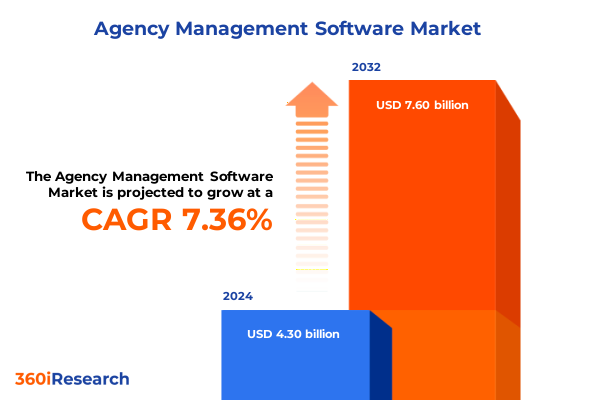

The Agency Management Software Market size was estimated at USD 4.30 billion in 2024 and expected to reach USD 4.60 billion in 2025, at a CAGR of 7.36% to reach USD 7.60 billion by 2032.

Understanding the Essential Role of Agency Management Software in Streamlining Workflow and Enhancing Collaborative Efficiency Across Organizations

In an era defined by rapid digital transformation and an ever-increasing demand for cross-functional collaboration, agency management software has emerged as a cornerstone for modern organizations striving to optimize workflow and drive efficiency. This solution suite transcends traditional project oversight by unifying diverse operational functions-ranging from resource allocation to performance tracking-within a single, accessible platform. As enterprises contend with fragmented toolsets and siloed teams, the adoption of integrated agency management systems becomes a strategic imperative to deliver consistent, high-quality outcomes.

The sophistication of these platforms is underscored by innovations in collaborative work management, project management, resource management, task management, time tracking and traffic management software. By centralizing communication channels, automating routine processes and offering real-time visibility across all stages of creative and strategic initiatives, organizations empower teams to focus on value-added activities rather than administrative overhead. The convergence of these software types not only accelerates delivery cycles but also fosters accountability and transparency, thereby strengthening client relationships and safeguarding brand reputation.

Building upon these foundational developments, this executive summary delves into the transformative shifts reshaping the industry, examines the cumulative impact of recent tariff policies, unpacks segmentation and regional insights, evaluates leading providers and delivers actionable recommendations. By navigating through this analysis, decision-makers gain a holistic perspective on how to harness agency management software to secure competitive advantage and sustain growth in an increasingly complex marketplace.

Exploring How Emerging Technologies and Evolving Work Dynamics Are Driving Transformative Shifts in Agency Management Software Adoption and Functionality

Rapid advancements in artificial intelligence and machine learning are fundamentally transforming the core capabilities of agency management software. Intelligent automation for routine tasks, predictive analytics for resource forecasting and natural language processing for streamlined communication are now table stakes for vendors and users alike. Consequently, organizations that incorporate AI-driven features into their operational toolkit are achieving unprecedented levels of agility and precision, while reducing time-to-market and minimizing costly human errors.

Simultaneously, the proliferation of remote and hybrid work models has redefined collaboration, necessitating solutions that deliver seamless, secure access from any location. Cloud-native architectures, enhanced encryption protocols and integrated video conferencing modules ensure that geographically dispersed teams remain synchronized, maintain data integrity and uphold compliance standards. Mobile-first experiences, with intuitive interfaces on tablets and smartphones, further empower field personnel and client representatives to engage with critical workflows in real time.

Integration with enterprise resource planning, customer relationship management and digital asset management systems has likewise gained prominence, as organizations seek consolidated insights and unified reporting. Open APIs, webhook support and pre-built connectors simplify data exchange, enabling leaders to visualize performance metrics across the entire technology stack. In parallel, advanced visualization dashboards and configurable alerts translate raw data into actionable intelligence, fostering proactive decision-making and continuous performance optimization.

Looking ahead, the evolution of immersive collaboration tools-powered by augmented reality and virtual reality-promises to redefine creative brainstorming sessions, client pitches and project reviews. As these technologies mature, industry stakeholders must prepare to integrate immersive experiences into their software ecosystems, ensuring that human ingenuity remains at the heart of digital transformation.

Analyzing the Cumulative Effects of 2025 United States Tariff Policies on Agency Management Software Supply Chains and Cost Structures

The introduction of new tariff measures in the United States throughout 2025 has introduced a layer of complexity to the supply chains underpinning agency management software solutions. Hardware dependencies, including on-premises servers and edge devices, have encountered elevated import duties, leading vendors to reassess vendor relationships and logistic pathways. As a result, some providers have accelerated shifts toward cloud-only offerings to insulate clients from fluctuating hardware costs and delivery lead times.

Moreover, these tariffs have exerted pricing pressure on integrated third-party components, such as specialized networking equipment and high-performance workstations, which traditionally supported on-premises deployments. Customers evaluating hybrid configurations now weigh the trade-offs between capital expenditure and operational flexibility, often favoring subscription-based SaaS models that bundle infrastructure within predictable monthly fees. By reallocating procurement budgets from one-time purchases toward recurring subscriptions, organizations gain budgetary certainty and mitigate the financial impact of tariff-driven price volatility.

In parallel, some vendors have pursued partial localization strategies, establishing regional data centers and support hubs to circumvent importation barriers. This geographic diversification not only reduces exposure to trade policy fluctuations but also enhances system resilience through distributed architecture. Clients benefit from lower latency, localized compliance adherence and more responsive technical assistance, particularly in regions where customs delays previously hindered software rollouts.

As agencies refine their procurement policies, agility and supply chain transparency have emerged as critical decision criteria. Leaders must now evaluate software roadmaps in tandem with sourcing strategies-prioritizing vendors that demonstrate robust contingency planning, clear tariff-adjusted pricing structures and the capacity to adapt swiftly to evolving trade regulations.

Unlocking Critical Market Segmentation Insights Through Software Type Pricing Models End User Categories and Deployment Modes for Strategic Positioning

Market segmentation by software type reveals a diverse ecosystem where collaborative work management platforms serve as the connective tissue for cross-departmental initiatives, while specialized project management and resource management solutions address the nuanced demands of budget allocation and team capacity planning. Task management tools deliver granular oversight of individual activities, complemented by time tracking modules that enforce accountability and streamline billing. Meanwhile, traffic management systems orchestrate the flow of deliverables, ensuring that creative assets proceed through review cycles without bottlenecks.

Pricing model segmentation highlights a clear dichotomy between freemium offerings that introduce users to core capabilities at no cost, one-time purchase licenses appealing to organizations seeking perpetual access and subscription-based plans that provide continuous feature updates and scalable user counts. This spectrum of pricing strategies accommodates a wide range of buyer preferences, from small agencies testing foundational functionalities to global enterprises requiring flexible licensing agreements that align with evolving headcounts.

End user segmentation underscores the varied adoption profiles across distinct agency types. Traditional advertising agencies, including print and television specialists, often integrate legacy systems with modern platforms to preserve creative continuity, while branding firms prioritize unified asset libraries and client collaboration features. Digital agencies-spanning content marketing and social media specialists-demand real-time analytics dashboards and seamless integration with publishing tools. Insurance agencies leverage workflow automation to accelerate policy administration, media buying firms focus on dynamic campaign scheduling and public relations agencies utilize centralized approval workflows to maintain message consistency.

Deployment mode segmentation continues to reflect a strategic crossroads between cloud environments that offer rapid provisioning and automatic updates, and on-premises installations that grant organizations direct control over infrastructure security and customization. This dual-modal landscape compels software providers to maintain feature parity and tailored support services for both environments, ensuring that each deployment pathway meets stringent performance and compliance requirements.

This comprehensive research report categorizes the Agency Management Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Software Type

- Pricing Model

- End User

- Deployment Mode

Mapping Regional Dynamics in the Agency Management Software Market Across the Americas EMEA and Asia Pacific for Informed Decision Making

Across the Americas, which encompass North, Central and South regions, agencies are capitalizing on mature digital infrastructures and high levels of cloud adoption. North America remains the epicenter of innovation, with leading agencies in the United States and Canada pioneering the integration of AI-powered resource allocation and advanced analytics. Meanwhile, Latin American markets demonstrate rapid uptake of subscription-based models, driven by flexible payment structures and regional data residency initiatives that address local regulatory requirements.

Europe, the Middle East and Africa exhibit a complex tapestry of adoption rates. Western European agencies benefit from robust digital ecosystems and stringent data privacy standards, prompting vendors to invest heavily in compliance features and GDPR-aligned security protocols. In contrast, the Middle East showcases strong interest in hybrid deployments, as enterprises balance rapid digital transformation mandates with on-premises control. Sub-Saharan Africa is experiencing nascent growth, supported by mobile-first solutions and partnerships between global providers and local system integrators to bridge connectivity gaps.

Within Asia-Pacific, innovation trajectories vary significantly by sub-region. Developed markets such as Japan and Australia are driving demand for mobile-optimized, AI-driven platforms that support both in-house and distributed teams. Rapidly expanding economies in Southeast Asia and South Asia prioritize low-code integrations and localized functionality to accommodate linguistic diversity and regional business practices. In addition, the rise of pan-Asian media conglomerates has spurred interest in scalable, multi-tenant architectures capable of managing cross-country campaigns with unified reporting.

Recognizing these regional dynamics is vital for vendors crafting expansion strategies and for agencies evaluating partnerships. Aligning deployment, pricing and feature roadmaps with the nuanced demands of each geography ensures that stakeholders maximize adoption potential and sustain competitive differentiation on a global scale.

This comprehensive research report examines key regions that drive the evolution of the Agency Management Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Leading Agency Management Software Providers Their Strategic Initiatives Partnerships and Innovations Shaping the Competitive Landscape

Leading providers in the agency management software domain are investing heavily in platform extensibility and ecosystem partnerships to differentiate their offerings. Major players have launched strategic alliances with cloud infrastructure providers to guarantee uptime SLAs and expanded geo-coverage for data sovereignty. Similarly, integration with leading CRM, ERP and marketing automation systems has become a standard requirement, prompting vendors to develop robust API frameworks and partner marketplaces that simplify deployment.

Innovation roadmaps are increasingly focused on embedding AI-driven insights directly within user workflows. Several prominent suppliers have introduced machine learning-based resource optimization engines that recommend staffing allocations based on historical project performance. Others have unveiled advanced predictive analytics dashboards capable of identifying potential schedule risks and cost overruns before they materialize, thereby enabling proactive course corrections and performance enhancements.

In parallel, service providers are enhancing customer success initiatives by offering comprehensive onboarding, training academies and certification programs. These programs aim to accelerate time-to-value, ensure user proficiency and gather actionable feedback that informs product development cycles. Moreover, strategic acquisitions have allowed certain vendors to bolster capabilities in adjacent domains-such as digital asset management and financial reporting-thereby creating more cohesive solution suites and deepening customer engagement.

By continuously refining their platforms through strategic investments, partnerships and targeted acquisitions, these leading companies are shaping a competitive landscape defined by integrated ecosystems, data-driven decision support and end-user empowerment. Prospective buyers should evaluate vendor roadmaps with an eye toward long-term innovation commitments and the availability of comprehensive support structures that facilitate sustainable growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Agency Management Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 37signals LLC

- Accelo, Inc

- Agency Software, Inc.

- Formagrid, Inc.

- Asana, Inc.

- Creative Manager Inc.

- Deltek, Inc.

- Forecast Technologies Trading Limited

- Function Point Productivity Software Inc.

- FunctionFox System Inc.

- Ignite Software Systems Ltd

- Kantata, Inc.

- Mango Technologies, Inc.

- Nimble, Inc.

- PwC

- Resource Guru Limited

- Sage Group plc

- Scoro Software OÜ

- Screendragon Limited

- Synergist Express Ltd

- Teamwork.com

- The Productive Company Inc.

- Toggl Technology Limited

- Wrike, Inc.

- Ziflow Limited

Strategic Actionable Recommendations for Industry Leaders to Optimize Adoption Implementation and Growth of Agency Management Software Solutions

To capitalize on the evolving capabilities of agency management software, industry leaders should prioritize the integration of artificial intelligence and automation across mission-critical workflows. By embedding predictive analytics within resource planning and leveraging intelligent task routing, agencies can optimize staffing utilization and minimize the risk of project bottlenecks. Furthermore, establishing clear governance policies for AI-driven decision-making ensures that outcomes remain aligned with organizational objectives and ethical standards.

Leaders must also embrace flexible pricing models that align with growth trajectories and budgetary constraints. Transitioning from one-time purchase agreements to subscription-based structures not only provides predictable revenue streams for vendors but also grants agencies access to continuous feature enhancements and scalable user licensing. Simultaneously, evaluating freemium offerings can facilitate internal trials and proof-of-concept exercises, enabling teams to validate critical functionality before committing to enterprise-wide deployments.

Investing in comprehensive training and change-management programs is essential to drive user adoption and realize the full value of sophisticated software platforms. By establishing certification pathways and embedding best-practice playbooks within the user community, organizations minimize resistance, accelerate workflow standardization and cultivate a culture of continuous improvement. Supplementing these efforts with regular feedback loops ensures that product roadmaps remain aligned with evolving agency requirements.

Finally, diversifying deployment options across cloud and on-premises environments provides agencies with the flexibility to address data sovereignty, security and performance considerations specific to their operational context. By collaborating with software vendors to design balanced hybrid architectures, industry leaders achieve both the agility of cloud services and the control afforded by localized infrastructure.

Comprehensive Research Methodology Combining Quantitative and Qualitative Techniques to Ensure Robust Insights into the Agency Management Software Market

This research combines quantitative surveys conducted with senior executives across advertising, branding, digital, insurance and media buying agencies, alongside in-depth interviews with technology officers and procurement specialists. Primary data collection focused on understanding purchase drivers, deployment preferences and the operational challenges that shape software adoption decisions. These insights were supplemented by structured discussions with vendor representatives to capture innovation roadmaps and support models.

Secondary research involved a thorough review of industry publications, regulatory filings, company press releases and technology journal articles. This phase provided historical context for tariff implications, regional adoption trends and vendor consolidation activities. Publicly available data on cloud infrastructure investments and application security standards was also analyzed to validate emerging patterns and benchmark platform capabilities.

Data triangulation ensured the robustness of findings by cross-verifying primary responses with secondary evidence, while rigorous quality checks were applied to eliminate outliers and confirm statistical significance. Advanced analytics techniques, including cluster analysis for segmentation and correlation analysis for impact assessment, were employed to distill high-level insights and reveal hidden relationships within the dataset.

Finally, expert validation workshops with industry veteran advisors and software specialists were convened to refine hypotheses and validate strategic recommendations. This iterative process ensured that the conclusions reflect both empirical evidence and practical, real-world considerations, providing a reliable foundation for decision-making and strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Agency Management Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Agency Management Software Market, by Software Type

- Agency Management Software Market, by Pricing Model

- Agency Management Software Market, by End User

- Agency Management Software Market, by Deployment Mode

- Agency Management Software Market, by Region

- Agency Management Software Market, by Group

- Agency Management Software Market, by Country

- Competitive Landscape

- List of Figures [Total: 28]

- List of Tables [Total: 525 ]

Conclusion Highlighting the Strategic Value and Future Trajectory of Agency Management Software in Driving Operational Excellence and Competitive Advantage

In summary, agency management software has evolved from simple collaboration tools into comprehensive platforms that integrate project management, resource planning, analytics and automation. Organizations that adopt these solutions stand to unlock significant operational efficiencies, improve client satisfaction and gain greater visibility into complex workflows. Moreover, emerging trends in AI and immersive collaboration promise to extend these benefits, reshaping how teams engage with data and with each other.

As the industry navigates the ramifications of 2025 tariff policies, supply chain resilience and deployment flexibility will remain key differentiators. Vendors that demonstrate adaptability through localized infrastructure, transparent pricing adjustments and robust contingency plans will earn client trust and secure competitive advantage. Regional dynamics further underscore the importance of tailoring feature sets and support services to the unique demands of the Americas, EMEA and Asia-Pacific markets.

Looking forward, the next frontier lies in converging advanced analytics with immersive user experiences. Agency leaders should prepare to embrace augmented and virtual reality modules for creative reviews, while ensuring that AI governance frameworks and data privacy measures are firmly in place. By aligning strategic initiatives with these emerging trajectories, organizations can sustain growth, drive innovation and maintain their position at the forefront of the dynamic agency management software landscape.

Take the Next Step to Empower Your Organization with Tailored Agency Management Software Insights by Connecting with Ketan Rohom for Your Comprehensive Report

To gain unparalleled clarity on the evolving agency management software landscape and secure tailored insights that will accelerate your organization’s growth, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to purchase the full comprehensive market research report. This in-depth analysis equips you with strategic guidance, actionable data and proprietary evaluations that will inform every facet of your deployment, investment and competitive planning. Engage directly to receive a personalized briefing, explore custom data packages, and align your roadmap with the most critical trends shaping agency operations today. Position your business to lead in an increasingly dynamic and technology-driven marketplace by partnering with our research experts for the definitive resource on agency management software.

- How big is the Agency Management Software Market?

- What is the Agency Management Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?