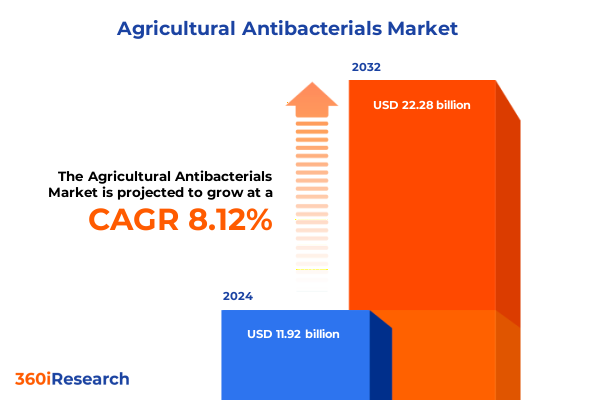

The Agricultural Antibacterials Market size was estimated at USD 12.83 billion in 2025 and expected to reach USD 13.81 billion in 2026, at a CAGR of 8.20% to reach USD 22.28 billion by 2032.

Unveiling the Vital Role and Emerging Dynamics of Agricultural Antibacterials in Safeguarding Crop Health and Bolstering Sustainable Farming Practices

The agricultural antibacterials sector occupies a pivotal position in modern crop protection by offering targeted solutions against bacterial pathogens that threaten global food security. As bacterial diseases continue to evolve and develop resistance to conventional treatments, the demand for innovative antibacterials has intensified, underscoring the sector’s significance in sustaining yield and quality. Against this backdrop, regulatory agencies worldwide are tightening approvals and monitoring protocols, compelling manufacturers to prioritize both efficacy and environmental safety.

Moreover, dynamic shifts in farming practices-driven by sustainability goals and consumer preferences-have elevated the importance of precision application and minimal-residue solutions. Consequently, agricultural antibacterials must not only deliver consistent performance but also align with integrated pest management frameworks promoting ecological balance. In addition, rising investments in R&D are catalyzing the development of next-generation compounds and formulations, positioning the sector at the intersection of scientific innovation and practical farm-level adoption.

Taken together, these factors create a complex yet opportunity-rich landscape, where stakeholders must navigate evolving regulations, market expectations, and technological possibilities. This executive summary provides a comprehensive overview of these critical forces, setting the stage for detailed exploration of transformative trends, tariff impacts, segmentation insights, regional dynamics, leading companies, and actionable recommendations.

Revolutionary Trends and Technological Breakthroughs Redefining Agricultural Antibacterials from Biologics Innovation to Precision Application Techniques

In recent years, the agricultural antibacterials arena has undergone transformative shifts driven by technological breakthroughs, regulatory evolution, and changing grower expectations. First, biotechnology innovations have introduced biological antibacterials derived from microbial metabolites, offering eco-friendly alternatives that resonate with strict environmental standards and consumer demands for chemical reduction. These biologically based products illustrate how science can reconcile efficacy with ecological stewardship.

Furthermore, novel delivery mechanisms have emerged to optimize active ingredient performance. Nanoformulation techniques enhance solubility and leaf coverage, while encapsulation technologies enable controlled release, reducing application frequency and minimizing non-target exposure. Consequently, manufacturers are collaborating with precision agriculture platforms to integrate data-driven decision support, ensuring that treatments are applied at optimal times and locations.

Additionally, artificial intelligence and remote sensing are revolutionizing disease detection and management, enabling predictive modeling of disease outbreaks and tailored antibacterials deployment. This synergy between digital agriculture and chemical innovation is redefining crop protection strategies. Together, these developments are reshaping the market landscape, accelerating the shift toward smarter, more sustainable solutions that meet stringent regulatory criteria and deliver measurable agronomic benefits.

Assessing How the 2025 United States Tariff Adjustments on Agricultural Antibacterials Reshape Supply Chains Costs and Domestic Production Strategies

The 2025 United States tariff adjustments on imported agricultural antibacterials have introduced a new layer of complexity to the global supply chain. Building on measures announced in late 2024, these additional duties target key active ingredients such as oxytetracycline and streptomycin, increasing landed costs for imports from major producing regions. As a result, importers have faced heightened price pressures, prompting many to reassess their procurement strategies and negotiate alternative sourcing agreements.

Moreover, the cumulative impact of escalating duties has stimulated domestic production incentives, encouraging U.S.-based manufacturers to expand capacity and invest in localized R&D to mitigate reliance on imports. This shift has also accelerated collaborations between domestic chemical producers and agricultural biotech firms, focusing on developing proprietary formulations less susceptible to tariff fluctuations. Consequently, through continuous monitoring of policy changes and strategic investment in local supply chains, stakeholders are realigning their operational models to preserve profit margins and secure consistent access to critical antibacterials.

However, growers confronted with higher application costs must adapt by integrating advanced disease monitoring platforms and exploring complementary biological options to optimize usage. In summary, the 2025 tariff landscape has served as a catalyst for supply chain diversification, domestic capacity building, and strategic innovation, reshaping how agricultural antibacterials reach the market and how end users deploy them.

Deconstructing Market Segmentation for Agricultural Antibacterials to Reveal Strategic Insights Across Formulations Ingredients Crops and Application Stages

A nuanced understanding of the agricultural antibacterials market emerges when examining its core segments by formulation, ingredient, crop, application method, distribution channel, and crop stage. For formulation type, granule, liquid, and powder presentations each offer distinct advantages; liquid formats provide versatility through emulsifiable concentrates, solutions, and suspension concentrates, while powder options deliver high stability in both soluble powder and wettable powder variations. Granular systems remain preferred in soil treatment scenarios due to their ease of incorporation and controlled release. Transitioning to active ingredient classes, kasugamycin appeals for its novel mode of action against resistant strains, oxytetracycline maintains broad-spectrum appeal, and streptomycin is often the go-to for bacterial wilt management.

Regarding crop type, the segmentation reveals differentiated needs across cereal and grain crops like maize, rice, and wheat; fruits and vegetables such as lettuce, potato, and tomato; and oilseeds and pulses including canola, chickpea, and soybean. Each crop category exhibits unique disease profiles and regulatory considerations, driving tailored formulation preferences and application frequencies. In terms of application method, foliar sprays continue to dominate for rapid disease control, while seed treatments enhance early-stage protection, soil drench methods target root pathogens, and trunk injections offer precision for high-value orchards.

Furthermore, distribution channels encompass direct sales, distributors, e-commerce, and retail, reflecting both traditional outreach and digitized procurement trends. Finally, crop stage segmentation underscores the significance of timing, with treatments at seedling, vegetative, flowering, and fruit setting phases calibrated to interrupt pathogenic cycles effectively. Collectively, these segmentation insights provide a strategic framework to align product development, marketing initiatives, and field deployment with specific grower requirements.

This comprehensive research report categorizes the Agricultural Antibacterials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Formulation Type

- Active Ingredient Class

- Crop Type

- Application Method

- Crop Stage

- Distribution Channel

Geospatial Analysis of Agricultural Antibacterials Reveals Distinct Market Drivers and Adoption Patterns Across Americas EMEA and Asia-Pacific Regions

Regional dynamics play a decisive role in shaping the adoption, regulation, and innovation trajectory of agricultural antibacterials across the globe. In the Americas, stringent regulatory frameworks and well-established agricultural infrastructure underscore a mature market environment. This region benefits from high adoption rates of precision agriculture practices, translating into more targeted and efficient antibacterial applications. Moreover, public and private investments in sustainable farming practices have encouraged the development of low-residue formulations that meet both environmental safety standards and consumer expectations. Consequently, manufacturers regularly engage with extension services and research institutions to fine-tune their offerings for local agronomic conditions.

Conversely, the Europe, Middle East & Africa region grapples with complex regulatory heterogeneity. European Union policies impose rigorous approval processes, steering the market toward microbial-based and organically certified antibacterial solutions. Meanwhile, in parts of the Middle East and Africa, diverse climatic challenges and limited infrastructure have created high demand for robust, easy-to-apply formulations that maintain stability under extreme conditions. This juxtaposition of stringent EU compliance and emerging-market pragmatism has spurred collaborations between multinational technology providers and regional distributors.

In the Asia-Pacific region, rice paddies and vegetable farms confronted by recurrent bacterial blight and leaf spot diseases have driven rapid uptake of both traditional chemical antibacterials and cutting-edge biological agents. Government-led subsidy programs and public–private partnerships further accelerate product trials and expand market reach. Additionally, the prevalence of smallholder farmers has catalyzed the growth of e-commerce platforms, allowing growers to access customized antibacterial blends and application guidance. Collectively, these region-specific hallmarks illustrate how market maturity, regulatory complexity, and farm structures converge to influence the landscape of agricultural antibacterials worldwide.

This comprehensive research report examines key regions that drive the evolution of the Agricultural Antibacterials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Agricultural Antibacterial Manufacturers Spotlighting Their Strategic Moves Partnerships and R&D Investments Shaping Industry Competition

The competitive landscape of agricultural antibacterials features both legacy agrochemical titans and agile innovators forging new frontiers in crop protection. Leading incumbents have broadened their antibacterial portfolios through strategic alliances, leveraging extensive regulatory expertise and global distribution networks. These top players consistently reinvest in R&D to refine existing actives while scouting for novel compounds to circumvent rising resistance. Furthermore, partnerships with biotechnology firms and academic institutions have become integral to accelerating discovery pipelines and achieving regulatory approvals.

Simultaneously, specialized mid-tier companies are gaining traction by focusing on narrow-spectrum and biological antibacterials tailored to specific crop-pathogen pairings. Their lean organizational structures permit rapid iteration and market entry, which resonates with growers seeking alternatives to broad-spectrum chemical solutions. In addition, innovative startups are harnessing cutting-edge platforms-such as gene editing and microbial fermentation-to engineer next-generation actives that promise heightened efficacy at lower application rates.

Meanwhile, distribution specialists are incorporating digital sales channels and subscription-based models to streamline procurement and foster closer customer engagement. Collectively, these strategic moves-from high-profile mergers and acquisitions to collaborative R&D ventures-are intensifying competition and accelerating the pace of innovation within the agricultural antibacterials arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Agricultural Antibacterials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACTO GmbH

- ADAMA Agricultural Solutions Ltd.

- AgriPhage

- BASF SE

- Bayer AG

- Corteva, Inc.

- EnviroZyme

- FMC Corporation

- Marrone Bio Innovations, Inc.

- Nufarm Limited

- Sumitomo Chemical Co., Ltd.

- Syngenta AG

- UPL Limited

Actionable Strategic Roadmap for Industry Leaders to Navigate Regulatory Pressures Supply Chain Disruptions and Evolving Farm Management Practices

To excel in this rapidly evolving landscape, industry leaders must adopt a proactive, multifaceted approach that emphasizes resilience and innovation. First, diversifying supply chain sourcing by cultivating relationships with both domestic producers and reliable international partners can mitigate the impact of tariff volatility and logistical disruptions. Additionally, channeling investments into biological research and development-particularly microbial metabolites and targeted enzyme inhibitors-can create differentiated products that fulfill tightening environmental regulations and grower demand for sustainable solutions.

Moreover, forging strategic alliances with digital agriculture providers will enable more sophisticated disease prediction models and precision application platforms. This synergy can significantly reduce input volumes and optimize treatment timing, thereby enhancing both economic and environmental outcomes. Alongside technological integration, collaborating closely with regulatory bodies to streamline registration processes and co-develop safer, low-residue formulations will expedite market entry and strengthen compliance posture.

Furthermore, elevating grower education through training programs and interactive digital tools will foster informed decision-making at the farm level, driving adoption of advanced antibacterial strategies. Finally, expanding multi-channel distribution networks-incorporating direct sales, distributor partnerships, e-commerce portals, and retail engagements-will ensure broad market coverage and customer accessibility. By pursuing these strategic imperatives, companies can safeguard market share, drive sustainable growth, and maintain competitive advantage.

Comprehensive Research Methodology Overview Detailing Primary Surveys Expert Interviews and Data Triangulation Processes Underpinning Market Insights

This analysis draws upon a rigorous research framework designed to ensure depth, reliability, and relevance. Primary research involved structured interviews with senior R&D scientists at major agrochemical firms, consultations with regulatory authority representatives, and in-field surveys conducted among growers across key producing regions. These direct interactions yielded nuanced insights into formulation preferences, application challenges, and future innovation roadmaps.

Complementing primary inputs, secondary research encompassed systematic reviews of regulatory filings, patent databases, technical journal publications, and publicly available sustainability reports. A comprehensive cross-verification process triangulated these data points to validate emerging trends and confirm stability of observed patterns over time. Data integrity was further ensured by deploying standardized quality checks, including consistency audits and anomaly detection procedures.

Quantitative analysis employed statistical techniques to interpret grower adoption rates, formulation efficacy metrics, and tariff impact modeling, while qualitative thematic analysis distilled strategic imperatives from stakeholder interviews. By integrating both quantitative rigor and qualitative depth, the methodology provides a holistic foundation for the insights presented, ensuring that stakeholders can confidently translate findings into actionable strategies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Agricultural Antibacterials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Agricultural Antibacterials Market, by Formulation Type

- Agricultural Antibacterials Market, by Active Ingredient Class

- Agricultural Antibacterials Market, by Crop Type

- Agricultural Antibacterials Market, by Application Method

- Agricultural Antibacterials Market, by Crop Stage

- Agricultural Antibacterials Market, by Distribution Channel

- Agricultural Antibacterials Market, by Region

- Agricultural Antibacterials Market, by Group

- Agricultural Antibacterials Market, by Country

- United States Agricultural Antibacterials Market

- China Agricultural Antibacterials Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Key Insights and Strategic Imperatives to Guide Stakeholders Through the Complex Landscape of Agricultural Antibacterials

In conclusion, the agricultural antibacterials landscape is marked by a convergence of regulatory tightening, technological innovation, and shifting grower expectations. The 2025 U.S. tariff adjustments have underscored the imperative for diversified supply chains and bolstered domestic production capabilities. Concurrently, the emergence of biological alternatives and precision delivery mechanisms is redefining efficacy benchmarks and environmental performance.

Strategic segmentation analysis highlights the importance of aligning formulation types, active ingredients, and application methods with specific crop disease profiles and growth stages. Regional disparities-from mature markets in the Americas to regulatory complexity in EMEA and rapid adoption in Asia-Pacific-further emphasize the need for tailored go-to-market strategies. Leading companies are responding through partnerships, R&D investments, and digital distribution initiatives, setting new competitive standards.

Looking ahead, industry participants who proactively engage with regulatory stakeholders, invest in next-generation biological and nano-enabled solutions, and integrate digital agriculture platforms will be best positioned to navigate uncertainties and capitalize on emerging opportunities. Ultimately, this report provides a strategic blueprint for stakeholders to enhance crop health management, drive sustainable practices, and secure enduring market relevance in the dynamic agricultural antibacterials sector.

Connect with Our Associate Director of Sales and Marketing to Secure the Definitive Agricultural Antibacterials Market Research Report and Gain Competitive Advantage

Embarking on the journey toward comprehensive market intelligence is essential for stakeholders seeking to outpace competitors and adapt to emerging trends in the agricultural antibacterials domain. To secure this competitive advantage and obtain in-depth analysis covering every critical facet-from regulatory dynamics and tariff implications to segmentation and regional nuances-reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch).

He stands ready to guide you through our detailed market research offering, ensuring that you gain the actionable insights necessary to navigate complexities, identify high-potential opportunities, and fortify your strategic roadmap. Connect today to elevate your decision-making with rigorous, data-driven perspectives crafted for tomorrow’s market challenges.

- How big is the Agricultural Antibacterials Market?

- What is the Agricultural Antibacterials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?