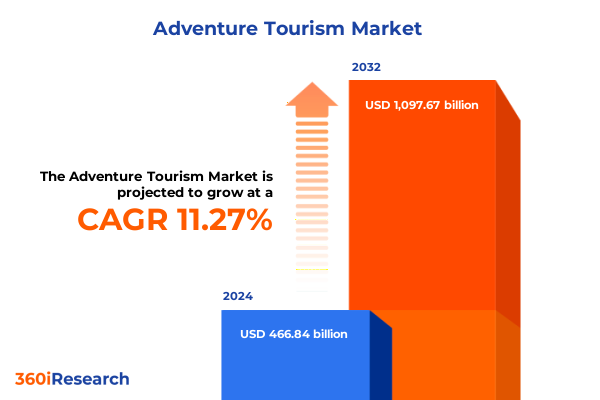

The Adventure Tourism Market size was estimated at USD 507.22 billion in 2025 and expected to reach USD 551.10 billion in 2026, at a CAGR of 11.65% to reach USD 1,097.67 billion by 2032.

Unveiling the Next Wave of Adventure Tourism Fueled by Immersive Technology, Sustainability Initiatives, and Evolving Traveler Mindsets Globally

Adventure tourism has transcended beyond simple thrill-seeking to become a powerful catalyst for personal enrichment and sustainable development. Over the past decade, the sector has witnessed a remarkable shift as travelers seek not only adrenaline-fueled experiences but also authentic cultural immersion, environmental stewardship, and transformative encounters. This momentum reflects a global appetite for journeys that challenge comfort zones while fostering deeper connections with nature and local communities.

Recognizing these evolving preferences, industry leaders are reimagining offerings to integrate technological innovation, ethical practices, and seamless booking processes. From virtual reality previews of climbing routes to interactive apps that offset carbon footprints, these advances are reshaping how adventures are marketed and experienced. This executive summary distills essential insights from the latest research on the adventure tourism landscape, illuminating the factors driving change and the strategic imperatives organizations must embrace to thrive.

Charting How Digital Innovation, Sustainability Commitments, and Demographic Evolution Are Redefining Adventure Tourism Landscapes Around the World

The adventure tourism landscape is undergoing transformative shifts as digital capabilities, sustainability imperatives, and demographic diversification converge. Cutting-edge mobile platforms now enable operators to deliver real-time safety updates, customizable itineraries, and interactive trail maps, enhancing traveler confidence and convenience. Concurrently, augmented reality and artificial intelligence tools are revolutionizing pre-trip planning by offering immersive previews of remote destinations and personalized destination recommendations.

Moreover, a heightened focus on sustainability commitments is reshaping how experiences are designed and delivered. Ethical supply chains, local community partnerships, and low-impact accommodations are no longer optional; they have become hallmarks of competitive differentiation. Younger cohorts, especially Millennials and Generation Z, are demanding transparent environmental practices and genuine cultural exchange. As a result, companies are reassessing sourcing strategies, aligning with conservation initiatives, and integrating carbon offset mechanisms to meet these expectations.

In parallel, shifting demographic patterns have broadened the traveler profile. Established segments such as multi-generational families and corporate retreat groups are blending with solo travelers seeking wellness retreats in natural settings. This mosaic of preferences requires adaptive product architectures and dynamic pricing that cater to both budget-conscious backpackers and ultra-luxury adventurers. Ultimately, the interplay of technological innovation, ecological responsibility, and evolving consumer mindsets is redefining the competitive contours of the sector.

Examining the Far-Reaching Cumulative Effects of United States 2025 Tariff Policies on Adventure Tourism Supply Chains and Pricing Dynamics

In 2025, newly implemented United States tariffs on imported outdoor equipment have exerted a cumulative impact across the adventure tourism value chain. Operators reliant on specialized gear-from high-altitude mountaineering tools to professional-grade scuba sets-have experienced rising procurement costs and lengthened lead times. These supply chain bottlenecks have prompted many providers to diversify sourcing strategies, forging relationships with domestic manufacturers and exploring regional partnerships to mitigate exposure to international duties.

The financial burden of tariffs has inevitably influenced pricing dynamics. Some companies have absorbed increased expenses to maintain competitive offerings, while others have passed costs onto end consumers through incremental surcharges or premium package structures. In response, differentiated pricing models have emerged, enabling travelers to select experiences based on equipment levels and service tiers. Simultaneously, a growing emphasis on gear-sharing programs, rental services, and modular equipment kits has gained traction as operators seek cost-efficient alternatives that preserve access without compromising safety standards.

Looking ahead, these policy-driven pressures have spurred wider strategic adjustments. Stakeholders are reassessing inventory management practices, investing in onshore repair and refurbishment facilities, and exploring recyclable or locally sourced materials to reduce tariff sensitivity. By embedding flexibility into procurement frameworks and championing circular economy principles, the sector is positioning itself to navigate external shocks while fostering resilient growth.

Decoding the Influence of Activity Types, Booking Platforms, Trip Duration, Price Tiers, Traveler Profiles, and Age Groups on Adventure Tourism

The multifaceted nature of adventure tourism demands a segment-focused approach to product development and marketing strategies. When viewed through the lens of activity types, the industry encompasses air based experiences such as hot air ballooning, paragliding, and skydiving-each offering solo and tandem variants. Land based pursuits span from scenic day hikes to multi day expeditions ranging between two to five days or extending beyond a week, as well as high-altitude mountaineering and wildlife safaris. Water based adventures are equally diverse, including both sea kayaking and whitewater routes, a spectrum of river rafting classes from Grade I II up to Grade V plus, and scuba diving experiences for open water enthusiasts and deep diving aficionados.

Booking channels play an equally pivotal role in shaping supply and demand dynamics. Direct engagement via mobile apps and operator websites coexists with brick and mortar agencies and call center support, while online travel agencies operate through aggregator platforms and branded portals. Each distribution modality attracts distinct traveler profiles, influencing promotional messaging, commission structures, and customer relationship management approaches.

Duration preferences further delineate target audiences, spanning one day excursions, overnight stays, and multi day journeys categorized into brief two to five day trips or extended six plus day expeditions. Pricing tiers mirror financial accessibility and luxury aspirations, ranging from budget conscious offerings to mid range packages, as well as high end experiences and an exclusive ultra luxury segment designed for discerning travelers.

Traveler typology adds another dimension, differentiating between family units-whether adult child pairs or multi generational groups-corporate and student groups, and independent solo adventurers. Finally, age cohorts, from Baby Boomers seeking curated comfort to Generation Z and Millennials craving experiential authenticity, present unique behavioral patterns and media consumption habits. By integrating these segmentation frameworks, providers can craft precision-targeted offerings that resonate with each audience subset.

This comprehensive research report categorizes the Adventure Tourism market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Activity Type

- Trip Duration

- Trip Organization

- Distribution Channel

- Traveler Type

Highlighting Regional Dynamics Shaping Adventure Tourism Growth Across Americas, Europe Middle East & Africa, and Asia-Pacific Markets

Regional dynamics profoundly shape how adventure tourism evolves, with the Americas exhibiting strong demand for eco friendly experiences and culturally immersive treks. Infrastructure investments across North and Latin America are enhancing accessibility to national parks and remote wilderness areas. Operators are capitalizing on this momentum by developing curated itineraries that blend conservation education, community-led homestays, and high adventure pursuits such as heli hiking in the Andes or backcountry rafting in the Pacific Northwest.

In Europe, the Middle East, and Africa, regulatory frameworks and heritage preservation efforts guide the design of adventure experiences. European alpine routes and Middle Eastern desert circuits benefit from stringent safety standards and high service quality, whereas African safaris emphasize wildlife conservation and responsible tourism practices. Cross border collaborations and UNESCO heritage site access protocols are unlocking new experiential clusters, with luxury lodges and guided expeditions bridging the gap between cultural authenticity and premium service delivery.

The Asia-Pacific region stands out for its rapid expansion, driven by burgeoning middle class populations and advanced digital infrastructure. Southeast Asia’s river systems and volcanic mountain ranges attract thrill seekers, while Australia and New Zealand continue to define global best practices in adventure safety and certification. Partnerships with regional tech firms enable seamless mobile booking, AI based itinerary customization, and contactless check in, catering to tech savvy travelers and reinforcing the region’s reputation as a hub for next generation adventure offerings.

This comprehensive research report examines key regions that drive the evolution of the Adventure Tourism market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Initiatives and Competitive Positioning Undertaken by Leading Operators and Innovators in the Adventure Tourism Sector

Leading adventure tourism operators are intensifying innovation to capture diverse traveler segments and navigate evolving market conditions. For instance, ExpeditionCo has invested heavily in virtual reality trail simulations that preview remote trekking routes, while TrailBrew Tours has launched a subscription based model offering equipment rental and guided excursion bundles. EcoHorizons, a pioneer in low impact rafting, has partnered with regional conservation NGOs to restore river ecosystems and integrate community stewardship programs into trip narratives.

Simultaneously, technology platforms such as WanderLink and PeakPass are consolidating booking data to deliver predictive analytics on traveler behavior, enabling operators to refine pricing algorithms and tailor promotions. Through strategic alliances with local outfitters, these platforms also expand inventory breadth and bolster support infrastructure in emerging destinations.

Across the board, incumbents and disruptors alike are prioritizing sustainability certifications, loyalty programs that reward repeat engagement, and omnichannel customer service frameworks. These initiatives underscore a broader recognition that competitive advantage stems not only from unique offerings but also from the ability to deliver seamless user experiences and verify environmental and social responsibility credentials.

This comprehensive research report delivers an in-depth overview of the principal market players in the Adventure Tourism market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abercrombie & Kent International Ltd.

- Adventure Life, LLC

- Backroads, Inc.

- Compagnie du Ponant SAS

- Contiki

- Exodus Travels Ltd.

- Explore Worldwide Limited

- G Adventures Inc.

- Go Travelling LTD

- Hurtigruten Expeditions AS

- Hurtigruten Group AS

- Intrepid Travel

- Kuoni Travel Holding Ltd.

- Lindblad Expeditions Holdings, Inc.

- Natural Habitat Adventures, LLC

- Seabourn Cruise Line Limited

- Silversea Cruises Ltd.

- Travelopia Holdings Limited

- TUI AG

- Viking Holdings Ltd.

- Wild Frontiers Adventures Ltd

- Xanterra Parks & Resorts, Inc.

Equipping Industry Stakeholders with Practical Strategies to Enhance Sustainability, Leverage Technology, and Strengthen Customer Engagement in Adventure Tourism

Industry stakeholders should first strengthen digital ecosystems by integrating robust mobile applications, AI enabled recommendation engines, and real-time safety monitoring tools. By enhancing user interfaces and personalizing content, operators can increase conversion rates and foster deeper traveler engagement. Sharing anonymized usage data across partner networks further refines experience design and operational efficiencies.

Next, embedding sustainability into every facet of the value chain is imperative. Companies should pursue recognized eco labels, integrate carbon offset options directly into booking flows, and collaborate with environmental organizations to co-create conservation projects. Communicating these commitments transparently will build trust and resonate with eco conscious segments, driving loyalty and positive word of mouth.

Diversifying procurement networks and onshoring critical equipment maintenance services can mitigate risks associated with international tariff fluctuations. Providers should also consider adopting modular gear schemes and rental partnerships to lower capital expenditures and reduce logistical complexity. This approach not only safeguards margins but also aligns with circular economy principles increasingly valued by travelers.

Finally, cultivate human capital by delivering specialized training on safety protocols, cultural competence, and sustainable practices. Investing in local guides and community ambassadors enriches experiential authenticity while reinforcing social impact goals. By simultaneously optimizing technology, sustainability, supply resilience, and talent development, industry leaders will be well positioned to capture emerging opportunities and fortify their competitive standing.

Outlining the Rigorous Multi-Method Approach Employed to Gather, Validate, and Analyze Critical Data Driving Adventure Tourism Insights

This research harnessed a multi method approach combining extensive secondary analysis with primary data collection to ensure robustness and accuracy. Initially, comprehensive desk research examined industry reports, academic studies, and expert commentary to identify prevailing themes and structural trends within adventure tourism. Key performance indicators and best practice frameworks were extracted to inform subsequent inquiries.

Building on these insights, targeted interviews were conducted with senior executives from leading tour operators, equipment manufacturers, and regulatory bodies. Simultaneously, an online survey of frequent adventure travelers captured evolving preferences across activity types, trip durations, pricing sensitivities, and distribution channels. Data triangulation techniques were applied to reconcile qualitative perspectives with quantitative metrics, while iterative peer reviews validated the analytical frameworks and mitigated potential biases.

Finally, segmentation models were constructed to map consumer cohorts against behavioral attributes, enabling nuanced scenario analyses. Quality assurance protocols, including cross tabulation checks and outlier analysis, reinforced confidence in the findings. Through this rigorous methodology, the study delivers a credible foundation for strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Adventure Tourism market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Adventure Tourism Market, by Activity Type

- Adventure Tourism Market, by Trip Duration

- Adventure Tourism Market, by Trip Organization

- Adventure Tourism Market, by Distribution Channel

- Adventure Tourism Market, by Traveler Type

- Adventure Tourism Market, by Region

- Adventure Tourism Market, by Group

- Adventure Tourism Market, by Country

- United States Adventure Tourism Market

- China Adventure Tourism Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Drawing Together Key Observations on Evolving Trends, Opportunities, and Resilience Factors Defining the Future of Adventure Tourism

In synthesis, adventure tourism today stands at the crossroads of technological innovation, environmental stewardship, and evolving consumer expectations. Stakeholders who harness advanced digital tools, embed sustainability principles, and align offerings with precise segment profiles will realize the greatest returns. Although external factors such as tariff policies introduce complexity, they also create opportunities for supply chain reconfiguration, local sourcing, and sustainable differentiation.

By embracing adaptive strategies and leveraging robust data insights, operators can transform challenges into strategic advantages. As the sector continues to mature, resilience will be defined not only by growth metrics but also by the capacity to deliver authentic, impactful experiences that resonate with increasingly discerning audiences.

Partner with Ketan Rohom to Secure In-Depth Adventure Tourism Market Knowledge and Transform Your Strategic Planning with Expert Insights

To gain unparalleled clarity into the evolving dynamics of adventure tourism and secure the decisive intelligence needed to stay ahead of competitors, reach out to Ketan Rohom, Associate Director of Sales & Marketing. By partnering directly, you will access tailored insights that empower you to refine your strategic initiatives, optimize resource allocation, and unlock new avenues for growth in a rapidly changing environment.

Begin a conversation today to explore how this comprehensive research can be customized to your organization’s objectives and help you chart a resilient path forward. Elevate your planning and decision-making by securing the full report-connect with Ketan Rohom to transform data into strategic action and ensure your leadership position in the world of adventure tourism.

- How big is the Adventure Tourism Market?

- What is the Adventure Tourism Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?