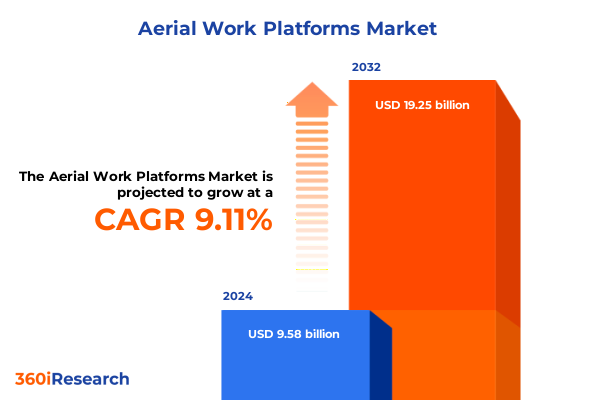

The Aerial Work Platforms Market size was estimated at USD 10.44 billion in 2025 and expected to reach USD 11.23 billion in 2026, at a CAGR of 9.13% to reach USD 19.25 billion by 2032.

Setting the Stage for Innovation and Safety in Aerial Work Platforms Addressing Emerging Operational Demands and Regulatory Drivers

Aerial work platforms have evolved from rudimentary scaffolding alternatives into highly sophisticated equipment, driven by technological innovation and heightened safety standards. As global construction, maintenance, and industrial sectors demand greater efficiency and compliance, the landscape is shifting to embrace machines that offer extended reach, precision control, and seamless integration with digital tools. This introduction delves into the current state of the aerial work platforms market, mapping the critical drivers, regulatory imperatives, and emerging use cases that are reshaping how organizations plan and execute elevated tasks.

The market’s momentum is fueled by a convergence of factors, including urbanization trends that lead to high-rise construction, stringent occupational health and safety regulations that mandate fall protection, and the increasing adoption of telematics for real-time monitoring and maintenance planning. Stakeholders across construction, industrial, and maintenance segments are prioritizing platforms that not only enhance worker safety but also deliver cost efficiencies through reduced downtime and improved operational visibility. This report lays the groundwork for understanding these foundational dynamics, setting the stage for a deeper analysis of transformative shifts, policy impacts, and strategic opportunities.

Unleashing the Future of Elevated Work through Electrification Digitalization Automation and Innovative Service Models

The aerial work platforms sector is undergoing a profound transformation as electrification, digitalization, and automation converge to redefine equipment capabilities and business models. Electrically powered lifts are rapidly gaining traction in urban centers and indoor environments where zero-emission requirements and noise restrictions are paramount. Meanwhile, hybrid and diesel options continue to serve heavy-duty applications and remote job sites, reflecting a nuanced balance between sustainability goals and practical operational needs.

Simultaneously, the integration of telematics and Internet of Things connectivity has ushered in an era of predictive maintenance, asset location tracking, and automated fault diagnostics. Manufacturers are embedding sensors to monitor hydraulic pressure, battery health, and structural integrity, enabling fleet managers to preempt failures and optimize lifecycle costs. Automation features such as self-leveling functions, remote-controlled maneuvering, and even semi-autonomous navigation in constrained workspaces are enhancing precision and reducing the reliance on operator skill alone.

Beyond hardware innovations, service models are evolving. Subscription-based access and usage-based pricing are emerging alongside traditional sales and rental channels, giving customers flexibility in fleet composition and financial commitment. Training programs leveraging virtual reality simulations are also becoming mainstream, underscoring a shift toward holistic solutions that combine cutting-edge machines with robust support services to meet the complex demands of modern infrastructure projects.

Navigating Trade Barriers and Supply Chain Realignment under Enhanced Tariff Measures in the Evolving Global Trade Environment

The introduction of enhanced tariff measures on imported aerial work platform components and complete units in early 2025 has precipitated a notable recalibration of global supply chains. Increased duties on steel parts, hydraulic systems, and finished lifts have driven manufacturers and distributors to reassess sourcing strategies, pushing some production capacities to regions with favorable trade agreements or localized suppliers. The immediate effect has been a rise in landed costs for certain equipment, translating into price adjustments that ripple through procurement budgets and rental rate structures.

In response, several original equipment manufacturers have accelerated partnerships with domestic suppliers to mitigate exposure to fluctuating trade levies. This shift has fostered closer collaboration on component design and testing, expediting product localization efforts to maintain competitive pricing. Additionally, some companies are exploring tariff engineering techniques, such as redesigning brackets or reclassifying subassemblies, to qualify for lower-duty categories under existing trade regulations.

Despite the initial cost pressures, the realignment offers long-term advantages. Strengthened domestic supply chains reduce lead times and logistics vulnerabilities, while joint ventures in allied manufacturing hubs facilitate technology transfer and capacity expansion. Ultimately, stakeholders that proactively navigate the tariff landscape will be better positioned to sustain margins, preserve service levels, and offer customers resilient supply solutions in a volatile trade environment.

Unveiling Nuanced Market Dynamics through In-Depth Segmentation across Equipment Types Operational Modes End Users and Distribution Modalities

A nuanced view of the aerial work platforms market emerges by examining the segmentation across platform types, operational modes, end users, height ranges, payload capacities, and distribution channels, revealing tailored opportunities for each niche. Platforms such as boom lifts, personnel lifts, scissor lifts, and telehandlers each serve distinct use cases, with boom lifts catering to extended outreach requirements on complex construction sites, and scissor lifts excelling in vertical elevation within confined indoor environments.

Operational mode further distinguishes demand profiles. Diesel-powered units, spanning height classes up to 20 meters, 21 to 40 meters, and above 40 meters, continue to dominate remote and heavy-duty operations where runtime and power density are critical. Conversely, electric variants across identical height tiers are gaining ground in sectors prioritizing reduced emissions and operational silence, particularly in densely populated or noise-sensitive urban locales.

End users in construction, industrial, and maintenance environments exhibit divergent preferences that drive product design and service offerings. Construction firms often prioritize machines with extended outreach and robust chassis for rugged terrain, while industrial operators focus on compact, precise lifts for machinery servicing. Maintenance crews in facilities management seek units with ease of transport and quick setup to minimize downtime during routine inspections.

Height range segmentation, subdividing into up to 20 meters, 21 to 40 meters, and above 40 meters, integrates payload subcategories from up to 250 kilograms to above 450 kilograms, shaping equipment specifications for tasks spanning from single-operator light-duty inspections to heavy-material handling at significant elevations. Distribution channels encompassing the aftermarket, direct sales, and rental models complete the picture, reflecting a continuum of customer commitment levels-from ad hoc rentals for short-term projects to direct acquisitions and ongoing parts and service contracts-underscoring the importance of flexible commercial strategies.

This comprehensive research report categorizes the Aerial Work Platforms market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform Type

- Operation Mode

- Height Range

- Payload Capacity

- End User

- Distribution Channel

Exploring Regional Growth Drivers and Strategic Imperatives in the Americas EMEA and Asia-Pacific Aerial Work Platforms Markets

A regional analysis underscores divergent growth vectors and strategic imperatives across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, robust infrastructure investments and stringent occupational safety regulations are driving fleet renewals and expansions. The emphasis on localized production and tariff mitigation has also reinforced a shift toward domestic manufacturing hubs and regional supplier networks, enhancing supply chain resilience.

Across Europe, the Middle East, and Africa, stringent emissions mandates and retrofitting initiatives for legacy infrastructures are catalyzing demand for electric and hybrid aerial work platforms. Rental models, supported by well-established dealer networks in Western Europe, complement direct sales to large industrial users, while emerging Middle Eastern markets prioritize high-capacity boom lifts for scalable construction projects.

In the Asia-Pacific region, rapid urbanization, megaproject developments, and government-led infrastructure programs are fueling adoption across all equipment types. The shift toward electric units is particularly pronounced in metropolitan markets with aggressive pollution control measures, while emerging economies continue to rely on diesel-powered solutions for cost-sensitive applications. Strategic partnerships between global OEMs and local assemblers are accelerating technology transfer and product customization to meet diverse regulatory and operational requirements.

This comprehensive research report examines key regions that drive the evolution of the Aerial Work Platforms market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Market Leaders and Innovators Shaping the Competitive Landscape through Technology Partnerships and Strategic Alliances

Leading equipment manufacturers are defining competitive dynamics through differentiated innovation, strategic alliances, and expanding service portfolios. Industry stalwarts with global footprints have invested heavily in telematics platforms, aftermarket support networks, and training programs to foster customer loyalty and optimize asset utilization. Meanwhile, emerging players from Asia and Europe leverage agile development cycles to bring specialized electric and hybrid models to market more rapidly, capturing share in segments prioritizing environmental compliance and operating cost efficiency.

Collaborative ventures between OEMs and technology service providers are shaping the next generation of connected equipment, featuring features such as automated fault alerts, cloud-based fleet analytics, and integrated maintenance scheduling. These partnerships are increasingly critical for companies seeking to offer end-to-end solutions, from machine acquisition and deployment planning to end-of-life recycling and component remanufacturing.

Moreover, several key players have pursued targeted mergers and acquisitions to strengthen regional footholds and broaden product lineups. By integrating complementary capabilities-whether in battery chemistry, hydraulic design, or digital service platforms-companies are positioning themselves to address the full spectrum of customer requirements, from high-reach boom lifts for complex construction sites to compact scissor lifts for indoor maintenance tasks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aerial Work Platforms market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aichi Corporation

- Altec Industries, Inc.

- Dinolift Oy

- Haulotte Group SA

- Hyster-Yale Materials Handling, Inc.

- JLG Industries, Inc.

- KION Group AG

- Linamar Corporation

- Manitou BF S.A.

- MEC Aerial Work Platforms

- Niftylift Limited

- Oshkosh Corporation

- Palazzani Industrie S.p.A.

- Ruthmann GmbH & Co. KG

- Skyjack Inc.

- Snorkel International

- Terex Corporation

- TIME Manufacturing Company

- Toyota Industries Corporation

- Upright Powered Access

Driving Competitive Advantage through Electrification Telematics Rental Partnerships and Strategic Supply Chain Diversification

Industry leaders can capitalize on emerging trends by adopting a multifaceted strategic approach. Prioritizing investments in electric and hybrid fleets not only aligns with tightening emission regulations but also addresses customer demand for lower total cost of ownership and quieter operation. Equally important is the integration of telematics and predictive maintenance solutions to reduce unplanned downtime and extend asset lifecycles, thereby enhancing customer satisfaction and recurring revenue streams.

Expanding rental network partnerships and forging alliances with equipment financing firms can unlock new customer segments, particularly among small-to-mid-sized contractors and facility management companies with limited capital outlays. In parallel, enhancing aftersales service capabilities-such as rapid-response maintenance teams and remote diagnostics-will differentiate offerings and foster long-term client relationships.

To mitigate the impact of trade barriers, companies should diversify supplier portfolios and explore localized manufacturing or assembly options in key markets. Collaborating with regulatory bodies and industry associations to shape safety and environmental standards can also create a competitive advantage by positioning brands as industry thought leaders. Finally, targeted marketing initiatives highlighting sustainability credentials, safety innovations, and total cost savings will resonate with decision-makers focused on balancing performance, compliance, and profitability.

Ensuring Rigor and Reliability through a Comprehensive Methodology Combining Primary Insights Secondary Validation and Multi-Dimensional Segmentation

The research underpinning this report employed a rigorous methodology combining qualitative and quantitative approaches to ensure robust, actionable insights. Primary data collection involved in-depth interviews with executives from original equipment manufacturers, fleet managers, and rental operators, providing firsthand perspectives on technology adoption, operational challenges, and strategic priorities. Complementing these inputs, structured surveys were deployed across a representative sample of construction, industrial, and maintenance end users to quantify demand drivers and feature preferences.

Secondary research encompassed a thorough review of industry publications, regulatory documents, patent filings, and company financial statements to contextualize primary findings and validate emerging trends. Data triangulation techniques were applied to reconcile discrepancies and enhance reliability, while a multi-tier validation process-spanning expert reviews, peer consultations, and cross-regional comparisons-ensured the accuracy of segmentation frameworks and regional analyses.

The study’s segmentation strategy integrates multiple dimensions including platform type, operation mode, end user, height range, payload capacity, and distribution channel to capture the full market complexity. Regional breakdowns cover the Americas, Europe Middle East & Africa, and Asia-Pacific, reflecting geopolitical, regulatory, and economic variables. This comprehensive methodology lays a transparent foundation for the insights and recommendations presented throughout the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aerial Work Platforms market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aerial Work Platforms Market, by Platform Type

- Aerial Work Platforms Market, by Operation Mode

- Aerial Work Platforms Market, by Height Range

- Aerial Work Platforms Market, by Payload Capacity

- Aerial Work Platforms Market, by End User

- Aerial Work Platforms Market, by Distribution Channel

- Aerial Work Platforms Market, by Region

- Aerial Work Platforms Market, by Group

- Aerial Work Platforms Market, by Country

- United States Aerial Work Platforms Market

- China Aerial Work Platforms Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Market Drivers Disruptions Fragmented Segmentation and Regional Dynamics to Illuminate Strategic Opportunities in Aerial Work Platforms

The aerial work platforms market is poised at the confluence of technological innovation, regulatory evolution, and shifting end user priorities. Electrification and digital connectivity are redefining machine capabilities and service delivery models, while trade policies and supply chain realignments are reshaping production footprints and cost structures. A deep dive into segmentation highlights the importance of tailored solutions-from high-reach boom lifts designed for major infrastructure projects to compact electric scissor lifts optimized for indoor maintenance.

Regional dynamics further underscore diverse growth trajectories, with the Americas focusing on fleet modernization and domestic sourcing, EMEA prioritizing emissions compliance and rental flexibility, and Asia-Pacific driven by rapid urbanization and extensive infrastructure programs. Leading companies invest in partnerships, digital services, and strategic acquisitions to stay ahead of market shifts, while recommended strategies emphasize electrification, telematics integration, and supply chain diversification.

By synthesizing these insights, industry leaders can anticipate emerging challenges and capitalize on growth opportunities across all market segments and regions. This report serves as a strategic roadmap for decision-makers seeking to optimize equipment portfolios, enhance operational resilience, and unlock sustainable competitive advantage in a rapidly evolving landscape.

Empower Your Strategy with Exclusive Market Insights and Connect Directly with Our Sales Leader for Tailored Support and Purchase Options

To access the comprehensive analysis, in-depth data, and strategic foresight presented in this report, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings extensive expertise in guiding industry stakeholders toward data-driven decisions, ensuring you unlock actionable intelligence to propel fleet optimization, regulatory compliance, and sustainable growth. Partnering with him grants you access to tailored insights, customized pricing, and ongoing support to maximize the value of your investment. Connect with Ketan to secure your copy of the aerial work platforms market research report and position your organization at the forefront of innovation and competitive advantage

- How big is the Aerial Work Platforms Market?

- What is the Aerial Work Platforms Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?