

- Advanced Metering Infrastructure Market, by Country

- United States Advanced Metering Infrastructure Market

- China Advanced Metering Infrastructure Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Summarizing Strategic Takeaways and Concluding Perspectives on the Evolutionary Trajectory of Advanced Metering Infrastructure in Global Energy Systems

In summary, AMI stands at the forefront of smart grid evolution, offering unprecedented visibility and control over utility operations. The convergence of advanced hardware, resilient communication networks, and intelligent software platforms is catalyzing a shift toward proactive asset management, dynamic pricing, and enhanced customer engagement.

Policy shifts, including the recent tariff adjustments in the United States and regulatory incentives across major regions, have introduced new complexities into deployment strategies. Yet, these challenges are driving innovation in supply chain management, localized manufacturing, and outcome-based service models. By aligning strategic investment with flexible architectures and robust cybersecurity frameworks, utilities can safeguard project momentum and derive maximum value from their AMI assets.

Ultimately, successful AMI programs will hinge on the ability to integrate multi-dimensional segmentation insights, adapt to regional nuances, and engage cross-functional teams. Decision-makers who act on these strategic imperatives will be best positioned to navigate an increasingly dynamic energy ecosystem and unlock lasting operational benefits.

Empowering Informed Decisions through Expert Guidance and Personalized Consultation with Ketan Rohom for Tailored AMI Market Intelligence Solutions

To take advantage of these actionable insights and gain competitive advantage, reach out to Ketan Rohom, Associate Director of Sales & Marketing at our firm. He is ready to guide you through tailored AMI research offerings that align with your strategic priorities and operational needs. Begin a personalized consultation today to explore a comprehensive suite of market intelligence solutions designed to address your most critical challenges and accelerate your journey toward a smarter utility ecosystem.

- How big is the Advanced Metering Infrastructure Market?

- What is the Advanced Metering Infrastructure Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?