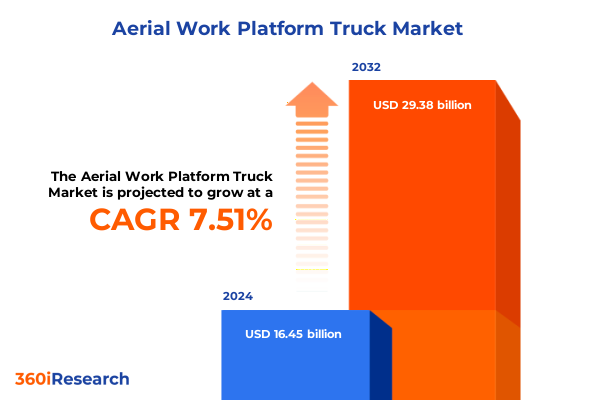

The Aerial Work Platform Truck Market size was estimated at USD 17.62 billion in 2025 and expected to reach USD 18.88 billion in 2026, at a CAGR of 7.57% to reach USD 29.38 billion by 2032.

Unveiling the critical role and rapid evolution of aerial work platform trucks in today’s industrial and construction environments

The aerial work platform truck has emerged as an indispensable asset across a broad range of industries, enabling safe and efficient access to elevated workspaces. From renovation projects in urban centers to maintenance operations in sprawling distribution hubs, these specialized vehicles combine mobility with precision lifting capabilities. Their integration of hydraulic systems, robust chassis, and versatile platform configurations has redefined how companies approach tasks that once required extensive scaffolding and manual labor.

As global infrastructure projects gain momentum and regulations around workplace safety continue to tighten, demand for aerial work platform trucks has accelerated. Organizations recognize the dual benefits of enhanced productivity and reduced risk associated with mechanized elevation solutions. In addition, the growing adoption of rental models has lowered entry barriers, allowing small and medium enterprises to deploy the latest equipment without committing to large capital expenditures. This convergence of technological advancement, regulatory compliance, and flexible procurement sets the stage for transformative developments within the sector.

Looking forward, this report delves into the dynamics shaping the aerial work platform truck landscape. It dissects major trends, examines policy impacts, and uncovers strategic pathways that industry participants must navigate. By synthesizing the most relevant insights, stakeholders will emerge equipped to make informed decisions, optimize fleet performance, and capitalize on emerging opportunities in this rapidly evolving domain.

Exploring the technological and regulatory milestones driving a paradigm shift in aerial work platform truck deployment

The landscape of aerial work platform trucks is undergoing profound transformation, driven by converging technological, regulatory, and business-model innovations. Electrification has moved beyond experimentation, with major manufacturers rolling out battery-powered units that deliver zero-emissions operation and lower lifecycle costs. Simultaneously, the integration of telematics and Internet of Things capabilities enables real-time fleet monitoring, predictive maintenance, and optimized deployment-turning individual machines into nodes within a fully interconnected asset network.

Regulatory pressures aimed at reducing carbon footprints have further catalyzed the shift from diesel-driven powertrains toward hybrid and fully electric propulsion. Stricter emissions standards in urban areas are prompting fleet operators to transition older units and adopt quieter, cleaner alternatives for indoor and metropolitan applications. At the same time, the rise of digital rental platforms and subscription-based equipment access models is reshaping traditional dealer-centric channels, fostering direct connections between end users and machine suppliers.

These transformative forces collectively signal a new era of elevated productivity and sustainability. As aerial work platform trucks evolve into intelligent workhorses, organizations that embrace these shifts will gain a competitive edge by reducing operational risks, enhancing workforce safety, and driving total cost of ownership down. This section explores how these innovations are setting the course for the next generation of lifting solutions.

Assessing how recent US steel and aluminum tariffs have reshaped cost structures and supply chain strategies for aerial work platform trucks

Since the enactment of Section 232 tariffs in 2018, the United States has maintained a 25 percent duty on imported steel and a 10 percent duty on aluminum, significantly affecting the cost structure of aerial work platform truck manufacturers. Component costs for booms, chassis, and booms booms sourced abroad have risen, forcing OEMs to reassess their global supply chains. Some suppliers have shifted to domestic steel mills or sought alternative sourcing from tariff-free regions, while others are negotiating long-term contracts to hedge against price volatility.

Beyond base metals, the scope of trade measures introduced under Section 301 has extended additional duties to certain imported components from specific regions, complicating planning for procurement teams. Manufacturers with vertically integrated operations have found greater resilience, as in-house metal fabrication capabilities buffer the impact of external price shocks. Conversely, smaller producers reliant on third-party supply face margin compression and may pass increased expenses down the value chain, prompting rental and maintenance providers to explore fleet optimization strategies.

Looking ahead, the sustained presence of these tariffs underscores the need for proactive cost-management practices within the aerial work platform truck sector. Companies that diversify their supplier base, invest in domestic partnerships, and embrace design innovations that reduce material intensity will be better positioned to mitigate the cumulative effects of trade policy on product affordability and availability.

Deciphering the multifaceted segmentation of aerial work platform trucks to uncover targeted insights across types and applications

An in-depth look at the market reveals how different product and customer dimensions drive distinct strategic priorities. Within type classification, articulating and telescopic boom platforms cater to high-reach, complex tasks, whereas self-propelled and trailer-mounted scissor units excel in static, lower-height applications. This dichotomy influences not only machine design but also aftermarket services, as boom configurations often require specialized inspection protocols compared to simpler scissor lifts.

Evaluating power sources, diesel engines remain prevalent in remote or outdoor settings, while electric and hybrid drive systems are gaining traction for indoor and urban environments. The choice between these propulsion options correlates strongly with customer sustainability goals and site-specific emission restrictions. At the same time, platform height segmentation-spanning up to 30 feet, 30 to 60 feet, and above 60 feet-determines structural reinforcement needs and hydraulic capacity, leading to discrete engineering roadmaps for each category.

Tire technology further differentiates performance characteristics, as pneumatic solutions-whether air-filled or foam-filled-offer cushioning on rough surfaces, whereas solid cushion tires deliver stability on smooth concrete floors. Rough terrain models equipped with two- or four-wheel drive systems extend operational reach in unpaved conditions. Meanwhile, application-based considerations underscore distinct value propositions: commercial, industrial, and residential construction contexts each impose unique payload and maneuverability requirements, while facility or infrastructure maintenance tasks demand rapid deployment and low noise. Finally, end-user dynamics across construction, manufacturing sectors such as automotive or electronics, oil and gas operations, transportation modes, and warehousing scenarios reflect varied utilization patterns and service expectations, driving tailored product roadmaps across the ecosystem.

This comprehensive research report categorizes the Aerial Work Platform Truck market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Propulsion

- Platform Height

- Tire Type

- Application

- End User

Comparative analysis of regional dynamics highlighting diverse drivers in the Americas, EMEA, and Asia-Pacific markets

Geographic dynamics play a pivotal role in shaping market behavior across different regions. In the Americas, robust infrastructure investment and a mature rental industry underpin steady demand for both new and refurbished aerial work platform trucks. North American operators often prioritize advanced telematics and fleet management solutions, while Latin American markets exhibit growing appetite for cost-efficient models and flexible financing options as construction activity scales.

Across Europe, Middle East, and Africa, stringent safety regulations and urban density constraints have driven the adoption of compact, low-emission equipment. Subscription models and full-service leasing arrangements are increasingly common as businesses seek to streamline operational overhead. In the Gulf region, infrastructure megaprojects and energy sector developments fuel demand for high-capacity boom platforms, whereas in Europe, retrofit and renovation initiatives energize the market for mid-rise scissor lifts.

The Asia-Pacific region stands out with its rapid urbanization and large-scale infrastructure programs. China and India lead volume growth owing to ongoing airport, rail, and metro expansions, while Southeast Asian nations demonstrate keen interest in electrified units to address air quality concerns. Japan and South Korea favor precision-engineered units for high-rise construction, reflecting their stringent seismic and safety standards. This regional mosaic highlights how local regulations, economic cycles, and project typologies converge to shape distinct priorities and growth trajectories.

This comprehensive research report examines key regions that drive the evolution of the Aerial Work Platform Truck market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining how leading OEMs and emerging players are forging innovation and service partnerships to secure a competitive edge

The competitive landscape features a blend of global OEMs and specialized regional players, each leveraging unique strengths to capture market share. Industry pioneers have intensified their focus on product diversification, introducing modular platforms that can be readily configured for both electric and diesel operation. These leading players are also forging strategic alliances with technology firms to embed advanced sensor suites and analytics platforms directly into their machines, enhancing visibility into uptime, utilization, and maintenance needs.

Meanwhile, emerging manufacturers from Asia and Europe are gaining traction by delivering value-engineered equipment tailored to local market preferences. Their emphasis on lightweight materials and simplified controls appeals to cost-conscious buyers in developing economies. At the same time, companies with robust aftermarket networks are deepening customer engagement through preventive maintenance contracts, operator training programs, and rapid parts distribution schemes.

A notable trend involves cross-border mergers and partnerships, as well as participation in joint development initiatives aimed at standardizing battery modules and telematics protocols. These collaborations not only reduce time-to-market for new product introductions but also align safety and interoperability standards on a global scale. This convergence of innovation and service excellence marks the path forward for players seeking to differentiate their offerings in an increasingly crowded arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aerial Work Platform Truck market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aichi Corporation

- Altec, Inc.

- Bronto Skylift Oy AB

- CTE S.p.A.

- Dinolift Oy

- Hunan RUNSHARE Heavy Industry Company, Ltd.

- Hunan Sinoboom Heavy Industry Co., Ltd.

- JLG Industries, Inc.

- Manitex International, Inc.

- Manitou BF, SA

- Nandan GSE Pvt. Ltd.

- RUTHMANN Holdings GmbH

- SOCAGE S.r.l

- Stevenson Crane Service, Inc.

- Tadano Ltd.

- Terex Corporation

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

Strategic recommendations for industry leaders to capitalize on emerging trends and strengthen competitive resilience

To thrive in this dynamic environment, industry leaders must adopt a multifaceted approach that balances technological investment with operational resilience. Prioritizing electrification efforts will be essential, as end users increasingly demand zero-emissions equipment for both indoor and urban applications. Allocating R&D resources to develop high-energy-density battery systems and modular drive trains can accelerate time-to-market for next-generation units.

Simultaneously, diversifying supply chains by partnering with domestic metal fabricators and alternative component providers will help to mitigate the financial impact of trade measures. Cultivating strategic supplier relationships and negotiating long-term agreements can secure critical materials at stable prices. On the customer engagement front, embedding advanced telematics packages and offering predictive maintenance services will deepen end-user loyalty while reducing downtime.

Finally, stakeholders should explore collaborative platforms to harmonize product standards and certifications globally. Aligning on safety protocols, data interfaces, and training curricula can reduce barriers to international expansion. By integrating these actionable strategies, companies will bolster both their innovative capacity and operational agility, positioning themselves at the forefront of the aerial work platform truck market’s next chapter.

Detailing the rigorous mixed-method research design and validation processes behind these aerial work platform truck insights

This study employs a rigorous, mixed-method research design to ensure the reliability and depth of insights. It begins with a thorough review of secondary sources, encompassing industry publications, regulatory filings, and technical white papers to establish a foundational understanding of market drivers and constraints. Primary research follows, involving detailed discussions with design engineers, procurement directors, and maintenance specialists to capture qualitative perspectives on evolving technology and operational requirements.

Quantitative validation comes through data triangulation, combining shipment records, component cost indices, and rental utilization statistics. The segmentation framework is constructed using a bottom-up approach, classifying the market by machine type, propulsion system, platform height, tire configuration, application, and end-user verticals. Each segment undergoes rigorous cross-verification to confirm consistency with supplier production capacities and end-user adoption patterns.

Finally, the draft findings are subjected to peer review from external consultants and industry veterans to identify potential biases or blind spots. This iterative process ensures that the final analysis is both comprehensive and actionable, providing stakeholders with a clear, evidence-based roadmap for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aerial Work Platform Truck market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aerial Work Platform Truck Market, by Type

- Aerial Work Platform Truck Market, by Propulsion

- Aerial Work Platform Truck Market, by Platform Height

- Aerial Work Platform Truck Market, by Tire Type

- Aerial Work Platform Truck Market, by Application

- Aerial Work Platform Truck Market, by End User

- Aerial Work Platform Truck Market, by Region

- Aerial Work Platform Truck Market, by Group

- Aerial Work Platform Truck Market, by Country

- United States Aerial Work Platform Truck Market

- China Aerial Work Platform Truck Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2862 ]

Synthesizing pivotal trends and strategic imperatives to guide stakeholders through the future of aerial work platform trucks

The aerial work platform truck domain is poised at the intersection of technological innovation, regulatory evolution, and shifting customer expectations. Electrification and digital connectivity are redefining value propositions, while trade policies continue to influence supply chain strategies and cost dynamics. Simultaneously, granular segmentation reveals distinct opportunities tied to machine type, propulsion, operational height, tire technology, application context, and end-user verticals.

Regional nuances underscore the importance of aligning market entry and product-development strategies with local regulations, infrastructure trends, and financing models. Leading OEMs and agile new entrants alike are embracing partnerships and modular approaches to capture these diverse market pockets. In turn, actionable recommendations on electrification roadmaps, supply chain diversification, telematics integration, and global standards alignment can guide stakeholders toward sustainable growth.

By synthesizing these insights, executives can better navigate the aerial work platform truck landscape’s complexities. This holistic perspective illuminates the strategic imperatives necessary to optimize fleets, reduce operational risk, and capitalize on emerging opportunities, ensuring that organizations remain resilient and competitive in an ever-evolving market.

Secure expert guidance from Ketan Rohom to acquire comprehensive market intelligence and drive your growth strategy

To gain exclusive access to the full market research report, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He can guide you through the comprehensive findings, deliver tailored insights aligned with your strategic needs, and ensure your organization captures every opportunity in this dynamic market. Contacting Ketan today will unlock in-depth intelligence on emerging trends, competitive landscapes, and actionable data that will position your business for sustained growth and operational excellence. Engage with an expert who understands your challenges and is ready to support your decision-making with precision and clarity.

- How big is the Aerial Work Platform Truck Market?

- What is the Aerial Work Platform Truck Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?