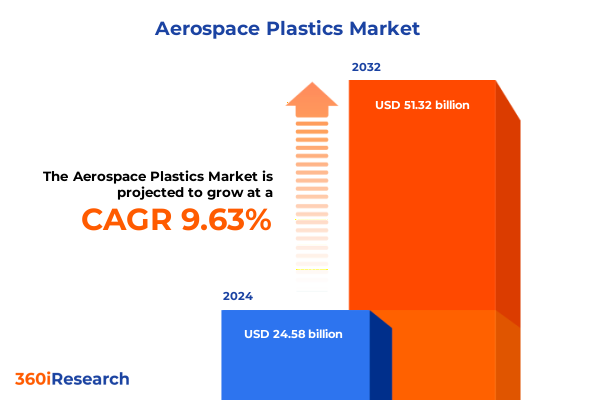

The Aerospace Plastics Market size was estimated at USD 26.83 billion in 2025 and expected to reach USD 29.29 billion in 2026, at a CAGR of 9.70% to reach USD 51.32 billion by 2032.

Introduction to the Pivotal Role of High-Performance Plastics Revolutionizing Global Aerospace Manufacturing Through Lightweight, Durable, and Sustainable Solutions

The aerospace sector has witnessed a remarkable evolution driven by the adoption of high-performance plastics, which offer a transformative combination of lightweight characteristics, durability, and resistance to extreme environments. Materials such as polyetheretherketone (PEEK) and polyaryletherketone (PAEK) have emerged as viable alternatives to traditional metals, demonstrating weight reductions of up to 60 percent in structural components while maintaining comparable mechanical strength and thermal stability. This shift not only enhances fuel efficiency but also extends maintenance intervals and lowers lifecycle costs, making advanced polymers indispensable to modern aircraft design.

Moreover, the imperative to reduce carbon emissions and comply with increasingly stringent environmental regulations has accelerated the integration of thermoplastic composites and recyclable resins across OEM and MRO processes. Leading polymer suppliers are refining material formulations and processing techniques to deliver superior flame, smoke, and toxicity (FST) performance parameters, as well as improved out-of-autoclave (OOA) consolidation methods. These developments underscore a broader industry trend where sustainability goals are aligned with operational excellence, heralding a new era of aerospace innovation.

Unveiling the Transformative Shifts Redefining Aerospace Plastics With Digital Innovation, Recycling Imperatives, and Composite Technologies Driving Future Competitiveness

The landscape of aerospace plastics is undergoing a profound transformation, propelled by digitalization, additive manufacturing, and the circular economy ethos. Additive manufacturing has matured from prototyping to volume production, enabling complex geometries and part consolidation that were once unachievable with conventional molding methods. This capability not only streamlines supply chains but also unlocks design freedom, allowing engineers to optimize parts for performance and weight reduction without incurring significant tooling costs.

Concurrently, digital twin technology and integrated data analytics are redefining material qualification and process validation. By simulating part behavior under diverse load cases and environmental conditions, manufacturers can accelerate certification pathways and reduce time-to-market. This confluence of advanced manufacturing and digital tools is complemented by an industry-wide push toward recyclability and closed-loop material recovery. Polymer developers are pioneering chemically recyclable thermosets and biodegradable matrix systems, signaling a shift toward sustainable life cycle management. Together, these trends are reshaping competitive dynamics, as agility and technological differentiation become paramount for long-term success.

Examining the Cumulative Impact of Newly Enacted United States Tariffs on Aerospace Plastics Supply Chains and Cost Structures in 2025

In March 2025, the U.S. government implemented a 25 percent tariff on all steel and aluminum imports under Section 232, eliminating numerous previous exemptions and extending duties to downstream derivative products used in aerospace manufacturing. Although the primary intent was to safeguard domestic producers, the immediate consequence has been a surge in input costs throughout the supply chain, as aluminum components and alloyed feedstocks now carry substantially higher landed costs. Given aerospace assemblies rely extensively on high-grade aluminum and specialty steel alloys, manufacturers have faced compressed margins and have had to reassess procurement strategies.

These tariffs have also triggered potential EU countermeasures targeting U.S. resin and plastics exports. The European Commission’s information-gathering notice identified sixty resin and plastic products for possible retaliatory duties, potentially impacting $5.9 billion in export value based on 2024 data. Such reciprocal actions risk disrupting established supply agreements and could impose additional levies on critical polymer inputs. As a result, aerospace companies are navigating heightened geopolitical uncertainty while evaluating the viability of alternate sourcing regions and reshoring initiatives to stabilize cost structures and ensure uninterrupted production.

Unlocking In-Depth Insights Into Aerospace Plastics Through Rigorous Material, Manufacturing Process, Application, and End User Segmentation Dynamics for Strategic Clarity

Strategic segmentation provides a multidimensional view of the aerospace plastics market, revealing nuanced opportunities across material type, manufacturing process, application, and end-user channels. Materials are broadly divided between thermoplastics and thermosetting plastics, with thermoplastics such as PEEK and PEI prized for their high-temperature resilience while engineering resins like PPS and polyamide balance cost and performance. Thermosets, including epoxy and unsaturated polyester, remain critical for primary structures and exterior components due to their superior mechanical integrity.

Manufacturing methods span conventional injection molding and extrusion molding to advanced compression molding, thermoforming, and 3D printing, each offering distinct trade-offs in part complexity, cycle time, and post-processing requirements. Applications range from avionics housings and electrical components to engine brackets, fuselage panels, interior assemblies, and structural subcomponents. Within these segments, OEMs prioritize materials with proven certification pedigrees, while maintenance, repair, and overhaul providers often favor versatile polymers that simplify repairs and reduce downtime.

The market’s end-user bifurcation between MRO and OEM endows each segment with unique value drivers. MRO operations demand rapid material availability, straightforward processing, and compatibility with legacy components, whereas OEMs emphasize long-term cost optimization, lightweighting mandates, and integration with digital manufacturing ecosystems. This segmentation framework illuminates where strategic investments and innovation efforts can yield maximum ROI.

This comprehensive research report categorizes the Aerospace Plastics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Manufacturing Process

- Application

- End User

Exploring Key Regional Dynamics Influencing Aerospace Plastics Demand, Innovation, and Supply Chains Across Americas, Europe Middle East & Africa, and Asia Pacific

Regional dynamics profoundly shape the trajectory of aerospace plastics adoption and innovation, as diverse market imperatives drive tailored strategies across the globe. In the Americas, robust defense spending and a deep-rooted MRO infrastructure underpin demand for high-performance polymers, while domestic OEMs leverage localized value chains to accelerate qualification and deployment of cutting-edge composite parts. This concentration of manufacturing prowess and regulatory alignment has positioned North America as a crucible for new material certifications and platform modernization initiatives.

Europe, the Middle East, and Africa face a complex interplay of sustainability targets and trade policy recalibrations. The region’s commitment to reducing lifecycle emissions has catalyzed R&D in recyclable thermosets and low-energy processing techniques. However, countermeasures to U.S. steel and aluminum tariffs underscore the volatility of trade relations and necessitate diversified sourcing strategies. Stakeholders in EMEA are navigating evolving regulatory frameworks while seeking to secure supply resilience amid shifting geopolitical winds.

Asia-Pacific stands as the fastest-growing region for aerospace plastics, driven by expanding commercial fleets and government-led manufacturing initiatives. Key markets such as China and India are scaling up domestic composite production capabilities, while nations in Southeast Asia have emerged as pivotal hubs for MRO services. Recent bilateral agreements, including favorable terms for aerospace programs in Indonesia, highlight the region’s strategic importance and its potential to reshape global supply trajectories.

This comprehensive research report examines key regions that drive the evolution of the Aerospace Plastics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Aerospace Plastics Innovators and Their Strategic Initiatives Shaping Market Leadership, Technological Advancement, and Ecosystem Partnerships

The competitive landscape of aerospace plastics is defined by a cadre of specialized material suppliers forging strategic partnerships with OEMs, tier-one manufacturers, and MRO organizations. Victrex has emerged as a leader in high-performance PEEK and PAEK solutions, with its AE250 composites enabling weight reductions up to 60 percent compared to aluminum while delivering five times greater specific strength. These hybrid overmolding technologies bridge the gap between continuous fiber composites and injection molding, underscoring Victrex’s role in advancing part consolidation and process efficiency.

Solvay has fortified its position with the CYCOM® EP2190 epoxy prepreg, tailored for primary structure applications and demonstrating exceptional toughness across hot-wet and cold-dry cycles. Its rigorous qualification under NCAMP protocols and adaptability to out-of-autoclave processes have accelerated adoption across commercial and defense platforms. Meanwhile, BASF continues to expand its portfolio of phenolic and bismaleimide resins, focusing on heat-resistant formulations for engine components, and Toray Industries has leveraged its carbon fiber expertise to co-develop thermoplastic composites with major aerospace OEMs. Celanese and Evonik round out the top tier by scaling industrial production of PEEK and polyimide grades, respectively, each pursuing digital integration initiatives to enhance traceability and certification workflows.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aerospace Plastics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3P Performance Plastics Products

- Aero-Plastics Inc.

- BASF SE

- Big Bear Plastics Limited

- Celanese Corporation

- Compagnie de Saint-Gobain S.A.

- Covestro AG

- DuPont de Nemours, Inc.

- Ensinger GmbH

- Evonik Industries AG

- Grafix Plastics LTD

- Loar Group, Inc.

- Mitsubishi Chemical Group Corporation

- PACO Plastics & Engineering Inc.

- PPG Industries, Inc.

- Röchling SE & Co. KGaA

- SABIC

- Solvay S.A.

- Sterling Plastics Inc.

- Toray Industries, Inc.

- Victrex plc

- Zeus Industrial Products, Inc.

Strategic and Actionable Recommendations for Aerospace Plastics Industry Leaders to Navigate Market Disruptions and Capitalize on Emerging Opportunities

Industry leaders must adopt a proactive posture to navigate an evolving aerospace plastics ecosystem characterized by regulatory shifts, supply chain complexity, and technological disruption. First, implementing a holistic supply risk framework that incorporates geopolitical intelligence and tariff scenario modeling will enable faster response to policy changes while safeguarding cost structures. Such frameworks should integrate end-to-end visibility of critical raw materials and identify alternate sourcing corridors to preempt potential bottlenecks.

Second, investing in digital material qualification platforms, including digital twins and AI-driven process analytics, will streamline certification cycles and support agile production scale-up. Collaborations with regulatory authorities to validate simulation-based evidence can reduce reliance on traditional physical testing and shorten time-to-market. Third, fostering cross-industry partnerships for recyclable polymer development and closed-loop recycling schemes will align sustainability goals with regulatory compliance, enhancing brand reputation and reducing exposure to raw material price fluctuations.

By prioritizing these strategic initiatives, manufacturers and service providers can fortify their competitive positions, accelerate innovation pipelines, and deliver value-added solutions that meet the dual imperatives of performance and environmental stewardship.

Comprehensive Research Methodology Detailing Data Collection, Qualitative and Quantitative Analysis Techniques, and Validation Protocols Ensuring Robust Insights for Aerospace Plastics

This research employed a rigorous, multi-phase methodology to ensure the validity and reliability of the insights presented. Primary data collection included in-depth interviews with senior executives from leading OEMs, polymer manufacturers, and MRO service providers, complemented by surveys designed to capture emerging product priorities and procurement strategies. Interviews were conducted under confidentiality agreements to elicit candid perspectives on material performance, supply chain resilience, and regulatory influences.

Secondary research entailed a comprehensive review of industry publications, trade association white papers, regulatory filings, and company press releases. Data triangulation techniques were applied to reconcile discrepancies between disparate sources, while expert panels and peer reviews validated key findings. Analytical methods included SWOT assessments for strategic segmentation, PESTEL analysis to contextualize macroeconomic and policy drivers, and scenario modeling to evaluate the potential impact of tariff regimes and technological disruptions. This combination of qualitative and quantitative approaches underpins the robustness and actionability of our conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aerospace Plastics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aerospace Plastics Market, by Material Type

- Aerospace Plastics Market, by Manufacturing Process

- Aerospace Plastics Market, by Application

- Aerospace Plastics Market, by End User

- Aerospace Plastics Market, by Region

- Aerospace Plastics Market, by Group

- Aerospace Plastics Market, by Country

- United States Aerospace Plastics Market

- China Aerospace Plastics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Conclusion Summarizing Strategic Imperatives, Emerging Trends, and Future Outlook for Aerospace Plastics Industry Growth, Innovation, and Competitive Advantage

The aerospace plastics market stands at a strategic inflection point, where technological innovation, sustainability imperatives, and geopolitical considerations converge to redefine competitive advantage. High-performance polymers and composite solutions have transcended niche applications to become foundational enablers of aircraft modernization, offering weight savings, enhanced durability, and reduced environmental footprints. Concurrently, evolving trade policies and tariff measures underscore the necessity for agile supply chain strategies and diversified sourcing networks.

Looking ahead, the industry’s trajectory will be shaped by continued advancements in digital manufacturing, closed-loop sustainability models, and collaborative material qualification pathways. Stakeholders who invest in strategic risk management, digital integration, and cross-sector partnerships will be best positioned to capture emerging growth opportunities and drive performance excellence. The insights and recommendations provided herein serve as a strategic compass to inform decision-making and align innovation agendas with the dynamic demands of the global aerospace ecosystem.

Elevate Your Competitive Edge by Connecting With Ketan Rohom to Access the Comprehensive Aerospace Plastics Market Research Report and Drive Strategic Decisions

Are you ready to transform your strategic initiatives with unparalleled insights into the aerospace plastics landscape? Reach out to Ketan Rohom to secure your access to a comprehensive market research report designed to empower data-driven decisions, mitigate risks, and identify high-impact growth opportunities. Partnering with our team ensures you receive tailored, in-depth analysis and actionable recommendations that will keep you ahead in an increasingly competitive environment. Contact Ketan Rohom to unlock the full potential of this vital industry intelligence and drive superior business outcomes today

- How big is the Aerospace Plastics Market?

- What is the Aerospace Plastics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?