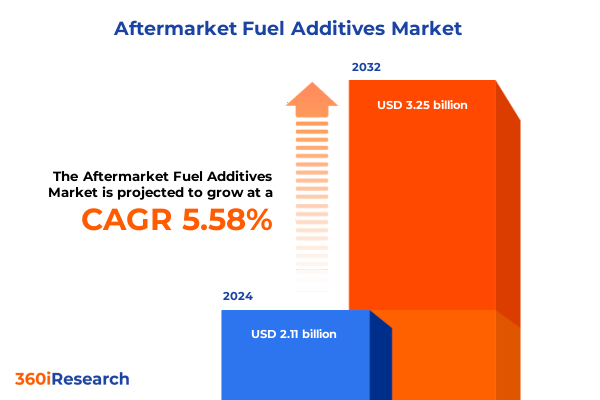

The Aftermarket Fuel Additives Market size was estimated at USD 2.36 billion in 2025 and expected to reach USD 2.49 billion in 2026, at a CAGR of 7.08% to reach USD 3.82 billion by 2032.

Introduction that underscores the critical role of high-performance aftermarket fuel additives in enhancing engine efficiency and reducing emissions

The aftermarket fuel additives sector plays a pivotal role in modern engine performance enhancement and emissions management, responding to both legacy vehicle needs and evolving environmental expectations. As global fleets age, there is an increasing demand to sustain engine efficiency, reduce deposit formation, and optimize combustion quality without requiring costly mechanical overhauls. This arena bridges the gap between fuel refiners and vehicle operators, providing targeted formulations that complement baseline fuel properties to maintain reliability in the face of tightening regulatory standards.

Building on the fundamental need for cleaner, more efficient combustion, the aftermarket additives landscape has gained momentum from rising environmental regulations, escalating consumer emphasis on vehicle uptime, and the imperative to extend the lifespan of both gasoline and diesel engines. Stakeholders across workshops, retail outlets, and online platforms have recognized that strategic deployment of specialized chemistry can unlock performance gains, mitigate maintenance downtime, and uphold warranty compliance with original equipment manufacturers. As such, this sector is increasingly viewed not merely as a supplementary service but as an essential element of holistic engine management strategies.

Emerging regulatory mandates on emissions and advancements in automotive electrification are reshaping the aftermarket fuel additives landscape

In recent years, regulators worldwide have introduced stringent emissions thresholds that challenge legacy combustion systems, compelling industry players to innovate beyond traditional formulations. At the same time, the growing electrification of light-duty vehicles has prompted additive suppliers to diversify their portfolios and reinforce their value proposition in hybrid and internal combustion powertrains. This dual pressure has accelerated development of multi-functional additives capable of addressing the intersecting demands of emission compliance, fuel economy improvement, and component durability.

Meanwhile, digital transformation is reshaping customer engagement and product delivery. IoT-enabled monitoring and telematics platforms are enabling end users to track fuel quality in real time, while predictive diagnostics highlight ideal intervention points for additive dosing. Formulation breakthroughs-such as bio-based stabilizers and next-generation detergents-are aligning with circular economy principles to reduce dependence on petrochemical feedstocks. Together, these shifts are redefining competitive positioning in a landscape where agility and innovation determine market leadership.

Recent United States tariff implementations have significantly altered supply chains and cost structures for providers of aftermarket fuel additives

Throughout 2025, new U.S. tariffs on imported chemical intermediates and specialty petrochemicals have introduced a complex cost calculus for additive manufacturers and distributors. Duties imposed on crucial solvent blends and performance-enhancing compounds have disrupted longstanding supply arrangements, prompting many producers to reassess global sourcing strategies. The result has been an uptick in domestic manufacturing investment and a concerted effort to secure nearshore partners capable of delivering resilience against evolving trade policies.

This shift in trade dynamics has translated into material adjustments across the value chain. Distributors have been compelled to negotiate new pricing frameworks with both suppliers and end users, while formulators have accelerated R&D efforts to identify alternative chemistries that bypass tariff-exposed inputs. Consequently, collaboration between additive developers, logistics specialists, and end-market service providers has intensified, fostering a wave of joint ventures and strategic alliances designed to mitigate cost pressures and ensure uninterrupted product availability.

Diverse product types, vehicle categories, application environments, distribution channels, and packaging formats illustrate broad opportunities in the aftermarket fuel additives sector

Analysis of product type segmentation reveals distinct value propositions for cetane improvers, combustion catalysts, injector cleaners, octane boosters, and stabilizers, each addressing specific performance challenges from ignition delay to deposit control. Diesel applications benefit strongly from cetane-enhancing chemistries that promote cleaner combustion, while gasoline segments derive measurable efficiency gains from octane-boosting and detergent packages. Fuel injector cleaners play a critical role across both vehicle types by preventing nozzle fouling and preserving spray patterns over prolonged service intervals.

Examining vehicle and application dimensions highlights divergent requirements: commercial fleets demand high-concentration formulations to counteract extreme operating conditions in buses and trucks, whereas passenger vehicles rely on maintenance-additive routines tailored to engine size and driving cycles. Marine environments, from recreational yachts to commercial vessels, require stabilizers that withstand long idle periods and high-salinity exposures. Distribution channels shape access and pricing dynamics, with automotive aftermarket retailers and workshops offering professional guidance, while e-commerce platforms and manufacturer websites provide convenience and direct-to-consumer models. Package formats ranging from concentrated liquids to portable sachets and single-dose tablets cater to varying preferences in dosing accuracy and ease of use.

This comprehensive research report categorizes the Aftermarket Fuel Additives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Vehicle Type

- Package Format

- Application

- Distribution Channel

Regional dynamics across the Americas, Europe, Middle East & Africa, and Asia-Pacific markets highlight distinct growth drivers and competitive nuances

In the Americas, legacy diesel fleets and agricultural machinery drive robust demand for heavy-duty additive solutions, supported by well-established workshop networks and a mature distribution infrastructure. North American regulatory frameworks continue to push for lower particulate emissions, reinforcing the need for advanced cetane improvers and robust stabilizer chemistries in remote farming operations. South American markets, with their unique biofuel blend mandates, are fostering tailored formulations that harmonize with ethanol and biodiesel blends prevalent across the region.

Across Europe, the Middle East, and Africa, the aftermarket landscape is shaped by diverse emission regimes and infrastructural variances. In Western Europe, stringent Euro VI-equivalent regulations demand top-tier deposit control and fuel detoxification packages, whereas parts of the Middle East and Africa prioritize product stability under extreme climatic conditions. Cross-regional trade corridors are leveraging free-trade agreements to streamline additive sourcing, even as localized workshops and chain retailers adapt to rapidly changing vehicle portfolios.

Asia-Pacific exhibits perhaps the most dynamic mix of challenges and opportunities. Rapid motorization in Southeast Asia, paired with strict environmental policies in China, is catalyzing demand for multifunctional additives that address both combustion efficiency and engine longevity. In markets like Australia and Japan, where precision dosing and high-performance lubricity are critical, specialist formulations are emerging to meet exacting OEM and aftermarket standards.

This comprehensive research report examines key regions that drive the evolution of the Aftermarket Fuel Additives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading industry players are driving innovation through advanced formulations, strategic partnerships, and digital engagement to gain competitive advantage

Leading additive developers are differentiating through proprietary formulation platforms that combine empirical performance data with advanced analytical modeling. Partnerships with major oil companies and lubricant producers are extending reach into captive distribution networks, while direct collaborations with fleet operators enable field-tested refinements. Several firms have launched dedicated digital portals offering subscription-based dosing guidance and real-time performance monitoring, effectively integrating their products into broader vehicle management systems.

Strategic alliances stand at the forefront of capability expansion, with joint ventures addressing supply chain transparency, sustainable feedstock sourcing, and compliance with evolving environmental mandates. Mergers and acquisitions have consolidated specialty chemistry expertise, bringing under one umbrella complementary technologies such as combustion catalysts and deposit control packages. This corporate reshuffling is empowering nimble innovators to challenge legacy incumbents by delivering end-to-end solutions-spanning lab-scale formulation to workshop-level application-through unified service offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aftermarket Fuel Additives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Afton Chemical Corporatio

- Baker Hughes Company

- BASF SE

- Chevron Corporation

- Clariant International Ltd

- Cummins Inc.

- Dorf Ketal Chemicals (I) Pvt. Ltd.

- Eastern Petroleum Private Limited

- Eastman Chemical Company

- ELVI Bardahl, Inc

- Evonik Industries AG

- Fuel Performance Solutions Ltd.

- Infineum International Limited

- Innospec Limited

- Lanxess AG

- Lubrication Engineers, Inc.

- Lubrizol Corporation

- Lucas Oil Products, Inc.

- Solvay S.A.

- The Dow Chemical Company

- TotalEnergies SE.

Strategic steps for industry leaders to enhance resilience, drive innovation, and capitalize on evolving market dynamics in the aftermarket fuel additives domain

To navigate escalating trade complexities and shifting regulatory requirements, industry leaders should prioritize development of tariff-resilient formulations that leverage alternative feedstocks and streamlined supply networks. Investing in modular production facilities closer to key end-markets will not only mitigate duty exposure but also enable rapid customization for region-specific fuel characteristics. Concurrently, deploying advanced analytics in formulation research can reduce trial cycles and accelerate time to market for next-generation additive blends.

Enhancing customer engagement through digital platforms can fortify brand loyalty and unlock new revenue streams. Offering performance-as-a-service models, where dosing recommendations and results tracking are delivered via subscription apps, positions additive suppliers as trusted partners in engine management. Finally, fostering collaborative relationships with workshops, retail chains, and e-commerce operators will ensure comprehensive market coverage and seamless customer journeys, translating technical excellence into tangible business growth.

Robust research methodology leveraging primary expert interviews, comprehensive secondary sources, and rigorous data triangulation for actionable insights

Primary research for this analysis involved in-depth interviews with a balanced cross-section of stakeholders, including senior R&D executives, distribution channel heads, and fleet maintenance managers. These discussions illuminated key performance criteria, regional nuances, and emerging service models that are reshaping value propositions. Secondary research encompassed review of regulatory filings, industry whitepapers, and automotive association publications, ensuring a robust understanding of both historical developments and forward-looking standards.

Data triangulation methods harmonized qualitative insights with quantitative indicators, such as supply chain lead times, import-export flows, and patent filings. Rigorous validation sessions were conducted to corroborate emerging trends and refine segmentation frameworks. The combination of expert perspectives and extensive desk research underpins the credibility of this report and ensures actionable, fact-driven guidance for decision makers in the aftermarket fuel additives sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aftermarket Fuel Additives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aftermarket Fuel Additives Market, by Product Type

- Aftermarket Fuel Additives Market, by Vehicle Type

- Aftermarket Fuel Additives Market, by Package Format

- Aftermarket Fuel Additives Market, by Application

- Aftermarket Fuel Additives Market, by Distribution Channel

- Aftermarket Fuel Additives Market, by Region

- Aftermarket Fuel Additives Market, by Group

- Aftermarket Fuel Additives Market, by Country

- United States Aftermarket Fuel Additives Market

- China Aftermarket Fuel Additives Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Conclusion synthesizing insights, underscoring the imperative of agility, innovation, and strategic foresight in the evolving aftermarket fuel additives arena

This executive summary distills the critical themes transforming the aftermarket fuel additives landscape, from regulatory imperatives and trade disruptions to segmentation intricacies and regional dynamics. It underscores the strategic importance of agility in formulation innovation, supply chain optimization, and digital customer engagement. As market participants contend with tariff pressures and emission mandates, those who integrate advanced chemistries with resilient sourcing and forward-looking service models will secure a competitive edge.

By synthesizing insights across product types, vehicle categories, and distribution channels, this analysis provides a coherent framework to guide strategic decision making. Embracing collaborative partnerships and investing in data-driven research will enable stakeholders to navigate uncertainty and capitalize on opportunities presented by shifting market conditions. Ultimately, success in this evolving arena will hinge on the capacity to anticipate regulatory changes, adapt supply chains, and deliver measurable performance benefits to end users.

Secure comprehensive insights on aftermarket fuel additives directly through Ketan Rohom, Associate Director of Sales & Marketing, to drive your business forward

Secure comprehensive insights on aftermarket fuel additives directly through Ketan Rohom, Associate Director of Sales & Marketing, to drive your business forward

- How big is the Aftermarket Fuel Additives Market?

- What is the Aftermarket Fuel Additives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?