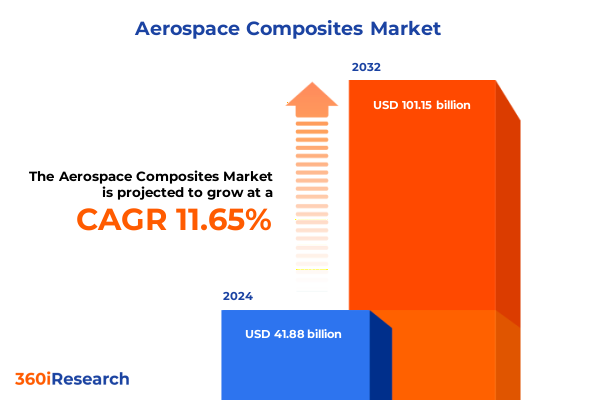

The Aerospace Composites Market size was estimated at USD 46.47 billion in 2025 and expected to reach USD 51.67 billion in 2026, at a CAGR of 11.75% to reach USD 101.15 billion by 2032.

Introduction to the Rise of Aerospace Composites and Their Role in Transforming Aircraft Design and Performance Across Commercial and Military Applications

Aerospace composites have become foundational to modern aircraft design, driving critical improvements in fuel efficiency, structural integrity, and emissions reduction. Leading commercial programs such as the Boeing 787 and Airbus A350 showcase the strategic value of composite materials, incorporating up to half of their structural weight in carbon fiber–reinforced polymers to meet stringent environmental mandates and operational cost targets. The shift toward higher composite content reflects a decisive move away from conventional metal alloys, as airframers seek superior strength-to-weight performance to support growing air traffic demands while adhering to tightening regulatory standards

Emerging Technologies and Strategic Trends Redefining the Aerospace Composites Landscape Through Automation, Sustainability, and Global Capacity Realignment

The aerospace composites landscape is undergoing strategic upheaval as automation, advanced manufacturing, and geopolitical realignments converge to reshape industry dynamics. Automated fiber placement and additive manufacturing are accelerating production throughput and enabling greater design complexity, with robotics and AI-driven systems reducing material waste and improving dimensional accuracy. Concurrently, the emergence of nano-enhanced carbon fibers is redefining material performance, delivering unprecedented strength-to-weight ratios that support next-generation airframes and specialized defense platforms. These converging trends are catalyzing a new era of lightweight, resilient aircraft architectures that balance operational efficiency with advanced mission capabilities

Assessing the Cumulative Impact of 2025 United States Tariff Measures on Aerospace Composites Supply Chains and Cost Structures Under Evolving Trade Policies

The implementation of expanded U.S. tariffs effective in early 2025 has materially elevated the landed cost of critical composite precursors, compelling manufacturers to reconfigure sourcing strategies and adjust inventory management practices. With carbon fiber imports now subject to duties rising as high as 25 percent, procurement teams have accelerated near-term imports ahead of deadlines while exploring tariff-friendly jurisdictions under USMCA provisions to mitigate cost pressures. This realignment has prompted a shift toward just-in-time replenishment models, stepped-up collaboration between resin producers and fabricators on alternative formulations, and a partial redirection of orders to domestic and regional suppliers to safeguard margins and production timelines

Deep Dive into Resin, Material, Process, Application, and Sales Channel Segmentation Revealing Critical Drivers Shaping the Aerospace Composites Market

Understanding the nuanced contours of segmentation is essential for recognizing where value is created and captured in the aerospace composites market. Differentiation by resin type underscores a strategic divide between thermoplastic solutions-valued for their recyclability and impact resistance-and thermoset systems, which deliver superior thermal stability and structural performance for primary aircraft structures. Material selection further refines application potential, with aramid fiber providing exceptional toughness for impact-resistant panels, carbon fiber driving the bulk of structural weight reduction, ceramic fiber offering heat-shielding properties for engine components, and glass fiber balancing cost efficiency for secondary parts. Process innovations span autoclave curing, which remains the benchmark for high-performance laminates, alongside automated fiber placement that optimizes tape laydown for large structures, hand layup for low-volume assemblies, pultrusion for continuous profiles, and resin transfer molding that achieves near-net shapes with reduced waste. Application segmentation reveals a broad spectrum-from business jets demanding bespoke interiors to high-cycle commercial platforms, rotary-wing designs with unique fatigue profiles, and military aircraft bifurcated into stealth-oriented fighter programs and robust transport and unmanned combat aerial vehicles-while distribution channels encompass the OEM landscape driving new builds and the aftermarket servicing fleet sustainment. These overlapping dimensions illuminate critical inflection points where material, process, and end-use converge to define competitive positioning.

This comprehensive research report categorizes the Aerospace Composites market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Resin Type

- Material Type

- Process

- Application

- Sales Channel

Unveiling Regional Dynamics in Aerospace Composites Across the Americas, Europe Middle East and Africa, and Asia Pacific Highlighting Key Growth and Challenges

Regional dynamics play a pivotal role in shaping the global trajectory of aerospace composites, with each geography presenting distinct opportunities and constraints. In the Americas, a mature supply chain anchored by North American production hubs supports both legacy OEM programs and aftermarket expansion, yet remains sensitive to policy shifts and raw-material import duties. Europe, the Middle East and Africa exhibit a fragmented landscape where defense modernization initiatives and ambitious sustainable aviation agendas drive demand for advanced composites, even as complex regulatory frameworks and fragmented supplier networks necessitate robust partnership models. Asia-Pacific has emerged as a growth engine, propelled by China’s rapid capacity expansion in carbon fiber manufacturing, burgeoning domestic aircraft programs, and supportive industrial policies in Japan and South Korea; however, this momentum is tempered by concerns over overcapacity and the need for quality alignment with global aerospace standards. Collectively, these regions underscore the importance of geographic diversification in risk management and innovation transfer across the value chain.

This comprehensive research report examines key regions that drive the evolution of the Aerospace Composites market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Innovators Steering Aerospace Composites Advancements Through Technological Investments and Strategic Partnerships

Leading players continue to invest heavily in research and production capabilities to secure competitive advantage in an evolving marketplace. Toray Industries and Teijin Corporation leverage decades of expertise in high-modulus carbon fiber to support critical fuselage and wing applications, while Hexcel Corporation has expanded its North American prepreg footprint to meet surging demand from major OEMs. European stalwarts such as SGL Carbon and Solvay are intensifying R&D on ceramic matrix composites for next-generation turbine engines, even as new entrants like Jilin Chemical Fibre Group and Zhongfu Shenying innovate in low-cost carbon fiber production. Strategic collaborations between raw material suppliers, tooling specialists, and aerostructure manufacturers are also proliferating, underscoring an industry-wide push toward integrated supply chains capable of delivering both scale and flexibility under tightening environmental and policy constraints.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aerospace Composites market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airborne

- Albany International Corporation

- AXIOM Materials by Kordsa

- Bally Ribbon Mills

- BASF SE

- FACC AG

- General Electric Company

- GKN PLC

- Hexcel Corporation

- Hexion Inc.

- Huntsman International LLC

- Hyosung Advanced Materials Corporation

- Lee Aerospace, Inc.

- Mitsubishi Chemical Holdings Corporation

- Owens Corning

- Park Aerospace Corp.

- Plasan Carbon Composites

- Plastic Reinforcement Fabrics Ltd.

- Rolls-Royce PLC

- SGL Carbon SE

- Solvay S.A.

- Spirit AeroSystems, Inc.

- TEIJIN Limited

- Toray TCAC Holding B.V.

- TPI Composites Inc.

Actionable Strategies for Industry Leaders to Navigate Supply Chain Disruptions, Enhance Resilience, and Capitalize on Emerging Composite Technologies

To navigate the converging pressures of tariff volatility, supply chain complexity and sustainability mandates, industry leaders must adopt a multifaceted approach. First, diversifying supplier portfolios across tariff-friendly regions and deepening partnerships with domestic resin and fiber producers will mitigate single-source exposure. Simultaneously, scaling up automated manufacturing platforms-particularly automated fiber placement and additive processes-will enhance throughput and reduce reliance on labor-intensive methods. Integrating advanced data analytics into supply chain management can also deliver real-time visibility to anticipate bottlenecks and optimize logistics. Moreover, accelerating development of recyclable thermoplastic composites and high-temperature ceramic systems can address long-term environmental targets and regulatory compliance. Finally, establishing cross-functional forums with defense, OEM and supply-chain stakeholders will foster collaborative roadmapping, ensuring alignment on certification pathways and enabling synchronized innovation roadmaps.

Comprehensive Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Triangulation to Ensure Robust Aerospace Composites Market Insights

This research combines extensive secondary analysis of industry publications, government documents and technical literature with primary interviews of composite engineers, supply-chain executives and program managers at leading aerostructure firms. Data synthesis was achieved through triangulation, reconciling trade data, financial disclosures and expert projections to validate qualitative insights. Segmentation frameworks were developed using a top-down perspective on resin, fiber and processing categories, then refined through bottom-up assessments of application and sales channel dynamics. Geographic analysis leveraged import-export statistics alongside regional policy reviews, while company profiles were informed by patent filings, capacity expansions and strategic announcements. Rigorous quality checks, including cross-referencing of independent data sets and iterative expert review, ensure the robustness and reliability of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aerospace Composites market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aerospace Composites Market, by Resin Type

- Aerospace Composites Market, by Material Type

- Aerospace Composites Market, by Process

- Aerospace Composites Market, by Application

- Aerospace Composites Market, by Sales Channel

- Aerospace Composites Market, by Region

- Aerospace Composites Market, by Group

- Aerospace Composites Market, by Country

- United States Aerospace Composites Market

- China Aerospace Composites Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesis of Insights Highlighting the Imperative for Innovation, Collaboration, and Adaptive Strategies in the Evolving Aerospace Composites Sector

The evolving aerospace composites sector is defined by a persistent drive toward lightweight, high-performance structures, underpinned by dynamic shifts in trade policy, production technologies and geographic capacity. As the industry confronts elevated tariffs, supply chain realignments and ambitious sustainability imperatives, the imperative for innovation and collaboration has never been greater. Stakeholders that proactively diversify sourcing, invest in advanced manufacturing and align cross-sector objectives will be best positioned to harness the full potential of composites. Ultimately, resilient strategies grounded in data-driven decision making and agile operational models will unlock value, support environmental goals and secure competitive differentiation in an increasingly complex aerospace ecosystem.

Connect with Ketan Rohom to Secure Comprehensive Aerospace Composites Market Research and Unlock Strategic Advantages for Your Organization

For access to authoritative, in-depth insights tailored to your strategic objectives in the aerospace composites domain, reach out to Ketan Rohom (Associate Director, Sales & Marketing) today and secure your comprehensive market research report. Gain the critical data and expert analysis necessary to guide your investment decisions, sharpen your competitive positioning, and accelerate growth. Connect directly for personalized assistance that aligns with your organizational needs and accelerates your entry into high-potential segments.

- How big is the Aerospace Composites Market?

- What is the Aerospace Composites Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?