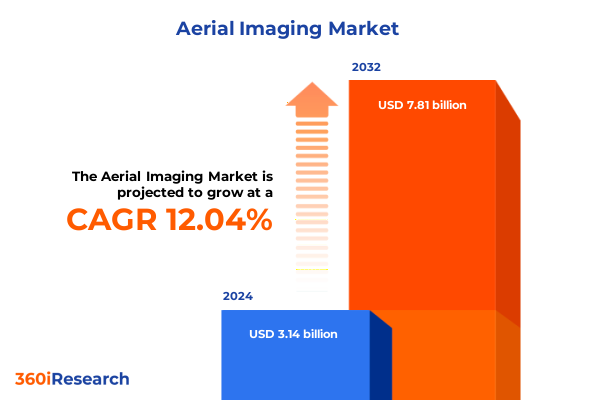

The Aerial Imaging Market size was estimated at USD 3.52 billion in 2025 and expected to reach USD 3.92 billion in 2026, at a CAGR of 12.02% to reach USD 7.81 billion by 2032.

Unveiling the Strategic Imperative Behind Adoption of Advanced Aerial Imaging Platforms to Elevate Operational Efficiency Across Industries

In an era defined by rapid technological advancement and intensifying demands for data-driven decision making, aerial imaging has emerged as a linchpin in industries ranging from agriculture to defense. As stakeholders seek to enhance operational visibility and strategic planning, the convergence of high-resolution sensors, sophisticated analytics, and versatile deployment platforms has elevated aerial imaging from a specialist capability to a core component of enterprise intelligence. This introduction lays the groundwork for understanding how aerial imaging solutions are reshaping workflows, unlocking new revenue streams, and fortifying risk management frameworks across disparate sectors.

By examining the interplay of technological innovation and market adoption, we can appreciate the critical role that aerial imaging plays in addressing complex challenges such as resource optimization, regulatory compliance, and environmental stewardship. As organizations pivot toward more resilient and adaptive operating models, the ability to capture, process, and interpret geospatial data in real time has become indispensable. Consequently, leaders must comprehend both the underlying components of these systems and their broader implications for competitive differentiation.

This opening discussion invites readers to consider the strategic imperative of integrating aerial imaging into their business models. In the sections that follow, we will explore transformative shifts in the industry landscape, assess the cumulative impact of recent policy measures, and distill insights from rigorous segmentation and regional analyses. Ultimately, this introduction establishes a clear line of sight from foundational concepts to actionable recommendations, setting the stage for a comprehensive exploration of the aerial imaging market.

Examining Transformative Shifts in Regulatory Frameworks Technological Innovations and Market Dynamics Driving Aerial Imaging Evolution

Over the past decade, the aerial imaging ecosystem has undergone profound transformations driven by regulatory evolution, breakthroughs in sensor capabilities, and novel business models. Rather than incremental improvement, the industry has experienced paradigm shifts that are recalibrating traditional expectations around data acquisition and analysis. From the relaxation of flight restrictions for unmanned platforms to the proliferation of high-bandwidth satellite constellations, these changes have broadened the horizon of what is operationally feasible.

Technological convergence is another hallmark of this dynamic landscape. The fusion of multispectral, hyperspectral, and LiDAR sensors with machine learning algorithms has yielded unparalleled granularity in geospatial intelligence. Consequently, applications once deemed too complex or cost-prohibitive-such as precision agriculture diagnostics and urban infrastructure monitoring-are now accessible to a wider range of users. At the same time, software-driven analytics and cloud-native architectures are simplifying workflows, enabling organizations to process terabytes of imagery with minimal manual intervention.

Market dynamics are mirroring these innovations. A shift from traditional service engagements to software-as-a-service and data subscription models is increasing customer retention and expanding addressable markets. Concurrently, strategic collaborations between platform providers, analytics firms, and end users are accelerating solution development cycles and reducing time-to-value. These transformative shifts underscore the need for continuous adaptation and strategic foresight as aerial imaging cements its position as a critical enabler of operational excellence.

Assessing the Far-reaching Impact of 2025 United States Tariffs on Supply Chains Investment Strategies and Competitive Positioning

The introduction of new United States tariffs in 2025 has exerted a multifaceted influence on the aerial imaging supply chain, compelling manufacturers and service providers to reassess sourcing strategies and cost structures. With increased duties on imported unmanned aerial vehicles and key sensor components, companies have faced mounting pressure to secure domestic alternatives or invest in onshore assembly capabilities. This realignment has triggered broader conversations around supply chain resilience and national security, particularly for applications in defense and critical infrastructure monitoring.

Moreover, the tariffs on high-precision optics and specialized semiconductors have accelerated supplier diversification efforts, prompting stakeholders to explore partnerships with emerging vendors in allied markets. While some organizations have leveraged these regulations to negotiate more favorable contracts and bolster inventory buffers, others have encountered challenges in qualifying new components without compromising performance benchmarks. The net effect has been a greater emphasis on strategic procurement planning and quality assurance protocols to mitigate the risk of operational disruptions.

Although the immediate fiscal impact has translated into modest increases in project budgets, the longer-term implications hinge on how swiftly the industry can adapt to evolving policy landscapes. In response, several leading integrators have established hybrid manufacturing models, combining offshore fabrication of lower-sensitivity parts with domestic production of critical subsystems. These approaches not only address tariff-related cost pressures but also reinforce intellectual property safeguards and support domestic workforce development. As tariff policies continue to shape strategic priorities, organizations that proactively recalibrate sourcing frameworks will be best positioned to maintain competitive agility.

Unlocking Deep Insights from Comprehensive Segmentation Across Platforms Technologies Services and Application Domains in Aerial Imaging

A nuanced understanding of the aerial imaging market necessitates rigorous segmentation across multiple dimensions, each offering unique insights into emerging trends and customer preferences. When examining the landscape through the lens of platform type, it becomes apparent that fixed wing unmanned systems provide unparalleled endurance for agricultural surveying, while rotary wing drones excel in urban inspections requiring vertical takeoff and landing capabilities. Manned aircraft still play a pivotal role in large-area surveillance tasks, and satellite platforms operating in both geostationary and low Earth orbit domains complement airborne sensors with global coverage and persistent monitoring.

Turning to imaging technology, the spectrum spans optical cameras delivering high-resolution visual data to radar systems capable of penetrating weather and vegetation canopy. Hyperspectral instruments enable material composition analysis, multispectral sensors inform crop health assessments, and thermal imagers support energy audits and rescue operations. LiDAR technology has emerged as an indispensable tool for generating precise elevation models, particularly in infrastructure planning and forestry management. This diversity of sensor modalities underscores the importance of selecting the optimal technology mix for each use case.

Service type segmentation further clarifies market trajectories, distinguishing organizations focused on data acquisition from those specializing in processing, analysis, and the development of software solutions. Meanwhile, applications range from agriculture and environmental monitoring to defense, disaster management, and smart city initiatives. Delivery modes have evolved in tandem, with cloud-based platforms facilitating real-time collaboration and on-premises deployments retaining appeal for sensitive projects requiring strict data governance. By weaving these segmentation perspectives together, stakeholders can pinpoint high-value opportunities and align their offerings with evolving customer requirements.

This comprehensive research report categorizes the Aerial Imaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform Type

- Imaging Technology

- Service Type

- Application

- Delivery Mode

Delving into Regional Nuances Shaping Aerial Imaging Adoption Trends and Growth Opportunities Across Diverse Key Global Markets

Regional dynamics in aerial imaging adoption reveal distinct drivers and maturation curves across the Americas, Europe, Middle East & Africa, and Asia-Pacific markets. In the Americas, vibrant agricultural and resource sectors have been early adopters of precision mapping and crop analytics, leveraging favorable regulations and established infrastructure to scale UAV deployments. Conversely, certain defense and emergency response use cases are concentrated in areas with robust regulatory frameworks that support rapid authorization and flight testing.

Across Europe, Middle East & Africa, regulatory harmonization efforts have accelerated cross-border operations, while investment in critical infrastructure monitoring has spurred demand for both satellite and airborne imaging. Renewable energy development and environmental compliance initiatives have likewise driven growth in thermal and hyperspectral applications in this region. In addition, partnerships between local agencies and global technology providers have facilitated knowledge transfer and localized service offerings.

The Asia-Pacific region exhibits a diverse spectrum of adoption maturity. Rapid urbanization in key markets has heightened interest in smart city deployments, with rotary wing drones conducting inspections of high-rise structures and transport networks. Meanwhile, expansive agricultural territories in other countries are fueling demand for large-scale fixed wing surveys. Satellite imaging constellations have also emerged from regional players, expanding low Earth orbit capacity and stimulating competitive innovation in sensor miniaturization. These varied regional insights highlight how geopolitical, economic, and infrastructural factors shape the trajectory of aerial imaging across global markets.

This comprehensive research report examines key regions that drive the evolution of the Aerial Imaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players Innovators and Strategic Collaborations Defining Competitive Dynamics within the Aerial Imaging Ecosystem

Leading organizations in the aerial imaging ecosystem are distinguished by their strategic focus on end-to-end solutions, partnerships, and technological differentiation. A number of unmanned system manufacturers have forged alliances with analytics providers to deliver turnkey platforms that streamline data collection and interpretation. At the same time, established aerospace corporations continue to integrate advanced sensor payloads into manned aircraft, targeting large-scale defense and infrastructure programs where certification and reliability are paramount.

Concurrent developments among satellite operators underscore a race to achieve higher revisit rates and finer spatial resolution, driven by both commercial demand and government contracts. Several data analytics firms have distinguished themselves by investing heavily in artificial intelligence, enabling predictive modeling capabilities that anticipate equipment failures, environmental changes, or security threats. Software innovators are also collaborating with cloud service providers to optimize data pipelines and deliver scalable, secure access to imagery repositories.

Start-ups specializing in niche applications-such as mining volume calculation or disaster response mapping-have captured attention by demonstrating rapid deployment models and user-friendly interfaces. Their successes have prompted larger incumbents to explore incubation programs and strategic investments, fostering an environment of co-innovation. Collectively, these movements are reshaping competitive dynamics and encouraging a convergence of hardware, software, and service expertise within the aerial imaging community.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aerial Imaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AeroVironment, Inc.

- Airbus Defence and Space GmbH

- BlackSky Technology Inc.

- DroneDeploy, Inc.

- EagleView Technologies, Inc.

- Hexagon AB

- L3Harris Technologies, Inc.

- Lockheed Martin Corporation

- Nearmap Pty Ltd

- Parrot SA

- Phase One A/S

- PhotoSat Information Ltd.

- Pix4D SA

- Planet Labs PBC

- senseFly SA

- SZ DJI Technology Co., Ltd.

- Teledyne FLIR LLC

- Terra Drone Corporation

- Trimble Inc.

- Vexcel Imaging GmbH

Driving Sustainable Growth and Innovation with Actionable Recommendations Tailored for Industry Leaders in Aerial Imaging

To capitalize on emerging opportunities and mitigate evolving risks, industry leaders must adopt multifaceted strategies that span technology development, partnership cultivation, and talent acquisition. Embracing advanced analytics capabilities will be critical, as integrating machine learning into imaging workflows unlocks deeper insights and drives operational efficiencies. Organizations should prioritize investments in sensor fusion platforms that seamlessly combine optical, thermal, and LiDAR data, thereby broadening their service portfolios and enhancing the value proposition for end users.

Simultaneously, firms must diversify their supply chains and explore regional manufacturing hubs to minimize exposure to policy fluctuations and logistical disruptions. Strengthening collaborations with universities, research institutes, and governmental agencies can accelerate innovation cycles and ensure compliance with evolving regulatory frameworks. Additionally, cultivating a skilled workforce proficient in geospatial data science and drone operations will be essential for maintaining a competitive edge in this rapidly evolving market.

Finally, leaders should explore hybrid delivery models that blend cloud-based analytics with secure on-premises solutions to meet the stringent data governance requirements of sectors such as defense, energy, and critical infrastructure. By aligning these actionable initiatives with organizational goals and customer needs, companies can foster sustainable growth and establish themselves as trusted partners in the aerial imaging domain.

Elucidating Rigorous Research Approaches Methodological Frameworks and Analytical Techniques Underpinning Comprehensive Aerial Imaging Market Studies

The methodology underpinning this report combines comprehensive secondary research, in-depth primary interviews, and robust data triangulation to ensure analytical rigor. Initially, industry publications, regulatory filings, and technical white papers were systematically reviewed to map the evolution of sensor technologies, platform capabilities, and business models. This desk research established a foundational understanding of market developments, competitive landscapes, and regulatory changes impacting the aerial imaging sector.

To validate and enrich these findings, structured interviews were conducted with senior executives across hardware manufacturers, software vendors, service providers, and end-user organizations. These conversations provided firsthand perspectives on market drivers, implementation challenges, and future technology roadmaps. Complementing this qualitative work, proprietary databases were analyzed to identify historical trends in deployment volumes, application adoption, and regional penetration.

Finally, the insights derived from secondary and primary research were synthesized through a triangulation framework, cross-referencing vendor disclosures, expert opinions, and empirical data. This approach ensured consistency and minimized bias, enabling the development of nuanced segmentation schemas and regional analyses. The resulting analytical structure provides stakeholders with a clear roadmap to navigate the evolving aerial imaging landscape and make informed strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aerial Imaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aerial Imaging Market, by Platform Type

- Aerial Imaging Market, by Imaging Technology

- Aerial Imaging Market, by Service Type

- Aerial Imaging Market, by Application

- Aerial Imaging Market, by Delivery Mode

- Aerial Imaging Market, by Region

- Aerial Imaging Market, by Group

- Aerial Imaging Market, by Country

- United States Aerial Imaging Market

- China Aerial Imaging Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Converging Insights and Strategic Imperatives Summarizing Essential Holistic Takeaways from Aerial Imaging Market Analysis

This report brings together converging insights on technological innovation, policy impacts, segmentation dynamics, and regional differentiation to present a holistic view of the aerial imaging market. Key takeaways include the accelerating integration of advanced sensors and machine learning algorithms, the strategic realignments prompted by tariff measures, and the critical importance of adapting offerings to diverse regional needs. Through comprehensive segmentation analysis, we have highlighted the distinct value propositions associated with each platform type, imaging modality, service model, and application domain.

Moreover, the profiling of leading players illustrates how competitive differentiation is increasingly driven by collaboration, data-driven analytics, and flexible delivery platforms. The actionable recommendations provided herein emphasize the need for organizations to invest in sensor fusion technologies, diversify their supply chains, and foster strategic alliances to maintain agility in a rapidly changing environment. Finally, the rigorous research methodology ensures that stakeholders can trust the robustness of the insights and confidently apply them to real-world decision making.

As aerial imaging continues to evolve, organizations that synthesize these strategic imperatives and align their capabilities accordingly will be best positioned to capitalize on emerging opportunities. This conclusion underscores the necessity of ongoing adaptation and investment in the capabilities that define the future of geospatial intelligence.

Seize Exclusive Opportunities in Aerial Imaging Intelligence by Engaging with Ketan Rohom to Access the Definitive Market Research Report

I appreciate your interest in our comprehensive exploration of the aerial imaging domain. To gain full access to the definitive market research report and unlock strategic insights tailored to your organization’s needs, I encourage you to reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan’s expertise will guide you through how these findings can directly inform your decision-making processes and investment strategies. By engaging with him, you can ensure your leadership team is equipped with the most rigorous data, nuanced analyses, and actionable recommendations presented in this report. Seize this opportunity to stay ahead of evolving market dynamics and capitalize on emerging growth areas within the aerial imaging industry by contacting Ketan Rohom today and securing your copy of the definitive market research report.

- How big is the Aerial Imaging Market?

- What is the Aerial Imaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?