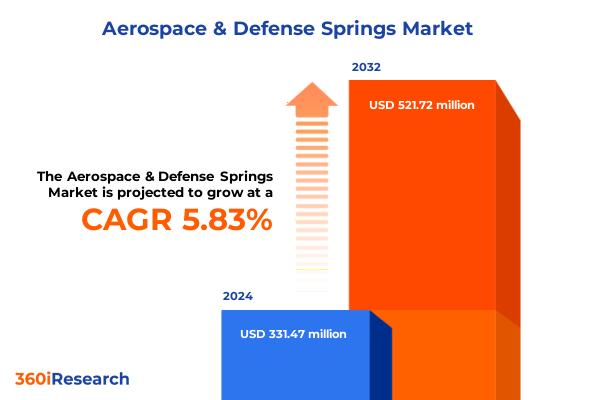

The Aerospace & Defense Springs Market size was estimated at USD 344.67 million in 2025 and expected to reach USD 365.27 million in 2026, at a CAGR of 6.10% to reach USD 521.72 million by 2032.

Navigating the Intricate World of Springs in the Aerospace and Defense Sector Amidst Rapid Technological and Regulatory Evolution

The aerospace and defense industry relies on precision-engineered components to ensure reliability, safety, and performance under extreme conditions. Among these, springs play a critical yet often underappreciated role in absorbing shock, controlling motion, and maintaining structural integrity across flight controls, landing gear, and other mission-critical systems. As global defense budgets evolve and civil aviation expands, the demand for specialized spring solutions that can withstand high fatigue cycles, fluctuating temperatures, and corrosive environments has never been more pronounced.

Against a backdrop of geopolitical realignments, regulatory changes, and rapid technological advancements, stakeholders must navigate complex supply chains, raw material sourcing challenges, and increasingly stringent certification standards. This executive summary synthesizes the most pressing trends shaping the aerospace and defense springs market, from transformative manufacturing innovations to tariff-driven cost pressures and nuanced segmentation insights. By focusing on the intersection of engineering excellence and market dynamics, this report equips decision-makers with the strategic context necessary to optimize product portfolios, pursue strategic partnerships, and reinforce supply chain resilience.

Unveiling the Monumental Technological and Strategic Shifts Reshaping Spring Solutions in Modern Aerospace and Defense Ecosystems for Enhanced Performance

Over the past decade, the aerospace and defense springs landscape has undergone radical transformation as digital engineering tools, advanced manufacturing techniques, and material science breakthroughs converge to redefine design and production processes. The integration of digital twin simulations now enables engineers to model spring behavior under exacting flight profiles, reducing reliance on costly physical prototypes and expediting product development cycles. In parallel, additive manufacturing platforms have emerged as a disruptive force, allowing the creation of complex spring geometries and graded-density structures that were previously unattainable through conventional coiling or forging methods. This shift towards additive fabrication not only accelerates customization but also supports lightweighting initiatives that enhance fuel efficiency and payload optimization.

Furthermore, recent innovations in multi-material composite springs are unlocking new performance thresholds by combining metallic elements with high-strength polymer matrices to achieve superior damping characteristics and corrosion resistance. Suppliers are increasingly partnering with material science firms to refine nano-alloy formulations and surface treatment technologies, ensuring that next-generation springs can endure humidity, salt spray, and extended thermal cycling without degradation. Sustainability considerations have also become pivotal, prompting industry players to adopt closed-loop recycling programs and greener heat-treat processes. In response, design engineers are evaluating lifecycle impacts from raw material extraction to end-of-life salvage, integrating environmental performance as a core design parameter rather than an afterthought.

Supply chain diversification has concurrently gained momentum, with strategic sourcing initiatives aimed at mitigating geographic concentration risk and tariff exposure. Original equipment manufacturers are broadening their supplier networks and forging collaborative research agreements with specialty metal producers across North America, Europe, and Asia-Pacific. This proactive approach balances the pursuit of cost optimization with the imperative of securing critical materials such as nickel alloy, stainless steel, and titanium alloy. As aerospace platforms evolve towards greater autonomy and electrification, springs must also adapt to interface seamlessly with advanced actuators, electromechanical systems, and embedded sensor arrays, reinforcing the need for agile design and manufacturing ecosystems.

Assessing the Far-Reaching Cumulative Consequences of United States Steel and Specialty Metal Tariffs on Defense Spring Manufacturing Dynamics

In early 2025, the United States government implemented additional tariffs on imported steel, nickel, and specialty metals, intensifying cost pressures on manufacturers of defense springs and associated components. While the stated objective of these measures is to protect domestic metal producers and strengthen national security supply chains, downstream spring fabricators have experienced material cost increases of up to 15 percent compared to pre-tariff levels. The cumulative effect has been felt across original equipment manufacturers and aftermarket suppliers alike, prompting many organizations to reassess supplier agreements and explore localized sourcing strategies closer to key production sites.

Consequently, some leading spring manufacturers have accelerated initiatives to source raw materials domestically or from allied nations, leveraging tariff exclusions for defense-critical materials where available. Others have invested in vertical integration, expanding in-house metal finishing and heat-treatment capabilities to recapture margin erosion from external processing fees. Material substitution has also emerged as a tactical response, with design engineers evaluating stainless steel and nickel-based alloys as cost-effective alternatives in lower fatigue applications. While these adjustments mitigate some immediate financial burdens, the ongoing uncertainty around tariff stability underscores the importance of flexible procurement frameworks and collaborative government-industry engagement to ensure sustained supply chain resilience.

Revealing Critical Market Segmentation Perspectives That Illuminate Diverse Product Types Applications Materials and End User Dynamics in Spring Systems

A nuanced understanding of market segmentation reveals critical pathways for targeted growth and product innovation. When studied based on product type, the spring market encompasses coil, gas, leaf, and torsion configurations, each offering distinct load-bearing and energy-absorption profiles. Coil springs remain the backbone of basic load management, whereas gas springs provide controlled damping crucial for hatch and door actuation. Leaf springs deliver high-capacity shock absorption in landing gear assemblies, and torsion springs enable precise rotational torque applications within weapon systems and flight controls.

Equally important, an application-centric view highlights the diverse operational demands placed on spring systems. Flight controls demand minimal hysteresis and rapid responsiveness to pilot inputs, landing gear assemblies require robust fatigue resistance under repeated touchdown loads, missile systems necessitate compact yet reliable actuation, and seating systems must blend comfort with crashworthiness. Within landing gear, both main landing gear and nose landing gear subsegments exhibit unique pressure, temperature, and weight distribution requirements, guiding specialized design tolerances.

From a material type perspective, nickel alloy, stainless steel, and titanium alloy dominate the landscape, each selected for its balance of tensile strength, corrosion resistance, and temperature stability. Nickel-based alloys excel in high-heat environments, stainless steel offers cost-effective corrosion protection, and titanium alloy delivers exceptional strength-to-weight advantages critical for weight-sensitive airframes. Finally, end user dynamics bifurcate into aftermarket and OEM channels, with aftermarket providers focusing on maintenance, repair, and upgrade cycles, and OEMs emphasizing integrated design partnerships and long-term performance warranties. By aligning product development roadmaps with these segmentation insights, companies can calibrate investment priorities and differentiate their offerings to capture evolving customer requirements.

This comprehensive research report categorizes the Aerospace & Defense Springs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Application

- End User

Exploring Nuanced Regional Demand Drivers and Strategic Opportunities Across the Americas Europe Middle East Africa and Asia-Pacific Aerospace Spring Markets

Regional analysis underscores how geopolitical strategies, defense allocations, and commercial aviation trends shape opportunities and challenges across distinct geographies. In the Americas, robust defense spending in the United States drives advanced spring requirements for next-generation fighter jets, unmanned systems, and commercial aircraft platforms. Canada’s growing role as a precision manufacturing hub bolsters localized spring fabrication capabilities, while Mexico’s rising position in the aerospace supply chain supports cost-competitive component assembly and maintenance services.

In Europe, the convergence of transatlantic defense cooperation and pan-EU research programs has stimulated harmonized standards for spring testing and certification. Nations such as Germany and France spearhead investments in lightweight material research and digital manufacturing adoption, fostering collaboration between tier-one aerospace primes and specialty spring suppliers. Meanwhile, Middle Eastern procurement surges, funded by sovereign wealth programs, target high-performance spring solutions for new fighter aircraft and missile defense installations. Africa, while representing a smaller absolute market, exhibits pockets of growth tied to civil aviation infrastructure modernization and maintenance network expansion.

Asia-Pacific dynamics present a multifaceted landscape of competing growth vectors. China’s continued modernization initiatives generate significant demand for large-scale spring systems integrated into new airframes, while India’s defense localization policies incentivize joint ventures and technology transfers with Western spring manufacturers. Southeast Asian nations, particularly Singapore and Malaysia, are emerging as key maintenance, repair, and overhaul centers, with aftermarket spring replacement and certification services gaining traction. Japan’s advanced materials innovation further elevates regional competitiveness, particularly in titanium alloy spring technologies. By mapping regional demand drivers and regulatory frameworks, stakeholders can tailor go-to-market strategies and regional partnership models to optimize resource allocation and market penetration.

This comprehensive research report examines key regions that drive the evolution of the Aerospace & Defense Springs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Top Spring Manufacturers and Examining Their Competitive Strengths Partnerships and Strategic Positioning within Aerospace and Defense Systems

Leading players in the aerospace and defense spring domain distinguish themselves through a combination of material science expertise, manufacturing scale, and strategic partnerships. Century Spring, for example, has leveraged its deep coil spring competencies to expand into gas spring and custom torsion solutions, investing in advanced heat-treatment lines and digital process controls. Similarly, MW Industries has pursued a dual strategy of organic innovation and acquisitions to broaden its material portfolio, integrating nickel-alloy specialists alongside its established stainless steel offerings.

Other notable manufacturers have strengthened their competitive positioning through collaborative R&D initiatives with defense OEMs and national laboratories. Companies such as Smalley Steel Ring and Inpro Technologies have co-developed composite spring assemblies for next-generation rotorcraft platforms, while NMB Technologies has introduced sensor-embedded springs that enable real-time condition monitoring. These technology partnerships, coupled with targeted facility expansions in strategic geographies, underscore a broader trend toward convergence of mechanical expertise and digital service capabilities. By continuously refining supply chain agility and investing in proprietary alloy development, these firms are poised to address the evolving performance and regulatory demands of both military and commercial aerospace sectors.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aerospace & Defense Springs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ace Wire Spring & Form Co., Inc.

- Argo Spring Manufacturing Co., Inc.

- Atlantic Precision Spring, Inc.

- Barnes Group Inc.

- Ebsco Spring Co.

- European Springs & Pressings Ltd.

- G&O Springs Ltd.

- James Spring & Wire Co.

- John Evans’ Sons Inc.

- Lee Spring Company

- M. Coil Spring Manufacturing Company

- Marvel Springs Inc.

- MW Components

- Myers Spring Co.

- Nordia Springs Ltd.

- Orlando Spring Corporation

- Peterson American Corporation

- Precision Coil Spring

- Renton Coil Spring Company

- Sogefi S.p.A.

- Springtech Ltd.

- Stanley Spring & Stamping Corporation

- Tennessee Spring and Metal, LLC

- Titan Spring, Inc.

- Vulcan Spring & Manufacturing Company

Delivering Strategic Recommendations to Propel Growth Operational Efficiency and Competitive Advantage for Spring System Leaders in Aerospace and Defense

Industry leaders seeking to fortify their market positions should prioritize investment in advanced material research and digital manufacturing platforms that support highly customized spring geometries. By adopting cloud-connected design and simulation environments, engineering teams can iterate faster and predict fatigue life more accurately, reducing time-to-market and minimizing costly field failures. In parallel, expanding aftermarket service offerings-such as rapid turnaround spring refurbishment and certified replacement kits-can unlock new revenue streams while enhancing customer loyalty during maintenance and overhaul cycles.

Moreover, supply chain resilience will remain paramount as trade policy uncertainties persist. Companies should establish strategic buffer inventories of critical alloys, negotiate long-term supply agreements with tariff-exempt partners, and explore reshoring opportunities for key processing steps such as shot peening, passivation, and precision grinding. Cross-functional teams combining procurement, quality, and engineering expertise can develop agile sourcing playbooks to respond effectively to material shortages or sudden tariff adjustments.

Finally, embedding sustainability metrics into spring design and manufacturing ecosystems can confer competitive advantage as defense and aerospace buyers increasingly evaluate environmental impact alongside performance. Implementing closed-loop recycling of scrap metals, optimizing heat-treatment energy consumption, and achieving cradle-to-gate carbon footprint transparency will resonate with environmentally focused stakeholders. Pursuing certifications such as AS9100D and ISO 14001 strengthens credibility, while collaborative industry consortia can drive joint standards for greener spring production and end-of-life reclamation.

Outlining the Rigorous Multi-Phase Research Methodology That Ensures Robust Data Collection Validation and Insight Generation for Spring Systems

This research leveraged a multi-phase methodology combining rigorous secondary research with extensive primary engagement to ensure data accuracy and contextual depth. In the initial phase, proprietary databases, industry journals, and regulatory filings were systematically reviewed to map the competitive landscape, identify key product innovations, and understand tariff frameworks impacting raw materials. This phase established the foundational knowledge base and highlighted areas requiring deeper investigation.

Subsequently, a series of structured interviews was conducted with decision-makers from original equipment manufacturers, specialty spring suppliers, and material science experts. Insights from these discussions were triangulated against publicly available financial statements, technical white papers, and government procurement reports to validate emerging issues such as additive manufacturing adoption rates and supply chain strategies. Finally, an iterative validation process involving cross-functional analysts ensured consistency and integrity of the findings, with periodic quality checks and peer reviews safeguarding against unintentional bias or data discrepancies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aerospace & Defense Springs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aerospace & Defense Springs Market, by Product Type

- Aerospace & Defense Springs Market, by Material Type

- Aerospace & Defense Springs Market, by Application

- Aerospace & Defense Springs Market, by End User

- Aerospace & Defense Springs Market, by Region

- Aerospace & Defense Springs Market, by Group

- Aerospace & Defense Springs Market, by Country

- United States Aerospace & Defense Springs Market

- China Aerospace & Defense Springs Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Critical Insights and Strategic Imperatives to Guide Forward-Looking Decisions and Future-Proofing in the Aerospace and Defense Spring Landscape

The aerospace and defense springs market is at an inflection point, driven by the imperative to integrate cutting-edge materials, digital processes, and resilient supply chains. Emerging technologies such as additive manufacturing and sensor-enabled components are redefining performance benchmarks, while geopolitical and tariff considerations continue to reshape sourcing strategies. Stakeholders that embrace agile design practices, cultivate strategic material partnerships, and embed sustainability imperatives into their operations will be best positioned to capture the rewards of this dynamic landscape.

In summary, a holistic approach that aligns product innovation with regulatory compliance, regional go-to-market nuances, and end-user value propositions is essential for long-term success. By leveraging the detailed segmentation, regional insights, and competitive analyses outlined in this report, decision-makers can make informed choices that propel growth, enhance operational efficiency, and reinforce market leadership amid evolving aerospace and defense demands.

Connect with Ketan Rohom to Acquire the Comprehensive Aerospace and Defense Spring Systems Market Research Report and Unlock Strategic Intelligence Today

To explore the detailed insights, strategic implications, and comprehensive data of the aerospace and defense springs market, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan’s expertise and consultative approach will ensure you receive the tailored research package that aligns with your organization’s specific objectives. Secure access to in-depth analysis of market segmentation, regional dynamics, competitive landscapes, and emerging technology trends to guide your next strategic move. Contact Ketan today to purchase the full report and gain the competitive intelligence you need to stay ahead of evolving market and regulatory shifts.

- How big is the Aerospace & Defense Springs Market?

- What is the Aerospace & Defense Springs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?