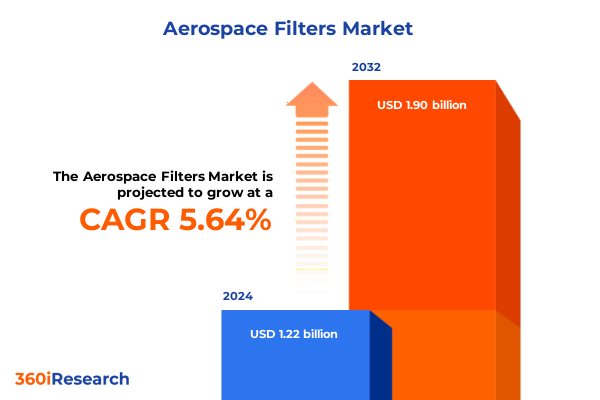

The Aerospace Filters Market size was estimated at USD 1.28 billion in 2025 and expected to reach USD 1.35 billion in 2026, at a CAGR of 5.74% to reach USD 1.90 billion by 2032.

Navigating the Complex Evolution of Aerospace Filtration Systems in a Rapidly Changing Global Aviation Environment Shaped by Technological Innovation and Regulatory Dynamics

The aerospace filtration sector has emerged as a cornerstone of operational excellence in modern aviation, where precision and reliability are non-negotiable. Filters play a vital role in preserving engine performance, safeguarding cabin air quality, and protecting hydraulic and fuel systems against particulate contaminants. As aircraft manufacturers, airlines, and maintenance providers adapt to evolving safety mandates and sustainability goals, filtration solutions continue to gain strategic importance within the broader aviation ecosystem. This introduction lays the groundwork for understanding how market dynamics, regulatory frameworks, and material innovations converge to define the next chapter of aerospace filtration.

In a landscape characterized by heightened environmental scrutiny and accelerating technological advances, filter OEMs and suppliers are compelled to explore new materials, design methodologies, and monitoring capabilities. From airframe filters that manage debris during extreme flight conditions to cabin air filters that ensure passenger comfort and health, each subsegment demands targeted performance attributes. Meanwhile, engine oil filters, fuel filters, and hydraulic filters face unique challenges related to temperature extremes, chemical compatibility, and lifecycle longevity. This summary sets the stage for a detailed examination of transformative industry shifts, trade policy impacts, and actionable strategies that will guide stakeholders in capitalizing on emerging opportunities.

Identifying the Pivotal Technological and Operational Shifts Redefining Aerospace Filtration Performance and Sustainability Standards Across the Industry

The aerospace filtration market is undergoing a profound transformation driven by breakthroughs in digitalization, additive manufacturing, and sensor integration. Advanced manufacturing techniques, such as 3D printing of filter housing components and precision bonding methods, are enabling more compact and efficient designs that reduce weight without sacrificing performance. Concurrently, embedded sensors and real-time monitoring systems are redefining maintenance paradigms by providing predictive insights into filter health and contaminant load conditions. These technological inflection points mark a shift from reactive servicing toward condition-based maintenance models that optimize turnaround times and reduce total cost of ownership.

On the materials front, research into advanced fiber blends, nanofiber coatings, and hybrid mesh structures is unlocking new levels of filtration efficiency and chemical resistance. Sustainable initiatives further drive the adoption of recyclable substrates and bio-derived media, underscoring the industrywide push toward reduced environmental impact. Regulatory bodies are responding with updated certification protocols that emphasize lifecycle assessment, emissions reduction, and compliance with global emissions targets. Taken together, these developments illustrate a sweeping evolution in how filters are designed, monitored, and validated, transforming them into smart, adaptive components within the modern aircraft architecture.

Analyzing the Far-Reaching Impacts of the 2025 United States Tariffs on Aerospace Filtration Supply Chains and Cost Structures in a Global Context

In 2025, the United States implemented new tariffs on imported aerospace filtration components, prompting a ripple effect across global supply chains and cost structures. Manufacturers reliant on overseas sourcing faced immediate challenges in managing increased input costs, which in turn pressured margins and forced them to reconsider procurement strategies. Airlines and MRO providers experienced a rise in maintenance expenditures as consumables such as cabin air filters and engine oil filters were directly affected by these duties. In response, many stakeholders accelerated efforts to localize production and diversify sourcing to mitigate tariff-driven volatility.

Supply chain realignments extended beyond nearshoring initiatives. Several leading filtration suppliers entered strategic partnerships with North American material providers, enabling them to secure tariff-exempt feedstocks and reduce lead times. Others invested in high-efficiency manufacturing lines domestically, leveraging federal grants and incentives aimed at strengthening critical aerospace supply chains. However, the transitional period was marked by temporary inventory shortages and price adjustments that impacted operational budgets for airlines and maintenance operators. Looking ahead, the cumulative impact of these 2025 tariffs underscores the importance of supply chain resilience, cost transparency, and proactive policy engagement for all industry participants.

Uncovering Deep Insights from Advanced Segmentation of the Aerospace Filtration Market by Type, Material, Aircraft Application, and End User Dynamics

A nuanced lens on the aerospace filtration market emerges when examined through multiple segmentation angles, each revealing distinct demand drivers and performance requirements. Within the filter type dimension, airframe filters stand out for their role in protecting critical systems from environmental debris, while cabin air filters emphasize passenger well-being through advanced microbial and particulate removal. Engine oil filters demand high pressure- and temperature-tolerance, and fuel filters combine contaminant separation with optimized flow characteristics. Hydraulic filters round out the spectrum by safeguarding actuators and flight control systems under dynamic load conditions.

Material type segmentation further differentiates market opportunities: activated carbon media excel at odor control and volatile organic compound absorption, cellulose-based filters offer cost-effective performance with moderate efficiency, metal mesh elements deliver robustness and reusability, and cutting-edge synthetic fiber constructs achieve superior particulate retention rates. When viewed across aircraft categories, demand varies significantly between business jets-ranging from heavy long-range platforms to light and midsize intercontinental models-and commercial jets with narrow and widebody variants. Helicopter operators prioritize lightweight, coalescing and debris-screening filters, especially in attack and transport subclasses, while military aircraft segments, including fighter jets and strategic airlifters, impose stringent reliability and rapid replacement criteria.

Applications such as oil removal and water separation in coalescing filters, subtwo- and subfive-micron particulate capture in fine filters, and both enhanced and standard HEPA filtration underscore operational safety and comfort imperatives. Pre-filter debris screening and dust removal extend component lifespans and support maintenance intervals. Finally, the end-user divide between aftermarket channels-including distributors and MRO providers-and OEM relationships with airframe and engine manufacturers shapes procurement cycles, certification processes, and aftermarket service offerings. This layered segmentation framework illuminates targeted areas for innovation, supply chain optimization, and strategic investment.

This comprehensive research report categorizes the Aerospace Filters market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Filter Type

- Material Type

- Aircraft Type

- Application

- End User

Exploring Distinct Regional Dynamics and Growth Drivers for Aerospace Filters across the Americas, Europe Middle East Africa, and Asia Pacific Markets

Regional dynamics in the aerospace filtration landscape reflect diverse fleet compositions, regulatory regimes, and maintenance infrastructures. In the Americas, a mature market with extensive commercial and business aviation fleets drives continued demand for high-performance filtration solutions. Leading MRO hubs in North America leverage advanced diagnostics and predictive maintenance platforms, while Latin American operators emphasize cost-effective consumables to manage aging aircraft inventories.

Europe, the Middle East, and Africa present a multifaceted picture. stringent environmental and safety regulations in Western Europe foster early adoption of sustainable filter media and smart monitoring systems. Gulf states channel significant investment into new airport developments and regional carriers, creating opportunities for localized filter assembly and certification partnerships. Meanwhile, African aviation markets focus on aftermarket retrofit programs to enhance operational safety and meet ICAO emissions and air quality directives.

Asia-Pacific stands out for its rapid fleet expansion across commercial, business, and military segments. Growing low-cost carrier networks and emerging market economies spur heightened requirements for robust, service-friendly filters that minimize aircraft downtime. Regional OEMs and component manufacturers are scaling production capacities, tapping into government-backed industrial clusters. Additionally, the pivot toward digital MRO solutions and integrated logistics in markets such as China, India, and Australia reinforces the need for filtration products compatible with real-time maintenance ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Aerospace Filters market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Aerospace Filtration Providers and Their Strategic Innovations Shaping Competitive Landscapes and Technology Adoption Trends

The competitive landscape of aerospace filtration is shaped by a mix of established conglomerates and specialized innovators, each vying to deliver precision-engineered solutions. Global industrial leaders have intensified focus on research and development, channeling resources into next-generation fiber technologies, smart sensing platforms, and integrated filter-monitoring systems. Technology-driven newcomers are gaining traction by offering modular, lightweight assemblies that align with stringent weight reduction mandates and cabin air quality enhancement goals.

Strategic partnerships and acquisitions have become commonplace, as companies seek to bolster their material science capabilities and expand regional manufacturing footprints. Collaborative ventures with airlines, OEMs, and defense contractors accelerate product validation cycles and streamline certification processes. Moreover, the shift toward aftermarket service contracts and performance-based maintenance agreements is reshaping how suppliers engage end users, encouraging the bundling of digital analytics services with traditional filter offerings. These competitive dynamics underscore the importance of agility, innovation, and customer-centric service models in maintaining a leadership position.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aerospace Filters market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Air Filter Company, Inc.

- Amphenol Corporation

- Camfil AB

- Champion Aerospace Inc.

- Chase Filters and Components, Inc.

- Donaldson Company, Inc.

- Eaton Filtration, LLC

- Epec, LLC

- Filtertech Inc.

- Freudenberg & Co. KG

- Genisco Filter Corp

- GKN Aerospace Services Limited

- Hollingsworth & Vose

- Mott Corporation

- Norman Filter Company

- Pall Corporation

- Parker Hannifin Corporation

- Porvair plc

- PTI Technologies Inc.

- Recco Products, Inc.

- Saifilter Filtration Technologies

- Sefar AG

- Sensata Technologies, Inc.

- Superior Felt & Filtration, LLC

- Swift Filters

- The Lee Company

Delivering Strategic, Actionable Recommendations to Guide Aerospace Industry Leaders in Optimizing Filtration Solutions and Operational Efficiencies

Given the evolving marketplace, aerospace stakeholders should prioritize the integration of digital monitoring solutions that afford real-time insights into filter performance metrics and maintenance scheduling. Investing in multi-material research and development programs will facilitate the adoption of sustainable, high-efficiency media, yielding both environmental and operational benefits. Companies should also explore regional manufacturing partnerships in North America and select EMEA markets to mitigate tariff exposure and enhance supply chain resilience.

Furthermore, collaboration across the value chain is essential; filter suppliers, airlines, and MRO providers should co-develop condition-based maintenance frameworks that reduce unplanned aircraft downtime and optimize lifecycle costs. Strategic alliances with regulatory agencies and industry associations can accelerate the approval of novel filter designs and material compositions. Finally, positioning aftermarket service offerings as performance-based engagements, bundled with analytics and lifecycle management tools, will unlock new revenue streams and strengthen customer loyalty.

Detailing the Rigorous Multi-Phase Research Methodology Underpinning the Aerospace Filtration Market Analysis and Insight Generation Process

This study employs a rigorous multi-phase research methodology, beginning with an exhaustive secondary data review of industry publications, regulatory filings, patent databases, and technical white papers. These sources provided a foundational understanding of current technology trends, material innovations, and certification requirements. Subsequently, primary research comprised in-depth interviews with key stakeholders, including filter OEM engineers, airline maintenance directors, regulatory compliance experts, and materials scientists, ensuring that qualitative insights informed every segment assessment.

Quantitative analysis involved the triangulation of data from supplier financial reports, government trade statistics, and fleet maintenance records to validate market drivers and impact factors such as tariff implementations. The research team applied a structured framework to map supply chain flows, production capacities, and regional demand dynamics. Throughout the process, findings underwent peer review by industry subject-matter experts, and data integrity checks ensured consistency across multiple sources. This comprehensive approach underpins the reliability and actionability of the aerospace filtration market insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aerospace Filters market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aerospace Filters Market, by Filter Type

- Aerospace Filters Market, by Material Type

- Aerospace Filters Market, by Aircraft Type

- Aerospace Filters Market, by Application

- Aerospace Filters Market, by End User

- Aerospace Filters Market, by Region

- Aerospace Filters Market, by Group

- Aerospace Filters Market, by Country

- United States Aerospace Filters Market

- China Aerospace Filters Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Synthesizing Critical Findings and Strategic Implications to Empower Decision Makers with Clear Perspectives on Aerospace Filter Market Trends

The rigorous examination of aerospace filtration dynamics reveals a market at the intersection of technological innovation, regulatory evolution, and supply chain realignment. Advanced materials, digital monitoring capabilities, and manufacturing breakthroughs are collectively driving the industry toward smarter, more sustainable filtration solutions. The 2025 tariffs in the United States have underscored the critical importance of supply chain agility and localized production strategies, while segmentation and regional analyses have highlighted nuanced demand profiles across filter types, material choices, aircraft classes, and end-user channels. Automotive parallels in service-based maintenance models and performance-based contracts further signal promising avenues for value-added differentiation.

Looking forward, stakeholders equipped with the insights provided in this summary are well-positioned to refine their strategic roadmaps, optimize procurement and manufacturing decisions, and foster collaborative ecosystems that accelerate product innovation. By leveraging the detailed findings and recommendations outlined here, decision makers can navigate market complexities, drive operational efficiencies, and deliver enhanced safety and performance outcomes in the global aerospace filtration arena.

Engage with Ketan Rohom to Acquire Comprehensive Aerospace Filtration Market Intelligence and Drive Informed Strategic Decisions for Your Organization

To explore the full scope of strategic opportunities, granular data insights, and comprehensive analysis of the aerospace filtration market, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan combines deep industry expertise with a consultative approach to help stakeholders align research findings with business objectives. By engaging with him, decision makers gain access to tailored report excerpts, priority data modules, and customized advisory sessions that translate market intelligence into actionable plans. Contact Ketan today to arrange a private briefing, secure your copy of the detailed report, and position your organization at the forefront of innovation in aerospace filtration.

- How big is the Aerospace Filters Market?

- What is the Aerospace Filters Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?