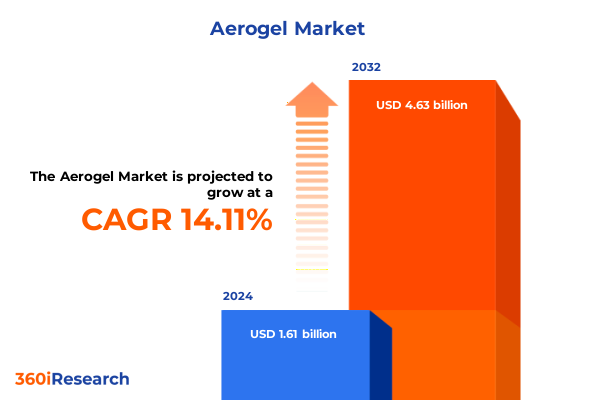

The Aerogel Market size was estimated at USD 1.83 billion in 2025 and expected to reach USD 2.08 billion in 2026, at a CAGR of 14.18% to reach USD 4.63 billion by 2032.

Pioneering Ultra-Lightweight Materials with Exceptional Insulation Properties to Revolutionize Energy Efficiency and Technological Applications

Aerogel represents one of the most fascinating material innovations of the past century, combining ultralow density with exceptional thermal insulation and structural versatility. Originally invented in 1931, this porous solid has evolved from a laboratory curiosity to a commercial solution across industries ranging from aerospace to construction. Its unique nano-porous architecture gives it remarkable heat-shielding capabilities, while its lightweight nature enables the development of products that were previously impossible under conventional material constraints.

As demand for higher energy efficiency and sustainable solutions accelerates, aerogel is emerging as a critical enabling technology. With advancements in manufacturing processes and material chemistries, the performance envelope of aerogel has expanded beyond traditional silica variants to include carbon, metal oxide, and polymer-based formulations. These developments have spurred interest among manufacturers seeking to reduce energy consumption, enhance product durability, and satisfy evolving regulatory requirements for environmental performance. Consequently, aerogel stands poised to reshape multiple markets by delivering differentiated properties that align with both operational and sustainability goals.

Emerging Innovations and Sustainability Imperatives Driving the Next Phase of Aerogel Development across Diverse Industrial and Commercial Sectors

The aerogel landscape is undergoing a period of rapid transformation driven by innovations in nanostructuring, composite integration, and sustainable production methods. Recent breakthroughs in sol–gel chemistry and supercritical drying techniques have reduced production costs and improved material uniformity. These process optimizations pave the way for large-scale manufacturing and create pathways for novel composite materials that marry aerogel’s insulating properties with enhanced mechanical strength.

Alongside process innovations, a growing emphasis on sustainability is reshaping product development priorities. Manufacturers are exploring bio-based precursors and greener synthesis routes to minimize carbon footprint and chemical waste. This shift not only aligns with corporate decarbonization targets but also meets the rising demand from end users for environmentally responsible solutions. As such, the aerogel sector is already witnessing the emergence of "green aerogels" that utilize renewable feedstocks while delivering comparable performance to their conventional counterparts.

In parallel, aerospace and electronics sectors are pioneering new applications that extend aerogel’s utility. Engineers in the aerospace industry are integrating aerogel into thermal protection systems for re-entry vehicles and hypersonic platforms, where weight savings and thermal resistance are paramount. Meanwhile, within the electronics sphere, aerogel composites are being deployed for next-generation thermal management and acoustic damping in miniaturized devices. Together, these converging trends highlight aerogel’s potential to drive value creation across a spectrum of high-growth applications.

Assessing the 2025 United States Tariff Adjustments and Their Multidimensional Effects on Supply Chains Procurement Costs and Competitive Dynamics

In early 2025, the United States implemented a suite of tariff adjustments targeting imported aerogel raw materials and finished products, reflecting a broader strategy to bolster domestic manufacturing capacity. These measures introduced tariff duties ranging from 10 to 25 percent on key imports, with the explicit aim of protecting local producers and fostering investment in domestic production infrastructure. As a result, procurement costs for companies reliant on imported aerogel components rose significantly, prompting a strategic reassessment of sourcing and supply chain configurations.

The immediate effect of these tariffs has been a twofold increase in operational expenditure for downstream manufacturers, particularly in industries such as automotive and construction that rely heavily on cost-effective insulation solutions. Faced with higher input costs, many firms have accelerated efforts to localize supply chains, forming partnerships with domestic aerogel producers or exploring vertically integrated models. This shift toward onshore sourcing has created new opportunities for U.S.-based producers, even as it places pressure on companies with established global procurement networks.

Looking ahead, industry stakeholders anticipate that sustained tariff barriers will drive further consolidation among global suppliers. Companies with robust scale and capital reserves are likely to expand their domestic footprints, while smaller players may seek strategic alliances or carve out niche markets to remain competitive. In parallel, technology licensing and joint ventures are expected to become more prevalent, as foreign suppliers collaborate with U.S. partners to navigate regulatory complexities and maintain market access.

Unveiling Critical Segmentation Dimensions to Illuminate Aerogel Market Opportunities Based on Material Type Structure and End-Use Applications

A deep dive into aerogel market segmentation reveals critical nuances influencing strategic positioning and product development. Based on Type, market players focus on four principal material families: Carbon Aerogels, prized for electrical conductivity and electrode applications; Metal Oxide Aerogels, valued for catalytic support and thermal resistance; Polymer Aerogels, leveraged for flexible insulating blankets; and Silica Aerogel, the longstanding benchmark for ultra-low thermal conductivity. Each material category offers distinct performance profiles, driving tailored solutions for application-specific requirements.

Segmentation by Form exposes further complexity, encompassing Blanket structures that deliver conformal insulation solutions for pipes and ducts; Monoliths engineered for structural rigidity in high-temperature environments; Panel assemblies that integrate seamlessly into building envelopes; and Particle formats which serve as thermal fillers and catalyst carriers. These diverse structural formats enable aerogel to meet a spectrum of mechanical and thermal specifications, augmenting its adoption across both industrial and consumer-facing sectors.

Equally significant is Application segmentation, which sheds light on demand drivers in end-use markets. Within the Aerospace Industry, aerogel is subdivided into Aircraft Insulation and Spacecraft Insulation, where performance criteria demand extreme thermal control under weight constraints. The Automotive Industry splits into Conventional Vehicles and Electric Vehicles, with aerogel contributing to battery pack insulation and cabin climate management. In the Construction Industry, Commercial Construction projects and Residential Construction developments incorporate aerogel panels for energy-efficient facades and HVAC systems. Electronics Industry applications span Consumer Electronics and Industrial Electronics, employing aerogel for thermal management and vibration dampening. Finally, the Oil & Gas Industry distinguishes Offshore Applications from Onshore Applications, deploying aerogel-based pipe insulation and subsea hardware protection to mitigate heat loss and prevent hydrate formation.

This comprehensive research report categorizes the Aerogel market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Application

- End-Use Industry

Navigating Regional Growth Landscapes by Examining Demand Drivers Supply Infrastructure and Regulatory Frameworks across Major Global Territories

Regional dynamics play a pivotal role in shaping aerogel market trajectories, as each geography presents unique demand drivers and regulatory landscapes. In the Americas, the construction and oil & gas sectors serve as primary growth engines, supported by stringent energy-efficiency standards in North America and infrastructure upgrade initiatives in South America. Manufacturers in this region leverage advanced logistics networks and favorable trade agreements to deliver aerogel solutions to remote applications, including offshore drilling platforms and Arctic pipeline systems.

In Europe, Middle East & Africa (EMEA), evolving sustainability mandates and aggressive decarbonization targets are fueling investment in high-performance insulation across building retrofits and renewable energy installations. Western European markets prioritize green building certifications that reward aerogel integration, while Middle Eastern and North African oil producers increasingly adopt aerogel-based insulation to optimize thermal management in desert environments. South Africa and other sub-Saharan regions are also evaluating aerogel composites for industrial process insulation, reflecting broader infrastructure development goals.

Asia-Pacific’s growth outlook is buoyed by rapid industrialization, urbanization, and renewable energy deployment. In China and India, expanding automotive manufacturing and electronics fabrication facilities are driving local demand for aerogel products. Meanwhile, Japan and South Korea maintain leadership in advanced materials research, focusing on aerogel innovations for hybrid vehicle thermal barriers and precision electronics cooling. Australia’s mining and LNG sectors are similarly exploring aerogel-based insulation for remote operations, underpinned by government incentives for energy- efficient technologies.

This comprehensive research report examines key regions that drive the evolution of the Aerogel market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Aerogel Industry Players Their Strategic Alliances Investment Portfolios and Innovation Pipelines Shaping Competitive Edge

The competitive arena for aerogel is defined by a combination of legacy chemical companies and specialized materials innovators. One notable player has strengthened its market position through strategic acquisitions that expand its portfolio of silica-based formulations, enabling comprehensive insulation solutions for industrial and building applications. Another leader emphasizes advanced carbon aerogel development, targeting energy storage and electrode applications through joint ventures with battery manufacturers and research institutions.

A third company distinguishes itself through its proprietary production platforms for metal oxide aerogels, supplying catalysts to the petrochemical sector and partnering with major energy corporations to validate performance under extreme operating conditions. Simultaneously, a seasoned polymer aerogel manufacturer has introduced flexible blanket systems for HVAC and refrigeration markets, leveraging collaborative R&D alliances with equipment OEMs to drive adoption.

Smaller, agile firms are carving out niche positions by focusing on high-value segments such as spacecraft insulation and specialized acoustic damping. These innovators rely on close customer engagement and rapid prototyping to tailor material properties and meet stringent performance specifications. Across the landscape, market leaders are investing heavily in pilot-scale manufacturing facilities and process automation, aiming to improve yield, reduce production costs, and respond more quickly to shifting customer requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aerogel market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABIS Aerogel Co., Ltd.

- Active Aerogels

- Aerogel Core Ltd.

- Aerogel Technologies, LLC

- Aerogel UK Limited

- Aerogel-it GmbH

- Armacell International S.A.

- Aspen Aerogels, Inc.

- Astrra Chemicals

- BASF SE

- Blueshift Materials, Inc.

- Cabot Corporation

- Dragonfly Insulation Ltd.

- Enersens SAS

- Gelanggang Kencana Sdn. Bhd.

- Guangdong Alison Technology Co., Ltd.

- Intelligent Insulation Ltd.

- JLM Oil & Gas LLP

- Keey Aerogel SAS

- Ningbo Surnano Aerogel Co., Ltd

- Outlast Technologies GmbH

- PBM Insulations Pvt. Ltd.

- Shanghai Aerogelzone Technology Co., Ltd.

- Svenska Aerogel Holding AB

- TAASI Corporation

- The Dow Chemical Company

- Thermulon Ltd.

- Vardhamaan Insulaation Limited

Implementing Targeted Strategic Initiatives to Accelerate Aerogel Industry Advancement Through Collaboration Digitalization and Sustainable Technology Integration

Industry leaders must prioritize strategic collaboration to capitalize on emerging aerogel opportunities. Forging partnerships with research institutions and technology consortia can accelerate the development of novel formulations and sustainable production pathways. By pooling resources and intellectual property, collaborators can de-risk early-stage innovation and expedite time-to-market for next-generation materials.

Integrating digital tools across the value chain is another critical initiative. Advanced data analytics and process simulation enable manufacturers to optimize reaction parameters, improve product consistency, and predict performance under real-world conditions. Digital twins of pilot plants can uncover process bottlenecks, inform equipment upgrades, and systematically reduce waste, ultimately supporting more resilient and scalable production models.

Sustainability must also be embedded into corporate strategies. Adopting greener precursors and closed-loop solvent recovery systems reduces environmental impact and appeals to customers with ESG mandates. Transparent reporting on carbon emissions and chemical use fosters trust among stakeholders and provides a differentiator in procurement decisions.

Finally, executive leadership should explore M&A and joint venture options to secure access to complementary technologies and geographic markets. Targeted investments in emerging regional producers or specialized material developers can broaden product offerings and ensure supply continuity. Maintaining an adaptive approach to portfolio management will be essential as tariff policies, regulatory frameworks, and customer expectations continue to evolve.

Employing a Robust Triangulated Research Framework Incorporating Primary Insights Secondary Data and Analytical Rigor for Comprehensive Market Understanding

The research methodology underpinning this report is anchored in a triangulated approach to ensure comprehensive and reliable insights. Secondary research formed the foundation of market understanding, incorporating peer-reviewed journals, industry publications, patent databases, and regulatory filings to map material innovations and policy developments. This desk-based analysis provided context on market drivers, technological breakthroughs, and competitive dynamics.

To validate and enrich secondary findings, primary research was conducted through structured interviews with over 40 stakeholders, including C-level executives, R&D directors, procurement managers, and application engineers across key geographies. These conversations offered firsthand perspectives on commercial adoption barriers, performance requirements, and investment priorities. Detailed discussions with supply chain partners illuminated logistical constraints and opportunities for local manufacturing.

Quantitative and qualitative data were synthesized through rigorous data triangulation, cross-referencing interview insights with macroeconomic indicators and trend analyses. This multi-layered validation process ensured that conclusions and recommendations reflect real-world market conditions and future outlooks. The combination of exhaustive secondary research, targeted primary interviews, and analytical rigor delivers a robust foundation for strategic decision-making in the aerogel sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aerogel market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aerogel Market, by Type

- Aerogel Market, by Form

- Aerogel Market, by Application

- Aerogel Market, by End-Use Industry

- Aerogel Market, by Region

- Aerogel Market, by Group

- Aerogel Market, by Country

- United States Aerogel Market

- China Aerogel Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Synthesizing Key Findings to Chart the Future Trajectory of Aerogel Adoption in Energy Efficiency Advanced Manufacturing and High-Performance Applications

The evolution of aerogel from a niche laboratory marvel to a cornerstone of advanced industrial and commercial systems underscores its transformative potential. Emerging process innovations, sustainability-driven formulations, and expanding application portfolios are converging to propel aerogel into the mainstream. As myriad sectors-from aerospace to electronics-seek to enhance performance while meeting environmental commitments, aerogel’s unparalleled material properties position it as a key enabler of next-generation solutions.

However, the recent tariff adjustments in the United States serve as a reminder of the complex policy and supply chain factors that can influence market dynamics. Stakeholders must remain vigilant, adapting sourcing strategies and exploring localized production models to mitigate cost pressures. At the same time, segmentation analysis reveals that differentiated material types, structural formats, and end-use applications will continue to offer pathways for growth and value creation.

Looking ahead, regional market variations and competitive maneuvers among leading players will define the contours of the aerogel landscape. Companies that effectively balance innovation, collaboration, and operational resilience will capture the lion’s share of emerging opportunities. By aligning strategic initiatives with evolving regulatory frameworks and customer demands, industry participants can chart a sustainable growth trajectory and realize the full promise of this revolutionary material.

Engaging Direct Inquiry Channels to Secure Your Comprehensive Aerogel Market Report and Partner with Expert Advisory for Informed Strategic Decision-Making

Securing the definitive Aerogel market intelligence you need couldn’t be more straightforward. Contact Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch to arrange your personalized briefing and obtain immediate access to the full market research report, complete with strategic insights and actionable data tailored for decision-makers.

- How big is the Aerogel Market?

- What is the Aerogel Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?