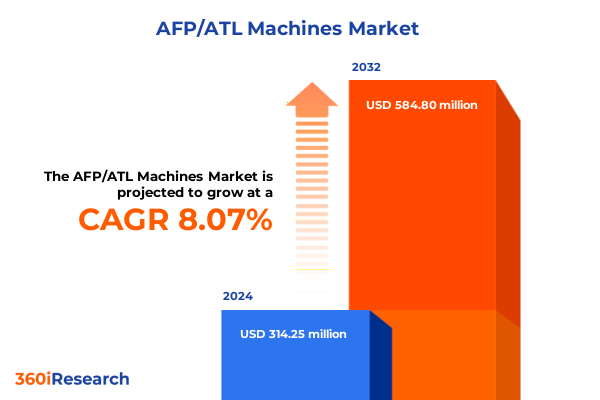

The AFP/ATL Machines Market size was estimated at USD 295.26 million in 2025 and expected to reach USD 314.30 million in 2026, at a CAGR of 6.73% to reach USD 466.12 million by 2032.

Unveiling the Strategic Imperatives Shaping the Future of Automated Fiber Placement and Tape Laying Machines Across Key Industrial Sectors

The AFP/ATL machines segment represents a pinnacle of precision manufacturing, enabling the automated placement of carbon fiber tows and prepreg materials onto complex tooling surfaces. Known as Automated Fiber Placement and Automated Tape Laying, these technologies allow manufacturers to produce lightweight, high-strength composite structures at speeds unattainable through manual layup. According to Wikipedia, AFP techniques heat and compact synthetic resin-impregnated fibers in precise courses, achieving properties in multiple orientations and reducing labor intensity compared to traditional methods.

As industries from aerospace to energy embrace composites for their superior strength-to-weight ratios, AFP and ATL machines have become critical enablers of innovation. In aerospace, major airframers are exploring composite-intensive designs to improve fuel efficiency, with next-generation jets projected to integrate greater proportions of thermoplastic and thermoset materials. This shift underscores the importance of AFP/ATL equipment in supporting industry goals of sustainability, performance, and cost efficiency.

Harnessing Industry 4.0 and Advanced Automation Technologies to Revolutionize Global Composite Manufacturing Operations and Drive Next-Gen Production Efficiencies

The landscape of composite manufacturing is undergoing transformative shifts driven by the convergence of digital technologies and advanced automation. The integration of Industrial Internet of Things sensors into AFP and ATL cells enables real-time monitoring of machine health, laying parameters, and environmental conditions. By harnessing IIoT, manufacturers can predict maintenance needs and optimize production schedules to minimize downtime and maximize throughput.

Complementing IIoT is the rise of digital twin technology, which creates virtual replicas of AFP machines and composite parts. Through continuous data feedback, these twins allow engineers to simulate process adjustments, assess defect impacts, and refine parameters before committing to physical runs, thereby reducing trial-and-error cycles and material waste.

Artificial intelligence and machine-learning algorithms are also reshaping AFP operations by automating defect detection and process optimization. Recent research demonstrates in-process inspection systems that marry laser and vision systems with machine learning to identify deviations, feed corrections directly into control loops, and log defect data for traceability and certification purposes.

Finally, collaborative robotics and modular machine architectures are enabling greater flexibility and scalability in composite manufacturing. Cobots can work alongside human operators to perform auxiliary tasks-such as material handling, trimming, and inspection-while modular AFP heads can be quickly reconfigured for varying tow widths and fiber types, accelerating changeovers and supporting mixed-material builds.

Assessing the Cumulative Consequences of New U.S. Trade Tariffs on Machinery and Materials in Automated Composite Manufacturing

In 2025, sweeping U.S. tariffs have materially altered the cost structure and supply dynamics for AFP and ATL machine operators. Effective March 12, new Section 232 tariffs set steel and aluminum duties at 25 percent with no country exemptions, raising input costs for machine frames, rollers, and ancillary equipment. These levies have also prompted OEMs to reconsider sourcing strategies, leading to longer lead times and increased capital expenditure.

Concurrently, 25 percent tariffs on machinery imports from China have driven up the prices of complete AFP heads and component assemblies. Many composite equipment producers rely on Chinese-manufactured subsystems, and this added duty has reduced margins and encouraged some firms to explore nearshoring or diversify into alternative sourcing markets.

While Canada and Mexico remain exempt from new metal tariffs when goods qualify under USMCA rules, composite machine imports often include non-originating inputs that fail to meet origin requirements. As a result, certain AFP and ATL systems imported through North America now face a 25 percent duty, introducing complexity into procurement processes and supply chain planning.

The cumulative impact of tariffs has created incentive for vertical integration and equipment refurbishment programs. Some end users are extending the life of existing AFP cells through modernization kits and retrofits, while OEMs are bundling maintenance and spare part offerings to offset tariff-induced cost increases and preserve customer relationships.

Decoding Market Dynamics Through In-Depth Segmentation Across Product Types, Materials, Automation Levels, and End-Use Industries

Market analysis reveals that AFP and ATL machines encompass a range of product configurations tailored to specific manufacturing tasks. Machines designed for contour tape laying excel in conforming to curved surfaces and complex geometries, while flat tape laying systems are optimized for rapid coverage of planar sections. Horizontal gantry systems support high-speed, multi-axis operations across large part envelopes, whereas vertical gantry configurations enable efficient layered builds on vertical mold faces. Robotic arm–based solutions add dexterity, permitting intricate layup patterns and facilitating seamless integration on production lines.

The choice of material type further nuances equipment capabilities. Carbon fiber preforms are prized for their high stiffness and strength, driving demand for machines that can precisely handle delicate tows at elevated speeds and temperatures. Glass fiber variants, valued for cost efficiency and corrosion resistance, often require different compaction settings and process controls, influencing machine head design and heater profiles to ensure uniform consolidation without damaging fibers.

Automation level is a key determinant of throughput and workforce requirements. Fully automated AFP heads, equipped with advanced sensors, end-of-arm tooling flexibility, and autonomous defect detection, minimize human intervention and support 24/7 production schedules. Semi-automated solutions strike a balance between operator oversight and mechanized motion control, offering versatile platforms for low-volume or mixed-material production runs alongside manual tasks like layup path programming.

Finally, end-use industry demands shape feature sets and lifecycle considerations. In aerospace and defense, composite structures for commercial airframes or military applications must meet stringent certification standards, driving machine OEMs to prioritize in-process quality monitoring, traceability, and data logging. Automotive applications, spanning body modules and structural components, emphasize cycle times, part consistency, and integration with downstream trimming and assembly cells. Energy-sector use cases in nuclear and wind energy focus on large-scale part reliability and corrosion resistance, while marine deck and hull fabrications require machines that can accommodate flexible tooling and manage moisture-sensitive materials under demanding environmental conditions.

This comprehensive research report categorizes the AFP/ATL Machines market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Machine Type

- Material Type

- Layup Width

- End-Use Industry

- Distribution Channel

Revealing Regional Competitive Landscapes and Growth Drivers Across Americas, Europe Middle East Africa, and Asia-Pacific

In the Americas, a robust aerospace and defense manufacturing base anchors demand for AFP and ATL equipment. The United States leads the region with significant investments in next-generation aircraft platforms, supported by major OEMs and tier suppliers that continuously seek process improvements to enhance fuel efficiency and structural performance. Meanwhile, reshoring initiatives and infrastructure modernization projects are generating fresh interest in domestic production capabilities, despite recent tariff headwinds that have elevated capital equipment costs.

Europe, Middle East & Africa hosts a diverse composite ecosystem driven by stringent regulatory frameworks, sustainability mandates, and defense procurement cycles. Western European nations such as Germany, France, and the UK are pioneering hybrid material architectures in automotive and renewable energy applications, demanding adaptable AFP and ATL systems that can toggle between carbon and glass fiber workflows. In the Middle East, national defense programs and large-scale solar and wind farm initiatives are fueling interest in composite solutions, while manufacturers in Africa are gradually adopting automated processes to elevate production quality and competitiveness.

Asia-Pacific stands out as the fastest-growing region for AFP and ATL machines, propelled by expanding aerospace, automotive, and renewable energy sectors. Countries including China, Japan, and India are investing heavily in automation to meet surging passenger aircraft orders and domestic vehicle electrification targets, thereby driving machine adoption rates upward. Government incentives and public–private partnerships aimed at technology transfer and localizing supply chains are further accelerating growth, positioning the region as a strategic priority for OEMs and component suppliers alike.

This comprehensive research report examines key regions that drive the evolution of the AFP/ATL Machines market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Movements Shaping the AFP and ATL Equipment Market Ecosystem

Leading machine manufacturers are advancing the state of AFP and ATL technologies through differentiated innovation strategies. M.Torres Diseños Industriales S.A.U has focused on augmenting tow capacity and integrating multi-tow heads to support high-volume runs, while Electroimpact Inc. has prioritized the development of high-speed, robotic cell architectures that cater to large part fabrication for airframe and wind turbine segments.

Ingersoll Machine Tools Inc. and Fives emphasize digital integration, embedding real-time monitoring and remote diagnostics into their systems to enable predictive maintenance and process transparency, ensuring consistent part quality and minimizing unplanned downtime. These features are particularly valued by aerospace and automotive OEMs that require strict adherence to certification protocols and just-in-time production schedules.

Coriolis Composites Technologies SAS and Automated Dynamics have pursued modular, scalable machine designs that allow clients to retrofit existing production lines with minimal capital outlay, providing a bridge for manufacturers transitioning from manual layup to full automation. Their platforms often support both fiber placement and tape laying heads, offering versatility across multiple component types and material systems.

Emerging players like Mikrosam AD and Accudyne System, Inc. are differentiating through turnkey service models, bundling equipment with process development, operator training, and supply chain advisory services to accelerate customer adoption and reduce time to market. These comprehensive offerings reflect a broader trend towards solution-oriented engagement between OEMs and machine suppliers.

This comprehensive research report delivers an in-depth overview of the principal market players in the AFP/ATL Machines market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accudyne System, Inc.

- Addcomposites Oy

- AFPT GmbH

- Boikon BV

- Broetje-Automation GmbH by Shanghai Electric Group Corp

- Compositence GmbH

- Conbility GmbH

- Coriolis Group Sas

- Credit Carbon Axis SAS

- Electroimpact, Inc.

- Excelitas Noblelight GmbH

- FIVES Group

- Ingersoll Machine Tools, Inc.

- Jota Machinery Industrial (Kunshan) CO., LTD

- Mikrosam DOO

- MTorres Diseños Industriales S.A.U.

- Park Aerospace Corp.

- SWMS Systemtechnik Ingenieurgesellschaft mbH.

- Trelleborg AB

- Tsudakoma Kogyo Co., Ltd.

Outlining Targeted Strategic Initiatives to Enhance Competitiveness and Foster Sustainable Growth for Machine OEMs and Stakeholders

Industry leaders should prioritize investment in digital twin platforms and in-process inspection technologies to enhance production agility and ensure composite part integrity. By leveraging virtual replicas and AI-driven analytics, organizations can iterate process adjustments in a simulated environment, reducing material waste and accelerating time to qualification.

To mitigate tariff-related cost exposures, companies are advised to diversify their supplier networks and explore nearshoring opportunities in low-risk jurisdictions. Establishing collaborative partnerships within regional supply clusters can buffer against duty fluctuations and strengthen compliance with local content requirements.

Machine OEMs should develop modular upgrade paths that allow end users to retrofit existing equipment with advanced sensors, fiber head variants, and automated material handling systems. Such scalable architectures enable incremental modernization without requiring full capital replacement, thus preserving cash flow and maximizing asset utilization.

Strengthening workforce competencies remains essential; targeted training programs that upskill technical personnel in digital manufacturing, data analysis, and maintenance of advanced composite equipment will ensure seamless integration of new technologies and support continuous improvement initiatives across production facilities.

Detailing Rigorous Research Methodology and Analytical Framework Underpinning the Comprehensive Market Study

This report synthesizes primary interviews with composite material manufacturers, machine OEMs, and industry experts to capture firsthand insights into equipment performance and adoption drivers. Secondary research included analysis of trade publications, government trade data, patent filings, and corporate disclosures to map competitive landscapes and technology trends.

Data triangulation techniques were applied by cross-verifying qualitative feedback with quantitative shipment figures, tariff schedules, and investment announcements. The segmentation framework was validated through supplier catalogs and end-user surveys, ensuring a robust categorization across product types, materials, automation levels, and industry applications.

Analytical models incorporated scenario analysis to evaluate the impact of potential tariff changes and supply chain disruptions. Regional profiles were developed using country-specific macroeconomic indicators and industry development programs, while reliability assessments of sources followed hierarchical criteria prioritizing official statistics and peer-reviewed technical studies.

All findings were subject to expert review panels, including representatives from aerospace OEMs, automotive tier suppliers, and composites research institutes, ensuring alignment with practical considerations and strategic imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our AFP/ATL Machines market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- AFP/ATL Machines Market, by Machine Type

- AFP/ATL Machines Market, by Material Type

- AFP/ATL Machines Market, by Layup Width

- AFP/ATL Machines Market, by End-Use Industry

- AFP/ATL Machines Market, by Distribution Channel

- AFP/ATL Machines Market, by Region

- AFP/ATL Machines Market, by Group

- AFP/ATL Machines Market, by Country

- United States AFP/ATL Machines Market

- China AFP/ATL Machines Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings to Inform Decision-Making and Align Strategies with Emerging Composite Manufacturing Trends

The evolution of AFP and ATL machines underscores a pivotal shift in composite manufacturing, where digital integration, advanced robotics, and materials innovation converge to meet the demands of sustainability and high-performance design. Market segmentation reveals clear pathways for OEM differentiation, from specialized contour laying heads to fully automated fiber placement cells tailored for aerospace certification requirements.

Regional analyses highlight the strategic importance of balancing cost structures and innovation incentives, as mature markets contend with tariff-driven cost pressures and emerging economies capitalize on growth incentives. Leading equipment suppliers are responding with modular, service-oriented offerings that accommodate diverse end-user needs while fostering long-term partnerships.

As industry players navigate an environment marked by geopolitical uncertainty and rapid technological change, those who proactively adopt digital twins, AI-driven inspection, and flexible supply chain strategies will secure competitive advantages. The confluence of these factors points to a market that rewards agility, collaboration, and continuous learning.

Ultimately, the trajectory of AFP and ATL machine adoption will be shaped by the ability of stakeholders to integrate evolving regulations, material advancements, and capital deployment strategies into cohesive roadmaps that deliver both economic and environmental value.

Secure Your Comprehensive AFP and ATL Machines Market Report by Connecting with Ketan Rohom to Empower Strategic Investments

Paragraph1: To explore the full depth of insights on the AFP and ATL machines market, including proprietary data, expert interviews, and complete regional profiles, connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive report subscription.

Paragraph2: Engage with Ketan to schedule a personalized briefing that will equip your organization with the actionable intelligence needed to optimize equipment selection, navigate tariff landscapes, and accelerate composite manufacturing initiatives.

Paragraph3: Take the next step toward informed decision-making and sustained competitive advantage by partnering with our team. Reach out to Ketan Rohom to begin your journey toward market leadership in automated composite fabrication.

- How big is the AFP/ATL Machines Market?

- What is the AFP/ATL Machines Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?