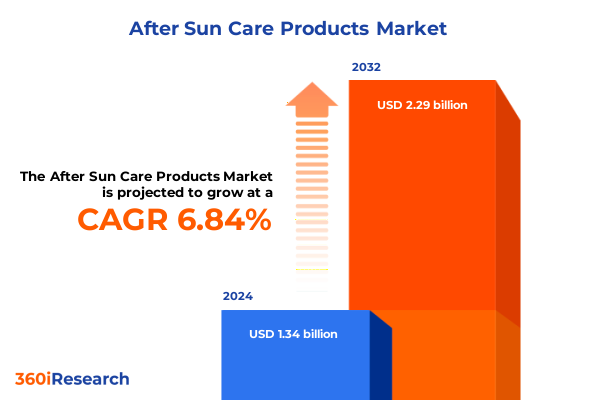

The After Sun Care Products Market size was estimated at USD 1.44 billion in 2025 and expected to reach USD 1.52 billion in 2026, at a CAGR of 6.84% to reach USD 2.29 billion by 2032.

Unveiling the Dynamics of the Global Sun Care Market and Its Evolving Role in Consumer Health and Beauty Routines Worldwide

The global sun care industry stands at the intersection of health, beauty, and performance, driven by growing consumer consciousness of UV exposure risks and an ever-expanding array of product innovations. Over the past decade, public health campaigns and dermatological research have heightened awareness that effective sun protection contributes not only to the prevention of skin cancer and photoaging but also to overall wellness. Concurrently, lifestyle trends emphasizing outdoor recreation and wellness tourism are fueling demand for formulations that combine high sun protection factors with aesthetic appeal and multifunctional benefits.

In response to these forces, manufacturers are redefining sun care offerings to meet the expectations of diverse consumer segments. Breakthroughs in UV filter technologies and the incorporation of skin-nourishing botanical extracts have elevated product performance beyond basic SPF ratings. Moreover, the rise of digital platforms and social media influencers has amplified consumer education, creating a more informed buyer base that seeks transparency in ingredient sourcing and formulation efficacy. As a result, industry stakeholders are forging new partnerships with academic institutions and regulatory bodies to ensure safety, efficacy, and compliance in a rapidly evolving landscape.

Looking ahead, the sun care sector is poised for further transformation as players explore personalized solutions, smart packaging, and sustainability credentials. These emerging dynamics underscore the importance of agile strategies and rigorous market intelligence to capitalize on growth avenues while navigating complex regulatory requirements and shifting consumer preferences.

Revealing the Major Market Disruptions and Innovations Reshaping the Sun Protection Industry in 2025 and Beyond

Recent years have witnessed profound disruptions in the sun protection arena, spearheaded by nutritional science advances and escalating environmental concerns. Innovators are reformulating traditional chemical sunscreens to integrate bioactive antioxidants and reef-safe ingredients, thereby addressing both consumer health and ecological stewardship. This shift toward dual-benefit formulations represents a seismic pivot from single-function products, and it has compelled legacy brands and emerging startups alike to invest in research and development more aggressively than ever before.

Parallel to ingredient evolution, digital technologies have introduced transformative pathways for consumer engagement and product personalization. Artificial intelligence–driven skin assessments now enable end users to receive bespoke SPF recommendations, while augmented reality applications allow real-time previews of product finish and shade compatibility. These digital tools not only enhance the shopping experience but also foster deeper brand loyalty by delivering customized solutions tailored to individual skin types and lifestyle demands.

Furthermore, escalating regulatory scrutiny in key markets has redefined compliance benchmarks. Regulatory agencies across North America, Europe, and Asia are harmonizing safety standards, which has prompted manufacturers to streamline their approval processes and fortify traceability in raw material provenance. As a result, the competitive landscape is being reshaped by agile players that can swiftly adapt to evolving guidelines and consumer expectations, thereby solidifying their positions in this dynamic market.

Analyzing the Far-Reaching Effects of Recent U.S. Tariff Implementations on Supply Chains Pricing and Competitive Dynamics in 2025

The implementation of new United States tariffs in early 2025 has reverberated across the sun care supply chain, altering the cost structures for imported UV filters and packaging components. Ingredient manufacturers that rely heavily on global sourcing, particularly for advanced chemical UV absorbers like avobenzone and octocrylene, have encountered elevated input costs. In turn, formulators have been compelled to reassess their supplier networks, negotiating long-term contracts to hedge against price volatility and ensure uninterrupted access to critical raw materials.

Simultaneously, domestic component producers have capitalized on the tariff-driven recalibration by expanding capacity for mineral filters such as titanium dioxide and zinc oxide. This shift has accelerated investment in local manufacturing infrastructure, reducing lead times and mitigating the risk of import delays. Consequently, brands that maintain strategic relationships with domestic suppliers are witnessing improved supply continuity and enhanced control over production timelines.

Nonetheless, the tariff landscape has also generated downstream effects on retail pricing, prompting some premium brands to absorb a portion of the cost increases in order to preserve market share. Others have recalibrated their value propositions by introducing tiered product lines that balance performance with affordability. As competition intensifies, companies that proactively optimize their supply chain portfolios and engage in dynamic cost management will be best positioned to navigate these evolving economic headwinds.

In-Depth Examination of End User and Formulation Segments Illuminating Consumer Preferences and Product Development Pathways in Sun Care

Discerning consumer preferences and production priorities necessitates a nuanced understanding of market segmentation by both end user and formulation type. Within the end user domain, the children’s segment encompasses toddlers through adolescent age groups, reflecting a heightened parental focus on gentle yet effective protection. At the same time, male consumers-ranging from teens to adults and extending into senior demographics-are embracing products that offer rapid absorption and matte finishes, catering to active lifestyles and skincare routines. Meanwhile, women across teen, adult, and senior cohorts are gravitating toward multifunctional offerings that seamlessly combine sun defense with anti-aging, hydration, and skin tone–enhancing properties.

Formulation trends further illuminate distinct growth trajectories. Chemical sunscreens characterized by filters such as avobenzone, octocrylene, and oxybenzone continue to dominate mainstream portfolios, owing to their lightweight textures and broad-spectrum efficacy. However, mineral alternatives built on zinc oxide and titanium dioxide have surged in popularity, driven by eco-conscious consumers and regulatory encouragement for reef-safe products. Hybrid formulations that blend chemical and mineral agents are emerging as a compelling middle ground, offering balanced aesthetics and performance attributes while appealing to a wide array of skin types and environmental considerations.

By mapping these segmentation criteria against consumer behavior insights and regulatory developments, stakeholders can refine product positioning, streamline R&D investments, and anticipate demographic shifts that will define market trajectories in the years ahead.

This comprehensive research report categorizes the After Sun Care Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- End User

- Formulation

- Product Type

Comparative Overview of Regional Market Trajectories Highlighting Growth Opportunities and Challenges across Americas EMEA and Asia-Pacific

An in-depth regional appraisal underscores divergent growth catalysts and challenges across the Americas, Europe Middle East & Africa, and Asia-Pacific territories. In the Americas, robust consumer spending on premium and natural-centric sun care offerings is strengthening brand penetration, while regulatory frameworks in Canada and the United States are aligning more closely on UV filter approvals and labeling requirements. This alignment facilitates smoother market entry for both domestic innovators and global incumbents seeking to scale in North America.

Conversely, the Europe Middle East & Africa region presents a complex mosaic of regulatory environments and consumer attitudes. Western European markets exhibit mature demand for high-SPF and multifunctional formulations, complemented by rigorous eco-certification standards that elevate reef-safe and organic credentials. Meanwhile, Middle Eastern markets, driven by extreme UV exposure and discretionary spending power, are witnessing a surge in water-resistant and long-wear sun care products. In select African markets, expanding retail infrastructure and rising health awareness offer untapped potential, although logistical constraints and import duties warrant strategic partnerships with local distributors.

The Asia-Pacific region continues to lead in innovation and volume growth, propelled by advanced skincare cultures in countries such as South Korea and Japan. Consumers in these markets demonstrate a strong preference for lightweight, whitening, and anti-pollution sun care solutions. Moreover, rapid e-commerce expansion across China India and Southeast Asia is creating direct-to-consumer channels that bypass traditional retail, empowering smaller brands to achieve significant reach with targeted digital campaigns.

This comprehensive research report examines key regions that drive the evolution of the After Sun Care Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players Strategic Movements and Collaboration Trends Steering the Sun Care Market Landscape in 2025

The competitive landscape is anchored by a combination of multinational conglomerates and agile specialists, each leveraging unique strengths to capture market share. Leading beauty and personal care corporations have reinforced their positions by incorporating advanced UV filter research into established R&D pipelines while pursuing strategic acquisitions of niche brands that excel in natural and reef-safe formulations. These consolidations have enabled enhanced geographic reach and cross-channel distribution, benefiting from legacy networks in both mass and prestige segments.

Simultaneously, specialist manufacturers focusing exclusively on sun care solutions have disrupted categories through the introduction of cutting-edge technologies, such as encapsulated UV filters and probiotic-infused formulations. By partnering with dermatologists and academic institutions, these players validate efficacy and safety claims, effectively distinguishing their offerings in a crowded marketplace. Smaller brand innovators are also capitalizing on direct-to-consumer models, leveraging data-driven marketing strategies to cultivate loyal followings and accelerate product iteration based on real-time feedback.

Moreover, contract manufacturers have emerged as critical enablers, expanding capacity for both chemical and mineral sun care production. Their investment in modular manufacturing lines and quality control frameworks ensures rapid scalability for brands launching new SKUs or expanding into adjacent markets. As a result, the sun care ecosystem is witnessing unprecedented collaboration and cross-pollination of expertise, driving continuous innovation and diversification of product portfolios.

This comprehensive research report delivers an in-depth overview of the principal market players in the After Sun Care Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amorepacific Corporation

- Amway Corporation

- Avon Products Inc.

- Beiersdorf AG

- Bioderma Laboratories

- Chanel S.A.

- Colgate-Palmolive Company

- Coola LLC

- Coty Inc.

- Edgewell Personal Care Company

- Groupe Clarins

- ISDIN SA

- Johnson & Johnson Services Inc.

- Kao Corporation

- Kenvue Inc.

- L'Oréal S.A.

- Mary Kay Inc.

- Natura &Co Holding S.A.

- Revlon Inc.

- S. C. Johnson & Son Inc.

- Shiseido Company Limited

- Sun Bum LLC

- The Estée Lauder Companies Inc.

- The Procter & Gamble Company

- Unilever PLC

Strategic Imperatives and Best Practices for Industry Leaders to Capitalize on Emerging Trends and Navigate Regulatory Shifts in Sun Care

To thrive amidst intensifying competition and evolving regulatory mandates, industry leaders should prioritize agility and consumer-centric innovation. First, investing in sustainable sourcing and manufacturing processes for both chemical and mineral UV filters can reduce supply chain risk while appealing to environmentally conscious demographics. Embracing certified reef-safe ingredients and transparent supply chain traceability will reinforce brand credibility and meet escalating eco-regulatory standards.

Second, accelerating the integration of digital tools into the consumer journey-from AI-driven skin diagnostics to virtual try-on experiences-will cultivate deeper engagement and facilitate personalized product recommendations. By harnessing emerging data analytics, companies can segment audiences more precisely and tailor marketing messages that resonate with distinct end user groups, such as toddler-safe variants or matte-finish formulations for active adults.

Third, diversifying distribution channels through e-commerce partnerships and selective retail collaborations will mitigate pricing pressures caused by tariff-driven cost increases. Brands can explore subscription models and customized bundle offerings to foster recurring revenue while providing value-added services like dermatologist-led consultations. Finally, establishing cross-sector alliances with dermatological research centers, packaging innovators, and regional distributors will create flexible ecosystems capable of rapid product launches and seamless geographic expansion.

Comprehensive Outline of Research Approaches Data Collection Techniques and Analytical Frameworks Underpinning the Sun Care Market Study

The analytical framework underpinning this report draws on a multi-stage research methodology designed to ensure rigor and validity. Initially, comprehensive secondary research was conducted, encompassing regulatory filings, patent databases, trade journals, and financial disclosures to map historical market trajectories and identify key technological innovations. This phase established the foundational context for deeper primary investigations.

Primary research complemented these insights through in-depth interviews with industry executives, dermatologists, formulation scientists, and distribution channel partners. These conversations provided qualitative perspectives on supply chain dynamics, consumer behavior shifts, and emerging formulation trends. In parallel, structured consumer surveys captured quantitative data on purchase drivers, brand perceptions, and segment-specific preferences across diverse demographic and geographic cohorts.

Data triangulation techniques were employed to reconcile findings from multiple sources, ensuring consistency and accuracy in the final analysis. Advanced analytical tools, including statistical modeling and scenario analysis, were utilized to validate market drivers, assess the impact of regulatory changes, and evaluate competitive positioning. Finally, continuous expert review cycles refined the insights and recommendations, guaranteeing that the report reflects the latest industry developments and stakeholder needs.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our After Sun Care Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- After Sun Care Products Market, by End User

- After Sun Care Products Market, by Formulation

- After Sun Care Products Market, by Product Type

- After Sun Care Products Market, by Region

- After Sun Care Products Market, by Group

- After Sun Care Products Market, by Country

- United States After Sun Care Products Market

- China After Sun Care Products Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 954 ]

Synthesizing Critical Findings to Empower Stakeholders with Clear Insights and Strategic Direction for Sustaining Growth in the Sun Care Sector

In summary, the sun care market is being transformed by a confluence of factors-innovative ingredient technologies, heightened regulatory demands, shifting consumer demographics, and evolving distribution channels. Companies that recognize the strategic importance of segment-specific product development, regional market nuances, and supply chain resilience will emerge as leaders in this dynamic environment. Moreover, embracing sustainable formulations and leveraging digital ecosystems for consumer engagement will be instrumental in capturing both established and emerging market opportunities.

The 2025 tariff landscape underscores the need for agile sourcing strategies and a diversified supplier base to mitigate cost pressures. At the same time, segmentation insights reveal that tailored approaches for children, men, and women, coupled with a balanced chemical, mineral, and hybrid formulation portfolio, will unlock new growth avenues. Region-specific tactics-ranging from e-commerce-centric models in Asia-Pacific to eco-certification alignment in Europe Middle East & Africa-are crucial for optimizing market entry and expansion.

Ultimately, stakeholders equipped with robust market intelligence, actionable recommendations, and a clear understanding of regulatory trajectories will be best positioned to navigate this complex terrain. By fostering collaborative alliances, prioritizing consumer-centric innovation, and maintaining operational flexibility, industry players can secure sustainable growth and drive the next wave of sun care advancements.

Engage with Ketan Rohom to Secure Exclusive Access to Detailed Market Intelligence and Propel Your Sun Care Business to New Heights

To explore the full breadth of insights and tactical guidance revealed in this comprehensive sun care market research, we invite you to connect with Ketan Rohom (Associate Director, Sales & Marketing). By engaging directly, you will gain exclusive access to the granular data, proprietary analyses, and expert foresight needed to sharpen your competitive edge and accelerate strategic decisions. Reach out today to secure your complete report package, including customized market breakdowns and priority consulting support that will empower you to seize emerging opportunities and drive sustained growth in the dynamic sun care landscape.

- How big is the After Sun Care Products Market?

- What is the After Sun Care Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?