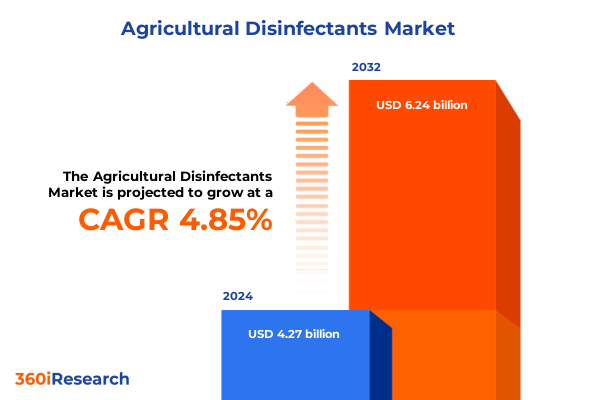

The Agricultural Disinfectants Market size was estimated at USD 4.47 billion in 2025 and expected to reach USD 4.65 billion in 2026, at a CAGR of 4.85% to reach USD 6.24 billion by 2032.

Setting the Stage for Unrivaled Agricultural Biosecurity Through Advanced Disinfectant Strategies That Strengthen Farm Resilience and Promote Sustainable Practices

Farm biosecurity has never been more critical as agricultural operations face growing threats from pathogens, tightening regulatory frameworks, and heightened consumer expectations. From controlling microbial outbreaks in animal housing to safeguarding the integrity of dairy equipment, disinfectants stand at the forefront of comprehensive hygiene protocols. Contemporary pressures underscore the need for reliable products that balance efficacy, safety, and environmental compatibility. With increasing farm consolidation and the rise of contract farming models, standardized sanitation procedures have become imperative to mitigate cross-contamination risks and maintain operational continuity.

Consequently, agricultural stakeholders are seeking advanced disinfectant strategies that go beyond traditional chemistries. These strategies integrate data-driven monitoring, precise dosing technologies, and eco-friendly formulations to deliver consistent performance. As global concerns about antimicrobial resistance grow, the development of targeted actives and synergistic blends is accelerating. Meanwhile, digital platforms are enabling real-time validation of cleaning cycles, ensuring traceability and adherence to best practices. This introduction outlines the foundational forces reshaping the agricultural disinfectants market, setting the stage for a deeper exploration of transformational trends and strategic considerations crucial for informed decision-making.

Navigating Emerging Forces Shaping the Agricultural Disinfectant Landscape From Regulatory Shifts to Technological Breakthroughs Transforming Biosecurity Protocols

Over the past several years, the agricultural disinfectant landscape has undergone transformative shifts driven by regulatory evolution, technological breakthroughs, and sustainability imperatives. Regulatory bodies worldwide are imposing stricter residue limits and environmental discharge standards, compelling manufacturers to innovate greener active ingredients and closed-loop application systems. At the same time, digitalization has permeated on-farm operations, with automated spray rigs, fogging machines, and sensor-equipped sprayers capable of optimizing contact times and reducing chemical waste.

In tandem, innovative chemistries such as nano-encapsulated biocides and enzyme-boosted formulations are enhancing microbial control while minimizing toxicity. The convergence of advanced analytics and Internet of Things connectivity has also enabled predictive maintenance of sanitation equipment and automated documentation of compliance data, driving operational efficiency. Moreover, capital flows into eco-certified and bio-based disinfectants continue to rise as end users prioritize sustainability alongside performance. These combined dynamics are fundamentally reshaping procurement practices, R&D roadmaps, and end-user expectations across the agricultural sector.

Examining the Broad Implications of United States Tariffs Implemented in 2025 on Agricultural Disinfectant Supply Chains and Cost Structures Across Markets

In 2025, the United States implemented a series of reciprocal and sector-specific tariffs that have substantially altered the cost structure and supply chain dynamics for agricultural disinfectant raw materials and finished products. A 10 percent duty on key chemical inputs from China, together with elevated rates on imports originating from Canada and Mexico, has prompted many manufacturers to reassess sourcing strategies and regionalize procurement to mitigate the impact of overlapping levies. The introduction of broader reciprocal tariffs on European Union-origin goods further compounds these pressures, driving landed costs higher and creating volatility in pricing negotiations at every stage of the value chain.

As a result, farmers and distributors face constrained access to core actives such as hydrogen peroxide precursors and peracetic acid concentrates, prompting some end users to explore domestically produced alternatives. Simultaneously, manufacturers are accelerating investment in local production facilities and forging strategic collaborations with regional chemical suppliers to enhance supply resilience. These adaptive measures, while necessary, introduce complexity in inventory management and demand forecasting. Looking ahead, ongoing dialogue between industry associations and trade authorities will be critical to navigate tariff harmonization and maintain consistent access to essential disinfectant solutions.

Uncovering Key Market Segmentation Dynamics Across Disinfectant Types, Forms, Application Modes, Packaging Varieties, End Uses, and Farming Sectors

The agricultural disinfectants market can be understood through multiple segmentation lenses that reveal distinct demand drivers and usage patterns. Disinfectant chemistries range from chlorine-based treatments renowned for rapid microbial kill to potent formaldehyde solutions valued for broad-spectrum efficacy, while hydrogen peroxide and peracetic acid blends offer powerful oxidation without harmful residues. Phenolic compounds continue to deliver persistent surface activity, and quaternary ammonium compounds dominate general-purpose sanitation due to their versatility and compatibility with diverse materials.

Furthermore, product forms influence application scenarios. Aerosols enable uniform coverage of hard-to-reach crevices, gels adhere to vertical surfaces for sustained contact times, liquid formats-available both as concentrates for cost-effective dilution and as ready-to-use offerings for immediate deployment-serve a wide array of operational scales, and powders provide long-term storage stability in challenging environments. The methods of deploying these chemistries include immersion tanks for small tools, dip systems for reusable components, fogging units for rapid broad-area sanitization, targeted spray applications for high-touch surfaces, and wipe-based interventions for spot treatments. Packaging formats such as durable drums accommodate large-volume users, bottles ensure precise dosing in moderate-use settings, flexible pouches offer reduced environmental footprint and portability, and bags cater to powdered disinfectants.

When considering end-use environments, agricultural disinfectants are applied to animal housing facilities, dairy processing equipment, diverse farm implements, non-porous surfaces, and water distribution networks. The spectrum of end users encompasses crop cultivators specializing in cereals, fruits, and vegetables, greenhouse and ornamental growers focused on floriculture and landscape enhancements, and livestock operations ranging from dairy herds and poultry barns to swine facilities. This multi-dimensional segmentation approach highlights the nuanced requirements and performance expectations that drive product development and go-to-market strategies.

This comprehensive research report categorizes the Agricultural Disinfectants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Disinfectant Type

- Form

- Mode Of Application

- Packaging Type

- Application

- End User

Highlighting Critical Regional Variations in Demand, Regulatory Environments, and Adoption Patterns Across the Americas Europe Middle East Africa and Asia Pacific

Regional market characteristics reveal significant variation in disinfectant demand, regulation, and adoption. In the Americas, mature markets emphasize large-scale operations and high throughput, with end users prioritizing low-residue formulations and automated application systems that maximize labor efficiency. North America leads in the deployment of digital record-keeping platforms to document clean-in-place cycles, while Latin American producers show growing interest in bio-based chemistries that address water scarcity and environmental stewardship.

By contrast, Europe, the Middle East and Africa are driven by stringent environmental regulations and consumer expectations for residue-free produce. The European Union’s comprehensive biocide framework mandates rigorous efficacy testing and authorizations, fostering the rise of greener actives and closed-circuit application tools. In emerging Middle Eastern and African markets, the emphasis is on affordable, stable formulations suited to high-temperature environments and variable water quality. Meanwhile, Asia-Pacific exhibits the fastest growth trajectory as modernization accelerates in China, India, and Southeast Asia. Farmers are increasingly integrating fogging and spray systems into post-harvest processes, and local manufacturers are scaling up to meet demand for concentrated formulations that align with cost sensitivities. These regional insights underscore the importance of tailored strategies that reflect distinct regulatory landscapes, economic conditions, and operational modalities.

This comprehensive research report examines key regions that drive the evolution of the Agricultural Disinfectants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Driving Innovation Strategic Partnerships and Portfolio Evolution in the Competitive Agricultural Disinfectants Market Landscape

Several leading players are shaping the evolution of the agricultural disinfectants market through innovation, strategic alliances, and portfolio diversification. Global sanitation specialists have intensified R&D investments to expand their range of bio-based and enzymatic solutions, partnering with enzyme technology providers and nanomaterials experts to enhance efficacy while reducing environmental impact. Meanwhile, multinational chemical companies are leveraging integrated supply chains to offer end-to-end hygiene solutions that bundle disinfectants with dispensing equipment, digital monitoring services, and compliance support.

In parallel, emerging competitors from specialty chemistry sectors have introduced modular dosing systems and subscription-based service models to simplify product replenishment and usage validation for growers. Cross-industry collaborations with agricultural technology firms are gaining traction, enabling the integration of disinfection data into precision-agriculture platforms and farm management software. These developments are catalyzing a shift toward value-added service offerings and recurring revenue streams, reinforcing the competitive positions of companies that can deliver holistic biosecurity outcomes rather than single-product solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Agricultural Disinfectants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- ADAMA Ltd

- BASF SE

- Bayer AG

- Ceva Sante Animale Group

- Corteva Agriscience

- Diversey Holdings Ltd

- Ecolab AB

- Evonik Industries AG

- FMC Corporation

- GEA Group Aktiengesellschaft

- Helena Agri-Enterprises LLC

- Huntsman International LLC

- ICL Group Ltd

- Kemira

- Kersia Group

- Lanxess AG

- Lonza Group AG

- Neogen Corporation

- Nufarm Limited

- Reckitt Benckiser Group

- Stepan Company

- Sumitomo Chemical Co Ltd

- Syngenta Group

- UPL Limited

Actionable Strategic Recommendations for Industry Leaders to Enhance Operational Agility Drive Sustainable Development and Capitalize on Emerging Disinfectant Trends

To thrive amid intensifying regulatory scrutiny, supply chain complexity, and sustainability demands, industry leaders should prioritize diversification of raw material sourcing and invest in local manufacturing capabilities to mitigate tariff and logistics risks. Engaging proactively with regulatory agencies and standardization bodies can expedite product approvals for novel chemistries and application technologies. Equally important is the adoption of cloud-based analytics and Internet of Things platforms to monitor disinfection cycles in real time, enabling immediate corrective actions and comprehensive traceability for audits.

Additionally, organizations should accelerate the transition to eco-certified formulations and packaging innovations that reduce environmental impact and align with evolving consumer expectations. Forging partnerships with enzyme technology firms, biotechnology startups, and precision-agriculture providers will drive differentiation and unlock new service-based revenue models. Finally, enhancing technical support and training programs for distributors and end users will foster loyalty, improve product utilization, and reinforce safe handling practices across diverse operational contexts.

Outlining a Robust Research Methodology Incorporating Diverse Data Sources Stakeholder Interviews and Triangulation Techniques to Ensure Comprehensive Market Insights

This study employed a comprehensive, multi-tiered research methodology to ensure accuracy and depth of insight. Initially, secondary research gathered publicly available information from regulatory databases, peer-reviewed journals, white papers, and industry association publications to map the regulatory landscape and technology trends. Concurrently, detailed analysis of trade data and customs filings provided granularity on import volumes, tariff codes, and regional flow patterns.

In the primary research phase, structured interviews were conducted with stakeholders spanning chemistry suppliers, equipment manufacturers, distributors, farm managers, and regulatory officials across major geographies. These conversations validated emerging trends, identified pain points, and illuminated regional nuances. Quantitative surveys supplemented interview insights, capturing end-user preferences related to efficacy, cost management, and sustainability. Finally, data triangulation and iterative reviews by an expert advisory panel ensured that findings were robust, unbiased, and reflective of real-world market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Agricultural Disinfectants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Agricultural Disinfectants Market, by Disinfectant Type

- Agricultural Disinfectants Market, by Form

- Agricultural Disinfectants Market, by Mode Of Application

- Agricultural Disinfectants Market, by Packaging Type

- Agricultural Disinfectants Market, by Application

- Agricultural Disinfectants Market, by End User

- Agricultural Disinfectants Market, by Region

- Agricultural Disinfectants Market, by Group

- Agricultural Disinfectants Market, by Country

- United States Agricultural Disinfectants Market

- China Agricultural Disinfectants Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Core Findings to Emphasize the Strategic Imperatives and Future Outlook for Agricultural Disinfectants Amid Evolving Market and Regulatory Dynamics

The agricultural disinfectants market is characterized by rapid technological evolution, increasing sustainability requirements, and complex international trade dynamics. Across the value chain, regulatory updates are fueling demand for greener chemistries and closed-loop application systems, while digital integration offers unprecedented visibility and efficiency. Meanwhile, tariff policies have underscored the strategic importance of supply chain resilience and localized production models. These combined forces are driving a new paradigm in biosecurity, where performance, safety, and environmental compatibility must coexist seamlessly.

Given the multifaceted segmentation spanning chemistries, product forms, application techniques, packaging configurations, and end-user contexts, successful market participation demands nuanced strategies tailored to specific operational challenges and regional frameworks. Leading companies are responding with expanded portfolios, strategic alliances, and novel service offerings that address the entire sanitation lifecycle. By embracing the actionable recommendations outlined herein-spanning supply chain diversification, regulatory engagement, and digital transformation-industry participants can position themselves for sustained growth and leadership in an ever-changing agricultural hygiene landscape.

Engage with the Associate Director of Sales and Marketing to Access In-Depth Agricultural Disinfectants Market Intelligence and Strategic Insights

To gain complete and strategic insight into the agricultural disinfectants market, industry stakeholders are encouraged to connect with Ketan Rohom, Associate Director of Sales & Marketing. Engaging early with this report will equip teams with the actionable intelligence needed to navigate complex regulatory frameworks, seize emerging growth opportunities, and optimize product portfolios for maximum impact. Ketan brings extensive experience partnering with agribusiness leaders to deliver bespoke guidance on market entry, competitive positioning, and long-term planning. His expertise ensures that clients receive tailored support and the deepest understanding of evolving supply chain dynamics. Reach out to schedule a briefing, discuss customized deliverables, and secure access to the full report that will empower your organization’s decision makers. By collaborating with Ketan Rohom, you will unlock strategic advantages that drive operational excellence and sustainable growth in the fast-evolving agricultural disinfectants landscape.

- How big is the Agricultural Disinfectants Market?

- What is the Agricultural Disinfectants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?