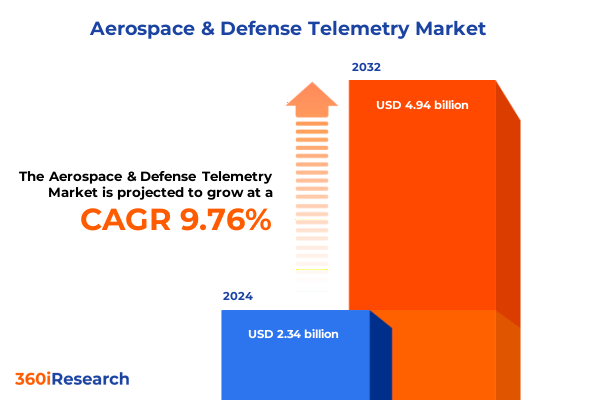

The Aerospace & Defense Telemetry Market size was estimated at USD 2.54 billion in 2025 and expected to reach USD 2.75 billion in 2026, at a CAGR of 9.95% to reach USD 4.94 billion by 2032.

Introducing the Evolving Landscape of Aerospace & Defense Telemetry with Insights into Emerging Capabilities and Strategic Imperatives

The aerospace and defense telemetry domain stands at the nexus of mission-critical data acquisition and real-time decision support, underpinning modern defense and commercial aerospace operations. In an era defined by rapid technological evolution and heightened geopolitical tensions, telemetry systems have transcended their traditional role of passive data relay to become integral enablers of predictive maintenance, structural health monitoring, and test-and-measurement workflows. This transformation is catalyzed by advancements in sensor miniaturization and high-throughput communication architectures, allowing platforms-from armored vehicles to hypersonic aircraft-to transmit granular performance metrics to centralized command centers with unprecedented fidelity and speed. A confluence of factors, including elevated defense spending by leading nations and the proliferation of unmanned systems, is fortifying telemetry’s strategic position across aerospace and defense ecosystems.

Uncovering How AI, Edge Computing, and Cybersecurity Are Transforming Telemetry into a Proactive Data-Driven Force Multiplier in Aerospace and Defense

The telemetry landscape is undergoing a profound metamorphosis driven by the integration of artificial intelligence, edge computing, and robust cybersecurity frameworks. AI-powered analytics have shifted telemetry from reactive fault detection to proactive anomaly prediction, enabling operators to address emergent system deviations before mission disruption occurs. Edge computing nodes embedded within unmanned aerial vehicles and satellite buses expedite data processing at the point of collection, reducing latency and preserving bandwidth for critical situational awareness updates. Concurrently, the adoption of encryption standards and intrusion detection mechanisms fortifies telemetry channels against cyber threats, assuring the confidentiality and integrity of mission data across contested environments. These converging trends are redefining telemetry as a force multiplier, where intelligent data pipelines and resilient communications coalesce to deliver operational superiority and strategic agility.

Assessing the Cumulative Repercussions of 2025 US Tariff Measures on Telemetry Supply Chains and Cost Structures in the Defense Sector

In early 2025, the United States implemented elevated import duties on critical aerospace materials and high-precision components, including aluminum, steel, and RF semiconductors. These measures have imposed additional cost burdens on telemetry hardware producers and intensified lead-time pressures for avionics modules and specialized sensors. The resultant margin compression has compelled system integrators to reassess supply chain dependencies and accelerate nearshoring initiatives to stabilize production pipelines. Concurrently, procurement teams are negotiating multi-year agreements and leveraging tariff-hedging instruments to attain cost predictability, mitigating short-term financial impacts while fostering resilience in a volatile trade environment.

Although initial margin erosion has been palpable, the industry response has galvanized innovative sourcing strategies. Partnerships with regional electronics foundries and collaborative agreements with allied procurement agencies are materializing to disperse risk. Moreover, firms are intensifying investment in domestic manufacturing capabilities for telemetry-critical components, thereby reinforcing the industrial base against further policy fluctuations. These adaptations, though reactive in origin, are laying the groundwork for a more agile and self-reliant supply chain architecture that can absorb future tariff-induced shocks without compromising on performance or delivery timelines.

Extracting Actionable Insights from Platform, Component, Application, End-User, and Frequency Band Segmentations to Navigate Telemetry Market Complexity

A comprehensive analysis of platform segmentation reveals a multifaceted telemetry ecosystem shaped by mission requirements across five primary domains: Ground Vehicle telemetry systems demand ruggedized Data Acquisition Units and strain gauges to withstand battlefield stresses, while Manned Aircraft integrate high-bandwidth RF Receivers and real-time visualization software to support fighter, trainer, and transport operations. Naval Vessels, including both Submarines and Surface Ships, leverage pressure and vibration sensors coupled with directional antennas for hull integrity monitoring and secure data uplinks. Satellites traversing GEO, MEO, and LEO orbits depend on satellite uplinks and predictive analytics modules to maintain uninterrupted telemetry flows under extreme environmental conditions. Meanwhile, Unmanned Aerial Vehicles-spanning Fixed Wing, Hybrid, and Rotary Wing configurations-capitalize on compact Omnidirectional Antennas and edge-deployed Real Time Analytics to execute autonomous missions with minimal latency.

Component-driven segmentation underscores the importance of modularity and interoperability. Systems architects are tailoring Antenna designs between Directional and Omnidirectional configurations to optimize signal reach, while selecting between Analog and Digital Data Acquisition Units based on resolution and sampling rate requirements. The prevalence of Pressure, Temperature, and Vibration Sensors highlights the criticality of high-fidelity environmental monitoring, and the transition to Predictive Analytics within software frameworks is fueling proactive maintenance regimes. RF Transmitters and Satellite Uplink modules continue to evolve toward higher frequency bands, enhancing data throughput and reducing spectral congestion.

Application segmentation further delineates telemetry’s functional breadth. In-Flight Monitoring functions provide real-time health diagnostics for crewed and uncrewed vehicles, while Predictive Maintenance algorithms identify anomaly patterns to preempt component failures. Structural Health Monitoring techniques-encompassing Crack Detection and Fatigue Monitoring-ensure airframe integrity throughout operational lifecycles. Test and Measurement platforms furnish post-mission performance validation, driving iterative platform enhancements and mission readiness.

End-user segmentation illuminates divergent requirements across Commercial Aviation, Defense, Space Exploration, and Unmanned Systems. Airlines and MRO Facilities prioritize reliability and cost efficiency, mandating turnkey telemetry solutions with seamless integration into existing maintenance workflows. Defense branches, including Air Force, Army, and Navy, emphasize encrypted channels and hardened hardware for classified operations. Space Exploration entities-both Government Agencies and Private Operators-demand satellite-grade subsystems capable of enduring radiation and extreme thermal cycles. Unmanned Systems integrators, spanning Commercial Drones to Military Drones, require lightweight, low-power telemetry nodes to maximize payload capacity and mission endurance.

Frequency Band segmentation plays an equally pivotal role in shaping system architectures. The selection of C, Ka, Ku, L, S, and X Bands is driven by mission-specific factors such as atmospheric attenuation, antenna size constraints, and data rate imperatives. Higher frequency bands facilitate greater bandwidth but necessitate advanced materials and precision manufacturing, while lower bands offer enhanced propagation characteristics for beyond-line-of-sight operations.

This comprehensive research report categorizes the Aerospace & Defense Telemetry market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform

- Component

- Frequency Band

- Application

- End-User

Analyzing Regional Dynamics across the Americas, EMEA, and Asia-Pacific to Illuminate Growth Drivers and Strategic Telemetry Opportunities

Within the Americas, North America commands a leading position, bolstered by substantial United States government investments in advanced telemetry for missile warning architectures and space-based situational awareness. The presence of tier-one contractors and a mature supply chain ecosystem has driven adoption of next-generation Telemetry products, as exemplified by ground-station expansions and satellite constellations valued at multiple billions. Latin American markets are emerging with selective procurements for commercial aerospace telemetry, particularly within aerospace test-and-measurement sectors where renewal of aging fleets has led to increased telemetry retrofits.

In Europe, strategic imperatives around NATO interoperability and sovereign defense modernization are propelling telemetry procurements. Nations such as France and Germany are integrating software-defined radios and optical telemetry prototypes into next-generation fighter platforms and collaborative space programs. Tariff and trade tensions with the United States have been effectively mitigated through multi-domestic manufacturing footprints, ensuring limited operational disruption even in the face of reciprocal tariff proposals.

Asia-Pacific stands out as the fastest-growing region, driven by rapidly increasing defense budgets in China, India, and Japan, expansive space launch initiatives, and a burgeoning Unmanned Aerial Vehicle sector. Governments are prioritizing indigenous telemetry development through public-private R&D partnerships, while commercial operators are expanding satellite fleets that necessitate robust uplink and downlink telemetry infrastructures. This vibrant ecosystem underscores the region’s strategic focus on technology sovereignty and advanced data analytics capabilities to support both military and civil aerospace objectives.

This comprehensive research report examines key regions that drive the evolution of the Aerospace & Defense Telemetry market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Companies’ Strategic Initiatives and Competitive Positioning Shaping the Aerospace and Defense Telemetry Ecosystem

RTX Corporation (NYSE: RTX) has navigated 2025’s trade headwinds by revising its profit outlook to account for a $500 million tariff impact while concurrently raising full-year sales guidance amid robust demand for Patriot air defense systems and Pratt & Whitney engines. The corporation’s Collins Aerospace subsidiary has further strengthened its market position by joining Airbus’s Digital Alliance for Aviation, expanding predictive maintenance and health monitoring solutions as part of an industry-wide push toward integrated digital ecosystems.

Thales Group has responded to elevated defense spending in Europe by lifting its 2025 organic sales growth forecast to 6–7%, driven largely by its defense and avionics units. The firm’s multi-domestic operational model has limited tariff exposure, and strategic import schemes have been employed to mitigate potential reciprocal duties, reflecting a nimble approach to geopolitical pressures while scaling its telemetry and avionics offerings for both crewed aircraft and space platforms.

Lockheed Martin continues to pioneer telemetry analytics with its Technology for Telemetry Analytics for Universal Artificial Intelligence (T-TAURI) algorithm, deployed across missile-warning satellites and digital-twin initiatives. This AI-driven platform facilitates proactive anomaly detection throughout design, production, and on-orbit operations, positioning Lockheed Martin at the forefront of artificial intelligence integration within space-based Telemetry networks.

Northrop Grumman is reinforcing its status in satellite communications by securing contracts for data transport satellites under the Space Development Agency’s Proliferated Warfighter Space Architecture and expanding ground station networks for Next-Gen OPIR missile warning systems. These efforts underscore the company’s commitment to delivering end-to-end Telemetry solutions-spanning in-orbit data relays to terrestrial gateways-to maintain persistent, reliable data flows for national security missions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aerospace & Defense Telemetry market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- AstroNova Inc.

- BAE Systems plc

- Ball Corporation

- CACI International

- Cobham Limited

- Curtiss-Wright Corporation

- Dassault Aviation

- Eaton Corporation PLC

- Elbit Systems Ltd.

- General Dynamics Corporation

- General Electric Company

- Honeywell International Inc.

- Intelsat S.A.

- Iridium Communications Inc.

- Kawasaki Heavy Industries

- Kongsberg Gruppen ASA

- L3Harris Technologies, Inc.

- Leidos, Inc.

- Leonardo S.p.A

- Lockheed Martin Corporation

- Mitsubishi Heavy Industries, Ltd.

- Northrop Grumman Corporation

- Orbit Communications Systems Ltd.

- Raytheon Technologies Corporation

- Safran S.A.

- Teledyne Technologies

- Thales S.A.

- The Boeing Company

- Viasat Inc.

Delivering Actionable Recommendations to Enhance Telemetry Resilience, Drive Innovation, and Optimize Value Chains for Industry Leadership

To bolster supply chain resilience, industry leaders should pursue diversified sourcing strategies that combine nearshored production of critical telemetry components with strategic inventory buffers and dynamic tariff-hedging mechanisms. By establishing mutually beneficial partnerships with regional foundries and leveraging long-term framework agreements, organizations can mitigate the financial volatility introduced by trade policy shifts while preserving production continuity and quality assurance.

Advancing telemetry system architectures demands prioritized investment in edge computing and AI-driven analytics. Companies should embed intelligent processing capabilities within sensors and transmitters to enable real-time anomaly detection and reduce bandwidth constraints on networked platforms. Collaborative R&D consortia, inclusive of government agencies and academic institutions, can accelerate the maturation of digital-twin and AI frameworks that underpin next-generation telemetry solutions.

Embracing open-standards and modular hardware designs will foster solution interoperability across multinational defense collaborations and civil aerospace programs. Adopting architectures aligned with the Modular Open Systems Approach (MOSA) ensures that telemetry subsystems can be seamlessly integrated, upgraded, and certified within heterogeneous fleets, thereby accelerating technology insertion and reducing lifecycle costs.

To capitalize on regional growth trajectories, stakeholders should tailor go-to-market strategies for key geographies. In North America, deep engagement with defense innovation accelerators and Space Systems Commands can unlock early access to emerging requirements. Within Europe, monitoring regulatory developments such as the EU Space Act and leveraging temporary import schemes will optimize market entry. In Asia-Pacific, forging joint ventures with domestic OEMs and prioritizing technology transfer agreements can navigate regulatory landscapes and deliver indigenous telemetry solutions.

Finally, cultivating a skilled workforce with expertise in telemetry system integration and data analytics is imperative. Organizations should invest in targeted training programs and partnerships with leading universities to develop engineers fluent in both hardware design and software-defined analytics. This human capital foundation will ensure that telemetry innovations translate into operational advantages for both defense and commercial aerospace missions.

Outlining a Rigorous Hybrid Research Methodology Integrating Primary Insights and Secondary Data for Comprehensive Telemetry Market Analysis

Our research methodology employed a hybrid approach integrating both primary and secondary data sources. We initiated the study with an exhaustive secondary research phase, encompassing industry reports, regulatory filings, trade press, and multinational defense procurement records to establish a comprehensive baseline of market dynamics and technological advancements.

Subsequently, we conducted in-depth interviews with telemetry system architects, procurement leads at prime contractors, and technology officers within aerospace integrator firms. These qualitative discussions were structured to validate emerging trends, tariff impact assessments, and regional growth perspectives, ensuring that findings reflect real-world decision frameworks.

Quantitative analysis involved triangulation of production volume data, component-level shipment records, and fiscal performance metrics of leading telemetry providers. Advanced statistical techniques, including regression modeling and sensitivity analysis, were applied to assess the elasticity of demand relative to defense budget fluctuations and policy shifts.

Finally, we synthesized insights through a rigorous cross-validation protocol, aligning primary inputs with secondary evidence to mitigate information bias. The final deliverables include detailed segmentation matrices, regional dynamics overlays, and competitive benchmarking profiles supported by transparent attribution of source data.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aerospace & Defense Telemetry market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aerospace & Defense Telemetry Market, by Platform

- Aerospace & Defense Telemetry Market, by Component

- Aerospace & Defense Telemetry Market, by Frequency Band

- Aerospace & Defense Telemetry Market, by Application

- Aerospace & Defense Telemetry Market, by End-User

- Aerospace & Defense Telemetry Market, by Region

- Aerospace & Defense Telemetry Market, by Group

- Aerospace & Defense Telemetry Market, by Country

- United States Aerospace & Defense Telemetry Market

- China Aerospace & Defense Telemetry Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3657 ]

Synthesizing Insights to Conclude on the Strategic Imperatives and Future Outlook of the Aerospace and Defense Telemetry Domain

In an industry defined by rapid technological progress and shifting global policy landscapes, aerospace and defense telemetry has emerged as a critical enabler of situational awareness, platform reliability, and mission success. The integration of AI-driven analytics, edge computing, and secure communications protocols has redefined telemetry from a passive data pipeline to an active decision support architecture.

While near-term challenges-such as tariff-induced supply chain pressures and evolving regulatory frameworks-have introduced cost and lead-time complexities, they have simultaneously accelerated strategic imperatives around domestic capability enhancement and cross-border collaboration. The market’s resilience is manifest in the proactive adoption of nearshoring strategies, modular open architectures, and long-term procurement agreements that underpin future growth.

Looking ahead, stakeholders who align their R&D investments with emerging edge analytics platforms, prioritize interoperable designs, and cultivate agile sourcing practices will be best positioned to capture value across commercial aviation, defense, space exploration, and unmanned systems. The path forward demands a synthesis of technological innovation, policy acumen, and human capital development to shape a telemetry ecosystem that delivers secure, scalable, and intelligent data solutions for tomorrow’s missions.

Empowering Decision-Makers to Secure In-Depth Telemetry Market Intelligence with Tailored Insights from Ketan Rohom, Associate Director

To explore the comprehensive Aerospace & Defense Telemetry market research report and unlock tailored insights that drive strategic decision-making, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Ketan brings deep expertise in translating technical analysis into actionable business intelligence and is ready to guide you through the report’s findings, methodology, and implications for your organization. Engage with Ketan today to discuss your specific telemetry intelligence needs and secure the insights that will empower your next strategic move.

- How big is the Aerospace & Defense Telemetry Market?

- What is the Aerospace & Defense Telemetry Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?