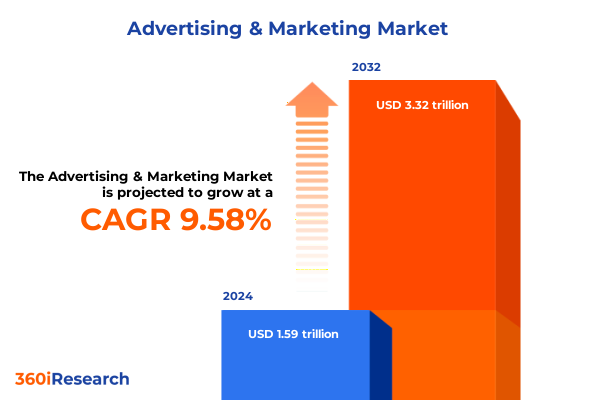

The Advertising & Marketing Market size was estimated at USD 1.74 trillion in 2025 and expected to reach USD 1.91 trillion in 2026, at a CAGR of 9.62% to reach USD 3.32 trillion by 2032.

Setting the Stage for a New Era of Advertising and Marketing Excellence Amid Evolving Digital Dynamics Across Platforms and Consumer Behaviors

The advertising and marketing landscape in 2025 is defined by accelerated digital transformation, shifting consumer behaviors, and increasingly complex regulatory environments. As brands grapple with evolving privacy regulations and the end of third-party cookies, first-party data strategies have surged to the forefront. Concurrently, an omnichannel approach-spanning search, social, video, mobile, and display-has become indispensable for engaging audiences across fragmented touchpoints. Against this backdrop, stakeholders require a cohesive framework to navigate the intricacies of platform dynamics, ad formats, industry vertical demands, and regional nuances.

This executive summary synthesizes the most salient insights gleaned from our latest market research, offering decision-makers a concise yet comprehensive overview of emerging trends, structural shifts, and strategic imperatives. By distilling core findings into actionable intelligence, we aim to equip advertisers, marketers, and C-suite executives with the clarity needed to optimize media investments, strengthen customer relationships, and drive sustainable growth. From technological innovations influencing campaign delivery to the macroeconomic factors reshaping procurement and budget allocation, each section highlights the critical forces at play and their implications for future campaigns.

Transitioning from broad market context to targeted analysis, the following sections explore the transformative shifts redefining advertising efficacy, the cumulative impact of new United States tariffs on ad technology, segmentation-driven performance drivers, regional landscapes, competitive dynamics, and recommended strategies. Together, this collection of insights forms an essential guide for industry leaders seeking a competitive edge in the rapidly evolving digital marketing ecosystem.

Uncovering the Pivotal Shifts Driving the Digital Advertising Ecosystem as Technology Integration and Consumer Expectations Converge in 2025 Market Dynamics

In recent years, the convergence of data-driven decision-making and creative storytelling has revolutionized campaign strategies. Machine learning-powered optimization engines now dynamically allocate budget across paid search and SEO, maximizing return on ad spend in real time. Likewise, the integration of augmented reality overlays and immersive video formats has elevated engagement, enabling brands to tell richer narratives that resonate with tech-savvy consumers.

Parallel to these technological advances, consumer expectations have evolved dramatically. Audiences demand personalized experiences delivered instantly, often through their preferred social channels or within mobile apps. This shift has accelerated the rise of story-driven ad formats on platforms like Instagram and Facebook, where ephemeral content fosters authenticity and drives higher engagement rates. As a result, marketers are reallocating resources from standard display units to interactive formats that prioritize narrative depth over traditional impressions.

Furthermore, the proliferation of connected devices and the internet of things (IoT) has opened new frontiers for programmatic out-stream video, in-stream ads on smart televisions, and geo-targeted mobile activations. These cross-device campaigns enable cohesive storytelling across a user’s journey, bridging the gap between online browsing and in-store visits. Taken together, these transformative shifts underscore the imperative for brands to adopt agile media strategies that blend innovation, data precision, and creativity in equal measure.

Examining the Far-Reaching Implications of United States Tariff Measures Implemented in 2025 on Advertising Technology Costs and Campaign Strategies

In 2025, the United States implemented a series of tariffs targeting imported technology components critical to advertising infrastructure. These measures have driven up costs for hardware such as servers used in programmatic ad exchanges and network equipment facilitating real-time bidding. Agencies and enterprise media buyers have consequently reevaluated their procurement strategies, weighing the benefits of on-premises data centers against the flexibility of cloud-based solutions unaffected by hardware levies.

The downstream effect of these tariffs is evident in campaign economics. As back-end operational expenses rise, agencies face pressure to optimize creative development and media allocation to maintain profitability. Some organizations have accelerated the transition from capital expenditure on infrastructure to subscription-based SaaS offerings for ad management and analytics. This shift not only mitigates tariff-related cost volatility but also unlocks advanced features like cross-channel attribution and AI-driven audience segmentation.

Moreover, the tariff landscape has prompted marketers to explore near-shoring partnerships and diversify technology vendors to reduce dependency on affected supply chains. Collaborative agreements with domestic ad tech providers have emerged, fostering innovation in identity resolution and privacy-compliant data enrichment. In sum, while the new tariffs introduce operational challenges, they also catalyze strategic realignment toward leaner, more agile technology ecosystems.

Gleaning Actionable Insights from Segmentation Analysis Revealing Key Drivers Across Advertising Platforms Formats Industry Verticals and Enterprise Sizes

Segmentation analysis reveals that platform selection profoundly influences both reach and engagement. Within display environments, rich media ads and native placements consistently outperform static banner units, particularly when deployed alongside dynamic creative optimization. Mobile touchpoints-split between in-app overlays and mobile web interstitials-offer distinct advantages, with in-app experiences yielding higher click-through rates through contextual targeting, while mobile web units deliver scale among audiences not tied to specific applications.

Search remains a cornerstone for performance marketing, where paid search and SEO complement each other. Paid search captures high–intent queries instantly, whereas SEO investment compounds over time, underpinning brand authority. On social media, the dual momentum of Facebook’s story ads and Instagram’s immersive canvas formats has eclipsed the impact of traditional feed ads, especially among Gen Z and millennial cohorts. LinkedIn’s sponsored content and InMail ads continue to command premium CPMs in B2B verticals by facilitating direct engagement with decision-makers, while Twitter’s promoted trends and timeline ads extend brand conversations at scale.

Video advertising demonstrates the power of context, with in-stream pre-roll placements driving upper-funnel awareness and out-stream units seamlessly integrating within editorial content. Broad adoption of programmatic video has enabled precise audience targeting across these stream types, allowing brands to tell cohesive stories from awareness through conversion. Together, these insights underscore the necessity of an integrated, platform-agnostic approach that leverages each segment’s unique strengths for maximum impact.

This comprehensive research report categorizes the Advertising & Marketing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Format

- Function

- Platform/Channel

- Campaign Duration

- End User

- Industry Vertical

- Business Size

Distilling Strategic Regional Insights from the Americas Europe Middle East Africa and Asia Pacific to Inform Market Entry Localization and Growth Trajectories

Geographic dynamics shape both strategy and execution in meaningful ways. In the Americas, the United States and Brazil lead digital transformation, with programmatic penetration and data-driven personalization reaching maturity in major metros. Localized content adaptations-such as Portuguese language video ads in Brazil’s mobile-first markets-illustrate a nuanced approach that resonates with regional preferences, while cross-border collaboration fosters innovation between North and South American hubs.

Across Europe, the Middle East, and Africa, regulatory frameworks around data privacy, such as GDPR variants and emerging ePrivacy mandates, compel marketers to invest in robust consent management platforms. Despite these requirements, markets in the Gulf region exhibit rapid adoption of mobile wallet integrations and in-app payment solutions, opening new avenues for performance-based campaigns. Meanwhile, key European markets emphasize contextual advertising and sustainable creative practices, aligning with broader consumer expectations for ethical brand narratives.

In Asia-Pacific, hyper-localization drives performance, with China’s e-commerce ecosystems blending livestreaming, short-form video, and social commerce into seamless experiences. Southeast Asian markets, notably Indonesia and Vietnam, have leapfrogged desktop advertising, propelling mobile-centric strategies that prioritize lightweight video assets for bandwidth-constrained audiences. These regional insights highlight the critical role of cultural nuances, regulatory compliance, and technology adoption rates in shaping tailored go-to-market plans.

This comprehensive research report examines key regions that drive the evolution of the Advertising & Marketing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Competitive Dynamics with In-Depth Profiles of Leading Innovators Their Strategies and Partnerships Shaping the Advertising Marketing Landscape

Leading players are differentiating through specialized capabilities and strategic partnerships. One consortium has invested in a unified identity solution that bridges walled gardens and open web environments, offering advertisers a persistent view of consumer journeys across devices. Another innovator has prioritized AI-powered creative studio tools that automate A/B testing at scale, reducing time-to-market for new campaign iterations.

Mergers and acquisitions continue to reshape the competitive landscape, with cloud data platforms integrating programmatic DSPs to deliver end-to-end orchestration from first-party data ingestion to real-time activation. Start-ups focused on privacy-compliant audience enrichment have attracted venture capital, signaling demand for solutions that reconcile personalization with regulatory adherence. Additionally, collaborations between telecom operators and media agencies are unlocking premium data sets for location-based targeting without compromising consumer trust.

Collectively, these company-level dynamics illustrate a market gravitating toward interoperability, automation, and privacy-by-design. Organizations that excel at marrying technological innovation with strategic alliances are best positioned to lead the next wave of digital advertising excellence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Advertising & Marketing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- Admarket Advertising

- Alibaba Group Holding Limited.

- Amazon.com, Inc.

- ByteDance Ltd.

- Cheil Worldwide Inc.

- Daniel J. Edelman Holdings, Inc.

- Deloitte Touche Tohmatsu Limited

- Dentsu Inc.

- Deutsch Inc.

- Droga5, LLC

- FCB Worldwide, Inc.

- Google LLC

- Havas SA

- Hurra Communications GmbH

- International Business Machines Corporation

- Leo Burnett Company, Inc.

- M+C Saatchi Group

- Mailchimp

- McCann Erickson Worldwide, Inc.

- Meta Platforms, Inc.

- MullenLowe Group Limited

- NP Digital, LLC

- Omnicom Group Inc

- Publicis Groupe S.A.

- R/GA LLC

- Seagull Advertising

- Synapse Marketing Consultancy Pvt. Ltd.

- Tencent Holdings Limited

- Wieden+Kennedy

- WPP plc

Offering Actionable Recommendations to Equip Industry Leaders with Innovative Strategies Optimized Processes and Collaborative Approaches for Sustained Growth

Industry leaders must embrace a multilateral strategy that harmonizes technological investment with creative agility. First, bolstering first-party data capabilities through CRM integrations and customer data platforms enables personalized messaging without relying on deprecated third-party identifiers. Concurrently, adopting AI-driven optimization engines for real-time bidding and creative iteration will ensure campaigns remain responsive to performance signals.

Second, diversifying supply paths by leveraging both programmatic open exchanges and direct publisher partnerships mitigates margin pressures introduced by external cost factors, including tariffs. This dual approach also grants greater control over brand safety and contextual relevance. Third, fostering collaborative innovation with technology providers and telecom operators can unlock proprietary data and localized targeting mechanisms, particularly in high-growth regions across Asia-Pacific and the Gulf.

Finally, cultivating in-house analytics and performance measurement expertise is paramount. Empowering cross-functional teams to translate granular segment insights into strategic roadmaps ensures that marketing spend aligns with evolving consumer behaviors. By implementing these recommendations, industry leaders will establish resilient, future-proofed operations capable of sustaining growth in an ever-changing digital ecosystem.

Detailing Rigorous Research Methodology Employed to Ensure Data Integrity Analytical Rigor and Comprehensive Insights across Multiple Advertising Dimensions

This study employed a multi-phase research methodology to guarantee robust and reliable insights. Initially, a comprehensive audit of primary and secondary sources was conducted, encompassing publicly available regulatory filings, corporate annual reports, and vendor white papers. This desk research was augmented by in-depth interviews with senior marketing executives, ad operations managers, and technology specialists across platforms.

Quantitative data was gathered via structured surveys targeting agencies, brands, and technology providers, ensuring representation across key geographies and enterprise sizes. Survey results were cross-validated through qualitative focus groups and expert panels to contextualize emerging themes and validate underlying assumptions. To account for recent developments-such as the implementation of tariff measures in 2025-supplemental interviews with procurement leads and supply chain analysts were incorporated.

Data integrity was maintained through rigorous cleaning protocols, outlier analysis, and triangulation against multiple data sources. Analytical frameworks, including SWOT analysis, PESTLE evaluation, and customer journey mapping, were applied to distill strategic insights. Ultimately, this blended approach delivers a holistic view of the advertising market, balancing empirical rigor with practitioner perspectives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Advertising & Marketing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Advertising & Marketing Market, by Type

- Advertising & Marketing Market, by Format

- Advertising & Marketing Market, by Function

- Advertising & Marketing Market, by Platform/Channel

- Advertising & Marketing Market, by Campaign Duration

- Advertising & Marketing Market, by End User

- Advertising & Marketing Market, by Industry Vertical

- Advertising & Marketing Market, by Business Size

- Advertising & Marketing Market, by Region

- Advertising & Marketing Market, by Group

- Advertising & Marketing Market, by Country

- United States Advertising & Marketing Market

- China Advertising & Marketing Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1749 ]

Synthesizing Core Findings and Strategic Implications to Provide a Cohesive Overview of Advertising Trends Challenges and Opportunities Shaping Future Markets

The convergence of technological innovation, data privacy regulations, and shifting consumer expectations has ushered in a new paradigm for advertising effectiveness. Core findings underscore the importance of integrated platforms, where programmatic video complements search, social, and mobile channels to form cohesive consumer journeys. Equally critical is the strategic realignment prompted by tariff-driven cost pressures, which has accelerated the adoption of cloud-based workflows and domestic technology partnerships.

Segmentation insights reveal that no single platform or format reigns supreme; rather, success depends on orchestrating the unique strengths of each segment-from the engagement potency of native and rich media display ads to the performance precision of paid search and the immersive appeal of out-stream video. Regional analysis further highlights the necessity of hyper-localization in Asia-Pacific, regulatory agility in Europe Middle East and Africa, and content personalization in the Americas.

Collectively, these insights point to a landscape where agility, interoperability, and consumer-first strategies determine competitive advantage. Organizations that proactively adapt their technology stack, diversify media supply paths, and refine first-party data assemblies will emerge as market leaders in the years ahead.

Engage Direct Consultation with Ketan Rohom Associate Director Sales Marketing to Secure Comprehensive Market Research Report and Unlock Actionable Insights Now

Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore how this comprehensive market research report can elevate your strategic initiatives and drive measurable outcomes.

By partnering with an expert in advertising and marketing intelligence, you gain access to in-depth analysis tailored to your organization’s unique objectives. Ketan Rohom’s expertise will guide you through the nuanced findings and deliverables, ensuring a seamless alignment with your growth ambitions.

Schedule a personalized consultation to delve into the methodologies, regional dynamics, segmentation insights, and actionable recommendations detailed within the report. This direct engagement empowers you to ask specific questions, clarify implications for your business, and pinpoint opportunities for operational excellence.

Secure your copy of the report today and unlock a roadmap to optimize ad spend, harness emerging channels, and stay ahead of transformative market shifts. Contact Ketan Rohom to initiate a collaborative journey toward data-driven success in the rapidly evolving advertising landscape.

- How big is the Advertising & Marketing Market?

- What is the Advertising & Marketing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?