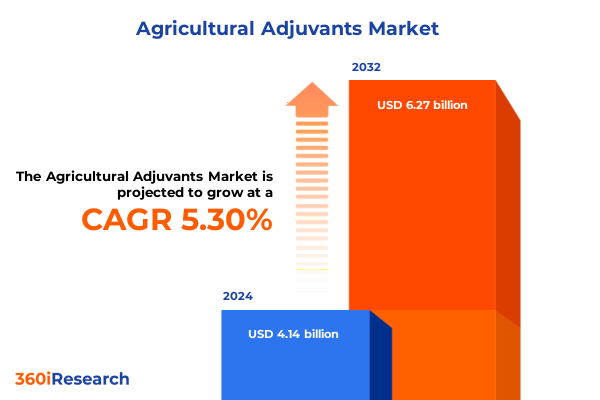

The Agricultural Adjuvants Market size was estimated at USD 4.35 billion in 2025 and expected to reach USD 4.56 billion in 2026, at a CAGR of 5.36% to reach USD 6.27 billion by 2032.

Foundational Perspectives on Agricultural Adjuvants That Illuminate Their Essential Functionality in Optimizing Pesticide Performance and Boosting Crop Yields

Adjuvants serve as essential enhancers within modern agricultural practices, augmenting the performance of crop protection agents and directly contributing to optimized yield outcomes. Through their capacity to alter spray dynamics, modify droplet behavior, and improve the delivery of active ingredients, these substances bolster the effectiveness of fungicides, herbicides, and insecticides while addressing challenges such as drift, runoff, and incomplete coverage. As growers and manufacturers seek to maximize resource efficiency and minimize environmental impacts, the role of adjuvants has ascended from a supportive additive to a strategic component of crop protection regimens.

In recent seasons, the integration of advanced adjuvant chemistries has paralleled the rise of precision farming technologies, where tailored applications depend on both product innovation and on-the-ground adaptability. This synergy has accelerated the adoption of specialized adjuvants that cater to diverse crop types and climatic conditions. Consequently, stakeholders across the value chain-ranging from suppliers to end users-recognize that a nuanced understanding of adjuvant functionality is imperative for addressing evolving agronomic and regulatory demands. This introductory overview sets the stage for examining how transformational shifts, trade dynamics, and segmentation insights intersect to shape the trajectory of this pivotal market segment.

Dynamic Transformative Forces Reshaping Agricultural Adjuvant Development Through Regulatory Evolution, Sustainability Imperatives, and Technological Breakthroughs

The landscape of agricultural adjuvants is undergoing rapid transformation fueled by advancements in sustainable chemistries and shifting regulatory priorities. Stakeholders across the sector are responding to tightening restrictions on synthetic surfactants and solvents by accelerating the development of bio-based alternatives. These novel formulations not only align with environmental stewardship goals but also demonstrate enhanced performance attributes such as improved biodegradability and reduced ecotoxicological risk.

Simultaneously, the convergence of digital agriculture and precision application techniques has prompted the introduction of adjuvants optimized for smart-spraying equipment. By integrating with nozzle-monitoring systems and leveraging real-time data on weather and canopy structure, these products enhance spray accuracy and mitigate drift. In parallel, ongoing research into encapsulation technologies and adjuvant–active ingredient compatibility is expanding the functional scope of existing chemistries. From buffering agents that stabilize pH-sensitive formulations to drift control additives that reduce off-target dispersion, the sector is experiencing an era of unprecedented innovation grounded in both agronomic efficacy and environmental responsibility.

Analyzing the Multifaceted Implications of United States Tariff Policies in 2025 on Supply Chain Dynamics, Cost Structures, and Strategic Sourcing Decisions

In 2025, the cumulative impact of U.S. tariffs on chemical imports has reverberated across the agricultural adjuvant supply chain, prompting a reassessment of sourcing strategies and cost structures. With levies imposed on key intermediates and finished adjuvants, import-dependent manufacturers have faced elevated input costs that, in turn, influence pricing dynamics for distributors and end users. The resulting margin pressures have compelled several industry participants to secure alternative supply agreements or to invest in localized production capabilities to mitigate exposure to fluctuating trade barriers.

Moreover, the tariff environment has catalyzed strategic partnerships between domestic formulators and regional raw material suppliers, fostering resilience in supply continuity. Organizations that have adopted vertically integrated models are better positioned to absorb trade-related surcharges, while those reliant on third-party imports must navigate lead-time uncertainties and currency fluctuations. Looking ahead, the capacity to anticipate tariff adjustments and to maintain agile procurement channels will be pivotal for companies striving to sustain competitive positioning amid evolving policy landscapes.

In-Depth Segmentation Insights Revealing How Product, Formulation, Source, Functionality, Application, Crop Type, and End-User Variations Drive Adoption Patterns

The market’s complexity emerges most clearly through its layered segmentation, where products are distinguished by activating or utility functions and further refined by their underlying chemistries and end-use characteristics. Activator adjuvants encompass oil-based chemistries and surfactants designed to enhance active ingredient penetration, while utility adjuvants cover buffering agents that maintain pH stability, compatibility enhancers that prevent formulation separation, drift control agents that reduce off-target deposition, and water conditioning substances that counteract adverse water qualities.

Further granularity is achieved through formulation types-spanning granular matrices for dry applications, liquid concentrates for tank-mix flexibility, and powder variants for ease of storage. The origin of these materials bifurcates into bio-based sources, which respond to the push for renewable inputs, and petroleum-based derivatives that continue to dominate conventional portfolios. Functionality segmentation highlights emulsification enhancers, moisture retention agents, and penetration promoters, each tailored to specific agronomic scenarios. Application-driven categorization aligns adjuvant selection with fungicidal, herbicidal, or insecticidal programs, while crop-type divisions allocate formulations to cereals and grains including corn, rice, and wheat; fruits and vegetables such as citrus, leafy greens, and root crops; and oilseeds and pulses like canola, soybean, and sunflower. Finally, end-user segmentation addresses the distinct requirements of commercial applicators operating at scale, independent farmers, and research institutions validating novel chemistries. Collectively, these segmentation layers form the foundation for strategic product development and targeted marketing initiatives.

This comprehensive research report categorizes the Agricultural Adjuvants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Formulation

- Source

- Functionality

- Application

- Crop Type

- End-User

Comprehensive Regional Perspectives on Adjuvant Market Dynamics Highlighting Distinct Growth Drivers and Regulatory Landscapes Across Major Global Territories

Global demand for adjuvants is marked by distinctive regional dynamics, with the Americas, EMEA, and Asia-Pacific each demonstrating unique drivers of growth and regulatory considerations. In the Americas, emphasis on yield maximization in large-scale row crops has spurred adoption of drift control and penetration-enhancing adjuvants, especially within the U.S. Corn Belt and Brazil’s expansive soybean belts. Evolving water quality concerns have further elevated interest in buffering and water conditioning agents capable of optimizing performance under variable irrigation conditions.

Within Europe, Middle East, and Africa, regulatory scrutiny on synthetic chemistries has accelerated the uptake of bio-based and ecologically benign solutions, particularly across the European Union where stringent Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) requirements prevail. North African and Gulf markets, by contrast, are embracing moisture retention and compatibility agents to address arid climate challenges and high-input water management needs. Turning to Asia-Pacific, rapid intensification of horticultural production in China, India, and Southeast Asia is driving demand for high-efficiency adjuvants that can enhance pesticide deposition on dense canopies and deliver robust control in monsoon-prone environments. Regional distribution networks and partnerships with local formulators play a pivotal role in customizing product offerings to align with distinct agronomic practices and regulatory frameworks.

This comprehensive research report examines key regions that drive the evolution of the Agricultural Adjuvants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Company Profiling Highlighting Market Leaders’ Innovations, Collaborations, and Competitive Approaches in the Global Agricultural Adjuvant Arena

A cadre of industry leaders has emerged, each leveraging differentiated strategies to capture market share and advance product portfolios. Major chemical conglomerates have broadened their offerings through targeted acquisitions of specialty adjuvant providers, effectively integrating proprietary technologies into broader agrochemical suites. Simultaneously, independent specialty firms are carving out niches by focusing on high-value segments such as bio-based emulsifiers and drift control chemistries tailored for precision agriculture.

Collaborations between agrochemical giants and technology-focused startups have accelerated co-development initiatives, marrying advanced formulation expertise with digital application platforms. Meanwhile, regional formulators in key markets are capitalizing on intimate knowledge of local agronomic conditions to deliver customized solutions and technical support. Across the spectrum, top companies are enhancing supply chain resilience by establishing regional production hubs and forging strategic raw material alliances. This multi-pronged approach-combining inorganic growth, innovation partnerships, and geographic diversification-underpins the competitive landscape and signals an ongoing shift toward more agile, customer-centric business models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Agricultural Adjuvants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adjuvant Plus Inc.

- AkzoNobel N.V.

- BASF SE

- Brandt, Inc.

- Clariant AG

- Corteva, Inc.

- Croda International PLC

- Drexel Chemical Company

- Evonik Industries AG

- GarrCo Products, Inc.

- Helena Agri-Enterprises, LLC

- Huntsman International LLC

- Ingevity Corporation

- Innvictis Crop Care, LLC

- Interagro (Uk) Ltd. by Nichino Europe Co., Ltd.

- J.M. Huber Corporation

- Lamberti S.p.A.

- Land O’Lakes, Inc.

- MaxEEma Biotech Private Limited

- Momentive Performance Materials Inc.

- Nufarm Ltd.

- Precision Laboratories, LLC

- Solvay S.A.

- Stepan Company

- The Dow Chemical Company

- UPL Limited

- Wilbur-Ellis Holdings, Inc.

Actionable Strategic Recommendations Empowering Industry Leaders to Capitalize on Emerging Opportunities and Navigate Regulatory Complexities in Adjuvant Markets

Industry leaders seeking to maintain their competitive edge should prioritize the integration of sustainable chemistries into core product lines, thereby future-proofing portfolios against escalating environmental regulations. Investing in research collaborations with academic institutions and technology startups can accelerate the development of next-generation adjuvants capable of enhancing efficacy while minimizing ecological footprints.

In parallel, establishing localized production and formulation capabilities within key regions can mitigate trade-related disruptions and ensure rapid responsiveness to market-specific requirements. Embracing digital agronomy platforms and forging partnerships with equipment manufacturers will enable the delivery of tailored application solutions that optimize tank-mix compatibility and dosage precision. Finally, proactive engagement with regulatory bodies and participation in industry consortia will facilitate compliance roadmaps, streamline registration processes, and position organizations as thought leaders in sustainable crop protection strategies.

Robust Multi-Stage Research Methodology Integrating Primary Interviews, Secondary Data Analysis, and Expert Validation for Comprehensive Market Insights

The insights presented throughout this report were derived from a structured research methodology that combined comprehensive secondary data analysis with targeted primary research initiatives. Initial phases involved the aggregation of publicly available information from regulatory databases, patent filings, and scientific literature to chart the evolution of adjuvant chemistries and application technologies. This foundational analysis informed the design of a proprietary questionnaire and the identification of key stakeholders for in-depth interviews.

Primary research encompassed consultations with senior executives, product managers, and technical specialists across agrochemical manufacturers, specialty adjuvant formulators, and end-user organizations. Quantitative validation was achieved through data triangulation techniques that cross-verified interview insights against industry publications and trade statistics. Expert panels convened to review preliminary findings, refine segment definitions, and ensure that the conclusions accurately reflect real-world market dynamics. This multi-stage approach underscores the robustness and reliability of the report’s conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Agricultural Adjuvants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Agricultural Adjuvants Market, by Product

- Agricultural Adjuvants Market, by Formulation

- Agricultural Adjuvants Market, by Source

- Agricultural Adjuvants Market, by Functionality

- Agricultural Adjuvants Market, by Application

- Agricultural Adjuvants Market, by Crop Type

- Agricultural Adjuvants Market, by End-User

- Agricultural Adjuvants Market, by Region

- Agricultural Adjuvants Market, by Group

- Agricultural Adjuvants Market, by Country

- United States Agricultural Adjuvants Market

- China Agricultural Adjuvants Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

Conclusive Reflections on the Future Trajectory of Agricultural Adjuvants Emphasizing Strategic Imperatives for Sustained Advancement in Crop Protection

The trajectory of agricultural adjuvants is firmly rooted in the dual imperatives of agronomic performance and environmental compatibility. As regulatory frameworks evolve to favor more sustainable solutions, the industry must continue to innovate formulations that reconcile efficacy with ecological responsibility. The segmentation landscape underscores the importance of tailored chemistries that address crop-specific challenges, weather variability, and application techniques.

Looking forward, the confluence of digital agriculture and advanced adjuvant technologies will redefine how growers approach crop protection, emphasizing precision and data-driven decision-making. Strategic investments in bio-based research, regional supply chain resilience, and collaborative partnerships will determine which players secure leadership positions. Ultimately, those organizations that integrate these imperatives into cohesive strategies will be best positioned to drive the next wave of innovation and to support global efforts toward productive and sustainable food systems.

Compelling Call-to-Action for Stakeholders to Connect with the Associate Director of Sales & Marketing for Exclusive Access to In-Depth Adjuvant Market Research

To seize the insights detailed within our extensive market analysis and to gain tailored guidance on how these trends translate into strategic advantages for your organization, please get in touch with Ketan Rohom, Associate Director of Sales & Marketing. Engaging directly will unlock personalized recommendations that align with your growth objectives and enable you to navigate the evolving landscape of agricultural adjuvants with confidence. By partnering for the full report, you will access in-depth evaluations, proprietary data, and expert perspectives that can drive immediate impact across your product development and distribution strategies. Secure your competitive edge today by scheduling a consultation and discovering how these comprehensive findings can be translated into actionable plans that accelerate your success in global markets

- How big is the Agricultural Adjuvants Market?

- What is the Agricultural Adjuvants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?