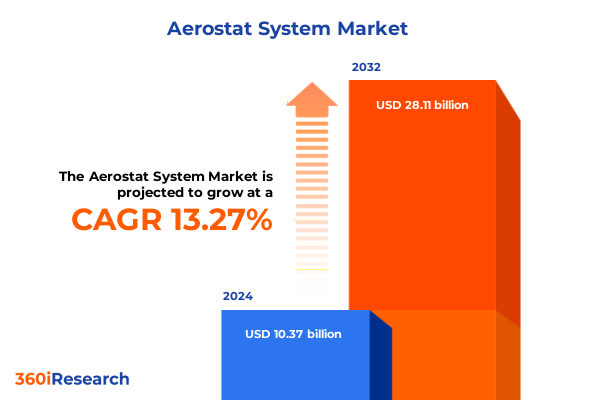

The Aerostat System Market size was estimated at USD 10.63 billion in 2025 and expected to reach USD 11.72 billion in 2026, at a CAGR of 10.53% to reach USD 21.44 billion by 2032.

Exploring how aerostat systems have emerged as indispensable assets in defense, commercial communications, environmental monitoring, and disaster response

The aerostat system market has evolved from niche defense platforms into foundational assets for pervasive surveillance, robust communications, and environmental stewardship. These lighter-than-air vehicles deliver persistent aerial coverage at fractions of the operational cost of satellites or manned aircraft, providing defense and homeland security agencies with continuous situational awareness over expansive areas. As geostrategic competition intensifies, governments are reaffirming their commitment to aerostat deployments for border patrol, electronic jamming, and real-time shot detection, ensuring enduring utility even amidst rapid technological change.

Beyond military applications, aerostats are cementing their value in commercial and humanitarian contexts. Broadband connectivity over remote communities, rapid-response communications during natural disasters, and high-fidelity environmental monitoring have all been enabled by tethered and free-flying aerostats. The convergence of miniaturization and advanced payloads-driven by compact surveillance cameras, synthetic aperture radar, and environmental sensors-has unlocked new use cases in scientific research and civil emergency services. These multipronged drivers underscore the aerostat system’s emergence as a versatile, cost-effective solution across public and private sectors.

Unveiling the transformative technological advances reshaping aerostat systems from AI-driven analytics to solar propulsion for mission endurance improvements

Recent years have witnessed a profound technological metamorphosis within the aerostat ecosystem, propelled by breakthroughs in artificial intelligence, materials engineering, and hybrid system integration. AI-enhanced analytics now empower aerostats to autonomously process vast sensor data streams, identifying potential threats and anomalies in real time. Coupled with lightweight composite envelopes that offer superior helium retention and structural resilience, modern aerostats can achieve extended mission durations with minimal ground intervention.

Simultaneously, the proliferation of solar-powered aerostats is redefining endurance parameters, enabling continuous flight for weeks without refueling and drastically lowering lifecycle costs. Hybrid aerial architectures that fuse aerostats with unmanned drones and satellite relays are further expanding coverage zones and enhancing redundancy for critical surveillance and communication missions. This shift towards multifunctional, networked platforms is driving a new paradigm in persistent aerial monitoring, enabling stakeholders to deploy scalable solutions tailored to diverse operational environments.

Assessing the cumulative impact of 2025 U.S. tariffs on aerospace alloys, composite materials, and sensor imports shaping aerostat manufacturing cost structures

In 2025, a significant tranche of U.S. tariffs on aerospace alloys, advanced composites, and specialized sensor modules has introduced new cost pressures for aerostat manufacturers and integrators. Key raw materials such as aluminum alloys and carbon-fiber fabrics are now subject to elevated import duties, driving procurement teams to re-evaluate supplier networks and renegotiate contractual terms. Concurrently, sensor payloads sourced internationally are facing similar levies, compelling industry leaders to localize assembly and calibration operations within the United States to mitigate tariff exposure.

Helium procurement has also been affected, as import duties on specialized lifting gas containers increase transportation and handling expenses. This confluence of tariffs has placed upward pressure on project budgets, prompting extended contract negotiations and heightened demand for transparent total cost of ownership analyses. To counteract these headwinds, leading providers are exploring nearshoring strategies and fostering partnerships with domestic material suppliers. Some innovators are even investing in research for alternative lifting gases and hybrid buoyancy concepts to lessen reliance on traditional helium stocks.

As cost optimization becomes a strategic imperative, aerostat stakeholders must carefully balance tariff mitigation efforts against performance requirements and program timelines. Those that proactively adapt their supply chains and invest in localized manufacturing capabilities are poised to sustain competitive advantage in a tariff-constrained environment.

Deriving strategic market segmentation insights across platform type payload capacity altitude range applications and end users to guide product alignment

Examining market segmentation reveals nuanced growth dynamics across platform typologies, payload thresholds, operational altitudes, application clusters, and end-user groups. Platforms break down into free-flying systems-spanning helium drones and solar-powered UAVs-and tethered variants such as surveillance balloons and strategic blimps. Each category addresses distinct mission sets, with free-flying models enabling rapid deployment and autonomous endurance, while tethered assets deliver unwavering station-keeping and robust lift capacities.

Payload capacity stratification further influences product positioning, dividing the market into sub-50 kg, 51–200 kg, and above 200 kg classes. Compact systems excel in urban and convoy protection missions, whereas mid-range and heavy-lift aerostats support multi-sensor arrays and advanced communications relays for long-range surveillance. Parallel altitude segmentation-up to 5 km, 5–15 km, and above 15 km-dictates platform endurance, environmental resilience, and payload integration complexity, guiding choice between lower-altitude tactical uses and stratospheric research or communications roles.

Applications span communications relay (including broadband connectivity and cellular backhaul), disaster management (damage assessment and search & rescue), environmental monitoring (air quality and wildlife tracking), and surveillance (border security, maritime domain awareness, and perimeter defense). End-user profiles range from civil emergency services and academic research to commercial sectors such as energy, media, and telecom operators, alongside defense branches including air force, army, and navy. This comprehensive segmentation framework empowers stakeholders to align platform design, payload integration, and service offerings to the precise mission requirements of each user group.

This comprehensive research report categorizes the Aerostat System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform Type

- Propulsion System

- Payload Capacity

- Altitude Range

- Payload Type

- Application

Mapping key regional dynamics driving varied adoption trends and challenges across the Americas Europe Middle East Africa and Asia Pacific aerostat markets

The Americas remain at the forefront of aerostat adoption, underpinned by robust defense investments and modernization programs. In April 2025, the U.S. Army awarded a potential $4.2 billion contract to sustain and upgrade its aerostat fleet, encompassing communications relay, electronic jamming, and shot-spotting capabilities. This deal highlights the platform’s enduring utility and underscores America’s commitment to persistent aerial surveillance and near-peer deterrence.

Across Europe, the Middle East, and Africa, aerostat systems are advancing both defense and civilian missions amid complex regulatory landscapes. European nations are integrating aerostat surveillance into border security frameworks and disaster management protocols, with regional markets projected to double by 2033. Meanwhile, GCC countries are expanding defense budgets to acquire persistent aerial monitoring solutions, and South Africa is deploying aerostats for military reconnaissance and event security. Although weather resilience and high initial costs present challenges, regional stakeholders are investing in system hardening and public-private partnerships to drive sustainable growth.

In the Asia-Pacific, escalating border tensions and maritime security concerns are catalyzing investments in aerostat platforms. Nations such as India and Australia are leveraging tethered systems to patrol contentious land and sea borders, while rising demand for rural connectivity is fueling interest in free-flying communication relays. Yet high deployment costs and vulnerability to typhoons and monsoons require thorough risk assessments. By integrating AI-based analytics and IoT sensors, APAC operators are enhancing system autonomy and data fidelity, positioning aerostats as critical enablers for both security and connectivity objectives.

This comprehensive research report examines key regions that drive the evolution of the Aerostat System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading aerostat system providers to examine their strategic innovations partnership initiatives and competitive positioning in the global market

Major defense and aerospace corporations are intensifying their focus on aerostat system portfolios, driving innovation through high-value partnerships and targeted acquisitions. Raytheon Technologies has integrated advanced radar and sensor suites into its tethered platforms, enhancing threat detection for both homeland security and maritime applications. Lockheed Martin’s Persistent Threat Detection System exemplifies the convergence of robust payload integration and scalable tethered endurance, securing key contracts across multiple theatres of operation.

Meanwhile, Northrop Grumman leverages its expertise in radar and electronic warfare to deliver airborne intelligence hubs tailored to air force and naval requirements. ILC Dover’s long-standing leadership in softgoods and envelope manufacturing underpins collaborations with integrators seeking lighter, more durable structures. European firms such as Lindstrand Technologies and RosAeroSystems are driving cost-effective tethered solutions, expanding access in emerging markets. Regional innovators like TCOM, IAI, and Raven Industries are also introducing hybrid UAV-aerostat platforms to bridge coverage gaps and boost system flexibility across civil and defense applications.

As competitive dynamics intensify, these leading players continue to invest in R&D, exploring AI-enhanced payloads, alternative buoyancy gases, and modular assembly processes to sustain differentiation. Strategic alliances with telecom operators, energy providers, and emergency services are further broadening the aerostat ecosystem, solidifying its role as a multipurpose platform across the global security and communications landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aerostat System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Lockheed Martin Corporation

- TCOM, L.P.

- Israel Aerospace Industries Ltd.

- Thales S.A.

- RTX Corporation

- RT LTA Systems Ltd.

- Aeroscraft Corporation

- Allsopp Helikites Ltd.

- Lindstrand Technologies Limited

- Altaeros Energies, Inc.

- Aero-Nautic Services & Engineering

- RosAeroSystems International Ltd.

- Aero Drum Ltd.

- Airborne Industries Ltd. by Icarus Training Systems Limited

- Aselsan Elektronik Sanayi ve Ticaret A.Ş.

- Bharat Electronics Limited

- Carolina Unmanned Vehicles, Inc.

- CNIM Group

- EDGE Group PJSC

- Hybrid Air Vehicles Limited

- ILC Dover, L.P. by Ingersoll Rand Inc.

- Peraton, Inc.

- QinetiQ Group plc

- Rheinmetall AG

- SkyDoc Systems

Presenting actionable strategic recommendations for industry leaders to navigate cost pressures embrace technological innovation and expand market reach effectively

Industry leaders should prioritize supply chain resilience by diversifying material sourcing and expanding domestic production to alleviate tariff-induced cost pressures. Establishing nearshoring partnerships with alloy and composite manufacturers will reduce exposure to import duties while shortening lead times and improving lifecycle cost visibility. Concurrently, investment in research for alternative lifting gases and hybrid buoyancy designs will offer long-term mitigation against helium supply constraints.

Technology roadmaps must accelerate the integration of AI-driven analytics and IoT-enabled payloads to enhance system autonomy and data accuracy. By embedding machine learning for predictive maintenance and threat detection, aerostat platforms can achieve higher operational availability and lower lifecycle costs. Collaboration with software vendors and academic institutions will expedite the development of advanced sensor fusion and real-time decision support tools.

Finally, organizations should pursue targeted market expansion strategies, leveraging the detailed segmentation and regional insights provided in this report. Engaging in joint ventures with regional defense agencies and telecom operators across APAC, EMEA, and the Americas will unlock tailored solutions for border security, disaster management, and rural connectivity. Proactive regulatory engagement and public awareness campaigns will further streamline approvals and foster community acceptance, enabling scalable deployments worldwide.

Outlining a robust mixed method research methodology integrating primary interviews secondary data analysis and rigorous triangulation for comprehensive market insights

The research methodology underpinning this executive summary integrates rigorous primary and secondary research to ensure comprehensive and accurate market insights. Primary research involved structured interviews with senior executives, technical experts, and procurement decision-makers across defense agencies, telecom operators, and environmental monitoring organizations. These discussions provided firsthand perspectives on strategic priorities, procurement challenges, and technology roadmaps.

Secondary research encompassed exhaustive analysis of industry publications, government contract announcements, patent filings, and corporate financial disclosures. Data points were validated through cross-reference with authoritative databases and real-time regulatory filings. Triangulation of qualitative and quantitative inputs enabled the synthesis of market drivers, restraints, and competitive dynamics.

Throughout the research process, a demographically representative sample frame ensured balanced input across geographies and end-use segments. Internal validation workshops were conducted with domain specialists to reconcile discrepancies and refine key findings. This multilayered approach guarantees that the insights presented are both actionable and aligned with current industry realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aerostat System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aerostat System Market, by Platform Type

- Aerostat System Market, by Propulsion System

- Aerostat System Market, by Payload Capacity

- Aerostat System Market, by Altitude Range

- Aerostat System Market, by Payload Type

- Aerostat System Market, by Application

- Aerostat System Market, by Region

- Aerostat System Market, by Group

- Aerostat System Market, by Country

- United States Aerostat System Market

- China Aerostat System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Capturing overarching executive summary findings on aerostat market evolution challenges and opportunities to inform strategic decision making

The aerostat system market stands at an inflection point, driven by converging forces of technological innovation, evolving security paradigms, and the imperative for resilient communications. Transformative advances in AI, materials science, and hybrid architectures are expanding mission capabilities, while 2025 tariff realignments and regional dynamics are reshaping cost structures and deployment strategies.

Segmentation by platform type, payload capacity, altitude range, application focus, and end-user profile provides a granular blueprint for targeted solution development. Regional heterogeneity-spanning the Americas’ defense modernization, EMEA’s regulatory complexities, and APAC’s security and connectivity imperatives-underscores the need for tailored market entry and scaling approaches.

By synthesizing these insights and leveraging the strategic recommendations outlined herein, stakeholders can navigate market challenges, harness emerging growth levers, and forge robust partnerships. The time to act is now; equip your organization with the foresight and intelligence necessary to lead in the evolving aerostat ecosystem.

Take immediate action today to connect with Ketan Rohom to secure the full market research report and gain decisive competitive intelligence on aerostat systems

Thank you for exploring our executive summary on the aerostat system market. To access the complete market research report with in-depth analysis, strategic frameworks, and exclusive data, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. By partnering with Ketan, you will gain immediate access to comprehensive insights that will empower your organization to capitalize on emerging opportunities, navigate industry challenges, and secure a competitive edge.

Don’t let critical intelligence slip away-reach out to Ketan Rohom today and arm your team with the authoritative market research necessary for decisive, proactive strategy development.

- How big is the Aerostat System Market?

- What is the Aerostat System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?