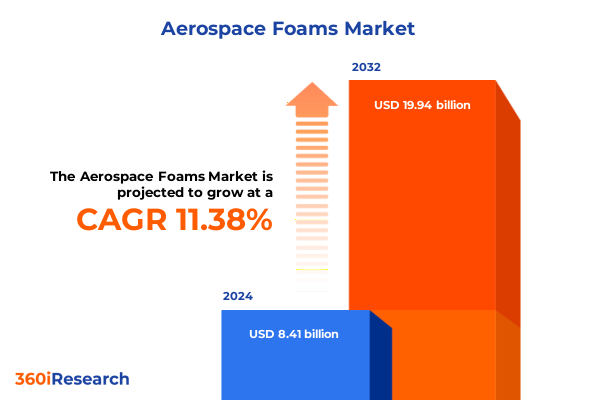

The Aerospace Foams Market size was estimated at USD 9.36 billion in 2025 and expected to reach USD 10.41 billion in 2026, at a CAGR of 11.40% to reach USD 19.94 billion by 2032.

Setting the Stage for Aerospace Foam Innovations Driving Next-Generation Aviation Performance and Safety Across Commercial and Military Platforms

The aerospace sector is undergoing a renaissance in material engineering, where advanced foam solutions are playing an increasingly pivotal role across a spectrum of aircraft platforms. Weight reduction, enhanced safety, and performance optimization are at the forefront of design imperatives, and the unique properties of various foam formulations-ranging from thermal insulation to structural reinforcement-are being leveraged to meet stringent regulatory standards and passenger comfort expectations. Innovations in foam chemistry have yielded materials that can withstand extreme temperatures, resist fire and chemical exposure, and attenuate sound and vibration within increasingly lightweight airframes.

Against the backdrop of ambitious sustainability targets and tightening environmental regulations, industry stakeholders are prioritizing materials that offer superior durability without compromising end-of-life recyclability or carbon footprint reduction. This evolution has been catalyzed by collaborative efforts among aerospace OEMs, specialized foam manufacturers, and research institutions, fostering an ecosystem that accelerates product development and validation. Forward-looking airlines and defense organizations are now incorporating advanced foam solutions in cabin interiors, wing and fuselage structures, and critical sealing applications to elevate operational efficiency and meet evolving passenger and mission requirements.

This executive summary distills the essential findings of our comprehensive aerospace foam market analysis, highlighting transformative shifts in material science, the ripple effects of trade policy adjustments, and strategic segmentation insights that underpin strategic planning. By distilling complex dynamics into targeted recommendations and actionable intelligence, this overview equips decision-makers with the clarity needed to navigate an increasingly competitive landscape.

Exploring the Transformative Shifts Reshaping the Aerospace Foam Landscape Fueled by Material Science Breakthroughs and Regulatory Pressures

The aerospace foam landscape is in the midst of a paradigm shift, driven by breakthroughs in polymer science and an intensified focus on multi-functional performance. Next-generation materials such as polyimide and phenolic foams have demonstrated exceptional thermal stability and flame retardancy, opening new avenues for their integration in engine nacelles and heat shields. Concurrently, silicone and polyurethane foam variants are being reformulated to deliver enhanced mechanical properties while maintaining compliance with global fire safety and toxicity standards.

Digital manufacturing techniques, including precision spray application and automated cast molding, are revolutionizing production workflows by reducing waste and ensuring consistency across high-volume components. These process innovations, coupled with data-driven quality assurance protocols, enable more agile customization of foam geometries to align with bespoke airframe designs. At the same time, the push toward electrified propulsion and hybrid-electric architectures is placing unprecedented demands on foam materials to deliver superior dielectric insulation and vibration damping for battery enclosures and motor housings.

Sustainability considerations are also reshaping the market, as stakeholders seek eco-friendly chemistries and closed-loop recycling initiatives. Compound formulations now incorporate bio-based polyols and low-emission blowing agents to address life cycle assessments and greenhouse gas reduction targets. Regulatory updates in key jurisdictions are reinforcing these trends by incentivizing lower carbon materials, thereby accelerating adoption of next-generation aerospace foams that balance performance, safety, and environmental stewardship.

Unveiling the Cumulative Impact of United States Tariffs on Aerospace Foams in 2025 Amid Global Supply Chain and Trade Policy Realignments

In 2025, modifications to United States tariff schedules have exerted significant pressure on cost structures and supply chain configurations for aerospace foam suppliers and OEMs alike. The escalation of duties on select imported resin precursors and finished composite panels has prompted a reassessment of global sourcing strategies, as manufacturers grapple with increased landed costs and potential delivery delays. These trade measures have particularly affected foam producers reliant on specialized chemical feedstocks from North America’s traditional trading partners.

In response, several foam fabricators have accelerated nearshoring initiatives, establishing production hubs closer to key aircraft assembly lines in the United States. This strategic pivot employs reaction injection molding and spray application facilities within federal trade zones to mitigate duties while capitalizing on logistical efficiencies. At the same time, contracts are being renegotiated with regional resin producers to secure preferential pricing and ensure continuity of critical raw materials such as polyimide precursors and polyurethane oligomers.

Despite short-term cost inflation triggered by tariffs, the realignment has broadened the domestic supplier base and catalyzed investments in process automation that offset duty impacts through productivity gains. OEMs have leveraged these developments to reinforce supply chain resilience, integrating multi-sourcing frameworks that blend in-country manufacturing with selective imports. Consequently, the cumulative tariff adjustments of 2025 are reshaping the competitive calculus by rewarding agile operators who can adapt their manufacturing footprints and maintain stringent lead-time commitments.

Uncovering Critical Segmentation Insights Revealing Dynamics Across Product Types Form Factors Applications End Uses Manufacturing Processes and Sales Channels

A nuanced understanding of segmentation reveals how diverse aerospace foam types and end uses converge to drive market differentiation. Beginning with product categories, polyethylene terephthalate-based systems coexist alongside high-temperature phenolic materials, versatile polyimide formulations, standard and specialty polyurethane variants, classic PVC foams, and advanced silicone chemistries, each fulfilling unique performance niches. The dichotomy between flexible and rigid foam structures further underscores varying design priorities, where pliable cushions enhance passenger comfort while stiffer cores provide structural reinforcement and cavity support.

Applications extend from impact cushioning, engineered to dissipate crash energies, to seat cushioning solutions optimized for ergonomic load distribution. Insulation needs bifurcate into acoustic barriers that mitigate cabin noise and thermal shields that protect avionics and passenger compartments. Sealing applications also branch into gasketing components for pressure integrity and adhesive-backed sealant tapes that expedite assembly processes. Beyond these functions, aerospace foams serve as critical structural elements and vibration damping media, balancing mechanical demands with weight and volume constraints.

End-use segmentation captures the requirements of business jet, commercial airliner, and military aircraft sectors, each influenced by distinct mission profiles and certification criteria. Manufacturing processes span cast molding techniques for complex geometries, reaction injection molding for high-throughput parts, and precision spray application methods that contour to irregular surfaces. Finally, sales channels balance original equipment manufacturer partnerships with aftermarket distribution networks, ensuring both fresh-build and retrofit opportunities are robustly served. This multidimensional segmentation framework illuminates how tailored foam solutions align with evolving aviation sector demands.

This comprehensive research report categorizes the Aerospace Foams market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Manufacturing Process

- Application

- End Use

- Sales Channel

Analyzing Regional Dynamics Driving Aerospace Foam Adoption Across Americas Europe Middle East Africa and Asia Pacific Markets Without Compromise

Regional dynamics in aerospace foam adoption reflect a convergence of local industry maturity, regulatory landscapes, and infrastructure investments. In the Americas, a dense network of aircraft OEMs and tier suppliers forms the backbone of demand, driving rapid integration of advanced foam solutions in both commercial airliners and defense platforms. Innovation clusters surrounding major manufacturing hubs foster close collaboration between material scientists and engineering teams, accelerating product qualification cycles for high-performance components.

Across Europe, the Middle East, and Africa, divergent market drivers coexist, from stringent European Union emissions and safety directives to strategic defense modernization programs in the Gulf region. Regulatory frameworks in Europe emphasize life cycle sustainability, prompting foam developers to introduce low-global-warming-potential chemistries. In parallel, operators in the Middle East and Africa prioritize temperature-resistant insulation for harsh environmental conditions, stimulating demand for silicone and phenolic variants.

The Asia-Pacific region exhibits some of the highest growth trajectories, propelled by an expanding civil aviation fleet in China and India alongside burgeoning defense procurement in Southeast Asia. Investments in domestic aerospace production capabilities have incentivized foam manufacturers to establish localized facilities, thereby reducing lead times and customizing formulations to regional performance standards. Collectively, these regional insights demonstrate how geographic-specific drivers and policy environments shape the strategic deployment of aerospace foams worldwide.

This comprehensive research report examines key regions that drive the evolution of the Aerospace Foams market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Key Company Strategies and Competitive Dynamics Shaping the Global Aerospace Foam Market Through Innovation Partnerships and Strategic Investments

Leading players in the aerospace foam market are leveraging a blend of innovation, strategic partnerships, and targeted acquisitions to bolster their competitive positions. Technology-focused enterprises are channeling R&D resources into high-performance polymers, unveiling foam variants that deliver superior thermal insulation and reduced densities, while maintaining compliance with emerging environmental regulations. Collaborative alliances with academic institutions have accelerated translation of novel chemistries into certified aerospace components, expediting market introduction timelines.

Simultaneously, major chemical conglomerates are forging joint ventures with regional fabricators to gain privileged access to established distribution channels and strengthen localized manufacturing capabilities. These partnerships facilitate agile responsiveness to OEM design updates and evolving certification requirements. Select firms have also pursued vertical integration strategies, acquiring resin compounding assets to secure consistent quality and cost control for critical feedstocks such as silicone oligomers and polyimide precursors.

Furthermore, some foam manufacturers are investing in digitalization initiatives, deploying advanced process monitoring and predictive maintenance tools across their production lines to ensure reproducibility and minimize downtime. Combined, these strategic moves underscore a competitive landscape where innovation velocity, supply chain resilience, and sustainability credentials are decisive factors distinguishing market leaders in the global aerospace foam sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aerospace Foams market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Armacell International S.A.

- BASF SE

- Covestro AG

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Huntsman International LLC

- NCFI Polyurethanes, Inc.

- Saint-Gobain S.A.

- Sekisui Plastics Co., Ltd.

- Solvay SA

- The Dow Chemical Company

- Woodbridge Foam Corporation

- Zotefoams plc

Empowering Industry Leaders With Actionable Recommendations to Navigate Aerospace Foam Market Complexities and Seize Emerging Opportunities Effectively

To thrive amid mounting technical demands and regulatory complexity, industry leaders must adopt a multifaceted strategic posture. Prioritizing investment in next-generation material research will unearth foam chemistries that satisfy increasingly rigorous flame retardant, thermal stability, and low-smoke toxicity standards. Concurrently, embracing digital manufacturing methods-such as automated spray application systems coupled with real-time process analytics-will enhance precision and efficiency, unlocking cost savings that can offset material premium costs.

Supply chain agility is paramount in light of evolving trade policies; diversifying sourcing portfolios to include nearshore resin suppliers and establishing dual-production footprints will mitigate tariff-induced disruptions. Implementing supplier scorecards and collaborative forecasting mechanisms with OEM partners can further strengthen alignment and reduce excess inventory risks. Additionally, embedding sustainability targets into product roadmaps through adoption of bio-based polyols and recyclable foam architectures will resonate with environmentally conscious stakeholders and preempt future regulatory constraints.

Finally, forging strategic alliances with aerospace integrators and certification bodies can accelerate market entry for innovative foam solutions. By co-developing test protocols and sharing technical data, foam producers can streamline qualification processes and tailor offerings to precise aircraft platform requirements. These actionable recommendations form a blueprint for navigating market complexities and capitalizing on emerging opportunities across the aerospace foam landscape.

Detailing Rigorous Research Methodology and Analytical Framework Employed to Ensure Comprehensive and Accurate Insights Into Aerospace Foam Market Dynamics

This analysis is underpinned by a rigorous research methodology that combines primary and secondary data collection, ensuring both breadth and depth of insight. Primary research involved structured interviews with material scientists, aerospace engineers, supply chain executives, and regulatory experts, providing firsthand perspectives on evolving performance criteria and procurement trends. Concurrently, comprehensive secondary research encompassed the systematic review of technical standards, patent filings, and industry white papers to validate emerging innovations and regulatory developments.

Data triangulation was employed to reconcile diverse information sources, enhancing the reliability of segmentation frameworks and regional market assessments. Quantitative data on production capacities, import-export volumes, and supply chain footprints were cross-validated with qualitative insights from key opinion leaders. The segmentation scheme-spanning product type distinctions, form factor delineations, multifaceted application categories, aircraft end-use classifications, manufacturing processes, and sales channel delineations-was crafted to mirror real-world decision-making matrices used by OEMs and tier suppliers.

Quality assurance protocols encompassed iterative reviews by subject matter experts and alignment with global certification requirements. This process ensured that analytical conclusions reflect current industry standards and future trajectories, furnishing stakeholders with a trustworthy foundation for strategic planning and investment prioritization.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aerospace Foams market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aerospace Foams Market, by Product Type

- Aerospace Foams Market, by Form

- Aerospace Foams Market, by Manufacturing Process

- Aerospace Foams Market, by Application

- Aerospace Foams Market, by End Use

- Aerospace Foams Market, by Sales Channel

- Aerospace Foams Market, by Region

- Aerospace Foams Market, by Group

- Aerospace Foams Market, by Country

- United States Aerospace Foams Market

- China Aerospace Foams Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Strategic Conclusions on Aerospace Foam Trends Challenges and Future Pathways to Equip Stakeholders With Actionable Intelligence and Vision

The aerospace foam market stands at the intersection of material innovation, regulatory evolution, and geopolitical realignment. High-temperature phenolic and advanced silicone chemistries are redefining performance benchmarks for insulation and structural support, while digital manufacturing advancements are streamlining production and facilitating design customization. At the same time, 2025 tariff adjustments have catalyzed supply chain realignment, incentivizing nearshoring initiatives and reinforcing domestic production capabilities to safeguard against trade policy uncertainties.

Segmentation analysis reveals that diverse product types meet specialized application requirements, from acoustic insulation in commercial cabins to impact cushioning in defense platforms. Regional insights underline the importance of localized strategies, with the Americas, EMEA, and Asia-Pacific markets exhibiting unique regulatory landscapes and growth drivers. Leading players are responding through targeted R&D investments, strategic partnerships, and sustainability-focused innovations that align with emerging environmental mandates.

Collectively, these dynamics underscore a market environment where agility, collaboration, and foresight are indispensable. By synthesizing comprehensive data and expert perspectives, this executive summary equips stakeholders with the strategic clarity needed to navigate the evolving aerospace foam landscape and to position their organizations for sustained competitive advantage.

Engaging Directly With Ketan Rohom to Unlock Exclusive Access to Comprehensive Aerospace Foam Market Research and Drive Strategic Decisions With Confidence

Unlock unparalleled strategic visibility into the aerospace foam market by engaging directly with Ketan Rohom, Associate Director, Sales & Marketing, to secure comprehensive market research that underpins confident decision-making and growth initiatives.

This call to action invites stakeholders to leverage personalized insights delivered by an industry authority who understands both technical nuances and commercial imperatives. Engaging with Ketan Rohom facilitates a seamless path to acquiring the definitive aerospace foam market research report, complete with granular segmentation analysis, tariff impact assessments, and regional dynamics tailored to inform procurement, product development, and investment strategies.

By connecting with Ketan Rohom, you gain access to in-depth findings that transcend generic overviews, enabling your organization to capitalize on emerging opportunities, mitigate supply chain risks, and align innovation roadmaps with evolving aviation standards. Don’t delay in harnessing actionable intelligence to sharpen your competitive edge and catalyze sustainable growth in the high-stakes aerospace foam sector.

- How big is the Aerospace Foams Market?

- What is the Aerospace Foams Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?