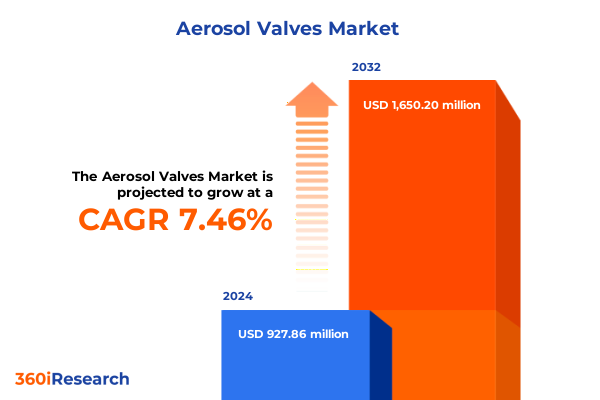

The Aerosol Valves Market size was estimated at USD 986.55 million in 2025 and expected to reach USD 1,050.39 million in 2026, at a CAGR of 7.62% to reach USD 1,650.19 million by 2032.

Unveiling the strategic significance of aerosol valves in enhancing product performance and shaping global dispensing markets

Aerosol valves play an indispensable role in the seamless delivery of pressurized formulations, transcending the boundaries of consumer convenience and industrial precision. As key enablers of product performance, these specialized components regulate the flow and dosage of liquids and gases under pressure, guaranteeing consistent release, user safety, and enhanced shelf stability. Their design intricacies-from actuator geometry to material compatibility-directly impact the end-user experience, whether in personal care products, household aerosols, or critical pharmaceutical applications.

In response to mounting regulatory scrutiny, shifting consumer preferences, and rapid technological advances, manufacturers are increasingly focusing on valve innovation as a strategic differentiator. The evolution of formulations-ranging from water-based propellants to eco-friendly aerosols-has spurred demand for valves capable of handling diverse viscosities and chemical profiles without compromising performance. Consequently, industry players are investing heavily in R&D to develop next-generation sealing mechanisms, miniaturized designs, and smart dispensing solutions. This introduction sets the stage for understanding how transforming market dynamics are redefining the strategic importance of aerosol valves across multiple end-use sectors.

Exploring the pivotal technological, regulatory, and consumer-driven shifts that are redefining the aerosol valve market landscape

The aerosol valve landscape is undergoing transformative shifts driven by a convergence of technological innovation, environmental mandates, and evolving consumer behaviors. Technologically, the integration of precision micro-machining and smart sensor technologies has enabled valves to deliver controlled release profiles with unprecedented accuracy. These advancements not only enhance product efficacy but also facilitate data-driven customization, allowing brands to offer personalized dispensing experiences.

Simultaneously, stringent environmental regulations aimed at reducing volatile organic compound (VOC) emissions and phasing down hydrofluorocarbon (HFC) propellants have compelled manufacturers to reformulate both valves and propellant systems. This regulatory pressure is accelerating the adoption of alternative materials and low-impact designs, which in turn is reshaping supplier ecosystems. In parallel, a growing segment of environmentally conscious consumers demands sustainable packaging solutions that minimize waste without sacrificing performance. Combined, these regulatory and consumer imperatives are redefining competitive priorities and catalyzing a new wave of collaborative innovation across the value chain.

Assessing the accumulated effects of newly implemented United States tariffs on aerosol valve imports and domestic supply chains

In 2025, the introduction of incremental tariffs on imported aerosol valves and related components has produced a cumulative impact that reverberates across the supply chain. Import duties applied to incoming valve assemblies have elevated landed costs for formulators and contract packagers, prompting many to reevaluate sourcing strategies and seek local manufacturing alternatives. This shift has highlighted vulnerabilities in global production networks, particularly for companies that have historically depended on low-cost imports.

As domestic production ramps up in response to higher import expenses, secondary effects are becoming clear. Upstream suppliers of raw materials, such as elastomers and metal alloys, are witnessing increased demand volatility, while downstream bottlers confront longer lead times and potential supply shortages. Furthermore, the tariff-induced cost pressure is being partially absorbed by manufacturers through process optimization and lean engineering initiatives. These adaptive measures underscore the resilience of the industry but also signal a more complex pricing environment moving forward, where strategic supply chain realignment will be critical to maintaining margin stability.

Illuminating critical segmentation dimensions that offer deeper understanding of valve types, materials, mechanisms, applications and distribution pathways

A robust understanding of key segmentation dimensions is essential for companies seeking to navigate market complexities and prioritize high-impact growth opportunities. When analyzed according to valve type-ranging from actuator latch designs and anti-drain configurations to crimp on seals, screw on fittings, and umbrella valves-distinct performance attributes and cost structures emerge, informing targeted product strategies. Meanwhile, material selection plays a pivotal role in balancing durability, chemical compatibility, and sustainability objectives, whether through advanced composites, engineered elastomers, precision-cast metals, or versatile plastics.

Examining operation mechanism segmentation reveals divergent value propositions between automatic systems that offer hands-free activation and manual variants designed for simplicity and user control. Application-focused analysis further deepens insight by differentiating requirements across automotive coatings, food and beverage dispensers, household cleaning aerosols, industrial lubricants, personal care foams, and life-science critical sprays. Finally, a granular appraisal of distribution channels-from direct partnerships and traditional distributors to burgeoning online sales via e-commerce platforms and manufacturer websites-uncovers evolving go-to-market models and channel-specific dynamics that shape buying behavior and revenue streams.

This comprehensive research report categorizes the Aerosol Valves market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Valve Type

- Material

- Operation Mechanism

- Application

- Distribution Channel

Exploring the diverse regional dynamics across Americas, EMEA and Asia-Pacific that shape aerosol valve demand and growth trajectories

Regional perspectives reveal how geographic dynamics influence demand patterns, regulatory frameworks, and competitive intensity. In the Americas, innovation in lightweight valve architectures and eco-friendly formulations is particularly pronounced, driven by robust consumer spending and stringent federal and state environmental regulations. Major bottling hubs in North America continue to expand capacity as formulators respond to shifting local content requirements and logistics considerations.

Across Europe, Middle East and Africa, the interplay between mature Western European markets and emerging economies in the Gulf and Sub-Saharan Africa creates a dual-speed environment. Established players invest in advanced valve coatings and precision controls to meet premium segment expectations, while cost-conscious markets prioritize scalable, value-engineered solutions. In the Asia-Pacific region, rapid urbanization and growing industrial end-use sectors-in particular, personal care and food and beverage packaging-are fueling demand for both standardized and customized valve innovations. Government incentives to develop domestic manufacturing clusters further amplify regional growth trajectories.

This comprehensive research report examines key regions that drive the evolution of the Aerosol Valves market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting leading industry players and their strategic initiatives that define competitive positioning within the aerosol valve sector

Leading companies have adopted distinct strategic approaches to maintain competitive positioning and capitalize on evolving market needs. Major global valve specialists are leveraging integrated manufacturing footprints and backward integration into elastomer and metal component production to enhance supply resilience and exert greater control over quality. Others are forging strategic joint ventures and technology alliances to accelerate innovation in smart valve systems and sustainable materials.

Meanwhile, midsize independents are carving out niches by focusing on rapid customization, agile R&D partnerships, and localized service offerings that address specific end-use challenges. Several forward-leaning firms are pioneering digital platforms for remote monitoring of valve performance, predictive maintenance scheduling, and on-demand customization services. Collectively, these strategic initiatives underscore a competitive landscape defined by collaboration, specialization, and a relentless focus on delivering differentiated value to brand owners and contract manufacturers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aerosol Valves market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AptarGroup, Inc.

- Berry Global, Inc.

- Clayton Corporation

- Coster Group S.p.A.

- GEKA GmbH

- Harpak-ULMA Packaging, S. Coop.

- Lindal Group Holding GmbH

- Mitani Valve Co., Ltd.

- Newman Green Inc.

- Pamasol AG

- Precision Valve Corporation

- Silgan Holdings Inc.

- Summit Packaging Systems, Inc.

- Valois SAS

Delivering actionable strategic recommendations to propel aerosol valve manufacturers and stakeholders toward sustainable competitive advantage

To secure a leading market position, manufacturers should prioritize a balanced innovation portfolio that advances sustainable materials and next-generation valve architectures while preserving cost competitiveness. First, investing in modular design platforms can streamline production scale-up and enable rapid configuration for diverse applications. Simultaneously, forging supplier partnerships to co-develop bio-based elastomers and recyclable composite materials will address both regulatory mandates and consumer sustainability expectations.

In parallel, companies must bolster supply chain agility by diversifying sourcing across regional hubs and implementing digital track-and-trace systems. This approach reduces exposure to geopolitical and tariff-driven disruptions while enhancing transparency and compliance. Additionally, leveraging data analytics to capture end-user usage patterns and performance feedback can drive continuous improvement cycles and foster deeper client engagement. Finally, exploring innovative distribution models-such as direct-to-consumer samplings and subscription-based replenishment services-will open new revenue streams and reinforce brand loyalty in an increasingly digital marketplace.

Outlining rigorous research methodology and data validation processes underpinning the aerosol valve market intelligence study

The research methodology underpinning this market intelligence study combines rigorous primary research with comprehensive secondary validation to ensure accuracy and depth. Primary inputs were gathered through structured interviews with senior executives, product engineers, procurement leaders, and sustainability officers across key valve manufacturers, contract packagers, and brand owners. These interactions provided firsthand insights into technology roadmaps, material sourcing strategies, and customer pain points.

Secondary research encompassed a meticulous review of publicly available financial filings, patent databases, industry association reports, and regulatory documentation from environmental agencies. Trade data analytics, including import-export volumes and tariff schedules, were leveraged to quantify supply chain shifts and regional trade flows. All data points underwent triangulation through cross-referencing multiple sources, and proprietary analytics frameworks were applied to standardize variables and minimize bias. This robust methodology ensures that the findings and recommendations presented herein reflect current market realities and emerging trends with high confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aerosol Valves market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aerosol Valves Market, by Valve Type

- Aerosol Valves Market, by Material

- Aerosol Valves Market, by Operation Mechanism

- Aerosol Valves Market, by Application

- Aerosol Valves Market, by Distribution Channel

- Aerosol Valves Market, by Region

- Aerosol Valves Market, by Group

- Aerosol Valves Market, by Country

- United States Aerosol Valves Market

- China Aerosol Valves Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Summarizing the key takeaways and strategic implications for stakeholders navigating the evolving aerosol valve market landscape

The aerosol valve market stands at a pivotal juncture characterized by accelerated innovation, heightened regulatory scrutiny, and evolving channel dynamics. Stakeholders must navigate a landscape where smart dispensing systems and sustainable material solutions increasingly define competitive differentiation. The imposition of new tariffs has underscored the importance of supply chain resilience, prompting a strategic shift toward localized production and digital traceability initiatives.

Segmentation insights reveal that valve type, material composition, operation mechanism, end-use application, and distribution channel each unlock unique value propositions and growth pathways. Regionally, the Americas lead in eco-innovation, Europe, Middle East and Africa balance premium and value-driven demands, and Asia-Pacific demonstrates rapid expansion fueled by urbanization and government incentives. Leading companies are responding through integrated manufacturing, collaborative R&D, and digital service platforms.

In summary, success in the evolving aerosol valve domain will depend on an agile blend of material innovation, process optimization, data-driven decision-making, and strategic partnerships. By internalizing these trends and recommendations, market participants can position themselves for sustainable growth and long-term resilience.

Engage with Ketan Rohom to gain unparalleled insights and unlock growth opportunities with the comprehensive aerosol valve market research report

To explore the full depth of strategic insights and seize emerging opportunities in the aerosol valve domain, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Engaging with his expert team will provide tailored recommendations, detailed data analyses, and customized solutions designed to align precisely with organizational objectives. By partnering with Ketan Rohom, stakeholders can leverage privileged access to in-depth competitive intelligence, proprietary benchmarking studies, and forward-looking scenario planning that will strengthen market positioning and accelerate innovation efforts.

Ketan Rohom’s consultative approach ensures that each client receives hands-on support in interpreting complex market dynamics, quantifying risk exposures related to tariff changes, and prioritizing high-growth segments. His extensive experience in driving strategic engagements enables teams to translate granular research into actionable roadmaps that deliver measurable ROI. Don’t miss the opportunity to transform insights into impact; connect with Ketan Rohom today to secure your copy of the comprehensive aerosol valve market research report and embark on a path to sustained competitive advantage.

- How big is the Aerosol Valves Market?

- What is the Aerosol Valves Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?