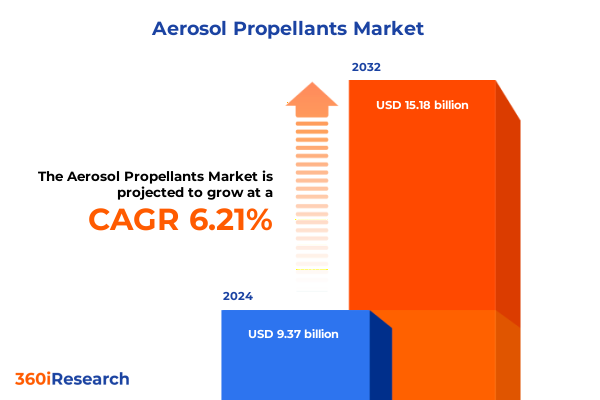

The Aerosol Propellants Market size was estimated at USD 9.85 billion in 2025 and expected to reach USD 10.36 billion in 2026, at a CAGR of 6.36% to reach USD 15.18 billion by 2032.

Unveiling the critical drivers and emerging paradigms shaping the aerosol propellants market within an evolving global regulatory and sustainability landscape

The aerosol propellants market is at a pivotal juncture, influenced by a complex interplay of regulatory reforms, environmental sustainability imperatives, and shifting consumer preferences. As global legislators accelerate the phase-down of high-global-warming-potential compounds under international agreements, manufacturers and suppliers are compelled to reevaluate their product portfolios. This realignment has catalyzed innovation in alternative propellant chemistries, prompting cross-industry collaboration from chemical producers and end-use sectors alike.

Furthermore, the industry is witnessing an intensified focus on sustainability credentials as brand owners integrate environmental, social, and governance metrics into their procurement criteria. Demand for lower-footprint propellants, such as dimethyl ether and advanced hydrocarbon blends, is emerging as a decisive factor in supplier selection. At the same time, established technologies like hydrofluoroalkanes remain integral during the transition, benefitting from continuous performance optimizations.

In parallel, digitalization of manufacturing processes and supply chain traceability is gaining traction, enabling real-time monitoring of quality attributes and regulatory compliance. These technological enablers not only mitigate risk but also enhance operational agility in a market defined by stringent safety standards and evolving environmental mandates. Collectively, these drivers set the context for a market landscape undergoing profound transformation, as stakeholders navigate toward resilient, future-proof propellant solutions.

Mapping the transformative technological breakthroughs and consumer-driven sustainability shifts redefining raw material selection and application strategies in aerosol propellants

Recent years have ushered in transformative shifts that are redefining the aerosol propellants landscape. Technological breakthroughs in formulation science are unlocking new performance frontiers, with dimethyl ether offering comparable atomization characteristics to traditional hydrofluoroalkanes while significantly reducing greenhouse gas impact. Concurrently, advancements in hydrocarbon propellant blends-leveraging isobutane, n-butane, and propane-have yielded formulations that meet flammability and safety regulations without compromising application efficacy, especially in personal care products.

Meanwhile, the consumer-driven sustainability movement is reshaping end-use categories. Automotive car care and paint sprays are increasingly adopting lower-GWP options to align with original equipment manufacturers' environmental targets, while food and beverage overwraps featuring whipped cream dispensers are transitioning to CO₂-based systems to respond to consumer demand for “clean label” ingredients. In household applications, air fresheners and insecticides are migrating toward propellant blends that minimize odor carryover and enable more precise dosing, reflecting heightened preferences for user-friendly and eco-responsible solutions.

Moreover, industrial lubricants and paints and coatings applications are benefiting from enhanced propellant selection that optimizes atomization and surface coverage, streamlining application processes and reducing waste. These cumulative shifts illustrate how innovation and sustainability mandates are converging, creating a dynamic environment in which agility and technical expertise are paramount.

Analyzing the cumulative effects of United States tariffs imposed in 2025 on supply chain dynamics costs and market positioning in aerosol propellants

In 2025, a suite of tariffs imposed by the United States has exerted a pronounced influence on aerosol propellant supply chains and cost structures. Tariffs on imported aluminum aerosols and certain hydrofluoroalkane precursors have increased cost pressures on North American filling operations, compelling manufacturers to explore alternative sourcing strategies. In response, several producers have diversified their procurement to domestic and regional suppliers that benefit from preferential trade agreements, thereby insulating margins against volatile tariff cycles.

These trade measures have also catalyzed strategic localization of key process steps, with an increasing number of formulators investing in regional mixing and filling facilities to bypass cross-border duties. While the immediate effect has been an uptick in capital expenditures, the longer-term outcome is a more robust, geographically dispersed production network that mitigates risk from future policy shifts. Furthermore, secondary effects on logistics-particularly shipping rates and container availability-have prompted a reevaluation of inventory strategies, leading to leaner, just-in-time models in place of large safety stocks.

From a competitive standpoint, companies that rapidly adapted to the tariff environment by optimizing domestic supply streams and renegotiating contracts have enhanced their market positioning. Conversely, less agile players have faced margin erosion and margin compression. These dynamics underscore the critical need for continuous policy monitoring and agile supply chain architectures in the aerosol propellants sector.

Uncovering pivotal segmentation insights that illuminate propellant variations container material shifts and application evolutions and distribution channel trends

Granular segmentation analysis reveals differentiated growth drivers and strategic imperatives across propellant chemistries, container materials, applications, and distribution channels. Within propellants, compressed gas variants-air, carbon dioxide, and nitrogen-are gaining traction in food and beverage whipped cream dispensers, while dimethyl ether applications are proliferating across personal care formulations due to their favorable environmental profile. Hydrocarbon blends segmented by isobutane, n-butane, and propane continue to dominate household insecticides and automotive spray markets, reflecting a balance of cost, performance, and regulatory compliance. Meanwhile, hydrofluoroalkane subtypes, including HFC-134a, HFC-152a, and HFC-227ea, are undergoing continuous performance refinements to meet evolving global phase-down schedules.

Turning to container materials, lightweight aluminum remains the material of choice for premium personal care and automotive cans, driven by recyclability mandates and consumer perceptions of quality. Plastic containers are expanding in household cleaning and insecticide segments due to cost efficiency and lower transportation emissions, whereas tin-plated steel persists in industrial lubricant and paint and coating formats, benefiting from structural integrity under high-pressure formulations.

Application segmentation underscores nuanced requirements: car care and paint sprays demand accelerated atomization, cooking sprays require food-grade inertness, and cosmetics hinge on precise aerosol dynamics. Distribution channels further refine go-to-market approaches, with e-commerce company websites and online marketplaces unlocking direct-to-consumer sales, institutional government agencies, hospitals, and hospitality requiring bulk deliveries, and retail convenience stores, drugstores, and supermarkets shaping last-mile packaging formats. This segmentation landscape informs targeted strategies to align product offerings with distinct end-use and channel requirements.

This comprehensive research report categorizes the Aerosol Propellants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Propellant Type

- Container Material

- Application

- Distribution Channel

Revealing critical regional insights underscoring market drivers regulatory frameworks and consumer preferences across the Americas EMEA and Asia-Pacific

Regional dynamics in the aerosol propellants domain vary markedly across the Americas, EMEA, and Asia-Pacific, driven by distinct regulatory frameworks and consumption patterns. In the Americas, stringent EPA regulations and consumer demand for low-GWP products have accelerated uptake of hydrofluoroalkane replacements and heavy investment in domestic mixing capabilities. The proximity of automotive manufacturing hubs further boosts demand for specialized propellants tailored to car care and paint spray applications, while evolving food safety standards underpin growth in carbon dioxide-based whipped cream formulations.

In EMEA, the integration of F-gas regulations under the European Union’s climate objectives has led to early adoption of dimethyl ether and hydrocarbon solutions, particularly in household air fresheners and industrial paints and coatings. Heightened consumer awareness around recyclability has amplified the use of aluminum containers in premium fragrances and refrigerated spray applications. Moreover, energy-efficiency mandates in regional hospitality sectors, especially in hotels and restaurants, are driving institutional channel procurement of bulk aerosol lubricants and maintenance sprays.

Meanwhile, the Asia-Pacific region stands out for its expansive manufacturing base and cost-sensitive markets. Rapid e-commerce growth in China and India is transforming distribution models, encouraging small-format retail packaging and online marketplaces. Regulatory heterogeneity across countries has spurred localized R&D efforts to adapt propellant blends to meet diverse safety and performance standards. Collectively, these regional insights enable stakeholders to tailor strategies that leverage local strengths while navigating complex compliance landscapes.

This comprehensive research report examines key regions that drive the evolution of the Aerosol Propellants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting strategic initiatives partnerships and competitive strategies deployed by leading manufacturers shaping innovation in the aerosol propellants arena

Leading entities in the aerosol propellants market are redefining competitive dynamics through strategic initiatives across innovation, partnerships, and operational excellence. Major chemical producers are allocating R&D resources to develop next-generation low-GWP propellants, collaborating with academic institutions and research consortia to accelerate testing and scale-up of dimethyl ether and advanced hydrocarbon blends. At the same time, several integration plays have emerged, with tier-one filling companies acquiring or partnering with propellant suppliers to secure upstream access and enhance supply chain resilience.

Collaborative ventures between container manufacturers and propellant producers are optimizing end-to-end formulations, yielding proprietary aerosol platforms that deliver improved atomization, shelf stability, and compliance with international phasing schedules. In parallel, digital transformation initiatives-incorporating IoT-enabled sensors for pressure and temperature monitoring-are being piloted by leading players to ensure consistent product performance and to preempt regulatory deviations.

On the M&A front, select regional champions are expanding footprint through acquisitions of strategic assets in emerging markets, seeking to capitalize on local cost advantages and growing e-commerce demand. These competitive maneuvers underscore a broader shift toward vertically integrated, innovation-led business models, where control over propellant chemistry, container design, and filling technologies provides a distinct differentiation in a crowded marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aerosol Propellants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ASVR Engineering Pvt Ltd

- Baker Perkins Ltd

- Baxter Manufacturing Co., Inc.

- Bongard S.A.S.

- Classic Engineering Industry

- Doyon Equipment Inc.

- Empire Bakery Machines Pvt Ltd

- Good Luck Bakery Machines

- LBC Bakery Equipment Inc.

- Macadams Baking Systems

- MIWE Michael Wenz GmbH

- Monolinére MONO Equipment Ltd

- Naik Oven Manufacturing Co.

- Revent International AB

- Salva Industrial S.A.

- Sveba Dahlen AB

- Tagliavini S.p.A.

- Thermodyne Bakery and Industrial Equipments Pvt Ltd

- Wiesheu GmbH

Delivering actionable recommendations to help industry leaders enhance sustainability reduce regulatory exposure and drive innovation in aerosol propellants

Industry leaders should rapidly advance low-GWP propellant portfolios by aligning R&D roadmaps with evolving regulatory calendars and consumer sustainability commitments. Integrating lifecycle assessments into product development will not only preempt forthcoming restrictions but also strengthen brand reputation in environmentally conscious markets. To optimize cost structures, executives are advised to pursue regional manufacturing hubs, leveraging favorable trade agreements to circumvent tariff volatility and to minimize logistical complexities.

Additionally, organizations must fortify supply chain transparency through digital traceability platforms that monitor propellant origin, purity levels, and container integrity in real time. This capability will streamline compliance reporting and bolster risk mitigation frameworks. Market participants should also adopt a channel-specific go-to-market playbook, customizing formulation and packaging options for e-commerce direct-to-consumer channels, high-volume institutional buyers, and brick-and-mortar retailers to maximize shelf impact and service levels.

Finally, forging cross-sector collaborations-particularly with automotive OEMs, food & beverage brand owners, and household product manufacturers-can accelerate application-specific innovation and secure long-term offtake agreements. By synthesizing sustainability, digitalization, and partnership strategies, industry leaders can navigate the complex aerosol propellants ecosystem with agility and strategic foresight.

Outlining the rigorous research methodology data sources analytical frameworks and QA processes used to ensure integrity of insights into aerosol propellants

The analysis underpinning this executive summary draws upon a robust research methodology combining primary and secondary data streams. Expert interviews were conducted with senior R&D and supply chain executives from key propellant and container manufacturers, as well as procurement heads at leading end-use firms across automotive, food & beverage, household, industrial, and personal care sectors. These discussions provided qualitative insights into performance criteria, regulatory compliance hurdles, and go-to-market dynamics.

Secondary research integrated data from trade associations, regulatory agencies, technical journals, and company disclosures to map global policy landscapes and technological trajectories. Segment-level breakdowns were refined through triangulation with proprietary industry databases, ensuring consistency across propellant type, container material, application, and distribution channel paradigms. Analytical frameworks included SWOT assessments, value chain analysis, and scenario planning to evaluate potential impact vectors such as tariff adjustments and sustainability mandates.

Quality assurance processes encompassed peer review by subject-matter experts and comparison against historical trend lines to validate data integrity. This systematic approach ensures that the findings and recommendations presented are both reliable and actionable, offering stakeholders a solid foundation for strategic decision-making in aerosol propellants.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aerosol Propellants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aerosol Propellants Market, by Propellant Type

- Aerosol Propellants Market, by Container Material

- Aerosol Propellants Market, by Application

- Aerosol Propellants Market, by Distribution Channel

- Aerosol Propellants Market, by Region

- Aerosol Propellants Market, by Group

- Aerosol Propellants Market, by Country

- United States Aerosol Propellants Market

- China Aerosol Propellants Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2544 ]

Summarizing key findings strategic implications and future outlook to guide stakeholders in making resilient and sustainable decisions for aerosol propellants

In summary, the aerosol propellants market is evolving under the dual forces of environmental regulation and technological innovation. Stakeholders that proactively embrace low-GWP chemistries, optimize regional supply chains, and harness digital traceability will be best positioned to maintain competitive advantage. Segmentation insights highlight the necessity of tailoring formulations and container materials to distinct end-use and channel requirements, while regional analyses underscore the importance of aligning strategies with local regulatory and consumption dynamics.

Key companies are charting pathways to vertical integration and collaborative R&D, signaling a shift toward more resilient and innovation-driven business models. Actionable recommendations emphasize the integration of sustainability metrics, flexible manufacturing networks, and targeted channel strategies. Looking ahead, continued vigilance on policy developments and agile adaptation to consumer preferences will be paramount. By leveraging the insights and frameworks detailed herein, decision-makers can navigate uncertainty, capitalize on emerging opportunities, and drive sustainable growth in the aerosol propellants arena.

Motivating stakeholders to engage with Associate Director Sales and Marketing for tailored strategic insights and aerosol propellants research acquisition

For tailored guidance and in-depth analysis that align precisely with your strategic objectives reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Whether you require clarifications on specific propellant chemistries, deeper dives into segment-specific dynamics, or bespoke scenario planning, Ketan can connect you to the analysts best suited to address your priorities. Engaging with this resource ensures that you access the full scope of insights, proprietary interviews, and nuanced regional assessments covered in the market research report.

Secure your competitive advantage by partnering with a dedicated specialist who can facilitate immediate access to comprehensive data sets, executable recommendations, and ongoing advisory support. Contact Ketan Rohom today to explore customized offerings, obtain sample chapters, or discuss enterprise licensing options-catalyzing informed decisions that drive innovation and profitability in aerosol propellants.

- How big is the Aerosol Propellants Market?

- What is the Aerosol Propellants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?