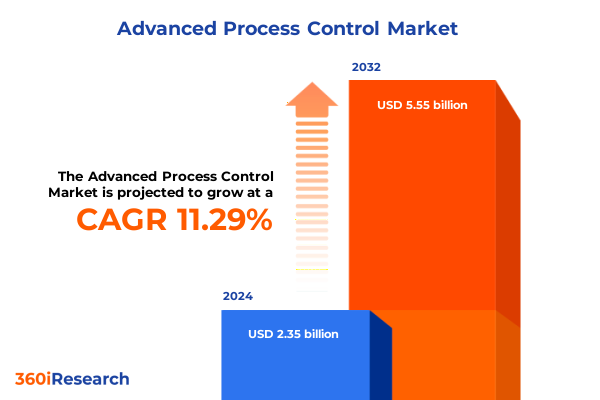

The Advanced Process Control Market size was estimated at USD 2.60 billion in 2025 and expected to reach USD 2.88 billion in 2026, at a CAGR of 11.42% to reach USD 5.55 billion by 2032.

Pioneering the Next Generation of Industrial Efficiency Through Advanced Process Control and Intelligent Automation Solutions

In today’s rapidly evolving industrial environment, the demand for robust, precise, and adaptive control solutions has never been greater. As global competition intensifies and operational complexities multiply, manufacturers and process operators are under unprecedented pressure to optimize throughput, maintain stringent quality standards, and uphold the highest safety protocols. Advanced Process Control represents a pivotal convergence of real-time data analytics, predictive modeling, and automated decision-making that enables organizations to transcend the limitations of traditional regulatory control systems.

By integrating cutting-edge algorithms with plant-wide instrumentation and control architectures, advanced process control empowers operations teams to anticipate disturbances, dampen process variability, and continuously fine-tune performance. This shift away from reactive interventions toward proactive, model-based management not only enhances asset utilization and product consistency but also creates new avenues for energy conservation and decarbonization. In essence, this introduction illuminates how organizations can harness intelligent control frameworks to drive resilience, profitability, and sustainable growth in an era defined by digitalization and supply chain challenges.

Reimagining Industrial Process Landscapes with AI Orchestration Digital Twins and Edge-Enabled Control Architectures and Cybersecurity Integration

The landscape of process control is undergoing transformative shifts driven by the convergence of artificial intelligence, digital twins, and edge computing. By orchestrating machine learning models alongside virtual replicas of physical assets, organizations can simulate scenarios, forecast potential upsets, and preemptively optimize operating conditions. These innovations, when coupled with edge-enabled control platforms, facilitate millisecond-level response times and minimize reliance on centralized infrastructures, laying the foundation for resilient, distributed automation architectures.

Simultaneously, the emphasis on cybersecurity integration has never been more pronounced. As control networks extend to the enterprise and beyond, safeguarding the integrity and confidentiality of process data becomes a strategic imperative. Integrated AI-powered threat detection, multi-layered encryption, and zero-trust network access models are now core components of advanced control deployments. These evolving capabilities not only protect critical operations but also ensure regulatory compliance and foster stakeholder confidence across the value chain.

Assessing the Far-Reaching Implications of Recent United States Tariffs on Process Control Technology Supply Chains and Costs

Recent changes in United States tariff policies have introduced new cost pressures and supply chain complexities for process control technology providers and end users alike. With levies imposed on key components such as specialized sensors, control valves, and high-performance computing modules, procurement teams are compelled to navigate higher acquisition costs while preserving reliability and safety standards. In response, many organizations are reevaluating supplier portfolios, negotiating longer-term agreements to stabilize pricing, and exploring regional manufacturing alternatives to mitigate import surcharges.

These tariff-driven disruptions have also accelerated the trend toward strategic reshoring and nearshoring of critical production and assembly activities. By cultivating local partnerships and establishing dual-sourcing strategies, companies can shorten lead times, reduce exposure to geopolitical uncertainty, and maintain greater control over quality assurance processes. In parallel, collaborative engagements with technology vendors are emerging to share risk and align incentives for innovation, ensuring that new control solutions remain both cost-effective and future-ready.

Uncovering Strategic Insights Across Hardware Services Software End-User Industries Cloud and On-Premise Deployment and Control Modalities

Strategic insights emerge when examining the market through a component lens, where hardware, services, and software intersect to deliver cohesive control ecosystems. The hardware segment underpins reliable input-output processing, high-precision measurement, and rugged industrial connectivity. Services encompass ongoing support, customization, and performance optimization to adapt control schemes over asset lifecycles. Meanwhile, software delivers the intellectual core-model libraries, advanced control routines, and intuitive visualization tools-that guide each real-time decision.

From the perspective of end-user industries-spanning chemicals, metals & mining, oil & gas, pharmaceuticals, power, and pulp & paper-diverse operational imperatives shape adoption patterns. Chemical and pharmaceutical plants prioritize tight reaction control and product purity, whereas metals & mining operations emphasize throughput maximization and equipment uptime in harsh environments. Deployment modes further influence strategic considerations, with cloud-native solutions offering rapid scalability and remote accessibility contrasted against on-premise installations that satisfy stringent latency and data sovereignty requirements. Control types round out the picture, as organizations choose between advanced regulatory control for enhanced setpoint management, multivariable predictive control for optimized multistream interactions, or traditional regulatory control for established stability and simplicity.

This comprehensive research report categorizes the Advanced Process Control market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Control Type

- Deployment Mode

- End User Industry

Mapping Regional Dynamics and Growth Opportunities Across the Americas Europe Middle East Africa and Asia-Pacific Industrial Sectors

Regional dynamics play a pivotal role in shaping how advanced process control solutions are adopted and tailored to specific market demands. In the Americas, industry leaders are embracing digital transformation initiatives to boost productivity in chemicals and oil & gas sectors, supported by robust capital investment and a favorable regulatory environment. This region’s mature infrastructure and strong R&D partnerships have catalyzed rapid integration of AI-driven control platforms and collaborative robotics into existing facilities.

Across Europe, the Middle East, and Africa, regulatory mandates on emissions reduction and energy efficiency have accelerated demand for control architectures that enable precise process tuning and continuous optimization. Energy-intensive industries in EMEA are collaborating with technology providers to deploy digital twins and real-time performance dashboards that align with sustainability targets. Meanwhile, in the Asia-Pacific arena, expanding manufacturing capacities in electronics, power generation, and petrochemicals are driving significant investments in cloud-enabled control solutions. Government incentives for smart factory initiatives and public-private partnerships are further fueling the region’s rapid uptake of IEC 62443-compliant systems and IIoT-integrated automation.

This comprehensive research report examines key regions that drive the evolution of the Advanced Process Control market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators and Strategic Collaborators Shaping the Future of Advanced Process Control Solutions

Leading technology providers continue to shape the trajectory of the advanced process control landscape through targeted innovations, strategic partnerships, and service expansions. Major incumbents have bolstered their portfolios with AI-infused control modules, scalable cloud offerings, and cybersecurity enhancements. Collaboration with startup ecosystems has brought fresh perspectives on machine learning applications, while joint ventures with software giants have facilitated seamless integration of enterprise resource planning and manufacturing execution systems.

By investing in modular architectures and open standards, these companies are enabling end users to adopt plug-and-play control components, thereby accelerating deployment timelines and reducing total cost of ownership. Additionally, an emphasis on outcome-based service contracts has emerged, aligning vendor incentives with client performance objectives such as energy savings, throughput gains, and yield improvements. This shift toward value-centric engagements underscores a maturation in the vendor-customer relationship, where long-term operational success is the ultimate benchmark of innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Advanced Process Control market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Ametek. Inc.

- Aspen Technology, Inc.

- Autodesk Inc.

- AVEVA Group plc

- Codesys Group

- Delta Electronics, Inc.

- Emerson Electric Co.

- Fanuc Corporation

- Fuji Electric Co., Ltd.

- General Electric Company

- Hitachi Ltd.

- Honeywell International Inc.

- KUKA AG

- Mitsubishi Electric Corporation

- Murata Manufacturing Co., Ltd.

- Omron Corporation

- Panasonic Corporation

- Robert Bosch GmbH

- Rockwell Automation, Inc.

- Schneider Electric SE

- Seiko Epson Corporation

- Siemens AG

- Texas Instruments Incorporated

- Toshiba Corporation

- UiPath

- Yokogawa Electric Corporation

Empowering Industry Leaders with Strategic Roadmaps for Adopting and Optimizing Advanced Process Control Initiatives

To capitalize on the evolving control environment, industry leaders should prioritize the deployment of scalable architectures that accommodate future technological advances. Building cross-functional teams that unite process engineers, data scientists, and IT security specialists will foster holistic control strategies and accelerate time to value. Cultivating partnerships with cloud and AI solution providers can expedite proof-of-concept trials and establish blueprints for wider roll-outs.

Furthermore, strengthening cybersecurity frameworks through rigorous vulnerability assessments and zero-trust access policies will safeguard critical operations as networks become more interconnected. Upskilling the workforce with targeted training programs in data analytics, model-based control, and digital twin management will ensure that teams can effectively leverage new tools. Embracing continuous improvement cycles-driven by real-time performance analytics and predictive maintenance insights-will help organizations sustain competitive advantage and adapt to market or regulatory shifts with agility.

Detailing Rigorous Research Frameworks and Analytical Approaches Underpinning Process Control Market Intelligence

Our research methodology integrates a multi-layered approach, commencing with an exhaustive review of industry publications, white papers, and regulatory documentation to establish foundational trends and emerging technologies. This secondary research phase is complemented by in-depth interviews with senior executives, control system engineers, and domain experts to capture nuanced perspectives on deployment challenges, best practices, and innovation drivers.

Data triangulation techniques are applied to validate findings, ensuring consistency across quantitative insights and qualitative feedback. Vendor profiles and use-case analyses are developed through collaborative workshops and site visits, while independent expert panels review and refine key assumptions. This rigorous framework underpins the credibility of our insights, delivering actionable intelligence that aligns with the complex realities of advanced process control implementations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Advanced Process Control market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Advanced Process Control Market, by Component

- Advanced Process Control Market, by Control Type

- Advanced Process Control Market, by Deployment Mode

- Advanced Process Control Market, by End User Industry

- Advanced Process Control Market, by Region

- Advanced Process Control Market, by Group

- Advanced Process Control Market, by Country

- United States Advanced Process Control Market

- China Advanced Process Control Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Consolidating Core Takeaways and Future-Proofing Strategies for Stakeholders in Advanced Process Control

The convergence of AI, digital twins, and edge-enabled architectures is irrevocably transforming advanced process control from a support function into a strategic differentiator. Across components, industries, and regions, the imperative to optimize performance, reduce emissions, and enhance safety drives deeper integration of intelligent control systems. As tariff realignments and geopolitical shifts reshape supply chains, organizations must adopt adaptable sourcing strategies and foster collaborative vendor ecosystems.

By embracing flexible deployment modes and outcome-based service models, companies can unlock new levels of operational resilience. The insights presented herein highlight the critical interplay between technology innovation, regulatory compliance, and strategic partnerships. As stakeholders chart their paths forward, vigilant attention to emerging trends, workforce capabilities, and cybersecurity imperatives will be essential to realizing the full promise of advanced process control.

Connect with Associate Director Ketan Rohom to Access Comprehensive Advanced Process Control Market Insights and Reports

To access the full breadth of insights and strategic recommendations outlined in this analysis, connect directly with Associate Director Ketan Rohom for a personalized discussion. Leveraging his extensive expertise in advanced process control market dynamics, he can guide you through tailored data sets, proprietary benchmarking information, and hands-on support to help you translate these findings into immediate operational improvements. Secure your competitive edge by partnering with him to obtain the comprehensive market research report, designed to empower decision-makers with the clarity and confidence needed to shape resilient control strategies for the years ahead.

- How big is the Advanced Process Control Market?

- What is the Advanced Process Control Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?