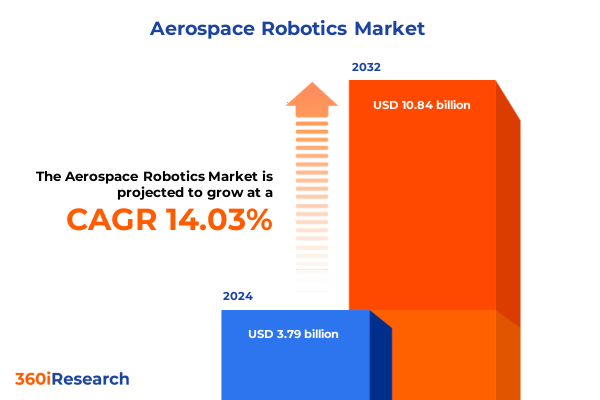

The Aerospace Robotics Market size was estimated at USD 4.27 billion in 2025 and expected to reach USD 4.82 billion in 2026, at a CAGR of 14.22% to reach USD 10.84 billion by 2032.

How the convergence of advanced autonomy, perception, and software-defined robotics is reshaping manufacturing, inspection, and sustainment across aircraft lifecycles

The aerospace robotics landscape is at a pivotal point where historically siloed engineering disciplines, advanced sensing, and autonomous decisioning converge to reshape how aircraft are manufactured, inspected, and sustained. In recent years, modernization of production lines has moved beyond incremental automation toward integrated human-robot teams that emphasize precision, repeatability, and the ability to operate in constrained, safety-critical environments. This evolution is not only a function of hardware improvements; it is driven by improved perception stacks, edge compute, and software orchestration that enable robots to interpret complex avionics and composite structures with greater confidence.

As operators and OEMs seek higher uptime and lower life-cycle costs, robotics are increasingly embedded across the aircraft value chain. From automated composite layup and high-precision drilling in airframe assembly to mobile inspection platforms that reduce aircraft-on-ground time, robotics interventions are chosen for repeatable quality and for reducing exposure to hazardous tasks. These deployments are accompanied by a parallel expansion of services-consulting for integration, maintenance and support for uptime assurance, and training to reskill workforces for collaborative operations. Consequently, the aerospace sector is shifting its resource allocations from manual-intensive labor and reactive maintenance toward predictive models and autonomous tooling that can be validated against stringent regulatory standards.

This introduction frames the remainder of the report: it highlights the convergence of mature mechanical systems and advancing autonomy, the growing importance of software-defined robotics, and an increasing appetite for services that bridge the gap between prototype pilots and scaled, certified operations. Together, these forces are enabling faster product cycles, more resilient in-service maintenance, and new business models focused on availability and outcome-based contracts rather than simple equipment sales.

Emerging autonomy, collaborative systems, and software-led orchestration are shifting supplier dynamics and accelerating integration across aerospace manufacturing and maintenance

The last eighteen months have seen transformative shifts in aerospace robotics that are changing strategic priorities for operators, OEMs, and suppliers. Collaborative robots (cobots) have moved from niche laboratory demonstrations into mainstream hangar and shopfloor applications, supported by robust machine vision, force sensing, and safer control paradigms that allow closer human-robot interaction in assembly and maintenance contexts. This transition reduces cycle times for repetitive micro-tasks while preserving human judgment for non-routine decisions, creating hybrid workflows that balance throughput and flexibility. Alongside cobots, mobile inspection platforms and drones for structural and system inspection have matured; they now integrate higher-fidelity sensors, automated flight and navigation stacks, and standardized reporting outputs that feed back into maintenance records.

Equally impactful is the acceleration of autonomy. Semi-autonomous and fully autonomous systems are increasingly used in repetitive inspection and material handling processes, reducing dependence on skilled operators for routine tasks and enabling continuous operations during off-shift windows. This surge in autonomy is enabled by improved algorithms, richer training datasets drawn from operational environments, and more capable edge compute that can meet the latency and determinism requirements of safety-critical tasks. Power and mobility innovations, including more efficient electric actuation, battery chemistry improvements, and hybrid drive systems, have expanded the feasible deployment envelope for mobile robotics within maintenance aprons and manufacturing floors.

Finally, the software layer has emerged as a strategic differentiator. Robotics-as-a-service models, cloud-to-edge orchestration, and analytics-driven maintenance insights are creating recurring revenue streams and altering procurement decisions. The net effect is an industry where technological capability, integration competence, and software ecosystems determine the speed and scale of adoption. These shifts are reshaping supplier relationships and compelling organizations to rethink skills, governance, and certification pathways for next-generation robotic deployments. The outcome is a faster-moving, more software-centric aerospace robotics ecosystem that emphasizes interoperability, safety, and lifecycle value over singular hardware performance metrics.

How recent U.S. tariff measures and trade investigations are reshaping aerospace robotics sourcing, supplier strategy, and procurement risk management

Beginning in 2024 and continuing into 2025, changes in U.S. trade policy and targeted tariff actions have introduced new layers of operational complexity for aerospace robotics supply chains and capital procurement decisions. Tariff measures and related trade investigations have focused on a range of strategic inputs-ranging from aircraft components and key materials to semiconductors and critical minerals-creating cost and timing pressures for manufacturers that depend on internationally sourced subassemblies and electronics. These trade actions are prompting manufacturers to re-evaluate supplier footprints, accelerate qualifying domestic or allied sources, and factor import duties into total landed cost calculations for both hardware and integrated robotic systems. The uncertainty generated by ongoing investigations and periodic tariff adjustments has also increased the cost of holding inventory and extended lead times for specialized procurements, especially for sensors and precision actuation systems where supplier pools are concentrated.

Supply chain responses have varied. Some firms are accelerating dual sourcing and nearshoring initiatives to reduce exposure to single-country dependencies, while others are accepting higher pass-through costs to preserve production schedules. In parallel, there is a marked uptick in investments in domestic assembly and validation capabilities for higher-value subsystems to maintain programmatic control and to comply with potential domestic content requirements tied to defense and government procurement. These shifts are influencing decisions at multiple levels of the procurement chain: from selection of arm processors, controllers, drives, and sensors in robotic hardware to choices about software licensing and long-term service agreements. Stakeholders should expect tariffs and trade measures to continue influencing supplier selection, capital planning, and certification timelines, and must design sourcing strategies that account for both immediate tariff impacts and the policy environment’s potential volatility.

Detailed segmentation reveals how offering choices, payload classes, autonomy levels, mobility, power systems, and applications determine aerospace robotics deployment pathways

Segment-specific dynamics reveal where investments and operational focus are consolidating across the aerospace robotics landscape. Within offerings, hardware remains central for performance-sensitive tasks; design choices pivot on the selection of arm processors, controllers, drives, and sensors that together determine precision, latency, and environmental robustness. Services now complement hardware at scale, spanning consulting that advises on integration pathways, maintenance and support that sustain availability, and training that upgrades human teams to work effectively with collaborative and semi-autonomous systems. Software is the connective tissue: it orchestrates perception, motion planning, and fleet management and increasingly carries the intellectual property that differentiates provider offerings.

Payload capacity is an operational axis with clear implications for application fit. Systems rated up to 10 kg are typically deployed for fine assembly and tooling tasks where high repeatability and low inertia are advantageous; platforms in the 10 kg to 50 kg band are favored for panel handling, moderate payload transfers, and many inspection manipulators where a balance of reach and payload is required; above 50 kg capacities are selected for heavy part transfer, large-tool operations, and specialized material handling where structural rigidity and drive power become dominant design concerns. Technology type further refines deployment decisions: collaborative robots are prioritized where human proximity, ease of programming, and re-tasking matter, while traditional industrial robots remain integral for high-speed, isolated automation where throughput dominates. Degree of autonomy shapes operational control: manual robots persist where human supervision is mandated by process variability or certification constraints, semi-autonomous systems reduce operator workload for standardized sequences, and fully autonomous robots are being trialed in defined inspection and logistics corridors where safety cases and data evidence support reduced oversight.

Mobility choices split between fixed installations, which provide the stability and repeatability required for assembly and composite layup, and mobile platforms that enable patrol-style inspection and hangar-wide part transfers. Power source decisions-electric actuation for precision and lower maintenance, hydraulic systems for high-force, and pneumatic systems where simple, clean actuation is useful-continue to influence both design and maintenance regimes. Application areas demonstrate how these segmentation axes intersect: assembly and manufacturing use automated drilling, automated fastening, and composite layup processes that demand precise kinematics and clean integration into tooling lines; inspection and maintenance employ structural and system inspection robots that emphasize sensing, nondestructive testing modalities, and data integration into maintenance records; material handling is split into part transfer and storage and retrieval workflows that value repeatability and throughput; surveillance applications use thermal and visual inspection modalities to augment safety and to detect corrosion, fluid leaks, and foreign object debris. Finally, end-user segmentation clarifies adoption drivers: commercial aviation leverages robotics to reduce aircraft on ground time and to improve manufacturing consistency, defense organizations value ruggedized, secure, and certifiable systems, and space organizations prioritize extreme-environment survivability and precision for unique assembly and test operations. These segmentation insights show that technical choices, certification pathways, and service models are tightly coupled to task and end-user constraints, so strategic investments must align product roadmaps with the operational demands of each segment.

This comprehensive research report categorizes the Aerospace Robotics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Payload Capacity

- Technology Type

- Degree of Autonomy

- Mobility

- Power Source

- Application

- End User

How regional manufacturing density, regulatory pathways, and supply-chain resilience shape aerospace robotics deployment strategies across the Americas, EMEA, and Asia-Pacific

Regional dynamics are materially affecting where aerospace robotics capabilities are developed, validated, and deployed. In the Americas, a dense cluster of OEMs, Tier 1 suppliers, and sustainment operators favors rapid integration of robotics into both manufacturing and line maintenance. North American labor dynamics, combined with proximity to major carriers and defense programs, make this region attractive for piloting collaborative systems and for establishing domestic service networks that can respond to regulatory and contractual demands. Meanwhile, Europe, the Middle East, and Africa maintain strong capabilities in precision manufacturing, aerospace composites, and advanced inspection methods, supported by robust aerospace supply chains and regulatory frameworks that emphasize certification and interoperability. This region continues to be the locus for innovation in inspection robotics and for cross-border partnerships that can scale validated solutions across national defense programs and civil aviation operators. Asia-Pacific remains the largest regional hub for high-volume manufacturing, component sourcing, and rapid production ramp-ups. Its vast ecosystem of component manufacturers, sensor suppliers, and integrators supports aggressive adoption of automation, especially in high-mix, low-cost manufacturing contexts.

These regional profiles also inform strategic choices. Investment in domestic production and nearshoring in the Americas is accelerating due to trade policy shifts and the desire for supply-chain resilience. Europe’s focus on certification pathways and standards creates opportunities for suppliers who can demonstrate compliance and interoperability at scale. Asia-Pacific’s manufacturing density and supplier ecosystems make it the natural region for piloting cost-optimized robotics and for scaling hardware production. From a market-entry perspective, companies that align product roadmaps with regional regulatory regimes, end-user procurement cycles, and localized service capabilities will be better positioned to capture early-adopter projects and to build sustainable installed bases.

This comprehensive research report examines key regions that drive the evolution of the Aerospace Robotics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

How integration expertise, certification know-how, and software-enabled services are defining competitive advantage among aerospace robotics solution providers

Companies operating at the intersection of robotics and aerospace are differentiating along several axes: systems integration expertise, validated safety cases for human-robot interaction, sensor and perception capabilities, and the depth of aftermarket service offerings. Traditional industrial robotics firms are partnering or competing with specialized robotics startups that offer lightweight arms, advanced perception stacks, or mobile inspection platforms; meanwhile aerospace OEMs and Tier 1 suppliers are increasingly embedding robotic capabilities into their production plants or acquiring niche providers to internalize expertise. Cross-industry partnerships are also becoming common, with robotics firms collaborating with avionics suppliers, materials specialists, and systems integrators to deliver complete automation lines and to create defensible integration IP.

Strategic positioning is varied. Some companies emphasize ruggedized hardware tailored to aerospace environments and invest heavily in qualification and certification pathways to win long-term procurement contracts. Others concentrate on software, analytics, and lifecycle services, offering robotics-as-a-service and outcome-based contracts that shift capital expenditure into operational expenditure. A third group focuses on sensor fusion and inspection payloads, coupling high-resolution imaging and nondestructive testing modalities with automated reporting that reduces aircraft downtime. Across these approaches, companies that can demonstrate repeatable compliance with safety and maintenance standards, and who can provide local support networks, are winning specification in both commercial aviation and defense programs. The current environment rewards firms that can integrate hardware, software, and services into validated solutions, while also maintaining agility to adapt to tariff-driven supply chain changes and region-specific certification requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aerospace Robotics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Airbus SE

- ASTROBOTIC TECHNOLOGY, INC.

- Astroscale Holdings Inc.

- Blue Origin Enterprises, L.P

- Ceres Robotics Inc.

- Comau S.p.A.

- DENSO Corporation

- FANUC Corporation

- General Atomics

- GITAI USA Inc.

- ispace, inc.

- Kawasaki Heavy Industries, Ltd.

- KUKA AG

- Lockheed Martin Corporation

- Maxar Technologies Holdings Inc.

- MDA Ltd.

- Metecs, LLC

- Motiv Space Systems Inc.

- Northrop Grumman Corporation

- Oceaneering International, Inc.

- PickNik Inc

- Redwire Corporation

- Stäubli International AG

- The Boeing Company

Practical, phased actions for leaders to de-risk adoption, accelerate certification, and align sourcing while delivering measurable manufacturing and maintenance value

Industry leaders should adopt a pragmatic, phased approach that balances capability demonstration with rigorous certification and supply-chain resilience planning. Start by prioritizing deployments that deliver measurable reductions in turnaround time and quality variance-targeting inspection and repeatable assembly operations where robotics can demonstrate clear ROI and minimal regulatory friction. Parallel to pilot deployments, pursue sourcing strategies that align with likely trade-policy scenarios: diversify component suppliers, validate alternative supply lines in allied markets, and build domestic assembly or final integration capacity for higher-value subsystems where cost and security considerations demand it.

Invest in workforce transition programs that combine hands-on training, digital twins for procedural rehearsal, and accredited certification pathways so technicians can supervise and maintain mixed human-robot teams. From a product perspective, emphasize modularity: configurable end-effectors, swappable sensor suites, and software APIs that enable integration with existing manufacturing execution systems and maintenance record databases. Finally, adopt a service-led business model for at least a portion of deployments, offering maintenance contracts, performance guarantees, and analytics subscriptions. This will create recurring revenue, deepen customer relationships, and generate the operational data necessary to justify further automation investments. Executed correctly, these measures will reduce program risk, improve total cost of ownership transparency, and accelerate time-to-value for aerospace robotics programs.

A multi-method research framework combining primary expert interviews, operator case studies, supplier briefings, and secondary policy analysis to ensure practical and validated conclusions

This research synthesizes primary interviews with subject-matter experts, supplier briefings, and operator case studies together with secondary-source analysis of trade, policy, and technical literature to construct a robust evidence base. Primary engagements included engineering leads at OEMs, maintenance organizations, and integration partners to capture real-world constraints on certification, workforce readiness, and operations. Supplier briefings focused on hardware component performance, sensor modalities, and software orchestration approaches, while operator case studies documented deployment timelines, validation protocols, and maintenance integrations. Secondary research evaluated policy and trade developments, standards and certification frameworks, and recent technology maturity reports to contextualize primary findings within the broader industry environment.

Methodologically, the analysis emphasizes triangulation: claims from a single source were validated against at least two independent data points or expert confirmations. Technical assessments used engineering performance benchmarks and field-validated tolerances rather than vendor claim sheets. Supply-chain analysis considered trade policy actions and public filings, and regional insights were corroborated with operator-level feedback to ensure applicability. This multi-method approach supports a practical, practitioner-focused perspective: the conclusions prioritize operational feasibility, certification pathways, and the likely impacts of trade and policy shifts on deployment timelines.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aerospace Robotics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aerospace Robotics Market, by Offering

- Aerospace Robotics Market, by Payload Capacity

- Aerospace Robotics Market, by Technology Type

- Aerospace Robotics Market, by Degree of Autonomy

- Aerospace Robotics Market, by Mobility

- Aerospace Robotics Market, by Power Source

- Aerospace Robotics Market, by Application

- Aerospace Robotics Market, by End User

- Aerospace Robotics Market, by Region

- Aerospace Robotics Market, by Group

- Aerospace Robotics Market, by Country

- United States Aerospace Robotics Market

- China Aerospace Robotics Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2385 ]

Converging advances in perception, autonomy, and service models are making aerospace robotics operationally viable while requiring resilient sourcing and workforce strategies

Aerospace robotics is transitioning from experimental deployments to operationalized systems that improve safety, reduce downtime, and raise quality consistency across manufacturing and maintenance. The combined forces of improved perception, more capable edge compute, advancing autonomy, and flexible service models are accelerating adoption in contexts that can meet strict certification and safety requirements. However, the current trade-policy environment and tariff measures create real near-term headwinds that must be managed through diversified sourcing, increased domestic integration, and clearer service and lifecycle propositions. Success will belong to organizations that invest in the integration of hardware, software, and services; that build resilient supplier networks; and that commit to workforce transition strategies that make robotics an enablement rather than a displacement.

In short, the path forward requires technical rigor, regulatory engagement, and pragmatic commercial models that align incentives across OEMs, operators, and suppliers. Those who act decisively to pair validated robotic solutions with resilient supply strategies and well-designed service propositions will capture the most value as aerospace enters a more automated, data-driven era.

Secure the definitive aerospace robotics market report and arrange a confidential briefing with the Associate Director to accelerate procurement and strategy

This market research report is available for purchase and tailored briefing sessions are offered to expedite decision-making and procurement planning. To secure a copy of the full study, schedule a one-to-one briefing, or request a custom data extract, please contact Ketan Rohom, Associate Director, Sales & Marketing at the research firm. Engaging directly will provide immediate access to the full dataset, reproducible methodology appendices, company-by-company profiles, and slide-ready strategic summaries that senior leaders can action within weeks rather than months.

A purchased report also includes optional add-ons such as executive workshops, bespoke competitor deep dives, and prioritized analyst Q&A hours that can accelerate implementation of automation roadmaps. For procurement teams evaluating capital allocation, the briefing with the Associate Director will clarify report scope, available licensing models, and any ancillary consulting services that support rapid integration of the insights into corporate strategy.

Acting now ensures priority access to the latest release and first-rights on any near-term updates or specialized regional supplements that may be released. Reach out to Ketan Rohom to arrange a confidential briefing and secure the report for strategic planning cycles that must respond to rapidly evolving regulatory and trade landscapes.

- How big is the Aerospace Robotics Market?

- What is the Aerospace Robotics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?