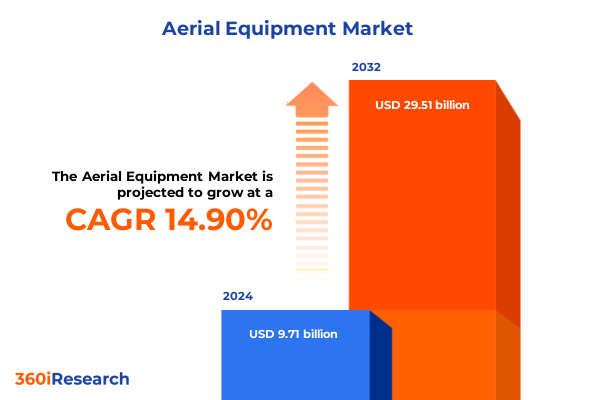

The Aerial Equipment Market size was estimated at USD 11.06 billion in 2025 and expected to reach USD 12.60 billion in 2026, at a CAGR of 15.04% to reach USD 29.51 billion by 2032.

Exploring Why Aerial Equipment Has Become Indispensable Across Key Sectors as Innovations and Market Dynamics Reshape Operational Efficiency and Safety

Global infrastructure spending is poised to surpass $9 trillion annually by 2025, fueled by sweeping urbanization and ambitious megacity developments across emerging and developed markets, while clean energy investments are set to reach a historic $3.3 trillion, with a record $2.2 trillion dedicated to renewables, nuclear, and storage technologies. This explosion in capital project activity is laying the groundwork for unprecedented demand in mobile elevating work platforms (MEWPs) to support construction, maintenance, and operations in sectors ranging from transportation and water to energy and digital infrastructure.

As data center investment has quadrupled since 2020 under AI-driven re-industrialization, aerial equipment has become critical for building and servicing hyperscale facilities, powerline networks, and advanced manufacturing sites. The surge in utility modernization and renewable energy projects further underscores the importance of versatile lifting solutions capable of navigating complex jobsite environments, offering safe, efficient, and compliant access at heights that traditional methods cannot match.

Innovations and Emerging Paradigms Redefining the Aerial Equipment Landscape With Sustainability, Connectivity, and Autonomous Workflows

The aerial equipment market is undergoing a profound metamorphosis as sustainability imperatives, digital connectivity, and automation converge to redefine how work at height is accomplished. Across construction and maintenance, electrification initiatives are accelerating the shift from diesel-powered lifts to zero-emission electric and hybrid platforms, reducing noise and carbon footprints in urban and indoor applications. Simultaneously, manufacturers are integrating advanced telematics, offering remote monitoring, predictive maintenance alerts, and machine-to-cloud data analytics to maximize uptime and extend asset lifecycles.

Moreover, emerging technologies such as semi-autonomous navigation, collision avoidance systems, and robotic end-effectors are beginning to augment operator capabilities, driving efficiency gains and enhancing safety. These transformative shifts are further propelled by stringent workplace safety standards and ESG mandates, compelling rental companies and end users to prioritize fleets equipped with real-time compliance tracking and smart access control features.

Assessing the Combined Impact of 2025 United States Tariff Policies on Material Costs, Supply Chain Stability, and Equipment Deployment Strategies

In March 2025, the United States reinstated 25% tariffs on steel and aluminum imports and introduced a baseline 10% duty on all other imports, with escalated rates on specific goods, significantly impacting the cost foundation of aerial equipment manufacturing and servicing. These levies have driven steel mill product prices up by more than 7%, while organizations reliant on imported hydraulic components and specialized electronics face heightened procurement costs and elongated lead times, squeezing margins across the value chain.

Complicating matters, reciprocal duties on Chinese-origin goods elevated certain equipment components by an additional 10%, triggering manufacturers and rental firms to reassess sourcing strategies. Supply chain disruptions have prompted a dual response: nearshoring critical fabrication to North American partners and redesigning product lines to minimize tariff-exposed inputs. However, these mitigation efforts entail capacity constraints and domestic price inflation, translating into increased acquisition and maintenance expenses for end users in construction, utilities, and industrial sectors.

Unraveling Market Segmentation Insights to Illuminate Demand Patterns Across Equipment Types, Power Sources, Height Capabilities, Operations, and End Users

Demand patterns in the aerial equipment market are shaped by a nuanced interplay of equipment typology, powertrain evolution, height performance, operational flexibility, and end-use requirements. Boom lifts-including articulating and telescopic variants-remain favored for their extended reach and adaptability on uneven terrain, whereas scissor lifts lead indoor maintenance tasks due to their compact footprint. Spider and trailer-mounted lifts cater to remote or confined sites, and vertical mast lifts excel in tight-space access, underscoring the importance of a diversified product portfolio informed by application demands.

The powertrain landscape is likewise fragmenting as diesel models coexist with fully electric and emerging hybrid platforms, each appealing to specific jobsite criteria: electric lifts dominate noise-sensitive and emission-restricted zones, while hybrid options bridge performance and eco-objectives. Height capability segmentation-from sub-11-meter units for low-rise shelving work to over-20-meter solutions for high-rise facade maintenance-further influences procurement decisions, driving OEMs to align R&D investments with differentiated reach requirements.

Operational mode segmentation divides fleets between mobile and static solutions: mobile operation portfolios extend beyond boom, spider, telehandler, and trailer-mounted lifts to address dynamic site workflows, while static operation concentrates on scissor and vertical mast lifts for stationary tasks. Across these segments, construction, energy utilities, events and entertainment, maintenance and repair, oil, gas and mining, and warehousing and logistics represent the primary end-user verticals, each with unique equipment utilization patterns and service model expectations.

This comprehensive research report categorizes the Aerial Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Power Source

- Height Capability

- Operation Mode

- End User

Decoding Regional Divergence in Aerial Equipment Demand Through a Closer Look at the Americas, EMEA, and Asia-Pacific Market Dynamics

Regional market dynamics for aerial equipment reflect varying economic priorities, regulatory landscapes, and infrastructure imperatives. In the Americas, robust federal and state infrastructure initiatives-bolstered by public-private partnerships-and a mature rental ecosystem drive demand for versatile electric and hybrid MEWPs. The utility sector, under pressure from aging grid assets and renewable energy integration, increasingly relies on advanced boom and spider lifts for safe asset inspection and maintenance.

Europe, the Middle East & Africa (EMEA) presents a heterogeneous picture: Western Europe’s stringent emission and safety regulations accelerate the electrification of static and mobile lifts, while parts of the Middle East leverage high-capacity telescopic and truck-mounted lifts for large-scale oil, gas, and civil projects. Africa’s emerging markets exhibit nascent growth, where rental penetration is gradually expanding to meet rising construction and industrial needs.

Asia-Pacific stands as the fastest-growing region, driven by urbanization in China, India, and Southeast Asia, where mega-infrastructure projects and warehouse automation in e-commerce hubs fuel demand for high-reach boom lifts and compact scissor units. Domestic manufacturers in China and Japan are scaling production, intensifying competitive pressures and fostering technology transfer across regional borders.

This comprehensive research report examines key regions that drive the evolution of the Aerial Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global Players Driving Innovation, Service Excellence, and Strategic Growth in the Evolving Aerial Equipment Market

Leading equipment manufacturers and service providers are intensifying efforts to differentiate through product innovation, digital services, and strategic alliances. JLG Industries, part of Oshkosh Corporation, has introduced its Rapid Replaceable Platform on select boom models to slash field service times and boost uptime for North American customers. Concurrently, JLG’s EC600AJ electric articulating boom lift underscores the company’s commitment to zero-emission solutions, mirroring rising demand for electric platforms with performance parity to diesel variants.

Haulotte Group has responded with its Advanced Access Management feature embedded in the SHERPAL telematics suite, enabling fleet managers worldwide to remotely secure machine access, monitor operator activity, and enforce safety protocols in real time. Meanwhile, global rivals such as Genie by Terex, Sinoboom, and Zoomlion are amplifying their electrification roadmaps and expanding aftermarket services, intensifying the competition landscape while fostering collaborative ecosystems for shared charging infrastructure and interoperability standards.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aerial Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aichi Corporation

- Altec Industries, Inc.

- Haulotte Group S.A.

- Linamar Corporation

- Manitou BF SAS

- Niftylift Ltd.

- Oshkosh Corporation

- PALFINGER AG

- SANY Heavy Industry Co., Ltd.

- Shandong Sinoboom Vehicle Co., Ltd.

- Snorkel International, Inc.

- Socage S.r.l.

- Tadano Ltd.

- Terex Corporation

- Xuzhou Construction Machinery Group Co., Ltd.

- Zhejiang Dingli Machinery Co., Ltd.

Strategic Recommendations for Industry Leaders to Navigate Disruptions, Capitalize on Technological Advances, and Enhance Competitive Agility

To thrive amid volatility and capitalize on rapid technological advances, industry participants should diversify supply chains by forging partnerships with North American steel and electronics suppliers to mitigate tariff exposure and ensure timely delivery of critical components. Investing in modular product architectures will enable faster adaptation to shifting powertrain preferences and height-range requirements, while embracing subscription-based service models can generate recurring revenue streams and strengthen customer loyalty.

Furthermore, prioritizing digital enablement through telematics platforms and predictive analytics will drive operational efficiency and differentiate service offerings. Collaboration with training providers and regulatory bodies to standardize remote-access certifications and safety protocols will enhance end-user confidence and expand adoption in new verticals. Finally, advancing R&D in battery chemistry and lightweight materials will solidify competitive positioning in the next wave of zero-emission aerial equipment.

Comprehensive Research Methodology Detailing Secondary Analysis, Expert Interviews, and Data Triangulation Techniques for Robust Market Insights

This research synthesis is grounded in an extensive secondary analysis of trade publications, regulatory filings, and industry reports, complemented by primary interviews with C-level executives, fleet managers, and end-user stakeholders to validate emerging trends. Key data sources include government trade databases for tariff classifications, technical standards documentation for safety regulations, and proprietary IoT usage metrics from leading telematics platforms.

Quantitative data were triangulated with real-world equipment utilization patterns sourced from rental and fleet operators across North America, EMEA, and Asia-Pacific. Qualitative insights were enriched through advisory panels comprising sector experts in construction, utilities, and warehousing, ensuring a holistic perspective. All findings were subjected to rigorous cross-verification to deliver robust, actionable market intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aerial Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aerial Equipment Market, by Type

- Aerial Equipment Market, by Power Source

- Aerial Equipment Market, by Height Capability

- Aerial Equipment Market, by Operation Mode

- Aerial Equipment Market, by End User

- Aerial Equipment Market, by Region

- Aerial Equipment Market, by Group

- Aerial Equipment Market, by Country

- United States Aerial Equipment Market

- China Aerial Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Insights on Transformative Trends, Market Drivers, and Strategic Imperatives Shaping the Future Trajectory of Aerial Equipment

The aerial equipment industry stands at a pivotal juncture, propelled by unprecedented infrastructure outlays, energy transitions, and technological breakthroughs. Electrification, digitalization, and modular design are not merely competitive differentiators but essential imperatives for equipment manufacturers and service providers. Simultaneously, shifting trade policies and tariff regimes demand agile supply chain strategies that safeguard profitability and resilience.

By embracing innovation in product engineering, telematics integration, and customer-centric service models, market participants can not only navigate the complexity of regulatory and economic fluctuations but also unlock new avenues for growth across construction, utilities, maintenance, and logistics. The confluence of sustainability goals, digital transformation, and strategic partnerships will ultimately dictate which organizations ascend as market leaders in this dynamic environment.

Connect With Ketan Rohom to Secure Your Detailed Aerial Equipment Market Research Report and Gain Unparalleled Strategic Intelligence

To explore how emerging trends, regulatory shifts, and strategic imperatives are reshaping the aerial equipment landscape-and to secure the most comprehensive, actionable intelligence for driving your organization’s growth-reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan’s expertise in tailored market consultation and in-depth reporting will ensure you obtain the precise insights needed to navigate competitive pressures, capitalize on technological breakthroughs, and optimize your investment strategy. Connect today with Ketan to discuss how this detailed market research report can empower your decision-making and fuel your next phase of expansion.

- How big is the Aerial Equipment Market?

- What is the Aerial Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?