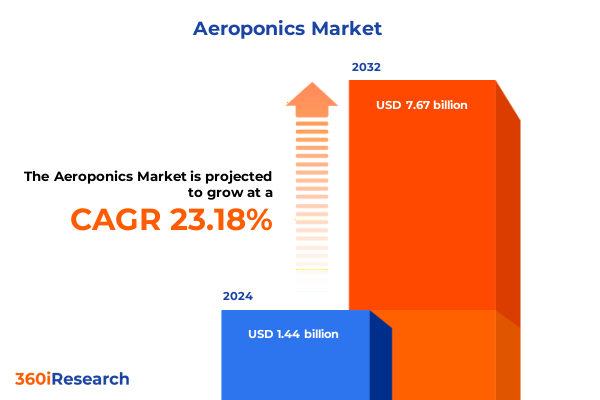

The Aeroponics Market size was estimated at USD 1.77 billion in 2025 and expected to reach USD 2.15 billion in 2026, at a CAGR of 23.21% to reach USD 7.67 billion by 2032.

Uncovering the Growth Trajectory of Aeroponics Technology Redefining Sustainable Agriculture with Water Efficiency and Urban Vertical Farming Innovations

Aeroponics represents a groundbreaking cultivation method that delivers nutrients in a fine mist directly to plant roots, eliminating soil as a medium and dramatically enhancing resource efficiency. This soil-less approach allows growers to optimize water usage, reduce the need for chemical inputs, and maximize yield per square foot. By embracing a closed-loop system that recirculates nutrient solutions, aeroponic farms can achieve significant reductions in waste and environmental impact compared to traditional agriculture practices.

As the global population continues to grow alongside urbanization trends, the demand for sustainable, high-yield farming solutions has never been more pressing. Aeroponics stands at the intersection of technological innovation and ecological responsibility, offering a path to year-round production that is insulated from extreme weather conditions. Its modular and scalable nature supports deployment across diverse settings-from rooftop installations in metropolitan centers to controlled-environment greenhouses-positioning it as a versatile solution for both commercial operations and residential growers alike.

Exploring the Technological and Market Shifts Driving Aeroponics from Niche Experiments to Mainstream High-Tech Food Production Platforms

Over the past decade, aeroponics has evolved from a niche research concept into a viable commercial farming technique driven by advances in misting technology, sensor integration, and data analytics. Innovations in high-pressure fog systems now enable precision delivery of nutrients in droplet sizes optimized for root uptake, while low-pressure mist variants cater to applications requiring gentler handling, such as delicate herb propagation. This progression reflects a broader shift towards precision agriculture, in which real-time monitoring and automated control loops are central to maximizing productivity and ensuring consistency across production batches.

Simultaneously, the convergence of IoT connectivity and AI-driven analytics has catalyzed a transformation in how cultivators manage environmental variables. Automated control units equipped with humidity and temperature sensors allow for dynamic adjustments to mist cycles, nutrient concentration, and lighting schedules. As a result, proliferating partnerships between agri-tech firms and software providers are streamlining the integration of digital platforms with hardware systems, enabling farm managers to oversee operations remotely and derive actionable insights from performance data. This digital revolution is repositioning aeroponics at the forefront of modern controlled-environment agriculture.

Analyzing the Comprehensive Impact of 2025 United States Trade Tariffs on Input Costs Supply Chains and Competitive Dynamics in Aeroponics

In 2025, the imposition of tariffs on key agricultural inputs and components has introduced new cost pressures for aeroponic operators. A 25% duty on fertilizers such as potash and ammonium sulfate, primarily imported from Canada, has driven up nutrient expenses for growers, challenging the cost-effectiveness of nutrient delivery systems central to aeroponic cultivation. Concurrently, tariffs on steel and aluminum, reinstated at 25%, have inflated the costs of structural materials used in greenhouse frames and misting reservoirs, compelling manufacturers to reassess supply chain strategies and production footprints.

Further complicating the landscape, reciprocal tariffs of up to 34% on selected technology imports have impacted the availability and pricing of precision monitoring hardware, including environmental sensors and automated controllers. Components such as microchips, IoT modules, and specialized pumps have seen extended lead times and higher unit costs, driving some startups to explore onshore manufacturing or seek tariff exemptions through policy advocacy. As these trade actions continue to evolve, stakeholders must adapt procurement and partnership models to maintain resilience and cost efficiency across their aeroponic operations.

Exploring Multifaceted Segmentation in Aeroponics Across Product Types Components Applications Crop Varieties and Distribution Channels

The aeroponics market is characterized by a nuanced segmentation based on product type, component offerings, application contexts, crop varieties, and distribution pathways. Within product types, high-pressure systems-including fog and mist variants-are selected for large-scale commercial installations requiring rapid nutrient delivery, while low-pressure systems employing drip and flood-and-drain configurations address the needs of smaller operators and residential hobbyists. Component segmentation covers a spectrum from control systems-spanning automated to manual controls-to lighting solutions that range from fluorescent grow lights to energy-efficient LEDs, as well as nutrient delivery assemblies, pumps, and sensor arrays designed for precision environmental measurement.

In terms of application, commercial use cases encompass greenhouse, indoor, and vertical farming setups that leverage aeroponics for high-density production, whereas residential applications include DIY systems and consumer-oriented garden kits optimized for novices. Crop type segmentation highlights a diversity of suited plants, from flowers-both edible and ornamental-to fruits such as strawberries and tomatoes, alongside fast-growing herbs like basil, mint, and parsley, and leafy greens including kale, lettuce, and spinach. Finally, distribution channels span direct sales through B2B contracts and in-house teams, offline retail via distributors and specialty stores, and online platforms like e-commerce marketplaces and manufacturer websites, ensuring that aeroponic technologies reach a breadth of end users.

This comprehensive research report categorizes the Aeroponics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Component Type

- Application

- Crop Type

- Distribution Channel

Highlighting Regional Dynamics and Key Growth Drivers Shaping the Aeroponics Market across Americas Europe Middle East Africa and Asia Pacific

Regional dynamics are integral to understanding the global aeroponics landscape, as geographic factors influence regulatory frameworks, investment climates, and consumer preferences. In the Americas, North American growers benefit from supportive policies aimed at water conservation and sustainable agriculture, enabling widespread adoption of high-efficiency aeroponic systems in both commercial greenhouses and urban farming initiatives. Latin American markets, meanwhile, are emerging as growth frontiers, driven by initiatives to address food security challenges and leverage renewable energy sources for controlled-environment agriculture.

Over in Europe, the Middle East, and Africa, robust funding under programs such as the EU’s Horizon Europe scheme is spurring research into climate-resilient farming technologies, with aeroponics playing a pivotal role in greenhouse modernization efforts. Meanwhile, Gulf-region investments in agri-tech hubs are fostering the deployment of containerized aeroponic farms in arid zones. In the Asia-Pacific region, high-density urban centers in Japan and South Korea are rapidly integrating aeroponic cultivation into retail and institutional applications, bolstered by government grants and strong public–private partnerships. China’s smart agriculture initiatives further contribute to R&D, positioning the market for continued technological breakthroughs and scale-up opportunities.

This comprehensive research report examines key regions that drive the evolution of the Aeroponics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Aeroponics Innovators Driving Strategic Partnerships Technological Advancements and Market Leadership in Controlled Environment Farming

Leading innovators in the aeroponics sector are advancing the industry through strategic alliances, technological enhancements, and global expansion efforts. AeroFarms has become synonymous with large-scale vertical aeroponic systems, leveraging proprietary misting technology to optimize yields in urban settings. Similarly, Freight Farms integrates shipping-container-based aeroponic units with cloud-native farm management software, enabling remote monitoring and modular scalability for commercial growers.

European pioneers such as LettUs Grow have distinguished themselves with bespoke stackable units for microgreens and herbs, while Panasonic’s foray into indoor aeroponic lettuce farms underscores the potential for premium retail partnerships. Elsewhere, startups like NextFarm in South Korea are demonstrating the efficacy of AI-driven nutrient monitoring for specialty crops such as strawberries, and Urban Agricool in France has secured funding to deploy container farms across Parisian rooftops. Collectively, these companies exemplify a dynamic ecosystem where innovation, capital infusion, and cross-border collaborations accelerate the maturation of aeroponic technologies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aeroponics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AeroFarms

- Aerospring Hydroponics

- AEssenseGrows

- Agresearch Labs

- Agrihouse Brands Ltd.

- Altius Farms

- Anu

- Aponic International Ltd.

- Bowery Farming Inc

- BrightFarms Inc.

- CleanGreens Solutions SA

- CombaGroup SA

- Eden Grow Systems

- Freight Farms Inc.

- General Hydroponics

- Heliponix

- Hexagro

- HydroGarden

- JWC

- LettUs Grow Ltd.

- Living Greens Farm Inc.

- Officine Agricole Milanesi

- Plenty Unlimited

- Ponics Technologies

- Tiger Corner Farms

Formulating Strategic Recommendations for Industry Leaders to Optimize Aeroponic Operations Mitigate Tariff Risks and Scale Sustainable Farming Solutions

To thrive amidst evolving trade dynamics and intensifying competition, industry leaders should prioritize the development of resilient supply chains that incorporate domestic manufacturing and diversified sourcing strategies. By forging partnerships with local component suppliers and investing in modular system designs, companies can mitigate the impact of tariffs on critical hardware and reduce lead times. Complementing this, targeted policy advocacy efforts aimed at securing tariff exemptions for agri-tech inputs and renewable energy components can further alleviate cost pressures.

Moreover, embracing digital transformation through advanced analytics and remote monitoring platforms will bolster operational agility and resource optimization. Integrating AI-driven insights into nutrient delivery and environmental control not only enhances yield consistency but also delivers compelling sustainability credentials to stakeholders. Finally, expanding into emerging regional markets with tailored offerings-such as compact residential kits for urban Asia or containerized farms for arid environments-will unlock new revenue streams and reinforce long-term competitiveness.

Outlining a Robust Research Methodology Integrating Primary Interviews Data Triangulation and Expert Validation to Uncover Aeroponics Market Insights

This research leverages a comprehensive methodology that combines primary and secondary data sources to deliver a holistic view of the aeroponics market. Primary research included in-depth interviews with senior executives, farm operators, technology providers, and policy experts, providing first-hand insights into operational challenges, investment priorities, and future innovation trajectories. These qualitative inputs were complemented by secondary research encompassing industry reports, peer-reviewed journals, regulatory publications, and company announcements to validate and enrich the analysis.

Data triangulation techniques were applied to ensure the integrity and reliability of findings, cross-referencing qualitative feedback with market intelligence and trade data. Expert validation sessions with technical specialists and sector consultants further refined key insights and recommendations. Through this rigorous approach, the study delivers an objective, multi-dimensional perspective on aeroponics, enabling stakeholders to make well-informed strategic decisions underpinned by robust evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aeroponics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aeroponics Market, by Product Type

- Aeroponics Market, by Component Type

- Aeroponics Market, by Application

- Aeroponics Market, by Crop Type

- Aeroponics Market, by Distribution Channel

- Aeroponics Market, by Region

- Aeroponics Market, by Group

- Aeroponics Market, by Country

- United States Aeroponics Market

- China Aeroponics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3021 ]

Drawing Comprehensive Conclusions on the Evolution Opportunities and Strategic Imperatives Underpinning Growth in the Global Aeroponics Market

The evolution of aeroponics reflects a broader shift towards resource-efficient, technology-enabled farming systems that address pressing global challenges such as water scarcity, urbanization, and climate volatility. As high-pressure and low-pressure misting systems continue to mature, and as digital platforms drive operational optimization, aeroponics is well-positioned to become a cornerstone of controlled-environment agriculture across commercial and residential segments.

Industry stakeholders must navigate evolving tariff landscapes, regulatory frameworks, and competitive dynamics with agility while capitalizing on the technological advances that underpin future growth. By aligning strategic investments with sustainable practices and market-driven innovation, organizations can unlock the full potential of aeroponic cultivation, delivering enhanced productivity, superior crop quality, and resilient supply chains in an increasingly resource-constrained world.

Connect with Ketan Rohom Associate Director Sales Marketing to Secure Your In-Depth Aeroponics Market Research Report and Drive Informed Strategic Decisions

The next step towards harnessing the full potential of aeroponics begins with accessing comprehensive insights tailored to your strategic needs. Reach out to Associate Director of Sales & Marketing, Ketan Rohom, who can guide you through the report’s in-depth findings, ensuring you have the clarity and context required to make high-stakes decisions with confidence.

By partnering with Ketan Rohom to secure this market research report, you gain a roadmap for navigating technological complexities, tariff headwinds, and evolving customer preferences. Leverage these insights to refine investment priorities, optimize operational efficiencies, and uncover unique growth avenues in the dynamic aeroponics landscape.

- How big is the Aeroponics Market?

- What is the Aeroponics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?