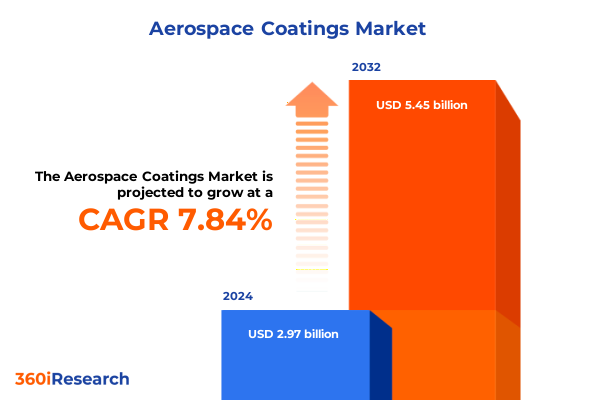

The Aerospace Coatings Market size was estimated at USD 3.21 billion in 2025 and expected to reach USD 3.43 billion in 2026, at a CAGR of 7.84% to reach USD 5.45 billion by 2032.

Unlocking the Future of Aerospace Coatings with Innovation-Driven Solutions, Regulatory Evolution, and Strategic Market Dynamics

The aerospace coatings sector is undergoing a period of unprecedented transformation, propelled by shifting industry demands, regulatory pressures, and rapid technological advancements. Historically characterized by stringent performance requirements and high barrier-to-entry standards, this market has evolved to embrace innovative chemistries and application processes that address sustainability, operational efficiency, and lifecycle cost optimization. As aircraft manufacturers and maintenance providers contended with rising fuel costs and heightened environmental scrutiny, coatings have become an integral enabler of both aerodynamic performance and corrosion protection, underpinning the sector’s drive toward more sustainable and cost-effective operations.

Emerging trends such as the adoption of water-based chemistries over traditional solvent-borne systems, the integration of functional additives for anti-icing and conductive capabilities, and the increasing deployment of digital application technologies are reshaping the competitive landscape. Moreover, global supply chain disruptions and evolving trade policies have underscored the critical importance of strategic sourcing, supply chain resilience, and regional production footprints. Within this context, aerospace coatings suppliers and end-users alike must navigate a complex interplay of regulatory mandates, sustainability objectives, and operational prerequisites. This analysis offers a holistic overview of the current market dynamics, setting the stage for deeper examination of transformative forces and strategic imperatives.

Navigating the Convergence of Sustainable Materials, Digital Coating Technologies, and Demand for Enhanced Aircraft Performance

In recent years, the aerospace coatings landscape has shifted dramatically as stakeholders prioritize sustainability without compromising on performance. The transition toward eco-friendly materials, notably waterborne and powder coating formulations, reflects both regulatory mandates and end-user commitments to reduce volatile organic compound emissions. Simultaneously, advancements in digital coating technologies-ranging from robotic spray systems to in-line curing using UV light-have enhanced application precision, minimized waste, and accelerated throughput. These developments have not only improved environmental footprints but have also delivered tangible improvements in coating uniformity, adhesion, and durability, elevating overall aircraft lifecycle performance.

Alongside material and process innovations, demand for multifunctional coatings continues to gain momentum. End-users now seek solutions that combine thermal barrier protection, abrasion resistance, anti-icing properties, and conductive pathways within single subsystems. This convergence of functionality is driving collaborative R&D efforts between chemical suppliers, aircraft manufacturers, and testing laboratories. At the same time, the rise of data-driven maintenance strategies is prompting more frequent and targeted inspections, placing new performance demands on coating systems. Consequently, market participants are increasingly focused on developing hybrid materials and smart coatings that offer real-time performance monitoring and adaptive response capabilities.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Measures on Raw Materials and Supply Chains in Aerospace Coatings

The introduction of new tariff measures in the United States during 2025 has exerted significant pressure on the aerospace coatings supply chain, particularly for resin imports and specialty additive components. Increased duties on key raw materials have driven up per-unit costs for traditional epoxy and polyurethane systems, compelling manufacturers to explore alternative sourcing strategies. This has accelerated interest in regional resin production and prompted suppliers to renegotiate contracts or absorb incremental costs to maintain competitive pricing. In turn, coating formulators have responded by re-engineering product portfolios to leverage domestically available polymers and reducing reliance on tariff-exposed inputs.

Beyond direct cost impacts, these trade policy shifts have catalyzed broader supply chain realignment. Manufacturers are reevaluating single-source dependencies, diversifying supplier bases across North America, Europe, and Asia-Pacific, and implementing strategic stockpiling to mitigate potential disruptions. At the same time, downstream buyers have sought greater transparency around landed costs, driving the adoption of digital procurement platforms and real-time tracking mechanisms. Ultimately, the cumulative effect of these tariffs is reshaping competitive dynamics and compelling players to adopt more agile sourcing and production models that can withstand future policy volatility.

Revealing Deep Insights into Aerospace Coatings Markets Across Resin Types Applications Technologies Platforms and Product Forms

A nuanced understanding of market segmentation reveals the diverse imperatives shaping product development and strategic positioning. Resin type delineation underscores the ongoing debate between established acrylic and epoxy chemistries versus more environmentally friendly waterborne and high-performance polyurethane systems. While acrylic formulations maintain an established role in decorative and UV-curable applications, epoxy systems continue to dominate high-strength anti-corrosion use cases. Polyurethane alternatives are gaining traction in thermal barrier and decorative segments, driven by their superior durability and flexibility. Waterborne resins, meanwhile, are supplanting solvent-borne materials across multiple application categories as end-users prioritize emissions reduction.

Application-based analysis highlights the layered complexity of functional requirements. Anti-corrosion coatings remain a perennial necessity for both airframe and engine platforms, while protective decorative finishes are prized for brand identity and passenger experience. Fire-resistant materials exhibit bifurcation between intumescent solutions that swell to form insulating char and film-forming fireproof chemistries. Functional coatings subdivide into abrasion-resistant systems suited to high-wear surfaces, anti-icing treatments that prevent ice accretion, and conductive finishes facilitating static dissipation and lightning strike protection. Thermal barrier coatings bifurcate into ceramic-based solutions for high-heat zones and thermal shield composites for global airframe temperature management. Technology segmentation further refines landscape comprehension, contrasting powder coatings’ low-VOC footprint with solvent-borne systems’ application versatility, UV-curable chemistries’ rapid cure times, and water-borne technologies’ regulatory appeal. Platform analysis extends from high-volume commercial applications to specialized military and unmanned aerial vehicles, while general aviation splits between business jets, piston-engine propeller aircraft, and turboprops. Finally, product form considerations-from aerosol sprays enabling field-level touch-ups to liquid formulations for large-scale production and powder variants for precision coating pods-underscore the broad spectrum of delivery mechanisms adapted to distinct operational contexts.

This comprehensive research report categorizes the Aerospace Coatings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Resin Type

- Application

- End Use

- Technology

- Aircraft Platform

- Product Form

Understanding the Distinct Drivers Shaping Aerospace Coatings Demand in the Americas Europe Middle East Africa and Asia-Pacific

Regional market dynamics reflect a mosaic of regulatory environments, fleet compositions, and growth trajectories. In the Americas, established commercial carriers and sizeable maintenance networks foster robust demand for both OEM coatings during new aircraft assembly and MRO finishes for line and base maintenance. Regulatory focus on emissions reduction has driven rapid adoption of water-borne and powder technologies across North America, while Brazil’s burgeoning business jet segment is fuelling niche growth in decorative and intumescent formulations.

Meanwhile, Europe Middle East and Africa present a diverse mix of mature and emerging opportunities. European regulatory bodies continue to tighten VOC thresholds, catalyzing a shift away from solvent-borne systems, whereas Middle Eastern carriers are investing in fleet expansion and premium cabin refurbishments that emphasize both protective and decorative coatings. In contrast Africa’s general aviation segment remains nascent but shows promise as infrastructural investments accelerate. Asia-Pacific stands as the fastest-growing region driven by rapid fleet modernization in China and India, rising defense spending, and UAV proliferation for both commercial and military applications. These diverse regional drivers necessitate nuanced market approaches that align product portfolios with localized performance standards and operational practices.

This comprehensive research report examines key regions that drive the evolution of the Aerospace Coatings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators Transforming Aerospace Coatings with Breakthrough Formulations Sustainable Solutions and Strategic Partnerships

Leading chemical producers and specialized aerospace finishers are converging to redefine competitive boundaries. Major global resin manufacturers have deepened partnerships with aircraft OEMs to co-develop next-generation coating systems that blend advanced polymer science with digital formulation platforms. Concurrently, niche technology providers are carving out differentiation through proprietary additive packages that impart multifunctional properties, such as self-healing microcapsules for corrosion mitigation or graphene-infused composites for ultra-lightweight conductive pathways.

Strategic alliances have become a cornerstone of innovation, with cross-sector collaborations linking materials scientists, application equipment vendors, and certification bodies. Joint ventures between coating formulators and MRO service providers are expediting product validation cycles, while research consortia are standardizing test protocols for emerging functional coatings. At the same time, several vertically integrated players are leveraging in-house pilot plants to accelerate scale-up, ensuring rapid commercial deployment of breakthrough chemistries and application methodologies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aerospace Coatings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V.

- APV Engineered Coatings

- Argosy International Inc.

- Axalta Coating Systems, LLC

- BASF SE

- Bodycote Plc

- Compagnie de Saint-Gobain S.A.

- Deft, Inc.

- Dunmore

- Hardide Plc

- Hempel A/S

- Henkel AG & Co. KGaA

- Hentzen Coatings, Inc.

- Hexion

- IHI Ionbond AG

- Mankiewicz Gebr. & Co.

- MAPAERO

- Master Bond Inc.

- Oerlikon Balzers Coating

- Permagard

- Polymer Technologies

- PPG Industries, Inc.

- Socomore

- The Sherwin-Williams Company

- Zircotec Ltd.

Empowering Industry Leaders with Actionable Strategies to Harness Technological Advancements and Optimize Aerospace Coatings Operations

To capitalize on evolving market conditions, industry leaders should prioritize investments in sustainable material platforms, particularly water-borne and powder coating systems. Aligning R&D roadmaps with anticipated regulatory shifts in VOC emissions and environmental safety will mitigate compliance risk while unlocking new business opportunities. In parallel, implementing digital application and inspection technologies can significantly enhance process consistency and quality assurance, reducing rework rates and lifecycle maintenance expenditures.

Furthermore, supply chain resilience must remain at the forefront of strategic planning. Diversifying raw material sources, establishing regional production capabilities, and integrating real-time procurement analytics will fortify operations against future tariff fluctuations and geopolitical disruptions. Engaging in collaborative partnerships with resin suppliers, additive innovators, and equipment manufacturers can accelerate co-innovation cycles. Finally, bolstering workforce competencies through targeted training programs in advanced surface preparation and digital coating applications will ensure that technical expertise keeps pace with material and process sophistication.

Detailing Rigorous Mixed Methods Research Approach Incorporating Industry Expert Interviews Data Triangulation and Technical Validation Processes

This research employs a mixed methods approach designed to ensure data integrity and analytical rigor. Initially, an exhaustive secondary review of trade publications, regulatory filings, patent databases, and technical white papers established foundational intelligence on historical trends and emerging technologies. These insights were supplemented by detailed supply chain mapping to identify key raw material flows and strategic supplier relationships.

Primary research comprised in-depth interviews with OEM and MRO executives, resin and additive specialists, certification experts, and independent consultants, enabling qualitative validation of emerging themes. A triangulation process cross-referenced quantitative inputs with technical performance data and real-world case studies to corroborate findings. Finally, a series of validation workshops with industry stakeholders tested preliminary conclusions, refined critical assumptions, and confirmed the practical applicability of recommended strategies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aerospace Coatings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aerospace Coatings Market, by Resin Type

- Aerospace Coatings Market, by Application

- Aerospace Coatings Market, by End Use

- Aerospace Coatings Market, by Technology

- Aerospace Coatings Market, by Aircraft Platform

- Aerospace Coatings Market, by Product Form

- Aerospace Coatings Market, by Region

- Aerospace Coatings Market, by Group

- Aerospace Coatings Market, by Country

- United States Aerospace Coatings Market

- China Aerospace Coatings Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Critical Findings to Illuminate the Strategic Imperatives Driving the Future Direction of Aerospace Coatings Industry

Collectively, this analysis underscores the imperative for coating formulators and end-users to adopt holistic strategies that integrate material innovation with digital application capabilities, robust supply chain frameworks, and regional market nuances. The shift toward multifunctional, environmentally compliant chemistries demands a departure from single-focus product portfolios to modular platforms that can be tailored to diverse end-use requirements and regional regulatory regimes.

Strategic collaboration emerges as a recurring motif, uniting chemical suppliers, equipment vendors, OEMs, and service providers in co-innovation ecosystems. As the industry grapples with the dual pressures of performance optimization and sustainability mandates, proactive investment in next-generation technologies and workforce upskilling will differentiate market leaders from laggards. By aligning R&D efforts with dynamic regulatory landscapes and operational priorities, stakeholders can secure a competitive edge in a market poised for continued evolution.

Engage Directly with Ketan Rohom to Explore Customized Insights Secure Your Comprehensive Aerospace Coatings Market Analysis Report Today

Engaging with an industry expert offers unparalleled clarity on the complexities and nuances of the aerospace coatings market. By partnering with Ketan Rohom, Associate Director of Sales & Marketing, you gain access to tailored intelligence that addresses your organization’s unique challenges and strategic objectives. This comprehensive report distills critical market insights into a cohesive narrative designed to inform executive decision-making and drive competitive advantage.

Don’t miss the opportunity to leverage a research asset that integrates in-depth segmentation analyses, regulatory impact assessments, and forward-looking technology trends. Reach out to Ketan Rohom today to secure your copy of the full aerospace coatings market analysis and embark on a data-driven journey toward enhanced performance, reduced risk, and sustained growth.

- How big is the Aerospace Coatings Market?

- What is the Aerospace Coatings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?