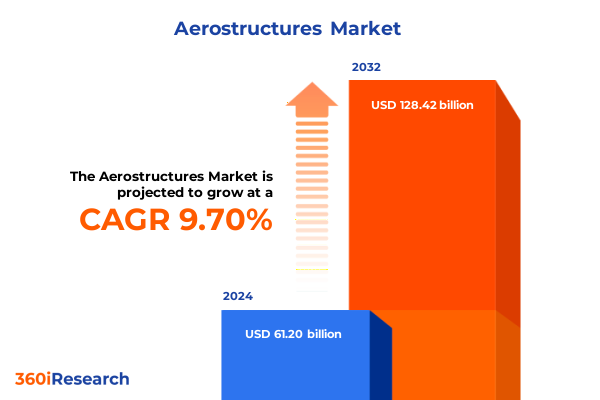

The Aerostructures Market size was estimated at USD 66.52 billion in 2025 and expected to reach USD 72.30 billion in 2026, at a CAGR of 9.85% to reach USD 128.42 billion by 2032.

Navigating the Evolving Aerostructures Domain Amid Global Supply Chain Disruptions Geopolitical Shifts and Technological Breakthroughs

The aerostructures domain encompasses the design, development, and manufacturing of primary load-bearing components that form the backbone of modern aircraft. These critical elements-including wings, fuselages, empennages, nacelles, and landing gear-must meet stringent requirements for strength, weight, and durability under extreme operating conditions. Over recent years, cascading pressures to improve fuel efficiency, reduce carbon emissions, and accelerate production timelines have converged to redefine traditional design paradigms and manufacturing processes. Manufacturers are increasingly leveraging advanced composite materials such as carbon fiber reinforced polymers and thermoplastic composites to achieve superior strength-to-weight ratios, while integrating automated fiber placement and robotic assembly systems to uphold quality and throughput demands.

Parallel to material innovations, the digital transformation of product development has gained momentum. Artificial intelligence–driven tools and digital twin simulations are streamlining the engineering cycle, cutting design iteration times by as much as thirty percent and reducing the need for physical prototypes. Additive manufacturing is facilitating the production of complex, customized components with unprecedented geometric freedom, enabling on-demand parts fabrication and more resilient supply chains. Together, these technological advances are reshaping the competitive landscape, compelling industry stakeholders to reassess their capabilities, partnerships, and strategies in order to thrive in a rapidly evolving ecosystem.

Unprecedented Technological Innovations Combined with Regulatory Reforms Are Redefining the Aerostructures Landscape for the Next Generation of Aircraft

Technological progress and regulatory reform are converging to accelerate the next wave of aerostructures innovation. On one hand, public-private partnerships such as the FAA’s Continuous Lower Energy, Emissions, and Noise (CLEEN) program are funding the development of lighter composite wings and advanced flight management algorithms, laying the groundwork for more efficient airframes and operations. Meanwhile, the FAA’s final rule on airplane fuel efficiency certification mandates new jet and turboprop designs incorporate progressive fuel-saving technologies by 2028, reinforcing the industry’s commitment to achieving net-zero emissions by 2050. This regulatory momentum is complemented by multi-agency Sustainable Aviation Fuel (SAF) initiatives that aim to supply billions of gallons of low-carbon fuels annually, further reducing lifecycle greenhouse gas emissions.

Concurrently, aerospace supply chains are undergoing profound realignment to enhance resilience in the face of geopolitical volatility and pandemic-driven disruptions. Leading OEMs and tier-one suppliers are exploring nearshoring strategies, particularly in Mexico and India, to mitigate logistics bottlenecks and labor constraints. India’s aerospace sector is rapidly transitioning from basic manufacturing to high-value design and engineering, with companies such as Airbus and Pratt & Whitney awarding door and component contracts to local suppliers to diversify sourcing risk. In Europe and North America, firms are prioritizing dual-sourcing agreements, digital-twin–enabled inventory visibility, and collaborative risk-management frameworks to navigate the complexities of modern global trade. These shifts underscore the imperative for agile, technology-driven supply network strategies.

Examining the Cumulative Effects of 2025 United States Aerospace Tariffs on Global Supply Chains Manufacturing Costs and Competitive Strategies

The imposition of new U.S. tariffs in early 2025 has materially altered cost structures across the aerostructures value chain. RTX, a leading defense and commercial aerospace supplier, disclosed an anticipated $850 million headwind from a ten percent levy on imported materials and components, while GE Aerospace projects an additional $500 million in costs attributed to the same measures including separate higher duties on steel and aluminum. For manufacturers and airlines alike, the cumulative effect of these tariffs has introduced significant price inflation in high-performance alloys and precision-machined parts.

Beyond raw materials, original equipment vendors and Tier-1 manufacturers face amplified expenses through proposed fifty percent duties on certain subassemblies. Embraer warns that such measures could increase per-aircraft costs by approximately $9 million, threatening the economic viability of regional jets and executive aircraft in the United States market. Similarly, GE Aerospace and Boeing have indicated that stricter trade barriers are likely to undermine long-standing duty-free exchange under historic aerospace agreements, prompting a strategic pivot to onshore production capabilities and forward-pricing contracts to hedge against further policy volatility.

Integrating Diverse Product Aircraft Material and Production Segments Provides Comprehensive Insights into Aerostructures Market Dynamics and Opportunities

A nuanced understanding of market segmentation is paramount for capturing growth pathways in the aerostructures sector. Within the product hierarchy, wings, fuselages, empennages, nacelles and pylons collectively define structural integrity and aerodynamic performance, while flight surface components such as ailerons, elevators, flaps, rudders and slats ensure precise maneuverability and stability. Structural assemblies, encompassing empennage, fuselage, and wing subassemblies, represent critical integration points for load distribution and system routing. On the aircraft type axis, diverse platforms from large, midsize, and light business jets to narrow-body and wide-body commercial airliners, regional turboprops and jets, general aviation aircraft, and military platforms each exert unique demands on materials selection, production volumes, and aftermarket services. Material segmentation delves into aluminum alloys-spanning castings, forgings, and sheet stock-alongside carbon fiber, aramid fiber and glass fiber composites, steel alloys including high strength and stainless grades, and titanium alloys in casting, forging, and sheet forms. Production channels bifurcate into original equipment manufacturing and aftermarket services such as maintenance, repair, overhaul, and replacement components. Finally, manufacturing processes from machining and forging to casting and final assembly integration delineate technology-led efficiency and cost profiles.

These segmentation lenses reveal several cross-cutting insights. High-volume commercial aircraft platforms drive continuous demand for fuselage assemblies and wing structures, while business and regional jets emphasize modularity and rapid production turnaround. Composites adoption skews toward wing and empennage assemblies in wide-body and next-generation narrow-body jets, whereas legacy platforms rely more heavily on aluminum and steel alloys. The aftermarket segment is increasingly lucrative, driven by fleet age cycles and rising utilization, elevating the strategic importance of MRO logistics and digital servicing capabilities. In process terms, automation in assembly and integration is gaining traction, complemented by precision forging for landing gear components and additive manufacturing for bespoke engine pylon brackets.

This comprehensive research report categorizes the Aerostructures market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Aircraft Type

- Material Type

- Manufacturing Process

- Production Type

- Application

Assessing Regional Aerostructures Trends Reveals Contrasting Growth Drivers and Challenges Across the Americas Europe Middle East Africa and Asia Pacific

Regional disparities in aerostructures demand are stark yet interdependent. In the Americas, robust commercial air travel recovery and defense spending have fueled investment in domestic manufacturing capacity and MRO infrastructure, particularly across the United States. Mexico’s aerospace clusters, notably in Querétaro and Monterrey, have matured to host component machining and subassembly operations, drawing nearshore projects seeking lower labor costs and shorter lead times. Canada’s focus on engine and nacelle integrations further complements regional supply diversity.

In Europe, Middle East and Africa (EMEA), aerostructures activity is concentrated in established hubs across France, Germany and the UK, where composites research, digital manufacturing centers, and advanced machining technologies form the backbone of OEM and tier-one innovation. Collaborative initiatives-such as Franco-German carbon fiber joint ventures and UK-based digital twin consortia-aim to de-risk supply chains amid Brexit-driven trade realignment. Meanwhile, the Africa region is emerging as a nascent market for maintenance services, underpinned by rising air traffic in North and sub-Saharan corridors.

Asia-Pacific demonstrates the fastest growth trajectory, with India scaling up from basic machining to value-added design and testing, targeting a ten percent stake in the global aerospace supply chain within the next decade. China’s domestic OEMs are integrating composite wing production lines and titanium forging facilities, while Southeast Asia’s industrial parks increasingly attract foreign direct investment for landing gear and structural assembly projects. Japan and South Korea remain pivotal suppliers of specialty alloys and precision castings, ensuring the region’s strategic role in the global aerostructures ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Aerostructures market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Aerostructures Manufacturers Highlights Strategic Partnerships Innovations and Financial Resilience in a Competitive Global Arena

Leading manufacturers are deploying distinct strategies to navigate the aerostructures headwinds and harness emerging opportunities. Boeing has doubled down on digital twin platforms to validate composite fuselage sections and is exploring thermoplastic composite wings to reduce lifecycle costs and improve recyclability. Airbus is similarly expanding its thermoplastic research initiatives and investing in robotic tape laying systems to boost production rates for its A320neo and A220 families.

Embraer, with a significant presence in Florida assembly operations, has issued cautionary forecasts on the impact of U.S. tariff proposals, highlighting the risk of per-jet cost inflation that could imperil its E175 regional jets and executive aircraft lines. RTX and GE Aerospace are adopting multi-pronged mitigation strategies, including forward-pricing of critical alloy purchases, tariff rebate applications, and selective onshore investments to neutralize an estimated $1.35 billion in combined 2025 tariff costs. Meanwhile, Tier-two suppliers such as Spirit AeroSystems and Safran are enhancing their aftermarket analytics capabilities and optimization of casting and forging processes to offset margin pressures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aerostructures market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus Aerostructures

- Airbus SE

- Bombardier Inc.

- Dassault Aviation

- Embraer S.A.

- GKN Aerospace

- Hindustan Aeronautics Limited

- Howmet Aerospace Inc.

- Korea Aerospace Industries, Ltd.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Premium Aerotec GmbH

- RTX Corporation

- Safran S.A.

- Spirit AeroSystems, Inc.

- Textron Inc.

- The Boeing Company

Actionable Strategic Recommendations Empower Industry Leaders to Navigate Tariff Challenges Supply Chain Resilience and Technological Evolution in Aerostructures

To thrive in this complex environment, industry leaders must pursue a multi-vector approach. First, accelerating digital transformation across design, production and servicing will unlock efficiency gains that counterbalance tariff-driven cost inflations. Embracing predictive analytics and digital twins in supply chain and MRO operations can reduce downtime and improve yield. Second, diversifying supply bases and nearshoring critical processes will shore up resilience against future trade policy shifts and geopolitical risks. Forging deeper partnerships with regional centers of excellence in Mexico, India, and Eastern Europe can create redundant capacity and preserve operational continuity. Third, intensifying R&D investments in sustainable materials-such as recyclable thermoplastics and bio-based composites-will align corporate roadmaps with emerging regulatory mandates and customer sustainability requirements. Finally, developing integrated aftermarket service platforms through digitized maintenance scheduling, remote diagnostics, and inventory optimization will unlock recurring revenue streams and reinforce customer loyalty.

Comprehensive Research Methodology Detailing Data Sources Analytical Frameworks and Validation Techniques Underpinning the Aerostructures Market Insights

This analysis synthesizes insights from a multi-stage research methodology. Secondary research involved a comprehensive review of regulatory filings, government reports, industry association publications, and reputable media sources to map policy developments and tariff measures. Primary research comprised in-depth interviews with senior executives at OEMs, tier-one suppliers, and MRO providers, complemented by surveys of procurement and supply chain managers to gauge operational readiness and strategic priorities.

Quantitative data was cross-validated through proprietary triangulation techniques, comparing vendor disclosure, customs tariff data, and publicly available financial reports. The segmentation framework was constructed by correlating product, aircraft, material, production type, and process categories against end-user demand indicators and capacity forecasts, excluding explicit market sizing or share estimates. Rigorous peer-review and expert validation rounds ensured factual accuracy and relevance, while scenario-based modeling informed the assessment of tariff and supply chain disruption impacts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aerostructures market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aerostructures Market, by Product Type

- Aerostructures Market, by Aircraft Type

- Aerostructures Market, by Material Type

- Aerostructures Market, by Manufacturing Process

- Aerostructures Market, by Production Type

- Aerostructures Market, by Application

- Aerostructures Market, by Region

- Aerostructures Market, by Group

- Aerostructures Market, by Country

- United States Aerostructures Market

- China Aerostructures Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2862 ]

Concluding Insights Emphasize the Critical Role of Technological Innovation Collaboration and Policy Navigation in Accelerating Aerostructures Market Growth

In closing, the aerostructures sector stands at a pivotal intersection of technological advancement, regulatory evolution, and geopolitical realignment. Rapid innovation in materials engineering and digitalization offers pathways to heightened performance and sustainability, yet is counterbalanced by the disruptive effects of new trade barriers and supply chain volatility. Strategic differentiation will hinge on an organization’s ability to integrate agile manufacturing processes, diversify sourcing strategies, and invest in the digital and sustainable technologies that will define next-generation aircraft.

Industry stakeholders who proactively adapt to these transformative shifts-embracing collaborative partnerships, reshoring strategic capabilities, and prioritizing lifecycle cost reductions-will be best positioned to capture growth in both mature and emerging markets. By aligning R&D roadmaps with regulatory objectives and embedding resilience at every tier of the supply chain, companies can mitigate headwinds and accelerate the adoption of breakthrough aerostructures solutions that meet the demands of a decarbonizing global aviation ecosystem.

Secure Your Comprehensive Aerostructures Market Research Report Today by Connecting with Ketan Rohom Associate Director Sales and Marketing for Unique Insights

To secure an in-depth strategic advantage, reach out to Ketan Rohom, Associate Director of Sales and Marketing, to obtain the full aerostructures market research report today. Engaging with Ketan will provide you with exclusive access to comprehensive insights on current and emerging trends, detailed segmentation analysis, and forward-looking recommendations tailored to your business needs. By partnering directly, you can empower your organization with the actionable intelligence required to make informed decisions, mitigate risks associated with supply chain disruptions and tariffs, and capitalize on growth opportunities across all major regions. Connect with Ketan Rohom to elevate your strategic planning and ensure your leadership in the rapidly evolving aerostructures landscape.

- How big is the Aerostructures Market?

- What is the Aerostructures Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?