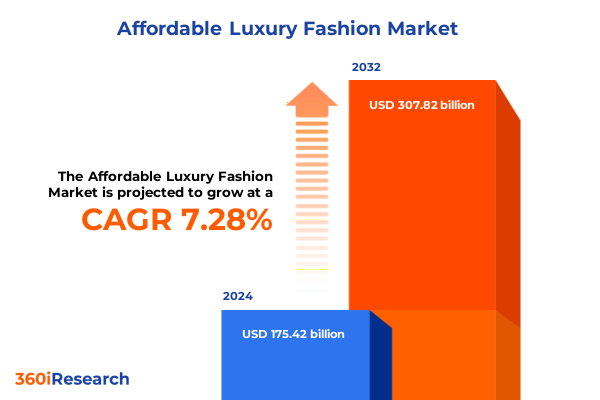

The Affordable Luxury Fashion Market size was estimated at USD 187.14 billion in 2025 and expected to reach USD 200.11 billion in 2026, at a CAGR of 7.36% to reach USD 307.82 billion by 2032.

Captivating Evolution of Affordable Luxury Fashion That Bridges Prestige and Accessibility for Aspiring Consumers in a Dynamic Market Landscape

Affordable luxury fashion has emerged as a defining force in today’s consumer landscape, blending the aspirational qualities of traditional high-end labels with accessible price points that resonate with an ever-expanding aspirational middle class. This hybrid segment caters to shoppers who seek the cachet of designer craftsmanship without the premium incurred by heritage luxury houses. Amid persistent inflationary pressures, with apparel costs rising 0.4 percent in the last month according to the U.S. Consumer Price Index, brands have been innovating on value propositions to retain engagement among price-sensitive yet quality-seeking consumers. Consequently, affordable luxury is not simply a bridge between mass-market and pure luxury but a dynamic category in its own right that continually reinvents notions of exclusivity and desirability.

Against a backdrop of rapid digitalization and shifting demographic preferences, this segment appeals especially to Millennials and Generation Z, whose purchasing behaviors are deeply influenced by social media, peer recommendations, and sustainability considerations. These cohorts prize authenticity, ethical production, and the experiential dimensions of their fashion choices. Notably, consumer surveys reveal that under-35 shoppers are channeling much of their luxury spend into secondhand markets or bespoke offerings, underscoring the importance of value beyond logo-driven consumption. As a result, brands must navigate a delicate balance between maintaining aspirational prestige and delivering demonstrable value through quality, design, and purposeful storytelling.

Transformational Currents Reshaping the Affordable Luxury Fashion Landscape Through Sustainability, Digital Innovation, and Emerging Consumer Dynamics

The affordable luxury fashion sector is undergoing profound transformations driven by sustainability imperatives, digital innovation, and the evolving tastes of a generation that prizes both purpose and personalization. In particular, the rise of boutique-focused resale platforms has disrupted the conventional new-product paradigm. Emerging ventures such as ReSee, Sellier, and The Hosta are betting on curated, high-touch experiences that combine authentication, styling, and concierge-level service to meet discerning resale shoppers-an approach that has propelled the global secondhand luxury market to a valuation of over $204.7 billion in 2024. This shift suggests that consumers increasingly view fashion as a cyclical asset, where pre-owned goods carry both sustainability credentials and unique provenance.

Meanwhile, brands are leaning on advanced analytics and AI-driven personalization tools to fine-tune product recommendations and streamline discovery. Retailers report that as much as 70 percent of purchases are digitally influenced, compelling luxury and affordable luxury players alike to invest in data-driven platforms that anticipate consumer preferences and adapt the online experience in real time. From AI-based visual search engines that decode individual style signals to predictive algorithms that pre-empt shifts in demand, these technological frameworks are reshaping how value is delivered in the sector.

Moreover, sustainability has evolved from an adjunct consideration into a core strategic priority. Luxury firms are piloting regenerative agriculture partnerships to secure eco-conscious materials, while blockchain-enabled traceability solutions promise full transparency across supply chains-a leap forward in meeting consumer expectations for ethical craftsmanship and reducing carbon footprints. Collectively, these trajectories underscore a landscape where digital fluency, circularity, and tailored consumer engagement are reconfiguring the future of affordable luxury fashion.

Navigating the Complex Terrain of 2025 United States Tariff Policies and Their Pervasive Impact on the Affordable Luxury Fashion Supply Chain and Pricing

The policy environment in 2025 has introduced unprecedented complexity into the cost structures underpinning affordable luxury fashion. United States tariff measures instituted this year extend beyond traditional most-favored-nation duties, featuring sweeping country-specific rate hikes that range from 27 percent on goods sourced from India to as much as 145 percent on Chinese apparel and accessories. Such measures have rippled through global supply chains, creating acute margin pressures for brands that rely heavily on Asian manufacturing hubs and thus driving tactical shifts in sourcing strategies.

Notably, trade associations have highlighted that over 97 percent of clothing and 99 percent of footwear consumed in the U.S. are imports-evidence that brands have limited latitude to absorb these costs without passing them onto consumers. Major labels are now evaluating dual approaches of supplier re-negotiations and selective price tiering, while others are augmenting promotional calendars to mitigate consumer fatigue. However, industry leaders warn that regenerative supply chain overhauls, including near-shoring and investment into domestic production, will require significant capital outlays and years of development given the lack of specialized U.S.-based infrastructure for critical inputs such as textile uppers and specialized hardware.

Furthermore, high-level engagements between fashion stakeholders and the White House in late May 2025 reflected industry advocacy for more balanced tariff frameworks-particularly given that the fashion sector contributes just 5 percent of total imports but accounts for over 25 percent of U.S. import duties. As negotiations continue, brands must remain agile, employing dynamic cost models and scenario planning to navigate an environment where tariff trajectories can shift rapidly. Ultimately, success will depend on synchronized efforts across procurement, pricing, and product development to preserve both brand integrity and consumer accessibility.

In-Depth Segmentation Revelations Illuminating Product Types, Pricing Tiers, Distribution Channels, Age Demographics, and Gender Preferences

Disaggregating the affordable luxury fashion market through multiple segmentation lenses reveals critical insights into consumer motivations and purchasing patterns. When dissected by product type, the category spans accessories-encompassing bags, hats, jewelry, and watches-alongside clothing segments of bottoms, dresses, outerwear, and tops, as well as footwear divisions in casual, formal, and sneakers. Each of these product clusters resonates differently with target audiences, compelling brands to curate distinct designs and messaging that align with the functional and emotional drivers unique to every category.

Equally pivotal is the lens of price range analysis, where tiers from $150 to $300, $301 to $500, and $501 to $1,000 delineate consumer willingness to trade up for perceived craftsmanship, brand narrative, and durable quality. These thresholds inform assortment planning, promotional cadence, and the degree of artisanal detailing incorporated into each offering.

Channel preference further stratifies consumer journeys: offline experiences unfold across brand-owned outlets, department stores, and specialty retailers, fostering tactile engagement and high-touch service; conversely, online pathways-via brand websites and e-commerce platforms-cater to convenience, breadth of assortment, and personalized digital interfaces. Consumer age groups spanning Baby Boomers, Generation X, Gen Z, and Millennials add additional granularity, as purchasing motivations evolve from heritage-driven brand loyalty among older cohorts to value-conscious, socially minded shopping behaviors among younger demographics. Finally, gender segmentation into men’s and women’s lines underscores design and fit nuances, color palettes, and marketing executions tailored to each audience. Together, these segmentation insights equip brands to calibrate product development, pricing architecture, and experiential touchpoints, ensuring that every aspect of the value proposition resonates with precisely defined consumer clusters.

This comprehensive research report categorizes the Affordable Luxury Fashion market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Gender

- Age Group

- Distribution Channel

Strategic Regional Perspectives Highlighting Unique Market Drivers and Consumer Preferences Across The Americas, EMEA, and Asia-Pacific Territories

A regional prism uncovers divergent growth drivers and consumer sentiments shaping the affordable luxury fashion sector. In the Americas, resilient demand stems from the United States’ mature retail ecosystem, where digitally influenced sales account for well over half of purchases and omnichannel engagement has become a non-negotiable standard. Yet, rising living costs and consumer vigilance demand that brands demonstrate clear value through elevated service, transparent pricing, and loyalty initiatives that reward meaningful interactions.

Across Europe, Middle East, and Africa (EMEA), the narrative is equally complex. European consumers-steeped in centuries of craftsmanship-are increasingly attentive to sustainability credentials and artisanal provenance. At the same time, Gulf markets exhibit robust appetite for luxury adjacent products, with affluent shoppers drawn to limited-edition accessories and capsule collaborations. However, looming tariff considerations on EU–U.S. trade, potentially escalating to 30 percent, have added a layer of uncertainty that brands must navigate through regional inventory buffers and localized sourcing partnerships.

In the Asia-Pacific region, growth trajectories remain among the steepest globally. China’s continued urbanization fosters a burgeoning middle class eager for aspirational brands, while Southeast Asian markets such as Vietnam have emerged not only as production powerhouses but also as high-potential consumer bases. Yet, the interplay of local preferences-ranging from color symbolism to digital social commerce ecosystems-requires brands to localize assortment mixes and marketing narratives thoughtfully. Moreover, tariff policy shifts affecting Vietnamese exports to the U.S., including a 20 percent increase on top of existing duties, underscore the imperative for supply chain agility in the region.

This comprehensive research report examines key regions that drive the evolution of the Affordable Luxury Fashion market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Foresight into Leading and Disruptive Brands Steering the Affordable Luxury Fashion Space with Innovation and Value Propositions

Within the competitive arena, established players and nimble newcomers are crafting differentiated strategies to capture the affordable luxury consumer’s wallet. Brands such as Coach and Ralph Lauren have harnessed the perceived value proposition by calibrating price increases with product innovation, posting double-digit revenue upticks in their most recent financial periods while outpacing traditional luxury conglomerates in select markets. Conversely, Michael Kors underwent a strategic pivot under Capri Holdings, embracing mid-tier pricing and an Amazon storefront to broaden reach, even as it contends with tariff-induced headwinds that may constrain margin expansion.

Meanwhile, direct-to-consumer innovators like Everlane continue to refine the quiet luxury ethos, embedding radical transparency and sustainable materials into their core narrative. Under new executive leadership, the brand is leveraging emotional storytelling to complement its cost-breakdown disclosures, driving deeper engagement with environmentally conscious shoppers seeking a “forever wardrobe” approach. At the same time, specialized resale platforms are raising the bar for service-driven circular experiences, offering authenticated, curated pre-owned pieces that resonate with Gen Z and Millennial cohorts demanding both accessibility and exclusivity.

Emerging digitally native labels such as Polène and Charles & Keith illustrate another frontier of disruption, deploying minimal overhead DTC models to deliver designer-inspired silhouettes at accessible price thresholds. These entrants sidestep traditional retail markups and harness social media amplification to achieve rapid scale, challenging incumbents to innovate across channels and value chains. Collectively, this mosaic of competitive activity underscores the sector’s vibrancy and the imperative for incumbents to adopt hybrid strategies that balance heritage equity with agile, consumer-centric execution.

This comprehensive research report delivers an in-depth overview of the principal market players in the Affordable Luxury Fashion market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- PVH Corp.

- Ralph Lauren Corporation

- Tapestry, Inc.

- Hugo Boss AG

- CAPRI HOLDINGS LIMITED

- G-III Apparel Group, Ltd.

- Lacoste S.A.

- LVMH Group

- Tory Burch LLC

- CHANEL S.R.L.

- Furla

- AllSaints

- Authentic Brands Group

- Bally's Corporation

- Citizen Watch Co., Ltd.

- Compagnie Financière Richemont SA

- DIESEL S.p.A.

- Mara Hoffman, Inc.

- Monica Vinader Ltd.

- Rebecca Minkoff LLC

- SAS LONGCHAMP

- Seiko Watch Corporation

- SMCP Group

- The Swatch Group Ltd

- Timex.com, Inc.

- Vince Holding Corp.

Action-Oriented Strategic Roadmap Enabling Industry Leaders to Capitalize on Affordable Luxury Fashion Trends Through Agile and Synchronized Initiatives

Industry leaders must adopt a multi-pronged strategy to sustain growth in the affordable luxury segment. First, optimizing supply chain resilience through diversification beyond single-country dependencies is critical; by balancing production footprints across Asia, Eastern Europe, and nearshore facilities, brands can mitigate the volatility of tariff escalations and expedite product replenishment cycles. In tandem, forging strategic partnerships with certified circular platforms or launching brand-owned pre-owned initiatives will unlock new monetization streams while reinforcing sustainability commitments, as demonstrated by rising adoption of blockchain-enabled traceability tools in luxury resale ecosystems.

Second, data-driven personalization frameworks must be elevated from pilot phases to enterprise-level integrations. Harnessing AI-powered analytics to deliver hyper-personalized product recommendations and targeted promotions will drive incremental conversions, especially among digitally savvy cohorts who expect seamless discovery and individualized brand experiences. Moreover, brands should recalibrate their loyalty programs, embedding experiential rewards-such as exclusive design previews or private styling sessions-to cultivate emotional bonds that transcend transactional interactions.

Finally, brands should invest in design philosophies that prioritize resilience and timelessness. By developing core signature collections that emphasize enduring craftsmanship and sustainable materials, companies can reduce SKU churn, limit markdown exposure, and align with consumer preferences for “forever wardrobe” staples. All the while, transparent communication of ethical sourcing, material innovations, and pricing rationales will bolster brand trust, enabling premium pricing power even amid inflationary contexts.

Robust Multimethod Research Framework Detailing the Blend of Primary Interviews, Surveys, Secondary Data, and Analytical Techniques Underpinning the Study

This research harnessed a rigorous, mixed-methods approach to deliver actionable insights. The primary research phase entailed in-depth interviews with senior executives across fashion houses, trade associations, and supply chain specialists to capture firsthand perspectives on tariff impacts, consumer behaviors, and emerging competitive models. Concurrently, online and intercept surveys were conducted among over 2,000 end consumers spanning the U.S., Europe, and Asia-Pacific to quantify preferences across product categories, price thresholds, and channel touchpoints.

Secondary analysis synthesized data from government publications, including U.S. Trade Representative tariff schedules and Bureau of Labor Statistics labor force metrics, alongside industry reports and peer-reviewed journals. This phase integrated consumer pricing indexes, import/export statistics, and financial disclosures of key publicly traded companies. Finally, advanced statistical techniques-such as cluster analysis for segmentation validation and scenario modeling for tariff sensitivity-ensured that findings reflect robust, defensible patterns and can withstand evolving market conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Affordable Luxury Fashion market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Affordable Luxury Fashion Market, by Product Type

- Affordable Luxury Fashion Market, by Gender

- Affordable Luxury Fashion Market, by Age Group

- Affordable Luxury Fashion Market, by Distribution Channel

- Affordable Luxury Fashion Market, by Region

- Affordable Luxury Fashion Market, by Group

- Affordable Luxury Fashion Market, by Country

- United States Affordable Luxury Fashion Market

- China Affordable Luxury Fashion Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Concluding Synthesis Emphasizing the Strategic Imperatives and Core Insights Shaping the Affordable Luxury Fashion Sector’s Future Trajectory

The affordable luxury fashion sector stands at a pivotal intersection of consumer democratization, policy uncertainty, and technological acceleration. As the blend of aspirational aesthetics and accessible pricing continues to attract a broadening audience, brands that excel will be those who marry digital fluency with sustainability leadership, supply chain agility, and data-driven consumer intimacy. Strategic differentiation will hinge on the ability to navigate tariff complexities without compromising on design integrity or value communication.

Moreover, the evolution of resale and circularity underscores a broader shift in consumer mindsets-where fashion is reimagined as a renewable asset rather than a disposable trend. This paradigm invites brands to broaden their purview beyond one-time transactions and cultivate enduring relationships through authentic storytelling, provenance tracking, and community engagement.

Ultimately, stakeholders poised for success will integrate flexible sourcing strategies, personalized digital ecosystems, and timeless design philosophies to deliver affordable luxury that resonates across regions and generations. Those who align organizational structures around these imperatives will define the next chapter of accessible fashion excellence.

Empowering Your Next Move in Affordable Luxury Fashion Procurement Through Personalized Consultation with Ketan Rohom, Associate Director

For a comprehensive deep dive into the mechanisms shaping the affordable luxury fashion sector-from nuanced tariff assessments to granular consumer segmentation analyses-reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Ketan will guide you through tailored insights and unlock exclusive access to the full market research report. Elevate your strategic decision-making today and secure your organization’s competitive advantage by engaging with an expert committed to actionable intelligence.

- How big is the Affordable Luxury Fashion Market?

- What is the Affordable Luxury Fashion Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?