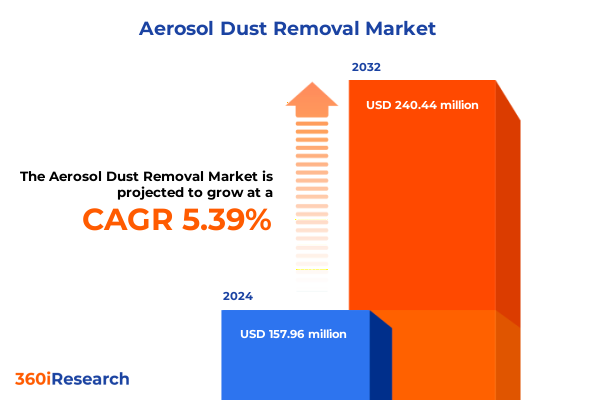

The Aerosol Dust Removal Market size was estimated at USD 166.50 million in 2025 and expected to reach USD 174.50 million in 2026, at a CAGR of 5.39% to reach USD 240.44 million by 2032.

Setting the Stage with a Comprehensive Overview of Aerosol-Based Dust Removal Innovations and Emerging Challenges Shaping Future Adoption

Aerosol-based dust removal has evolved from a niche maintenance practice into a critical component of equipment reliability and process integrity across diverse industries. In recent years, innovators have refined nozzle designs, propellant systems, and formulation chemistry to achieve more precise targeting of fine particulates, enabling end users to protect sensitive electronics, automotive assemblies, and industrial machinery from the adverse effects of dust accumulation. Concurrently, tightening environmental regulations and rising demand for sustainable solutions have driven the development of solvent-free and water-based formulations that minimize volatile organic compound emissions without compromising performance. As a result, organizations are reevaluating traditional cleaning protocols and integrating advanced aerosol products into their standard operating procedures to enhance safety and reduce downtime.

Looking ahead, industry stakeholders face a complex interplay of technological, regulatory, and supply chain considerations. Ongoing digitization efforts have introduced smart dispensing systems that monitor usage and permit data-driven maintenance scheduling, thereby optimizing resource allocation and reducing waste. At the same time, global material shortages and tariff realignments have heightened the need for resilient sourcing strategies, prompting distributors and manufacturers alike to pursue diversified supplier networks. This report offers a foundational overview of these dynamics, setting the stage for a deeper exploration of how transformative shifts, policy measures, and segmentation nuances are reshaping the landscape of aerosol dust removal.

Uncovering the Transformative Shifts Driving Aerosol Dust Removal from Technological Breakthroughs to Regulatory and Sustainability Demands

The aerosol dust removal sector is experiencing a period of rapid transformation driven by converging forces across technology, sustainability, and compliance. First, breakthroughs in formulation science have yielded solvent-free and water-based solutions that align with corporate sustainability commitments, enabling end users to reduce their environmental footprint without sacrificing cleaning efficacy. These greener alternatives are gaining traction in applications ranging from electronics maintenance to industrial equipment servicing, signaling a paradigm shift away from traditional oil-based or hydrocarbon-laden propellants.

Simultaneously, regulatory bodies in major economies are imposing stricter emissions and waste disposal standards, compelling manufacturers to redesign packaging and propellant systems for enhanced safety and lower environmental impact. In parallel, industry alliances and certification schemes are emerging to standardize performance metrics and quality benchmarks, facilitating transparent product comparisons and accelerating adoption in heavily regulated sectors such as healthcare and aerospace.

Moreover, digital integration has introduced intelligent dispensing units that track usage patterns, predict replenishment cycles, and facilitate remote management of inventory. This technological infusion is reshaping service models by enabling as-a-service offerings and performance-based contracts. As companies adapt to these convergent shifts, they are poised to capture new value streams through innovation, improved compliance, and stronger customer engagement.

Analyzing the Cumulative Impacts of 2025 United States Tariffs on Aerosol Dust Removal Supply Chains, Costs, and Strategic Realignments

In 2025, adjustments to United States tariff schedules have introduced added complexity to the aerosol dust removal supply chain, with heightened duties impacting raw propellants, specialized nozzles, and advanced formulation chemicals imported from key producing countries. These incremental levies have not only elevated direct procurement expenditures but have also triggered broader effects on shipping costs and lead times, as suppliers recalibrate logistics routes to mitigate tariff burdens and avoid high-duty entry points.

As a consequence, manufacturers reliant on compressed gas and hydrocarbon propellants are exploring alternative sourcing corridors, including nearshoring strategies and regional distribution hubs. Such realignments have led to increased inventory holding costs in certain geographies while enabling faster response times in regions where tariff exposure is minimized. At the same time, distributors are collaborating more closely with suppliers to share the financial impact of tariffs through joint agreements, volume commitments, and hedging arrangements designed to stabilize pricing for end users.

These strategic responses underscore a broader trend toward supply chain resilience, as industry participants integrate tariff analytics into procurement workflows and assess the total landed cost of goods. Through proactive scenario planning and diversified partner networks, companies are managing to maintain service levels and product availability despite the evolving tariff landscape.

Revealing Key Segmentation Insights by Application, End User, Formulation, Distribution Channels, and Propellant Dynamics for Targeted Strategies

A nuanced understanding of application-specific requirements reveals that aerosol dust removal solutions must cater to distinct operational environments. In equipment cleaning, for instance, formulations are tailored to automotive equipment servicing where precision and residue-free performance are paramount, while electronics equipment maintenance demands ultra-low moisture and static-dissipating properties. Industrial equipment cleaning applications, by contrast, prioritize broad-spectrum particulate removal and corrosion inhibition. Meanwhile, maintenance protocols extend beyond active cleaning to include scheduled reconditioning tasks that prolong equipment life, and surface preparation processes require formulations that optimize adhesion and coating performance.

When evaluating end-user verticals, the automotive sector bifurcates into aftermarket servicing, driven by repair shops and detailing centers, and OEM production lines that emphasize stringent quality control. Electronics manufacturers leverage aerosol dust removal for circuit board assembly and equipment maintenance, whereas healthcare facilities utilize specialized sprays to maintain sterile environments. Manufacturing plants in general deploy aerosol solutions across diverse machinery, from CNC equipment to packaging lines, each demanding unique performance characteristics.

Formulation segmentation further distinguishes between oil-based sprays valued for lubricity, solvent-free options that align with environmental mandates, and water-based variants offering rapid evaporation and minimal odor. Distribution channels play an equally pivotal role; traditional specialty stores and supermarkets & hypermarkets serve as primary outlets within offline channels, while digital platforms enable direct-to-end-user access and data-driven replenishment. Propellant choices-compressed gas for consistent peak pressure and hydrocarbon mixtures for cost efficiency-round out the segmentation landscape, providing clear pathways for product differentiation and strategic positioning.

This comprehensive research report categorizes the Aerosol Dust Removal market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Formulation

- Propellant

- End User

- Application

- Distribution Channel

Illuminating Essential Regional Insights Across the Americas, Europe Middle East & Africa, and Asia-Pacific for Aerosol Dust Removal Deployment

Regional dynamics exert a profound influence on the adoption, regulatory compliance, and innovation trajectories of aerosol dust removal solutions. In the Americas, demand is anchored by mature manufacturing hubs in the United States and Canada where stringent workplace safety standards and well-established industrial servicing networks drive consistent adoption. Investment in research labs and advanced pilot programs in this region have accelerated the rollout of next-generation water-based and solvent-free formulations, supported by government initiatives that incentivize sustainable manufacturing practices.

Across Europe, Middle East & Africa, a mosaic of regulations and industry standards shapes regional preferences. Western European markets exhibit a strong preference for eco-certified aerosol products, bolstered by comprehensive emissions legislation and consumer awareness campaigns. In contrast, emerging economies within the Middle East and Africa are gradually building capacity, with infrastructure development and foreign direct investment catalyzing demand for reliable equipment maintenance solutions.

The Asia-Pacific region represents both the largest growth arena and the most diverse market landscape. China and India, propelled by expansive electronics and automotive manufacturing sectors, are rapidly adopting aerosol dust removal technologies to enhance product quality and meet escalating quality control requirements. Meanwhile, Southeast Asian nations are witnessing a surge in online procurement channels, enabling smaller enterprises to access premium formulations and smart dispensing systems. These regional insights underscore the necessity of tailored go-to-market approaches and strategic partnerships to capitalize on local drivers.

This comprehensive research report examines key regions that drive the evolution of the Aerosol Dust Removal market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Competitive Dynamics Reshaping the Aerosol Dust Removal Landscape through Innovation and Partnerships

The competitive landscape of aerosol dust removal is defined by a blend of established chemical conglomerates and specialized niche players, each leveraging unique strengths to gain market share. Leading manufacturers have invested heavily in research collaborations to refine propellant technologies and sustainable chemistries, while forging partnerships with global distributors to ensure seamless reach. Many of these companies have expanded their product portfolios through targeted acquisitions of regional spray technology firms, thereby integrating localized expertise and enhancing their service capabilities.

Smaller innovators, on the other hand, have distinguished themselves through rapid iteration cycles and customer-centric offerings. By developing modular, smart dispensing solutions that integrate IoT connectivity, these agile firms are capturing the attention of large end users seeking real-time usage data and predictive maintenance analytics. Furthermore, strategic alliances between formulation experts and industrial equipment OEMs are becoming increasingly common, enabling co-branded solutions that embed aerosol dust removal protocols into new equipment sales.

In this dynamic arena, the balance between scale and specialization is shifting. Global players are seeking to maintain their leadership by accelerating sustainability initiatives and global distribution partnerships, whereas regional players are carving out niches through deep application expertise and digital engagement models. This evolving interplay between industry titans and innovative challengers is reshaping competitive dynamics and driving continuous improvement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aerosol Dust Removal market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Abro Industries, Inc.

- ACCO Brands Corporation

- Aerol Formulations Private Limited

- Ball Corporation

- Beiersdorf AG

- CRC Industries, Inc.

- Falcon Safety Products, Inc.

- Fellowes Brands, Inc.

- Henkel AG & Co. KGaA

- Honeywell International Inc.

- Illinois Tool Works Inc.

- Kimberly-Clark Corporation

- Maxell Holdings, Ltd.

- Norazza Inc.

- PerfectData

- Thermo Fisher Scientific Inc.

- Twin Tech India Pvt. Ltd.

Delivering Actionable Recommendations for Industry Leaders to Optimize Innovation, Compliance, and Market Penetration in Aerosol Dust Removal

To capitalize on emerging opportunities and mitigate evolving risks, industry leaders should prioritize investments that align with both operational excellence and sustainability targets. First, accelerating the development and commercialization of solvent-free and water-based formulations will address regulatory pressures and customer demand for greener solutions. By collaborating with research institutions and leveraging government incentives, companies can reduce product development timelines and secure first-mover advantages in eco-certified segments.

Concurrently, enhancing supply chain resilience through diversified sourcing strategies and real-time tariff analytics is essential. Leaders should establish multiple regional distribution hubs and negotiate flexible procurement contracts that can absorb sudden duty adjustments while preserving service levels. Integrating advanced digital tools for inventory tracking and predictive demand planning will further shield operations from external shocks.

Finally, embracing digital engagement models-from smart dispensing units that deliver actionable usage insights to direct-to-end-user e-commerce platforms-will strengthen customer relationships and generate new revenue streams. Cross-functional alignment between R&D, regulatory affairs, and sales teams can facilitate cohesive product roadmaps, ensuring that innovation pipelines respond directly to end-user requirements and compliance thresholds.

Detailing the Rigorous Multi-Source Research Methodology Underpinning Findings on Aerosol Dust Removal through Primary, Secondary, and Expert Analyses

The research underpinning this report was conducted through a rigorous multi-stage methodology designed to ensure accuracy, depth, and relevance. Initially, secondary intelligence was gathered from global regulatory bodies, technical journals, and patent filings to map historical product developments and regulatory milestones. This desk research established a robust baseline of technology trends, formulation breakthroughs, and policy shifts.

Building on that foundation, primary interviews were carried out with senior executives, product engineers, and procurement managers across equipment manufacturers, distribution firms, and end-user organizations. These structured conversations yielded granular insights into performance expectations, supply chain considerations, and strategic priorities. To complement qualitative inputs, technical performance data and safety compliance records were collected from leading formulation providers and third-party testing laboratories.

Throughout the analysis, triangulation techniques were applied to cross-validate findings, ensuring that divergent viewpoints were reconciled and anomalies investigated. The projected scenarios relating to tariff impacts and regional adoption patterns were stress-tested using expert panels and sensitivity analyses, providing decision-makers with confidence in the robustness of the conclusions. This disciplined approach delivers a comprehensive, evidence-based perspective on the aerosol dust removal landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aerosol Dust Removal market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aerosol Dust Removal Market, by Formulation

- Aerosol Dust Removal Market, by Propellant

- Aerosol Dust Removal Market, by End User

- Aerosol Dust Removal Market, by Application

- Aerosol Dust Removal Market, by Distribution Channel

- Aerosol Dust Removal Market, by Region

- Aerosol Dust Removal Market, by Group

- Aerosol Dust Removal Market, by Country

- United States Aerosol Dust Removal Market

- China Aerosol Dust Removal Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Core Findings and Strategic Implications from the Aerosol Dust Removal Study to Guide Decisions and Foster Sustainable Growth

This comprehensive report brings into focus the critical intersections of technology innovation, regulatory evolution, and supply chain strategy that define the aerosol dust removal industry. From the emergence of eco-friendly formulations to the operational realignments prompted by United States tariffs, each dimension of the analysis underscores the need for proactive adaptation. Moreover, the segmentation and regional perspectives illuminate targeted pathways for growth, while the competitive profiling highlights the strategic moves reshaping the competitive equilibrium.

Ultimately, the insights contained herein serve as a strategic compass, guiding stakeholders through a period of accelerated change. By synthesizing market dynamics, technology trajectories, and policy developments, this study equips decision-makers with the actionable intelligence required to navigate uncertainty and seize emerging opportunities. Implementing the recommended approaches to formulation innovation, supply chain diversification, and digital integration will position organizations to achieve sustained performance and competitive differentiation in the aerosol dust removal arena.

Take the Next Step to Acquire In-Depth Insights on Aerosol Dust Removal Trends and Opportunities by Connecting with Ketan Rohom Today

To explore the comprehensive findings and capitalize on the detailed analyses presented in this report, you are invited to connect with Ketan Rohom, Associate Director of Sales & Marketing. By engaging with Ketan, you will gain tailored guidance on how to leverage these insights for strategic advantage, ensuring that your organization remains at the forefront of aerosol dust removal innovation and operational excellence. Secure your copy of the full research and discover actionable intelligence that can drive your growth, inform investment decisions, and enhance competitive positioning in this dynamic industry.

- How big is the Aerosol Dust Removal Market?

- What is the Aerosol Dust Removal Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?