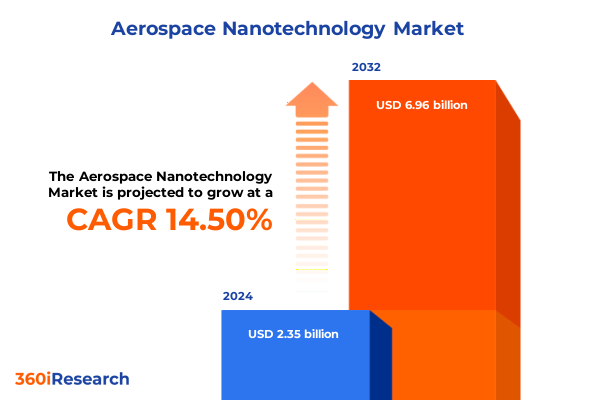

The Aerospace Nanotechnology Market size was estimated at USD 2.68 billion in 2025 and expected to reach USD 3.05 billion in 2026, at a CAGR of 14.59% to reach USD 6.96 billion by 2032.

Unveiling the Quantum Revolution in Aerospace: Introduction to the Impact and Opportunities of Nanotechnology on Flight Systems and Materials

Aerospace engineering stands at the cusp of a monumental transformation as nanotechnology advances redefine the boundaries of performance, efficiency, and durability. From the molecular engineering of coating systems to the integration of microscopic sensors, the industry is embracing an era in which manipulation at the atomic scale unlocks previously unattainable capabilities. These breakthroughs promise to address longstanding challenges in weight reduction, thermal stability, and structural health monitoring, setting new benchmarks for flight safety and operational cost savings.

Moreover, the convergence of nanomaterials with additive manufacturing and digital design platforms amplifies the potential for customizable, lightweight components that withstand extreme environments. This introduction frames a paradigm where strategic investment in nanoscale innovation not only enhances material properties but also spurs entirely new classes of avionics and propulsion systems. As stakeholders navigate this intricate landscape, a comprehensive understanding of core nanotechnology concepts becomes essential for seizing competitive advantage and guiding future development pathways.

Analyzing Disruptive Inflection Points and Emerging Paradigms Reshaping Aerospace Nanotechnology Adoption Across Materials, Sensors, and Manufacturing Techniques

The aerospace nanotechnology landscape is being reshaped by several interconnected inflection points. Breakthroughs in nanocoatings are delivering unprecedented resistance to corrosion and wear, fundamentally altering maintenance cycles and asset longevity. Simultaneously, advancements in nanofabrication techniques-such as two-photon polymerization and focused ion beam milling-are empowering engineers to conceive complex microstructures with unparalleled precision.

Furthermore, the integration of nanosensors into aircraft and spacecraft systems is redefining real-time monitoring capabilities. These minuscule devices can detect minute pressure variations, chemical signatures, and structural anomalies, enabling predictive maintenance and enhancing safety protocols. Coupled with the proliferation of digital twins and edge computing platforms, the rapid transmission and analysis of nanoscale data are enabling adaptive in-flight adjustments.

Collectively, these disruptive technologies are not isolated innovations but components of a larger ecosystem shift. The industry is transitioning from traditional bulk materials and macro-scale instrumentation to a finely tuned, data-driven paradigm. As a result, aerospace manufacturers and operators must recalibrate their R&D and supply chain strategies to harness these transformative forces effectively.

Evaluating the Comprehensive Consequences of 2025 Tariff Policies on Nanotechnology Component Supply Chains and Innovation Trajectories in US Aerospace Sector

In 2025, the United States implemented a targeted tariff regime affecting key nanomaterials and precursor chemicals essential to aerospace innovation. These measures have introduced cost pressures across multiple tiers of the supply chain, compelling manufacturers to reassess sourcing strategies and inventory buffers. The cumulative effect has manifested as extended lead times for critical components and heightened volatility in raw material pricing.

Consequently, many organizations have accelerated efforts to diversify their procurement networks, exploring domestic production partnerships and alternative suppliers in allied markets. This strategic pivot has been reinforced by increased federal R&D incentives aimed at reshoring advanced materials manufacturing. Additionally, companies are deepening collaborative efforts with academic and national laboratory programs to co-develop tariff-resilient formulations and streamline technology transfer processes.

These adjustments underscore a broader trend toward supply chain resilience and localized production. By adopting proactive mitigation strategies, aerospace stakeholders are not merely responding to immediate tariff impacts but are building foundational capabilities for sustained competitiveness in a dynamically evolving global trade environment.

Integrating Multidimensional Segmentation Perspectives to Illuminate Technology, Aircraft Type, Application, and End User Dynamics in Aerospace Nanotech Market

A multifaceted segmentation framework reveals nuanced insights into the aerospace nanotechnology domain. When examining the market through the lens of technology, it becomes evident that nanocoatings deliver critical enhancements in thermal protection and corrosion resistance, while nanofabrication techniques enable the creation of complex micro-architectures. Nanomaterials provide the structural backbone for lightweight, high-strength components, and nanosensors-spanning gas and chemical sensors, pressure measurement modules, structural health monitoring devices, and temperature sensors-facilitate sophisticated diagnostic and feedback loops.

From the perspective of aircraft type, commercial platforms exhibit strong demand for narrow-body and wide-body retrofits, driven by efficiency mandates and aftermarket service opportunities. Defense aircraft programs, particularly fighter jets, surveillance platforms, and transport assets, prioritize stealth coatings and embedded sensing to maintain tactical advantages. In the realm of spacecraft, launch vehicles and satellites integrate nanoscale materials to withstand extreme thermal cycles and reduce payload mass.

Application segmentation further clarifies the strategic deployment of nanotechnology, with avionics and electronics circuits becoming more compact, propulsion systems achieving higher fuel combustion efficiency, protective coatings enduring longer service intervals, structural materials combining greater toughness with weight savings, and thermal management solutions offering enhanced heat dissipation. Finally, end users-from commercial airlines and defense agencies to maintenance, repair, and overhaul providers, original equipment manufacturers, and research institutions-each navigate this landscape with distinct operational imperatives and investment horizons.

This comprehensive research report categorizes the Aerospace Nanotechnology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Aircraft Type

- Application

- End User

Interpreting Regional Differentiators Across Americas, EMEA, and Asia-Pacific to Reveal Priority Investment Zones and Innovation Ecosystems for Nanotechnology

Regional differentiation exerts a profound influence on the trajectory of aerospace nanotechnology deployment. In the Americas, leading OEMs and innovation clusters across the United States, Canada, and Brazil are cultivating ecosystems that emphasize domestic material production, pilot demonstration programs, and regulatory alignment. This region’s strong venture capital activity and federal research funding create fertile ground for early-stage technology adoption and collaborative testbeds.

In Europe, the Middle East, and Africa, regulatory frameworks and pan-regional consortia play a pivotal role in shaping R&D priorities. The European Union’s advanced materials directives and Gulf Cooperation Council investment initiatives are accelerating the integration of nanocoatings and nanosensors within both commercial and defense platforms. Simultaneously, emerging markets in Africa are exploring leapfrog opportunities, leveraging international partnerships to introduce state-of-the-art solutions.

Asia-Pacific represents another critical frontier, characterized by aggressive national programs in China, Japan, South Korea, and India that prioritize strategic autonomy in materials science. Rapid industrialization, coupled with substantial infrastructure investments and a growing talent pool, is driving large-scale implementation of nanotechnology in both aerospace manufacturing and satellite systems. Together, these regional dynamics are creating a mosaic of innovation pathways and investment priorities that will shape the global market’s evolution.

This comprehensive research report examines key regions that drive the evolution of the Aerospace Nanotechnology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovative Enterprises Driving Breakthroughs in Nanocoatings, Nanosensors, and Advanced Manufacturing for Next-Gen Aerospace Applications

Leading aerospace and technology enterprises are spearheading advancements in nanocoatings, nanosensor integration, and nanofabrication. Major OEMs have established dedicated nanotechnology centers to accelerate component development and certification, forging partnerships with specialized material suppliers and academic laboratories. These alliances often extend into co-development agreements aimed at scaling pilot processes into full production lines.

Concurrently, established defense contractors are integrating nanoscale electronic modules into next-generation unmanned aerial vehicles and tactical communications systems, enhancing battlefield awareness and resilience. Aerospace propulsion firms, meanwhile, are exploring nanoengineered alloys to elevate thrust-to-weight ratios, reduce fuel consumption, and extend mission profiles.

Innovative start-ups and spin-outs are also carving out niches, focusing on niche applications such as micro-encapsulated thermal interface materials and nano-enhanced composite layups. Their agility in pilot testing enables rapid iteration cycles and custom solutions for both commercial airlines and satellite integrators. By monitoring these diverse corporate strategies, industry participants can identify strategic partners, potential acquisition targets, and benchmark operational best practices.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aerospace Nanotechnology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- BAE Systems plc

- CHOOSE NanoTech Corporation

- Dassault Aviation S.A.

- Glonatech S.A.

- Honeywell International Inc.

- Israel Aerospace Industries Ltd.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Metamaterial Technologies Inc.

- Mitsubishi Heavy Industries Ltd.

- Nanocyl S.A.

- Nanoshine Group Corporation

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Rolls-Royce Holdings PLC

- Saab AB

- Safran S.A.

- Thales Group

- The Boeing Company

- Veelo Technologies LLC

- Zyvex Technologies

Strategic Roadmap for Industry Leaders Embracing Nanotechnology Advances to Enhance Competitiveness, Sustainability, and Resilience in Aerospace Value Chains

To capitalize on nanotechnology’s transformative potential, industry leaders should pursue a series of coordinated initiatives. First, establishing cross-sector consortia that include material scientists, aerodynamicists, and data analysts will accelerate the translation of laboratory discoveries into flight-worthy components. Simultaneously, integrating digital twins and in-line metrology within manufacturing lines can enhance quality control and reduce cycle times.

In parallel, organizations must diversify their supply chains by qualifying multiple raw material suppliers and advocating for harmonized regulatory standards to mitigate geopolitical risks. Investing in workforce development-through apprenticeships, academic partnerships, and targeted training programs-will ensure a pipeline of specialized talent capable of driving complex nanoscale projects.

Finally, dedicating resources to collaborative test programs and public-private partnerships will unlock new funding avenues and validate cost-benefit propositions. By aligning strategic roadmaps with pragmatic pilot initiatives and fostering an ecosystem mindset, aerospace stakeholders can not only manage immediate challenges but also position themselves at the forefront of sustainable, long-term growth.

Outlining Rigorous Research Framework and Data Collection Protocols Underpinning Robust Analysis of Aerospace Nanotechnology Market Dynamics

The research methodology underpinning this analysis combines rigorous primary and secondary data collection, guided by a systematic framework to ensure validity and reliability. Primary research included structured interviews with C-suite executives, materials scientists, and regulatory experts, supplemented by workshops and focus groups to glean qualitative insights into deployment challenges and success factors.

For secondary research, peer-reviewed journals, patent databases, and technical whitepapers were examined to trace the evolution of core nanotechnology processes. This was complemented by an exhaustive review of industry consortium reports and government policy documents. Data triangulation techniques were applied to validate findings and reconcile any discrepancies between sources.

Analytical rigor was maintained through the application of established frameworks, including PESTEL analysis to assess macro-environmental drivers, SWOT analysis to identify organizational strengths and vulnerabilities, and scenario planning to forecast potential technology adoption pathways. Regional mapping and segmentation overlays further contextualized the data, enabling targeted insights for stakeholders across diverse sectors.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aerospace Nanotechnology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aerospace Nanotechnology Market, by Technology

- Aerospace Nanotechnology Market, by Aircraft Type

- Aerospace Nanotechnology Market, by Application

- Aerospace Nanotechnology Market, by End User

- Aerospace Nanotechnology Market, by Region

- Aerospace Nanotechnology Market, by Group

- Aerospace Nanotechnology Market, by Country

- United States Aerospace Nanotechnology Market

- China Aerospace Nanotechnology Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing Critical Insights and Future Imperatives to Guide Stakeholders in Leveraging Nanotechnology for Sustainable Aerospace Innovation

As we synthesize the critical insights, it becomes evident that nanotechnology will be a defining factor in the next generation of aerospace innovation. From enhanced structural materials and smart coatings to real-time health monitoring and advanced propulsion interfaces, the path forward is paved with opportunities to improve safety, efficiency, and sustainability.

Looking ahead, collaboration across industry, government, and academia will be essential to surmount technical and regulatory hurdles. Standardization efforts, talent development initiatives, and strategic investment roadmaps will collectively determine the pace at which nanoscale solutions transition from pilot to mainstream applications.

Ultimately, stakeholders who proactively engage with these emerging paradigms will secure a competitive advantage. By embracing a holistic view that integrates technology, segmentation, regional, and corporate insights, the aerospace community can drive transformative change and chart a course toward a resilient, high-performance future.

Engage with Associate Director Ketan Rohom to Secure Comprehensive Aerospace Nanotechnology Market Research Insights and Drive Strategic Decision Making

Discussing a seamless path to engage directly with Ketan Rohom will transform curiosity into actionable insight and empower superior strategic positioning in the aerospace nanotechnology landscape. This tailored conversation unveils how our research encapsulates nuanced shifts in supply chains, technology trajectories, and regulatory environments. By reaching out today, stakeholders will gain privileged access to proprietary analysis, detailed companion dashboards, and expert support to navigate market complexities.

In partnering with Ketan Rohom, decision-makers will accelerate their go-to-market strategies, optimize investment priorities, and identify high-potential partnerships. This consultative engagement ensures clarity on addressing tariff impacts, leveraging segmentation intelligence, and capitalizing on regional variation. Engaging now secures a competitive edge by aligning corporate vision with actionable, data-driven recommendations.

To initiate this strategic dialogue, interested parties are invited to connect with Ketan Rohom, Associate Director of Sales & Marketing, who will tailor a demonstration of the full report’s capabilities. This call-to-action is designed to convert insights into outcomes, guiding organizations toward sustainable growth and technological leadership. Don’t miss the opportunity to transform market intelligence into measurable results by coordinating a session with Ketan Rohom today.

- How big is the Aerospace Nanotechnology Market?

- What is the Aerospace Nanotechnology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?