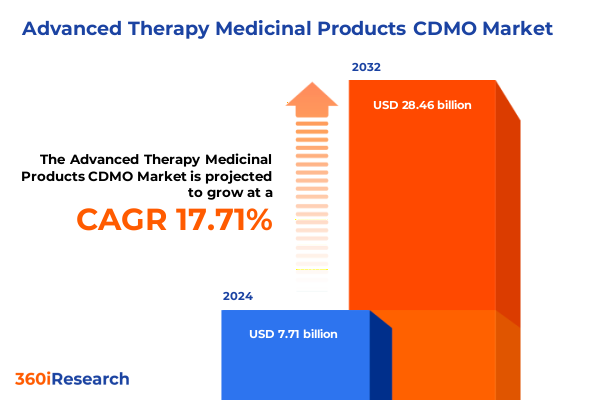

The Advanced Therapy Medicinal Products CDMO Market size was estimated at USD 8.97 billion in 2025 and expected to reach USD 10.43 billion in 2026, at a CAGR of 17.92% to reach USD 28.46 billion by 2032.

Pioneering the Evolution of Advanced Therapy Medicinal Products CDMO Services to Accelerate Breakthrough Biotherapeutic Innovations Globally

Advanced therapy medicinal products represent the vanguard of modern biotherapeutics, harnessing living cells, engineered tissues, and genetic materials to address previously intractable diseases. As the promise of cell therapy, gene therapy, and tissue-engineered products moves from the laboratory bench toward clinical and commercial realization, the role of specialized contract development and manufacturing organizations becomes indispensable. These CDMOs bridge the gap between innovation and scalable production, ensuring that groundbreaking treatments meet stringent quality standards and regulatory expectations.

In response to the escalating complexity of advanced therapy pipelines, CDMOs have evolved from basic manufacturing service providers into fully integrated partners offering end-to-end support. From intricate process development activities to robust analytical testing and quality control protocols, these organizations encapsulate the expertise and infrastructure necessary to navigate each stage of product life cycle advancement. Their capabilities include customizing bioreactor systems for stem cell expansion, optimizing vector production for somatic and germline gene therapies, and fabricating three-dimensional tissue constructs that replicate physiological environments.

Furthermore, leading CDMOs strategically cultivate alliances with academic research centers and biopharmaceutical companies, aligning operational scale with innovation pipelines. Such partnerships accelerate timeline efficiencies while mitigating technical and regulatory uncertainties. Through these collaborative networks, manufacturers can tap into advanced regulatory and compliance support, reducing approval risks and ensuring that therapeutic candidates maintain consistent quality attributes across clinical development and eventual commercial distribution.

Examining Game-Changing Technological Advances and Regulatory Reforms Reshaping the Landscape of Advanced Therapy CDMO Manufacturing

Over recent years, the advanced therapy manufacturing landscape has undergone transformative shifts driven by technological breakthroughs and evolving regulatory frameworks. Single-use bioreactor technologies have replaced traditional stainless steel systems, enabling flexible production scales and minimizing cross-contamination risks. Concurrently, innovations in viral vector engineering and formulary stabilization have improved yields for both germline and somatic gene therapies, while state-of-the-art analytical platforms now facilitate real-time release testing, expediting time-to-clinic. These advances collectively reconfigure the manufacturing model, shifting toward agile, modular facilities that can accommodate diverse product modalities.

Regulatory bodies worldwide have responded by streamlining pathways for advanced therapy approvals while emphasizing rigorous quality control measures. Initiatives to harmonize guidelines across major jurisdictions have reduced technical redundancies and fostered global market entry strategies. In parallel, process intensification methods, including perfusion bioprocessing and continuous manufacturing, have garnered attention for their potential to increase yield efficiencies and lower costs. The integration of digital twins and machine learning algorithms now supports predictive process analytics, enabling proactive control of critical quality attributes and reducing failure modes.

As these disruptive forces converge, contract development and manufacturing organizations must adapt by investing in robust quality management systems, modular cleanroom designs, and advanced data analytics infrastructure. By embracing end-to-end digitalization-from electronic batch records to cloud-based supply chain monitoring-CDMOs can deliver scalable, compliant, and cost-effective solutions that meet the rigorous demands of next-generation biologics development.

Assessing the Compound Effects of United States Tariff Adjustments in 2025 on Advanced Therapy Medicinal Products CDMO Supply Chain Dynamics

In 2025, a series of tariff adjustments introduced by the United States government have cumulatively impacted the supply chains underpinning advanced therapy medicinal products contract development and manufacturing. Raw materials essential for cell culture media components, viral vector inputs, and single-use consumables have experienced increased import duties, prompting specialty CDMOs to reassess sourcing strategies. As a result, many organizations have redirected procurement toward domestic suppliers or insulated markets, seeking to circumvent added costs and potential delays. This shift has spurred investments in local raw material manufacturing capacity and fostered closer collaboration with domestic chemical producers.

Moreover, the tariff landscape has influenced strategic decision-making around facility siting and capital expenditures. Companies evaluating new CDMO expansions are now prioritizing regions with favorable trade agreements or domestic supply chains to minimize exposure to import duties. As a consequence, certain service types, such as process development services and regulatory support functions, have migrated toward jurisdictions with lower trade barriers, ensuring uninterrupted progression of clinical-stage and commercial-stage product candidates.

Despite the initial disruption, these policy changes have accelerated resilience-building across the sector. By compelling CDMOs to diversify supplier bases and develop redundancies, the tariff impact has inadvertently enhanced supply chain security. Furthermore, the increased emphasis on local sourcing has potentially shortened lead times for critical consumables, ultimately benefiting project timelines and reinforcing industry efforts to maintain continuity in the delivery of life-changing therapies.

Uncovering Critical Market Segmentation Insights Across Product Type Service Offerings Therapeutic Applications Clinical and Commercial Domains and End Users

A nuanced understanding of market segmentation illuminates where advanced therapy contract manufacturers excel and where future opportunities lie. Examining products reveals that cell therapy offerings encompass both non-stem cell therapy formats and stem cell therapy constructs, each requiring distinct bioprocess capabilities. Gene therapy solutions divide into germline interventions-demanding rigorous ethical oversight-and somatic applications, which often integrate with oncology pipelines. Tissue engineered products fill a complementary niche, leveraging scaffold fabrication and three-dimensional culture technologies to replicate complex organ structures.

Service segmentation further delineates the market’s fabric, distinguishing analytical testing and quality control from manufacturing services, process development support, and regulatory and compliance advisory. Comprehensive process development lays the groundwork for scalable manufacturing runs, while regulatory guidance ensures alignment with evolving global frameworks. In terms of therapeutic areas, contract providers must tailor their expertise across cardiology, dermatology, hematology, neurology, and oncology, as each domain presents unique cell or vector behavior, dosing considerations, and safety profiles.

Application stage analysis differentiates between clinical-stage pipelines requiring cGMP-compliant small-batch production and commercial-stage demands for full-scale manufacturing capacity. End users range from academic and research institutes pioneering early-stage discovery programs to established biopharmaceutical companies advancing pivotal trials. These overlapping segmentation layers inform both service portfolio development and strategic partnerships across the CDMO ecosystem.

This comprehensive research report categorizes the Advanced Therapy Medicinal Products CDMO market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Service Type

- Therapeutic Area

- Application

- End-User

Exploring Regional Variations and Opportunities Across the Americas Europe Middle East Africa and Asia-Pacific in Advanced Therapy CDMO Markets

Regional dynamics significantly shape the advanced therapy contract manufacturing landscape, with each geography presenting distinct advantages and challenges. In the Americas, robust infrastructure in the United States and Canada supports large-scale manufacturing and advanced supply chain logistics, bolstered by government incentives for domestic bioprocess development. Latin American markets, while still emerging, offer cost-competitive labor pools and growing interest in public-private partnerships for clinical cell and gene therapy research.

Europe, the Middle East, and Africa collectively present a tapestry of regulatory environments and market maturity levels. Western European nations provide established CDMO networks, world-class academic centers, and harmonized EMA guidelines, facilitating cross-border product transfers. In contrast, Middle Eastern hubs increasingly invest in biotechnology clusters to attract global partnerships, and select African regions are building foundational GMP facilities to serve local unmet medical needs.

Across the Asia-Pacific region, CDMOs in countries such as China, Japan, and Australia have rapidly expanded capacity, driven by supportive government policies and substantial R&D funding. These facilities are increasingly certified to international standards, enabling them to handle both clinical and commercial production for global clients. Emerging markets in Southeast Asia are likewise drawing attention for cost efficiencies and evolving regulatory frameworks that balance patient access with safety oversight.

This comprehensive research report examines key regions that drive the evolution of the Advanced Therapy Medicinal Products CDMO market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Competitive Landscapes and Key Player Movements Driving Growth and Service Differentiation in Advanced Therapy CDMO Sectors

Leading contract development and manufacturing organizations continue to shape the advanced therapy field through strategic partnerships, capacity expansions, and service diversification. Key players have established multi-modal manufacturing platforms that integrate cell therapy production with viral vector development, supporting seamless transitions from preclinical process design to late-stage commercial batches. Recent collaborations between CDMOs and technology providers have bolstered capabilities in closed-system processing and automated cell handling, enabling consistent quality in complex multi-step workflows.

In addition to technology-driven differentiation, top tier organizations emphasize geographic footprint expansion to meet global demand. Investments in new facilities across North America, Europe, and Asia-Pacific underscore the competitive imperative to provide localized manufacturing and supply chain solutions. Furthermore, several leading CDMOs have launched proprietary digital portals to offer clients transparent process tracking, electronic batch management, and real-time analytics dashboards, enhancing decision-making efficiency.

Strategic acquisitions and equity partnerships have also played a pivotal role in shaping the competitive environment. By integrating specialized process development boutiques or acquiring complementary service providers, these companies bolster their end-to-end offerings. As a result, biotech innovators now encounter one-stop solutions that bundle analytical testing, clinical supply manufacturing, and regulatory consultancy, streamlining engagement pathways and reducing overall project complexity.

This comprehensive research report delivers an in-depth overview of the principal market players in the Advanced Therapy Medicinal Products CDMO market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abzena

- Advanced Therapies, LLC

- AGC Inc.

- Aldevron

- Almac Group

- Bio Elpida by Polyplus

- BlueReg

- Catalent Inc.

- CELONIC Group

- CGT Catapult

- Charles River Laboratories International, Inc.

- Coriolis Pharma Research GmbH

- Curia Global, Inc.

- Eurofins Scientific SE

- FUJIFILM Diosynth Biotechnologies

- Lonza Group

- Minaris Regenerative Medicine

- Oxford Biomedica PLC

- Patheon by Thermo Fisher Scientific Inc.

- Recipharm AB

- Rentschler Biopharma SE

- REPROCELL Inc.

- RoslinCT

- Samsung Biologics

- VIVEBIOTECH S.L.

Delivering Strategic Actionable Recommendations for Industry Leaders to Enhance Operational Resilience Innovation and Regulatory Compliance in CDMO Operations

Industry leaders seeking to capitalize on the advanced therapy manufacturing wave must adopt a multifaceted strategic approach. First, strengthening supply chain resilience through diversified sourcing and redundancy planning will mitigate risks associated with potential tariff shifts or raw material shortages. Establishing multiple qualified suppliers for critical reagents and consumables, combined with near-term stockpiling strategies, enhances continuity of operations.

Second, investing in flexible manufacturing platforms that support both clinical trial scale and commercial volume production enables rapid scaling in response to pipeline progression. Implementing modular cleanroom designs and single-use technologies facilitates quick reconfiguration between product runs, reducing downtime and optimizing facility utilization. Additionally, embedding advanced data analytics and machine learning models within production workflows can pinpoint process deviations in real time, safeguarding product quality and accelerating batch release.

Finally, proactive regulatory engagement is essential. Early alignment with global health authorities, through scientific advice meetings and pre-submission consultations, streamlines approval timelines and ensures alignment with evolving standards. By building internal regulatory expertise and leveraging external advisory services, CDMO partners can guide sponsors through the intricacies of advanced therapy approvals and post-market compliance, positioning both parties for sustainable long-term success.

Detailing Robust Research Methodology Combining In-Depth Primary Interviews Secondary Data Analysis and Rigorous Validation Techniques for Market Intelligence

The research underpinning these insights combined multiple data sources and rigorous validation techniques to ensure comprehensive market understanding. Secondary research involved extensive review of scientific publications, regulatory filings, public financial reports, and specialist white papers, providing a foundational context for advanced therapy manufacturing trends. These materials informed initial hypothesis generation around technological innovation, service segmentation, and regional dynamics.

Primary research was conducted through in-depth interviews with senior stakeholders across contract development and manufacturing organizations, academic research institutes, and biopharmaceutical companies. These qualitative discussions explored strategic priorities, operational challenges, and growth drivers, allowing for nuanced perspectives on both current capabilities and future investment areas. Interview data were triangulated with secondary findings to validate interpretations and highlight areas of convergence or divergence.

Quantitative validation emerged from proprietary databases tracking facility capacities, service portfolios, and partnership announcements. Statistical analyses were applied to identify correlations between regulatory developments, technology adoption rates, and regional capacity expansion. Rigorous cross-checking against external industry benchmarks ensured the reliability of key insights. Finally, iterative review cycles with subject matter experts refined the report’s structure, ensuring clarity, relevance, and actionable value.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Advanced Therapy Medicinal Products CDMO market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Advanced Therapy Medicinal Products CDMO Market, by Product Type

- Advanced Therapy Medicinal Products CDMO Market, by Service Type

- Advanced Therapy Medicinal Products CDMO Market, by Therapeutic Area

- Advanced Therapy Medicinal Products CDMO Market, by Application

- Advanced Therapy Medicinal Products CDMO Market, by End-User

- Advanced Therapy Medicinal Products CDMO Market, by Region

- Advanced Therapy Medicinal Products CDMO Market, by Group

- Advanced Therapy Medicinal Products CDMO Market, by Country

- United States Advanced Therapy Medicinal Products CDMO Market

- China Advanced Therapy Medicinal Products CDMO Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Core Findings and Forward-Looking Perspectives to Guide Stakeholders Through the Evolving Advanced Therapy CDMO Ecosystem Landscape

The amalgamation of technological innovation, regulatory evolution, and strategic industry responses paints a dynamic portrait of the advanced therapy CDMO ecosystem. From process intensification breakthroughs in continuous manufacturing to the strategic restructuring of supply chains in response to tariff shifts, stakeholders have demonstrated remarkable adaptability. Segmentation insights reveal how differentiated offerings across product types and service categories create niches for specialized competitors, while regional analysis underscores the importance of geographic flexibility and localized capabilities.

Moreover, the competitive landscape highlights the central role of integrated service models, where providers converge process development, manufacturing, analytical testing, and regulatory support under one roof. These end-to-end solutions not only streamline sponsor engagement but also reinforce quality assurance and accelerate time-to-market. Combined with actionable recommendations on supply chain resilience, modular facility design, and proactive regulatory planning, this report equips decision-makers with a holistic view of the market’s current state and future possibilities.

As the advanced therapy sector continues its rapid ascent, ongoing investment in digitalization, process innovation, and strategic partnerships will be key. Stakeholders who leverage these core findings and deploy the outlined strategies stand to benefit from streamlined operational models, enhanced regulatory alignment, and ultimately, more effective delivery of life-transforming therapies.

Compelling Invitation to Engage with Associate Director Sales and Marketing to Access Comprehensive Advanced Therapy CDMO Market Research Insights and Solutions

To access comprehensive insights into advanced therapy medicinal products CDMO services and gain a competitive edge in one of the most dynamic biomanufacturing spaces, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Engaging with Ketan Rohom ensures personalized guidance through the intricacies of the market research report, helping you align strategic priorities with validated industry data and emerging opportunities. His deep understanding of the CDMO landscape means your organization will receive tailored solutions that address critical decision points, from technology adoption to supply chain strategies and regulatory navigation.

Delivering direct access to the full suite of actionable intelligence, connecting with Ketan Rohom immediately unlocks the detailed analysis that can shape your next phase of growth. Whether you are refining partnership approaches, accelerating process development timelines, or evaluating geographic expansion scenarios, his expertise will enable you to leverage this report’s findings to maximum effect. Contact him today to secure your copy of the report and initiate a consultative conversation that will position your organization at the forefront of advanced therapy medicinal products contract development and manufacturing excellence.

- How big is the Advanced Therapy Medicinal Products CDMO Market?

- What is the Advanced Therapy Medicinal Products CDMO Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?