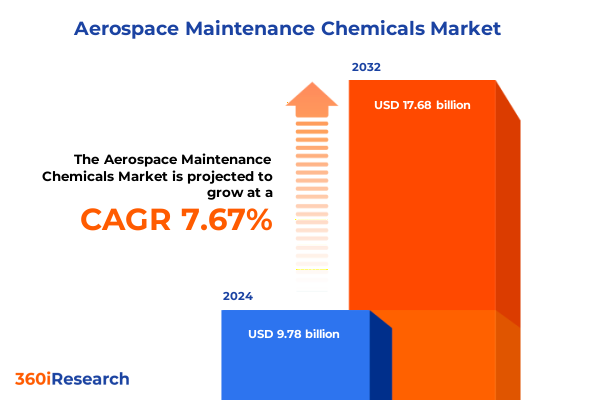

The Aerospace Maintenance Chemicals Market size was estimated at USD 10.55 billion in 2025 and expected to reach USD 11.38 billion in 2026, at a CAGR of 7.65% to reach USD 17.68 billion by 2032.

Unveiling the Critical Role of Maintenance Chemicals in Sustaining Aerospace Operational Excellence through Advanced Formulations and Processes

Maintenance chemicals underpin the safety, reliability, and operational continuity of modern aircraft fleets. Advanced chemical formulations play a pivotal role in every phase of aircraft upkeep, from precision removal of adhesives and coatings to the prevention of time-critical corrosion and the assurance of friction-less mechanical performance. Each category-whether chemical removers, cleaning agents, corrosion inhibitors, lubricants and greases, paints and coatings, or sealants and adhesives-has been engineered to address specific maintenance challenges encountered on complex metallic and composite airframes.

As maintenance cycles accelerate in response to tightening airline schedules and just-in-time turnaround targets, the demand for high-efficiency chemical solutions has surged. Service providers and OEMs are aligning on stringent specification requirements to shorten lay-over times without compromising on component integrity. At the same time, rising environmental scrutiny is propelling the transition from solvent-heavy products toward low-VOC, waterborne, and bio-based alternatives. In this evolving context, maintenance chemicals increasingly serve as both performance enablers and sustainability levers, establishing a foundation for aircraft operators to achieve enhanced reliability and reduced lifecycle costs.

Exploring the Transformational Dynamics Shaping the Aerospace Maintenance Chemicals Sphere in the Age of Digital Innovation and Environmental Responsibility

The aerospace maintenance chemicals landscape is undergoing profound transformation driven by digital innovation and an uncompromising focus on environmental stewardship. Artificial intelligence and machine vision techniques now guide precision cleaning robots, enabling real-time surface inspection and targeted application of chemical agents. Digital twins of aircraft subsystems allow formulators to simulate chemical interactions on new aluminum alloys and composite laminates, accelerating product development cycles while reducing prototyping costs.

Concurrently, regulatory bodies and end-users are demanding more sustainable chemistries. Low-emission coatings, biodegradable degreasers, and solvent-free corrosion inhibitors are rapidly moving from niche offerings to mainstream adoption. Suppliers are responding with multifunctional products that combine cleaning, corrosion protection, and lubrication in single applications, streamlining maintenance workflows. As collaborations between MRO providers, OEMs, and chemical manufacturers intensify, the competitive edge rests on the ability to innovate across both performance and environmental vectors.

Assessing the Cumulative Repercussions of United States Trade Tariffs on Aerospace Maintenance Chemicals Supply Chains and Cost Structures in 2025

In 2025, the cumulative impact of United States tariff measures on specialty chemicals has reshaped global supply chains and cost structures within the aerospace maintenance chemicals sector. Elevated duties on select solvents, synthetic base oils, and performance polymers have compelled formulators to re-evaluate sourcing strategies, increasingly turning to domestic producers or alternative feedstocks. The result has been a notable rise in input costs, eroding traditional pricing models and prompting end-users to renegotiate supply agreements.

Moreover, the specter of retaliatory tariffs from trade partners has injected further uncertainty into long-term procurement planning. To mitigate these risks, several leading suppliers have diversified their manufacturing footprints, establishing cost-effective production lines outside traditional tariff-affected corridors. In parallel, procurement teams within airlines and MRO hubs are adopting more agile contracting frameworks, including indexed pricing mechanisms and tariff pass-through clauses, to preserve margin stability and ensure uninterrupted access to critical maintenance chemistry supplies.

Revealing Critical Insights from Product to Distribution Channel Segmentation That Drive Strategic Decision Making in Aerospace Maintenance Chemicals

A nuanced understanding of market segmentation reveals how distinct sub-categories drive maintenance efficiency and shape supplier offerings. Within product types, chemical removers such as adhesive removers, paint strippers, and sealant removers lay the groundwork for downstream inspection and repair operations, while cleaning agents-ranging from aqueous cleaners to dry ice cleaning and solvent-based formulations-address diverse contamination profiles without damaging sensitive avionics. Corrosion inhibitors deliver both contact and vapor-phase protection, guarding against moisture ingress in hard-to-reach cavities, and lubricants and greases-including grease blends, oil-based lubricants, and synthetics-ensure consistent friction control under extreme temperature cycles.

Transitioning to applications, bonding and sealing tasks rely on high-strength adhesives and precision sealants optimized for assembly line throughput. Cleaning and degreasing methods integrate aqueous, solvent, and ultrasonic processes to balance effectiveness with environmental standards, while corrosion protection combines robust coatings and inhibitor systems to extend service intervals. Aircraft type segmentation underscores the heterogeneity of requirements: wide-body fleets demand long-cure, high-durability coatings, narrow-body operators prioritize rapid-dry top-coats, and rotary-wing platforms seek low-temperature-cure lubricants. End-user profiles further refine needs, with airlines emphasizing quick-turn solutions, defense entities mandating MIL-spec compliance, MRO providers focusing on cost-per-bearing-change optimization, and OEMs integrating maintenance chemistry considerations during design. Platform distinctions across commercial, general, and military aviation drive tailored product roadmaps, while differentiation between scheduled and unscheduled maintenance unveils unique turnaround and reliability drivers. Finally, the choice between direct sales and distributor channels reflects the balance of volume commitments, technical support requirements, and network reach.

This comprehensive research report categorizes the Aerospace Maintenance Chemicals market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Aircraft Type

- Platform

- Maintenance Type

- Application

- End User

- Sales Channel

Illuminating Distinct Regional Drivers of Aerospace Maintenance Chemicals Adoption Innovation and Regulatory Compliance across Americas EMEA and Asia Pacific Markets

Regional dynamics in aerospace maintenance chemicals adoption vary significantly across geographies. In the Americas, a mature market ecosystem benefits from established production hubs and rigorous safety regulations, fostering rapid uptake of low-emission coatings, advanced corrosion inhibitors, and automated chemical application systems. North American MRO clusters are implementing centralized chemical management programs to reduce variability and enforce compliance across large carrier networks.

Over in Europe, the Middle East, and Africa, stringent environmental regulations and REACH compliance requirements have accelerated a shift toward waterborne and solvent-free formulations. Key hubs in Western Europe are pioneering turnkey maintenance chemistry as a service offerings, combining inventory management with on-site technical support. Meanwhile, rapid fleet growth in the Middle East has spurred large-scale investments in MRO infrastructure, driving demand for scalable chemical supply agreements. Africa’s nascent commercial aviation sector is beginning to adopt best-practice maintenance chemical standards, often through partnerships with global suppliers.

Asia-Pacific markets are experiencing unprecedented expansion of narrow-body and regional jet fleets, creating immense demand for cost-effective cleaning agents and corrosion protection solutions. Local chemical producers in China and India are scaling capacity and forging joint ventures with established international formulators, intensifying competition while simultaneously expanding the portfolio of regionally compliant, high-performance products. These collaborations are enabling faster product registration and localized technical support, bolstering operator confidence and accelerating adoption of next-generation maintenance chemistries.

This comprehensive research report examines key regions that drive the evolution of the Aerospace Maintenance Chemicals market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global Players Shaping the Aerospace Maintenance Chemicals Arena through Innovation Alliances and Comprehensive Portfolio Strategies

Leading chemical suppliers are differentiating through strategic investments in research and development, targeted partnerships, and portfolio expansion. Several key players have established specialized laboratories dedicated to validating formulations on advanced composite substrates and hybrid metal structures. These centers collaborate directly with OEM engineering teams to co-develop mil-spec coatings that enhance corrosion resistance while meeting weight-saving objectives.

Innovation alliances extend into digital services, where top companies are embedding IoT sensors in chemical dispensing equipment to monitor consumption patterns, optimize inventory levels, and predict replenishment needs. This data-driven approach empowers MRO providers to transition toward outcome-based maintenance models, aligning chemical usage with aircraft health analytics. Additionally, a wave of mergers and acquisitions is consolidating complementary capabilities-ranging from high-performance sealants to ultra-low temperature lubricants-into unified offerings that address the full spectrum of maintenance chemistry requirements. Through these strategic moves, market leaders are strengthening their global footprints, accelerating product development timelines, and delivering integrated solutions that resonate across diverse operator segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aerospace Maintenance Chemicals market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALMADION International

- Arrow Solutions

- Callington Haven Pty Ltd.

- Chemco Industries, Inc.

- Chempace Corporation

- Chevron Corporation

- Eastman Chemical Company

- Exxon Mobil Corporation

- Florida Chemical by Archer Daniels Midland Company

- Frasers Aerospace

- Hubbard-Hall Inc.

- Jaco Aerospace

- Mil-Spec Industries Corp.

- Nuvite Chemical Compounds

- Quaker Chemical Corporation

- Royal Dutch Shell PLC

- RX Marine International

- SAE Manufacturing Specialties Corp.

- The Dow Chemical Company

- TMC Industries, Inc.

- Velocity Chemicals Ltd.

Crafting Actionable Strategies for Industry Leaders to Overcome Regulatory Complexities Supply Chain Disruptions and Capitalize on Technological Advances

To maintain a competitive edge, industry leaders should prioritize investment in bio-based and waterborne chemistries that not only comply with emerging environmental mandates but also deliver equivalent or superior performance to traditional solvent-based products. Equally important is the integration of digital maintenance platforms and predictive analytics, which enable proactive inventory planning and align chemical replenishment with real-time aircraft health data.

Building resilience against geopolitical and trade disruptions requires diversifying raw material sources and nearshoring critical manufacturing capabilities. Establishing multi-tiered supplier networks and maintaining strategic safety stocks of high-impact chemicals will mitigate the risk of tariff-induced volatility. Furthermore, co-innovation partnerships with research institutions can accelerate the development of solvent-free and additive-enhanced product lines, positioning companies at the forefront of performance and sustainability. Lastly, adopting outcome-based contracting models-where revenue is linked to measured maintenance efficiency gains-can strengthen customer relationships and open new service-oriented revenue streams.

Detailing Rigorous Research Methodology and Analytical Framework Ensuring Integrity Validity and Depth in Aerospace Maintenance Chemicals Study

This analysis is underpinned by a robust multi-stage research framework designed to ensure data integrity and analytical rigor. Primary research included in-depth interviews with formulators, MRO technicians, OEM quality engineers, and defense procurement specialists to capture nuanced perspectives on operational challenges and innovation priorities. Secondary research involved systematic reviews of regulatory filings, standards documentation, patent landscapes, and trade statistics to validate market dynamics and identify emerging technology trends.

To enhance the credibility of findings, data triangulation was performed by cross-referencing supplier capacity reports, customs import records, and maintenance service logs. Scenario analysis assessed the sensitivity of supply chains to tariff adjustments, while use-case mapping linked specific chemical formulations to distinct maintenance applications across diverse aircraft types. A peer-review process engaged independent subject matter experts to scrutinize methodology, assumptions, and conclusions, ensuring that the resulting insights reflect the highest standards of accuracy and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aerospace Maintenance Chemicals market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aerospace Maintenance Chemicals Market, by Product Type

- Aerospace Maintenance Chemicals Market, by Aircraft Type

- Aerospace Maintenance Chemicals Market, by Platform

- Aerospace Maintenance Chemicals Market, by Maintenance Type

- Aerospace Maintenance Chemicals Market, by Application

- Aerospace Maintenance Chemicals Market, by End User

- Aerospace Maintenance Chemicals Market, by Sales Channel

- Aerospace Maintenance Chemicals Market, by Region

- Aerospace Maintenance Chemicals Market, by Group

- Aerospace Maintenance Chemicals Market, by Country

- United States Aerospace Maintenance Chemicals Market

- China Aerospace Maintenance Chemicals Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2544 ]

Synthesizing Emerging Trends Strategic Imperatives and Collaborative Opportunities that Define the Future Path of Aerospace Maintenance Chemicals

The aerospace maintenance chemicals sector stands at a pivotal intersection of innovation, regulation, and strategic realignment. Digitalization and environmental objectives are reshaping product development pathways, driving the emergence of multifunctional, low-impact chemistries that satisfy both performance and sustainability criteria. Concurrently, tariff complexities and supply chain recalibrations are compelling suppliers and end-users to adopt more agile procurement models and localized manufacturing footprints.

Companies that pioneer advanced waterborne formulations, leverage predictive maintenance analytics, and forge integrated service partnerships will be best positioned to capture emerging growth opportunities. Collaboration across the OEM, MRO, and regulatory continuum will be essential to standardize specifications and accelerate the adoption of next-generation chemical solutions. Ultimately, success will depend on an organization’s ability to harmonize technological innovation with strategic risk management, delivering superior maintenance outcomes while contributing to broader operational resilience and environmental stewardship.

Engage with Ketan Rohom for Personalized Consultation to Access Comprehensive Aerospace Maintenance Chemicals Insights and Strategic Market Research Solutions

For tailored, in-depth insights into the aerospace maintenance chemicals market and strategic recommendations that align with your organization’s objectives, reach out to Ketan Rohom. As Associate Director of Sales & Marketing, Ketan can guide you through the comprehensive report’s detailed analyses-from segmentation deep dives to tariff impact assessments-and help you identify the most critical opportunities for growth and operational efficiency. Secure your copy of the full market research report and arrange a personalized briefing to explore how these actionable insights can be integrated into your strategic planning and procurement processes.

- How big is the Aerospace Maintenance Chemicals Market?

- What is the Aerospace Maintenance Chemicals Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?