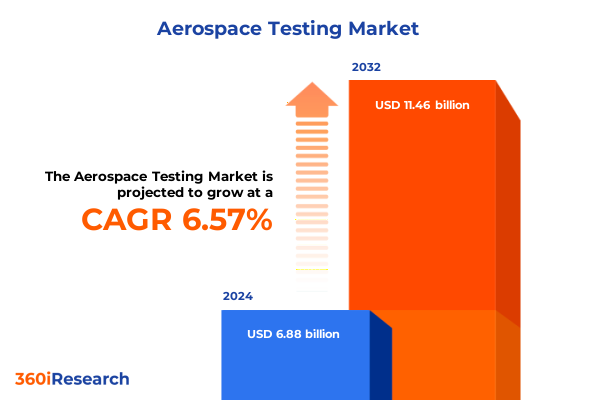

The Aerospace Testing Market size was estimated at USD 6.88 billion in 2024 and expected to reach USD 7.31 billion in 2025, at a CAGR of 6.57% to reach USD 11.46 billion by 2032.

Setting the Scene for Aerospace Testing Excellence: An Overview of Critical Challenges, Innovations, and Market Dynamics in the Modern Testing Environment

The aerospace sector operates under a relentless imperative for safety, reliability, and performance. Testing regimes are the linchpin that ensures every component, subsystem, and full assembly meets rigorous standards before entering service. In recent years, the convergence of advanced materials, novel manufacturing processes, and heightened regulatory requirements has intensified the complexity of validation protocols. Innovation cycles have accelerated, compelling testing organizations to adopt more agile frameworks while preserving uncompromised quality.

Navigating Transformative Shifts in Aerospace Testing Through Technological Innovation, Regulatory Evolution, and Holistic Operational Strategies

Over the last decade, digital transformation has permeated every facet of aerospace testing, elevating traditional practices through predictive analytics, automation, and virtual modeling. Digital twins have emerged as a cornerstone, replicating complex systems in simulated environments to identify failure modes long before physical prototypes are built. This shift towards data-driven validation reduces time-to-flight and mitigates risk by capturing nuanced insights from high-resolution sensors and embedded monitoring devices.

Regulatory agencies have also modernized certification pathways, embracing guidelines that account for advanced composite structures, additive-manufactured parts, and novel propulsion systems. Consequently, testing centers are reconfiguring their methodologies to align with updated safety frameworks and environmental mandates. Parallel to these regulatory evolutions, the integration of robotics and AI-powered nondestructive evaluation tools has optimized throughput, enabling continuous scanning processes that adapt to variable geometries without sacrificing precision.

Assessing the Cumulative Effects of 2025 United States Aerospace Tariffs on Testing Supply Chains, Operational Costs, and Competitiveness

In 2025, the United States implemented a new wave of tariffs targeting critical aerospace metals and components, fundamentally reshaping cost structures and supplier strategies across testing facilities. The increased duties on high-grade aluminum alloys, specialty steels, and advanced composites have driven up the expense of procuring test specimens and calibration standards. Testing laboratories have consequently revised capital budgets to account for higher lead times and elevated material costs, prompting many to explore regional sourcing alternatives to maintain competitive service rates.

Beyond direct procurement impacts, these tariffs have spurred closer collaboration between equipment manufacturers and testing service providers. By co-developing instrumentation components domestically, stakeholders are seeking to bypass trade barriers and streamline certification cycles. Simultaneously, the shifting customs landscape has reinforced the value of vertically integrated testing capabilities, encouraging organizations to bring more analysis stages in-house rather than relying on cross-border subcontracting. Although these adjustments demand upfront investment, the resulting supply-chain resilience and reduced logistical complexity position labs to respond more nimbly to future policy shifts.

Unveiling Comprehensive Segmentation Insights Across Type, Technique, Testing Capabilities, Usage, Application, Sourcing, and End-User Perspectives

A detailed examination of the aerospace testing ecosystem reveals layered segmentation that clarifies where industry leaders allocate resources and expertise. Based on type, offerings separate into destructive testing, which encompasses protocols such as crash testing, creep rupture testing, fatigue testing, fracture toughness testing, hardness testing, impact testing, shear testing, and tensile testing, and nondestructive testing, which includes techniques ranging from acoustic emission testing and computed tomography scanning to eddy current testing, infrared thermography, laser shearography, liquid penetrant testing, magnetic particle testing, radiographic testing, ultrasonic testing, and careful visual inspection. Each modality addresses distinct failure mechanisms, but both work in concert to validate structural integrity under operational stresses.

When viewed through the lens of technique, the market further divides into chemical analysis and material testing, environmental testing, fire and flammability testing, mechanical and physical testing, and thermal analysis. These thematic clusters guide investment in specialized chambers, analytical instruments, and calibration services, and they serve as critical touchpoints for customized protocols. Evaluating testing capabilities introduces another dimension: flight-worthy testing divides into post-flight analysis and pre-flight tests, on-ground testing encompasses dynamic ground tests and static ground tests, and simulation-based testing covers environmental simulation and flight simulation. The interplay among these three approaches ensures full lifecycle verification, from hardware stress analysis to system integration trials.

Usage segmentation bifurcates services between hardware testing and software testing, reflecting the growing importance of embedded system verification alongside physical endurance assessments. Application segmentation spans airframe, materials and structures, cabin and cargo systems, control and actuation systems, electrical and power systems, engines, fuel and propulsion systems, environmental control systems, landing and take-off systems, safety and emergency systems, and thermal protection systems. This matrix of applications underscores the complexity of managing end-to-end testing across multiple avionics, structural, and environmental domains.

Sourcing type delineates between in-house operations and outsourced partnerships, a critical decision point that balances capital expenditure against specialized expertise. Finally, end-user segmentation includes commercial aviation-with its cargo and passenger aircraft divisions-military aviation, which segments into bombers, fighter jets, helicopters, reconnaissance and surveillance aircraft, and transport aircraft, and spacecraft, differentiated between crewed spacecraft and satellites. This multifaceted segmentation framework not only highlights where current investments concentrate but also reveals emerging niches where service providers can differentiate through targeted capabilities.

This comprehensive research report categorizes the Aerospace Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Test Type

- Technology

- Test Environment

- Sourcing Type

- Application

- End-User

Examining Key Regional Dynamics in Aerospace Testing with In-Depth Insights into Americas, Europe Middle East & Africa, and Asia-Pacific Markets

Geographic considerations exert a profound influence on aerospace testing operations and service design. In the Americas, a robust defense sector and a concentration of major commercial airframers underpin high demand for both developmental and certification testing. Testing laboratories prioritize integration with regional OEM production lines and often co-locate near key manufacturing hubs to expedite turnaround times and minimize logistical costs. The availability of advanced research institutions also fosters collaborations on next-generation composite materials and innovative nondestructive evaluation methods.

Europe, Middle East, and Africa exhibit a balanced mix of legacy aerospace capabilities and burgeoning private space initiatives. European regulators demand stringent environmental testing and sustainability criteria, driving labs to enhance thermal chambers and emissions-focused protocols. In the Middle East, rapid infrastructure development and the emergence of new carriers translate into investments in cabin systems testing and environmental conditioning facilities. Meanwhile, Africa’s nascent aerospace footprint is characterized by growing partnerships with European testing centers to access state-of-the-art instrumentation.

In the Asia-Pacific region, manufacturing scale and cost efficiencies have made it a focal point for routine on-ground testing and simulation-based trials. Nations such as China, Japan, India, and Australia are expanding flight-worthy testing sites and simulation facilities to support indigenous aircraft programs, while Southeast Asia’s dynamic supply chain feeds global testing networks with competitively priced components. Regional initiatives that prioritize digital adoption are also advancing the integration of remote monitoring tools and cloud-based analytics, accelerating cross-border collaboration on data-driven validation.

This comprehensive research report examines key regions that drive the evolution of the Aerospace Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Aerospace Testing Organizations and Their Strategic Initiatives Shaping Innovation, Market Collaboration, and Competitive Edge

A cohort of industry leaders drives progress by leveraging proprietary technologies, strategic acquisitions, and global partnerships. Established test solutions providers have broadened service portfolios to include advanced digital diagnostic platforms that integrate real-time analytics and machine-learning models. At the same time, specialized laboratories are differentiating through the development of high-fidelity simulation environments that replicate extreme operational conditions for next-generation propulsion systems and hypersonic vehicles.

Consolidation trends are also prominent, as larger firms acquire niche testing startups to expand geographic reach and add capabilities such as in-line nondestructive evaluation or augmented reality-assisted test setups. Alliances with material science innovators and university research centers underpin co-development of custom test programs, enabling rapid certification pathways for novel additive-manufactured components. Meanwhile, equipment manufacturers are forging joint ventures with service providers to co-invest in test cell infrastructure, sharing capital outlays and aligning roadmaps for future technological leaps.

These strategic initiatives position leading companies to meet the diverse demands of commercial, military, and space applications. By balancing organic R&D with targeted M&A and alliance frameworks, these organizations are adapting to shifting regulatory landscapes and capitalizing on growth in emerging markets. Their collective efforts set new benchmarks for test accuracy, turnaround efficiency, and service integration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aerospace Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aerospace Testing Lab, Inc.

- Aerospace Testing Services

- Airbus SE

- Applied Technical Services, LLC

- Applus Services, S.A.

- Bureau Veritas SA

- Curtiss-Wright Corporation

- DEKRA SE

- Dyno One, Inc.

- Eaton Corporation PLC

- Element Materials Technology Ltd.

- Eurofins Scientific SE

- GE Aerospace

- Honeywell International Inc.

- imc Test & Measurement GmbH

- Innovative Test Solutions, Inc.

- Intertek Group PLC

- Lockheed Martin Corporation

- MISTRAS Group, Inc.

- Nemko Group AS

- Northrop Grumman Corporation

- Rohde & Schwarz GmbH & Co. KG

- Rolls-Royce plc

- RTX Corporation

- Safran SA

- SGS S.A.

- Telefonaktiebolaget LM Ericsson

- Thales Group

- The Boeing Company

- TUV SUD AG

- UL LLC

- VTEC Laboratories Inc.

Delivering Actionable Recommendations for Industry Leaders to Optimize Processes, Enhance Compliance, and Drive Strategic Growth in Aerospace Testing

Industry leaders should invest in integrated digital platforms that unify sensor data, simulation outputs, and real-time analytics. By standardizing data architectures, testing organizations can accelerate root-cause analysis, reduce cycle times, and improve predictive maintenance models. Partnerships with software developers should focus on embedding machine-learning algorithms into test cycles to identify anomalies before they manifest in field failures.

Supply-chain resilience remains paramount in light of recent trade policy fluctuations. Firms are advised to audit critical component sourcing channels, balancing domestic manufacturing partnerships with regional distributors to mitigate tariff risks and shipping delays. Long-term supplier agreements with flexible volume commitments can provide hedges against price volatility and ensure capacity alignment during peak certification periods.

On the operational front, cross-functional teams that blend materials scientists, digital engineers, and regulatory specialists can enhance test program design and certification readiness. Investing in workforce upskilling and certification programs ensures alignment with evolving standards and delivers a competitive talent advantage. Co-location of laboratories with OEM production lines facilitates just-in-time testing, reducing inventory overhead and accelerating time-to-market.

Outlining a Rigorous Research Methodology Underpinning Robust Data Collection, Analytical Frameworks, and Verification Measures for Study Integrity

This study employed a multi-step research methodology to guarantee accuracy, relevance, and comprehensive coverage. Primary research consisted of in-depth interviews with over twenty executives and technical leads representing test service providers, equipment manufacturers, and regulatory bodies. These discussions provided qualitative insights into evolving customer requirements, regulatory shifts, and emerging technology adoption patterns.

Secondary research drew on publicly available technical papers, patent filings, industry standards documentation, and corporate filings to map competitive landscapes and technology roadmaps. Data triangulation was achieved by cross-referencing primary feedback with secondary intelligence, ensuring robust validation of key trends and strategic drivers.

The segmentation framework was developed through iterative validation workshops with subject-matter experts, refining definitions for type, technique, capability, usage, application, sourcing, and end-user classifications. Regional insights were informed by shipment data, trade policy analysis, and field surveys of regional testing facilities. This structured approach underpins the report’s integrity and supports confident strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aerospace Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aerospace Testing Market, by Test Type

- Aerospace Testing Market, by Technology

- Aerospace Testing Market, by Test Environment

- Aerospace Testing Market, by Sourcing Type

- Aerospace Testing Market, by Application

- Aerospace Testing Market, by End-User

- Aerospace Testing Market, by Region

- Aerospace Testing Market, by Group

- Aerospace Testing Market, by Country

- United States Aerospace Testing Market

- China Aerospace Testing Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2703 ]

Concluding Synthesis of Aerospace Testing Market Insights Emphasizing Strategic Priorities, Emerging Trends, and Future Growth Imperatives

The aerospace testing landscape is transforming at pace, driven by digital innovation, evolving regulations, and strategic supply-chain restructuring. Segmentation analysis highlights the diverse service portfolios required to validate next-generation components and systems, while regional insights illustrate how geographic nuances shape investment priorities. Leading organizations are responding through targeted acquisitions, technology partnerships, and advanced simulation deployments, setting new performance benchmarks.

Tariff-induced cost pressures have underscored the importance of supply-chain agility, prompting a pivot toward domestic sourcing and collaborative development models. Meanwhile, the integration of machine-learning, digital twins, and automation is redefining test center architectures and enabling predictive validation strategies. As aerospace programs expand across commercial, defense, and space sectors, demand for comprehensive, high-fidelity testing will only intensify.

To thrive, stakeholders must embrace data-centric workflows, cultivate resilient partnerships, and align operational models with the imperatives of speed, accuracy, and compliance. The collective insights presented here offer a strategic roadmap to navigate uncertainties and capture growth opportunities in aerospace testing.

Engage with the Associate Director of Sales & Marketing to Access the Complete Aerospace Testing Market Report and Unlock Critical Industry Intelligence

To access a comprehensive and rigorous analysis that unlocks critical insights into the aerospace testing market, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. By engaging with Ketan, you will receive a tailored briefing on how this in-depth study addresses your unique operational challenges and strategic objectives. He can guide you through the report’s structure, highlight sections most relevant to your priorities, and discuss flexible licensing options to ensure seamless integration with your decision-making processes. Reach out to secure immediate access to a resource that synthesizes the latest industry developments, benchmarks best practices, and empowers your team with actionable intelligence. Elevate your competitive position in aerospace testing by leveraging this essential market research without delay

- How big is the Aerospace Testing Market?

- What is the Aerospace Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?