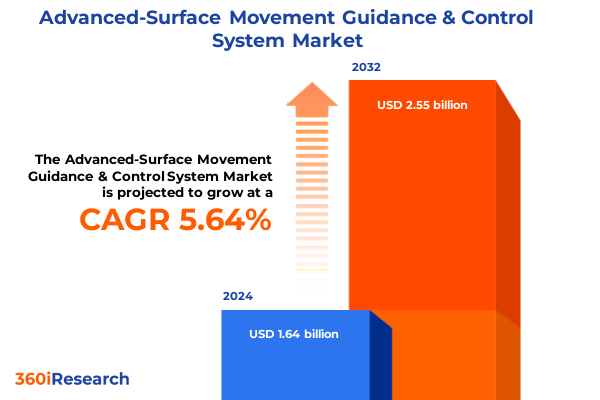

The Advanced-Surface Movement Guidance & Control System Market size was estimated at USD 1.72 billion in 2025 and expected to reach USD 1.80 billion in 2026, at a CAGR of 5.77% to reach USD 2.55 billion by 2032.

Setting the Stage for Evolution in Airport Surface Movement Guidance and Control Systems Amid Heightened Safety and Efficiency Demands

The advanced surface movement guidance and control system landscape is undergoing unprecedented transformation as global air traffic volumes surge and safety imperatives intensify. Airports and air navigation service providers are tasked with maximizing runway throughput while minimizing the risk of incursions and operational disruptions. In response, stakeholders are adopting increasingly sophisticated sensor arrays, integrated communication platforms, and predictive analytics to orchestrate the seamless flow of aircraft and vehicles on the tarmac.

Against this backdrop, the demand for real-time situational awareness has never been higher. Precision in tracking and guiding mobile assets is essential to reduce taxi times, lower emissions, and support wider sustainability goals. Concurrently, the proliferation of unmanned vehicles and military operations within civil airspaces has elevated the need for adaptive control architectures capable of managing heterogeneous traffic streams under stringent regulatory oversight.

This executive summary introduces the core dynamics shaping the advanced surface movement guidance and control system sector. It distills critical shifts, evaluates the impact of recent trade policies, and highlights segmentation, regional trends, and leading corporate strategies. Designed to inform decision-makers, the summary provides a concise yet comprehensive foundation for strategic planning, investment prioritization, and operational enhancements in an era defined by complexity and opportunity.

Uncovering the Transformative Forces Reshaping Surface Movement Guidance and Control Technologies in a Rapidly Evolving Operational Ecosystem

Emerging artificial intelligence and machine learning capabilities are redefining the boundaries of surface movement guidance and control. By leveraging advanced algorithms, operations centers can now predict potential conflicts and optimize routing paths with a level of precision previously reserved for en-route traffic management. This shift is rapidly accelerating the deployment of digital twin environments, wherein virtual replicas of airport surfaces permit rigorous scenario testing, continuous performance tuning, and proactive incident mitigation.

Simultaneously, the integration of interoperable communication standards is fostering seamless collaboration among vehicles, control towers, and ground service fleets. Enhanced data exchange protocols facilitate condition-based maintenance and instantaneous software updates, strengthening system resilience against cyber threats. Moreover, the move toward cloud-native solutions ensures rapid scalability while preserving on-premise capabilities for mission-critical applications.

In parallel, sustainability and electrification trends are nudging manufacturers and operators to innovate low-impact guidance devices and support equipment that reduce fuel consumption and carbon emissions. The emergence of electric automated towing vehicles and electric ground power units complements radar and optical surveillance improvements. Together, these advances form the bedrock of a more efficient, secure, and environmentally responsible ecosystem for managing surface movements.

Assessing the Cumulative Consequences of Recent United States Tariff Measures on Surface Movement Guidance and Control System Supply Chains

The imposition of broad U.S. tariffs on aerospace and defense imports in early 2025 has introduced a layer of complexity to surface movement guidance and control supply chains. Many critical hardware components-such as communication modules, control units, guidance devices, and high-precision sensors-rely on globally sourced alloys and electronic assemblies subject to duties ranging from 10% to 25%. For instance, leading suppliers have reported significant financial exposure, with RTX projecting a $850 million impact and GE Aerospace anticipating roughly $500 million in additional costs tied to new duties on metals and precisely engineered parts (Reuters; CNBC). These headwinds have prompted tier-one contractors and specialized system integrators to reassess procurement strategies and accelerate near-shoring initiatives where feasible.

Extracting Essential Market Intelligence Through Holistic Segmentation Analysis Across Technologies Components Applications Usage Modes and User Profiles

A multi-dimensional segmentation framework reveals nuanced market dynamics when viewed through various analytical lenses. On the technology front, infrared detectors coexist alongside laser and optical sensors, while radar and satellite-based surveillance solutions offer layered redundancy for all-weather operability. Component analysis shows hardware investments spanning communication modules, control units, guidance devices, and sensors complemented by extensive services in installation, integration, and maintenance, as well as software platforms dedicated to control, diagnostics, and tracking workflows. Application segmentation underscores differentiation between airport operations, cargo handling zones, helicopter pads, military airfields, and unmanned vehicle pathways, each demanding tailored configurations for peak performance. From the end-user perspective, the ecosystem serves major airports, defense agencies, ground transportation firms, logistics providers, and seaports, reflecting diverse operational priorities and regulatory requirements. Meanwhile, choice of installation mode-cloud-based versus on-premise-and system type-fixed installations or mobile solutions-further drive customization and deployment strategies across the sector.

This comprehensive research report categorizes the Advanced-Surface Movement Guidance & Control System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Installation Mode

- System Type

- Application

- End User

Revealing the Strategic Regional Variations Driving Adoption and Innovation in Surface Movement Guidance and Control Solutions Worldwide

Distinct regional imperatives influence the pace of adoption and the nature of surface movement solutions across the Americas, Europe, the Middle East, Africa, and Asia-Pacific. In North America, modernization initiatives are anchored in the U.S. FAA’s NextGen program, driving integration of digital communication protocols and remote tower experiments, while major hub airports pursue automated taxi planning to compress turnaround times. Across Europe, the Single European Sky ATM Research framework coordinates seamless cross-border guidance standards, and growing defense budgets in the Middle East fund state-of-the-art control centers at emerging gateway airports.

This comprehensive research report examines key regions that drive the evolution of the Advanced-Surface Movement Guidance & Control System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Industry Players and Their Strategic Initiatives Steering the Competitive Advanced Surface Movement Guidance and Control Landscape

Leading providers are deploying differentiated strategies to secure market leadership. Thales has leveraged its defense-grade surveillance portfolio to enhance ground control offerings, adjusting production footprints and temporary import arrangements to buffer tariff impacts while maintaining global service commitments (Reuters). Leonardo has consolidated its position through high-profile radar upgrades at key international airports and expanded runway incursion warning systems, demonstrating the strategic value of comprehensive hardware-software integration across diverse geographies (Leonardo Press Release). Meanwhile, established avionics and automation specialists are forging partnerships with cloud infrastructure firms to deliver hybrid installation models, and several regional champions are intensifying investment in R&D to refine AI-driven predictive maintenance and conflict-resolution algorithms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Advanced-Surface Movement Guidance & Control System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADB SAFEGATE

- Atg Airports Limited

- AZIMUT

- BAE Systems PLC

- Easat Radar Systems Limited

- ERA a.s.

- Frequentis AG

- Honeywell International Inc.

- Indra Sistemas, S.A

- Japan Radio Co., Ltd.

- Kongsberg Gruppen ASA

- Leonardo S.p.A.

- Moog Inc.

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Saab AB

- Searidge Technologies Inc.

- Surface Combustion, Inc.

- TAMAGAWA SEIKI Co., Ltd.

- Terma Group

- Thales Group

- Vaisala Oyj

Implementing Strategic Recommendations for Industry Leaders to Capitalize on Emerging Opportunities in Surface Movement Guidance and Control Systems

To seize emerging growth avenues, industry leaders should prioritize a three-pronged approach focusing on technological agility, strategic supply chain diversification, and partnership ecosystems. First, cultivating an innovation pipeline that integrates AI-enabled situational awareness and digital twin capabilities will bolster operational responsiveness and safety. Second, proactive engagement with alternate suppliers and localized manufacturing hubs will mitigate the financial and logistical impacts of fluctuating tariff regimes. Third, forging alliances with systems integrators, cloud service providers, and regulatory stakeholders can fast-track certification, reduce time to deployment, and expand service offerings across adjacent domains such as autonomous ground vehicles and unmanned aerial systems.

Detailing the Rigorous Research Methodology Underpinning the Insights into Advanced Surface Movement Guidance and Control System Dynamics

This study employs a rigorous mixed-methodological framework combining primary interviews with airport operators, avionics manufacturers, and service providers, alongside secondary analysis of industry white papers, regulatory filings, and publicly disclosed financials. Proprietary models triangulate qualitative insights and quantitative data points to ensure robust validation. Key steps include stakeholder mapping across the technology and service value chain, in-depth case studies of pioneering airport deployments, and cross-referencing of tariff schedules with historical procurement records to quantify supply-chain exposures. The research integrates scenario modeling to assess resilience against policy shifts, enabling a forward-looking perspective on system scalability and interoperability challenges.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Advanced-Surface Movement Guidance & Control System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Advanced-Surface Movement Guidance & Control System Market, by Component

- Advanced-Surface Movement Guidance & Control System Market, by Technology

- Advanced-Surface Movement Guidance & Control System Market, by Installation Mode

- Advanced-Surface Movement Guidance & Control System Market, by System Type

- Advanced-Surface Movement Guidance & Control System Market, by Application

- Advanced-Surface Movement Guidance & Control System Market, by End User

- Advanced-Surface Movement Guidance & Control System Market, by Region

- Advanced-Surface Movement Guidance & Control System Market, by Group

- Advanced-Surface Movement Guidance & Control System Market, by Country

- United States Advanced-Surface Movement Guidance & Control System Market

- China Advanced-Surface Movement Guidance & Control System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Concluding Perspectives on Navigating the Future of Airport Surface Movement Guidance and Control in a Complex and Interconnected Global Environment

In a period characterized by rapid digitalization, policy volatility, and escalating safety demands, advanced surface movement guidance and control systems stand at the confluence of operational excellence and technological innovation. Stakeholders who anticipate transformative shifts, whether driven by artificial intelligence, sustainability mandates, or trade policy disruptions, will be best positioned to capture efficiency gains and elevate safety standards. The insights encapsulated in this summary provide a strategic foundation for targeted investments, collaborative initiatives, and adaptive planning as the ecosystem navigates an increasingly complex global environment.

Engaging with Ketan Rohom to Secure Comprehensive Advanced Surface Movement Guidance and Control System Research for Strategic Decision Making

Unlock unparalleled strategic insights by partnering with Ketan Rohom, Associate Director of Sales & Marketing, to acquire the definitive market research report on advanced surface movement guidance and control systems. Engage directly to explore tailored solutions that align with your organization’s objectives and capitalize on the latest findings. Through a personalized consultation, you will gain immediate access to comprehensive analyses, in‐depth competitive assessments, and actionable intelligence required to drive operational excellence. Contact Ketan to secure your copy of this indispensable resource and equip your leadership team with the tools necessary to navigate the evolving landscape of airport surface movement management with confidence and foresight.

- How big is the Advanced-Surface Movement Guidance & Control System Market?

- What is the Advanced-Surface Movement Guidance & Control System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?