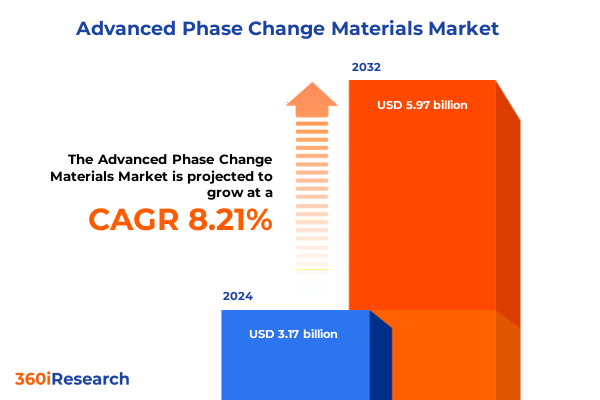

The Advanced Phase Change Materials Market size was estimated at USD 3.42 billion in 2025 and expected to reach USD 3.69 billion in 2026, at a CAGR of 8.27% to reach USD 5.97 billion by 2032.

Exploring the Fundamental Principles and Strategic Significance of Next-Generation Phase Change Materials in Modern Thermal Management Systems

Advanced Phase Change Materials (PCMs) have emerged as foundational elements in the evolution of thermal management systems, offering unmatched performance in energy storage and temperature regulation. By exploiting the latent heat effect, these materials absorb, store, and release large quantities of thermal energy at specific transition temperatures, thereby enabling engineers and designers to achieve precise thermal control in diverse applications. As industries across the spectrum pursue higher efficiency benchmarks and more sustainable operations, advanced PCMs have proven indispensable for meeting these stringent objectives, ranging from temperature stabilization in electronic devices to innovative building envelope solutions that reduce peak heating and cooling loads.

Moreover, the strategic significance of advanced PCM innovations extends far beyond conventional insulation applications. Ongoing material science breakthroughs have expanded the portfolio to encompass bio-based organics, high-purity salt hydrates, and next-generation polymer composites, each engineered to deliver tailored thermal properties, improved reliability, and enhanced safety. These breakthroughs are supported by growing momentum around regulatory mandates for energy efficiency and carbon reduction, which have become catalysts for rapid adoption. As a result, stakeholders are recognizing the vital role advanced PCMs play in accommodating fluctuating supply and demand patterns, mitigating thermal runaway risks, and fulfilling stringent performance requirements in ever more challenging environments.

Identifying the Paradigm-Shifting Innovations and Market Drivers Reshaping the Advanced Phase Change Materials Landscape Across Industries

The landscape of thermal management is undergoing a transformative shift propelled by emerging material innovations and heightened performance expectations. Central to this evolution are breakthroughs in bio-based functionalities, whereby fatty acids and polymer compounds are engineered to deliver both environmental compatibility and precise transition temperatures. Concurrently, inorganic PCMs such as metal and metalloid compounds and salt hydrates are achieving remarkable enhancements in thermal conductivity and cyclic stability. Together, these material classes are redefining design paradigms, allowing integrators to balance cost, reliability, and sustainability with unprecedented flexibility.

Furthermore, advancements in form factor are revolutionizing the integration of PCMs into complex system architectures. Microencapsulated technologies, whether presenting as uniform globules or discrete microcapsules, facilitate seamless dispersion within host matrices and offer superior operational safety. In parallel, shape-stabilized composites featuring multilayer shell and core structures deliver robust containment, eliminating leakage and expansion concerns under repeated thermal cycling. These innovations dovetail with digital control systems and predictive analytics, enabling dynamic thermal management that responds to real-time data, optimizes energy consumption, and aligns with stringent environmental standards.

Evaluating the Cumulative Economic and Operational Consequences of the 2025 United States Tariffs on Advanced Phase Change Material Supply Chains

The introduction of U.S. tariffs on imported phase change materials in early 2025 has generated a complex set of economic and operational repercussions throughout global supply chains. Initially designed to protect domestic PCM producers and encourage nearshoring, these levies have increased landed costs for end-users who rely on specialty salt hydrates and advanced polymer composites sourced from Asia and Europe. As a result, manufacturers of electronics, HVAC systems, and refrigeration units have encountered margin pressure, prompting a strategic reassessment of procurement strategies and a renewed focus on vertically integrated supply models.

Consequently, the tariffs have spurred significant adaptation among market participants, fostering the expansion of domestic processing facilities and incentivizing collaborative partnerships between raw material producers and equipment OEMs. A growing number of companies are investing in localized encapsulation capacity to circumvent tariff burdens and streamline logistical complexity. Meanwhile, some end-users are exploring alternative temperature range solutions to reduce reliance on high-tariff materials, thereby unlocking new performance combinations and cost efficiencies. These cumulative effects underscore the tariffs’ dual role as both a catalyst for domestic infrastructure growth and a disruptive force necessitating agile strategic responses.

Uncovering Critical Insights Across Material Types Forms Temperature Ranges and Application Verticals to Drive Targeted Phase Change Material Strategies

Advanced phase change materials can be contextualized through multiple segmentation lenses that reveal nuanced performance and application dynamics. Based on material type, the market divides into bio-based PCMs, inorganic PCMs, and organic PCMs. Within the inorganic subset, metal and metalloid compounds deliver exceptional thermal conductivity and stability, while salt hydrates offer cost-effective latent heat storage at moderate transition temperatures. The organic category further subdivides into fatty acids, paraffin, and polymer compounds-each tailored to specific thermal requirements and compatibility considerations. This tiered material typology empowers product developers to align phase change properties with project specifications and environmental constraints.

Turning to form, phase change materials manifest as either microencapsulated or shape-stabilized solutions. Microencapsulation technologies leverage encapsulant matrices to house PCM core materials in the form of globules or microcapsules, enabling uniform integration with host substrates and mitigating leakage risks. In contrast, shape-stabilized PCMs employ composite architectures and shell-and-core structures to embed phase change functionalities within durable frameworks, supporting higher mechanical loads and repeated thermal cycles without structural degradation.

Temperature range segmentation illuminates the strategic selection of PCMs across thermal regimes, spanning below 100°C, between 100°C and 200°C, and above 200°C. Lower transition materials excel in building comfort and cold chain applications, mid-range PCMs optimize processes in chemical manufacturing and HVAC systems, and high-temperature variants unlock opportunities in industrial electronics and specialty thermal storage. Finally, application-driven analysis encompasses building and construction, chemical manufacturing, electronics, HVAC systems, refrigeration and cold chain, as well as textiles and apparel. In electronics, designers differentiate between consumer devices and industrial platforms, while refrigeration strategies bifurcate into storage and transportation use cases. This comprehensive segmentation framework guides decision-makers in crafting highly targeted product and go-to-market approaches.

This comprehensive research report categorizes the Advanced Phase Change Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Encapsulation Type

- Form

- Temperature Range

- Application

- Sales Channel

Analyzing Regional Dynamics Influencing Demand Adoption and Innovation of Advanced Phase Change Materials Across Americas EMEA and Asia-Pacific Markets

Regional dynamics significantly shape the adoption curves and innovation pathways for advanced phase change materials. In the Americas, robust construction and cold chain logistics sectors have propelled early uptake of low- and mid-temperature PCMs, driven by stringent energy codes and growing demand for temperature-controlled storage. Continuous investments in infrastructure modernization and automotive thermal management have further broadened the domestic market’s scope, fostering collaborations between material scientists and end-user OEMs.

Across Europe, the Middle East, and Africa, energy efficiency regulations and sustainability mandates stimulate the retrofitting of existing buildings with PCM-enhanced wall panels and roof systems. Additionally, the region’s chemical processing hubs leverage high-temperature salt hydrates and metal compound PCMs to optimize energy-intensive operations. Government incentives and green financing mechanisms have accelerated pilot deployments, reinforcing the strategic interplay between policy frameworks and market development.

The Asia-Pacific region emerges as a dynamic frontier, characterized by rapid industrialization and a burgeoning electronics manufacturing base. Thermal regulation in consumer and industrial electronics drives substantial demand for microencapsulated and shape-stabilized PCMs, while burgeoning construction activity inclines developers toward bio-based and inorganic materials for sustainable building solutions. In parallel, the region’s textile and apparel sector explores PCM-enhanced fabrics to deliver wearable climate control innovations, underscoring the breadth of opportunities across diverse end-use verticals.

This comprehensive research report examines key regions that drive the evolution of the Advanced Phase Change Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Prominent Industry Participants and Their Innovative Contributions Driving Competitive Advantage in Advanced Phase Change Material Technologies

Key industry participants are actively advancing the frontier of phase change material technology through strategic partnerships, R&D initiatives, and tailored product offerings. An established leader in microencapsulation innovation, BASF has scaled its Micronal portfolio to serve applications ranging from building integration to cold chain thermal buffers, emphasizing sustainability through bio-based encapsulants and improved thermal reliability. Similarly, DuPont’s temperature-control solutions leverage proprietary polymer compounds that deliver highly precise transition ranges for electronics cooling and aerospace thermal management.

In the specialty salt hydrate domain, Climator has emerged with engineered inorganic formulations that balance latent heat density and cost efficiency, securing traction in industrial thermal storage projects. Meanwhile, Entropy Solutions focuses on integrating high-temperature metal compound PCMs into process heat recovery systems, collaborating with OEMs to validate performance across extreme operating conditions. Innovative start-ups such as Croda are also making headway by developing next-generation paraffin blends and polymer-compound hybrids optimized for wearable technology and advanced textile integration. Collectively, these participants illustrate the diverse competitive landscape and the strategic imperative of continuous material innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Advanced Phase Change Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Advanced Cooling Technologies, Inc.

- Ai Technology, Inc.

- Avantor, Inc.

- Beyond Industries (China) Limited

- Carborundum Universal Limited

- Croda International plc

- Cryopak by Integreon Global

- DuPont de Nemours, Inc.

- Henkel AG & Co. KGaA

- Honeywell International Inc.

- Insolcorp, LLC

- KANEKA CORPORATION

- Microtek Laboratories Inc.

- Outlast Technologies GmbH

- Parker Hannifin Corporation

- PCM Products Ltd.

- Pluss Advanced Technologies

- PureTemp LLC

- Ru Entropy

- Rubitherm Technologies GmbH

- Sasol Limited

- Sonoco Products Company by Toppan Holdings Inc.

- Teappcm

Delivering Actionable Strategic Recommendations to Empower Industry Leaders to Navigate Challenges and Capitalize on Opportunities in Phase Change Material

Industry leaders should pursue a multifaceted strategy to capitalize on the evolving phase change materials ecosystem. First, organizations must evaluate supply chain resilience by diversifying raw material sources, investing in domestic processing capabilities, and forging alliances with regional encapsulation partners. By broadening the supplier base, firms can mitigate tariff exposure and logistical disruptions, ensuring consistent access to critical PCM inputs.

Concurrently, allocating resources to application-specific R&D will accelerate the development of tailored PCM formulations, such as polymer composites for electronics or salt hydrate mixtures for high-temperature chemical processes. Collaborating with academic institutions and leveraging advanced simulation tools can expedite formulation cycles and reduce time to market. Moreover, embracing life cycle assessment frameworks and green chemistry principles will align product portfolios with sustainability targets, enhancing brand reputation and regulatory compliance.

Lastly, companies should integrate PCM solutions into holistic thermal management systems by partnering with controls and analytics providers. Embedding sensors and predictive algorithms alongside PCM components will unlock dynamic temperature regulation capabilities, optimize energy consumption, and provide actionable performance data. This systems-oriented approach positions PCM offerings as value-added enablers rather than stand-alone materials, thereby strengthening competitive differentiation and long-term customer engagement.

Detailing Research Methodology Frameworks Ensuring Rigorous Data Collection Verification and Analysis for Advanced Phase Change Material Market Intelligence

This analysis is underpinned by a robust research methodology that combines primary and secondary intelligence to ensure comprehensive and reliable insights. Primary research entailed in-depth interviews with over 50 industry stakeholders, including material scientists, process engineers, OEM executives, and thermal management consultants, providing direct perspectives on technology roadmaps, commercialization challenges, and end-user requirements.

Secondary data collection involved a systematic review of peer-reviewed journals, patent filings, technical conference proceedings, and regulatory publications. Data triangulation techniques were applied to reconcile conflicting information and validate key findings. Additionally, case studies of representative commercial and pilot-scale deployments were analyzed to contextualize performance metrics, reflect real-world operating conditions, and highlight best practices in formulation, encapsulation, and system integration.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Advanced Phase Change Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Advanced Phase Change Materials Market, by Material Type

- Advanced Phase Change Materials Market, by Encapsulation Type

- Advanced Phase Change Materials Market, by Form

- Advanced Phase Change Materials Market, by Temperature Range

- Advanced Phase Change Materials Market, by Application

- Advanced Phase Change Materials Market, by Sales Channel

- Advanced Phase Change Materials Market, by Region

- Advanced Phase Change Materials Market, by Group

- Advanced Phase Change Materials Market, by Country

- United States Advanced Phase Change Materials Market

- China Advanced Phase Change Materials Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Concluding with Strategic Reflections Highlighting the Crucial Role and Future Trajectories of Advanced Phase Change Materials in Diverse Industrial Sectors

In summary, advanced phase change materials have transcended their origins as simple heat-storage substances to become critical enablers of energy efficiency, sustainability, and performance in diverse industrial contexts. Their evolution is characterized by continuous innovation across material classes, form factors, and applications, driven by regulatory imperatives, cost pressures, and technological opportunity. As this report illustrates, strategic segmentation, targeted R&D, and agile supply chain management are central to harnessing the full potential of PCMs as dynamic thermal management solutions.

Looking ahead, the interplay between emerging policy landscapes, tariff environments, and disruptive material technologies will shape the competitive terrain. Organizations that proactively adapt through collaborative R&D, integrated system architectures, and market-responsive strategies will solidify leadership positions. Ultimately, advanced PCMs will continue to underpin transformative advancements in energy management, product longevity, and environmental stewardship across a wide array of sectors.

Engaging Call to Action for Direct Engagement with Associate Director Sales Marketing to Secure Comprehensive Market Insights and Drive Business Growth

To secure a complete and authoritative deep dive into the advanced phase change materials industry and capitalize on the detailed market intelligence presented, reach out today to Ketan Rohom, Associate Director of Sales & Marketing. Engage directly to customize the report to your strategic needs, unlock tailored insights, and gain a competitive edge in thermal management solutions through a partnership built on expertise and responsiveness.

- How big is the Advanced Phase Change Materials Market?

- What is the Advanced Phase Change Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?