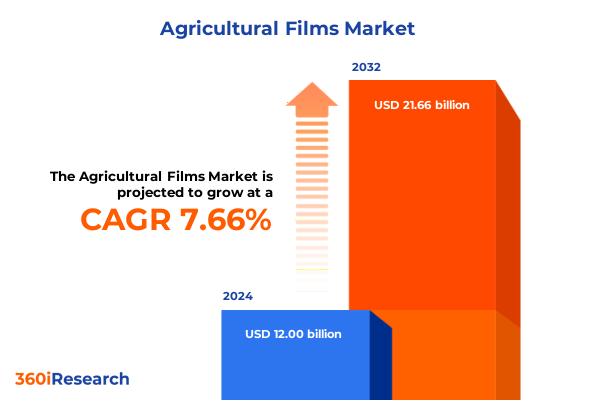

The Agricultural Films Market size was estimated at USD 12.83 billion in 2025 and expected to reach USD 13.72 billion in 2026, at a CAGR of 7.76% to reach USD 21.66 billion by 2032.

Unveiling the Strategic Importance of Agricultural Films in Modern Farming Operations for Sustainable Crop Protection and Yield Optimization

Agricultural films have emerged as indispensable tools in modern farming, reshaping the way growers approach crop protection, greenhouse management, and soil conservation. With increasing pressures from climate variability, resource scarcity, and evolving consumer demands for sustainable practices, these specialized polymer-based films deliver critical advantages, including enhanced moisture retention, temperature regulation, and suppression of weeds and pests. As global food security concerns intensify, the strategic adoption of agricultural films stands out as a cost-effective, scalable solution that can substantially boost productivity while aligning with environmental stewardship goals.

Beyond traditional cultivation methods, the versatility of films-whether applied as greenhouse coverings or mulch layers-provides opportunities for crop diversification and extension of growing seasons, allowing producers to meet shifting market demands and capture premium pricing. Innovation in film formulations, driven by advanced polymer science and biodegradable alternatives, further underscores the sector’s commitment to minimizing ecological footprints. This introductory exploration underscores how agricultural films serve as the nexus between agronomic performance and sustainable development, setting the stage for a detailed examination of the technological, regulatory, and market forces driving industry evolution.

Identifying the Transformative Technological, Regulatory, and Market Shifts Reshaping the Agricultural Films Industry Worldwide

The agricultural film landscape is undergoing transformative shifts propelled by technological breakthroughs, evolving regulatory frameworks, and dynamic end-user expectations. Advances in polymer blends and multilayer extrusion techniques have enabled the production of films that combine strength with biodegradability, addressing longstanding concerns around plastic pollution in agricultural soils. Simultaneously, smart films embedded with sensors and spectral filters are gaining traction, offering real-time monitoring of crop microclimates and targeted light modulation to boost photosynthetic efficiency.

On the regulatory front, governments across key markets are tightening restrictions on non-biodegradable plastics and incentivizing the use of compostable alternatives, catalyzing a transition toward circular economy principles. These mandates are complemented by industry-led initiatives to establish film take-back schemes and standardized degradation testing protocols. Market consolidation among film manufacturers is also accelerating, as scale becomes crucial to funding research and securing sustainable polymer feedstocks. Collectively, these technological innovations, policy developments, and commercial realignments are reshaping competitive dynamics and setting new benchmarks for performance and environmental responsibility.

Analyzing the Cumulative Impact of United States Tariff Measures in 2025 on Agricultural Film Supply Chains and Competitive Dynamics

In 2025, the United States implemented a series of tariff measures targeting imported polymer resins and finished agricultural films, significantly altering supply chain economics and competitive positioning. Tariffs on key polymer categories imported from major producing regions prompted domestic processors to reevaluate sourcing strategies, leading to renewed investments in local compounding and resin production infrastructure. While downstream film manufacturers initially grappled with cost pressures, many leveraged the disruption to strengthen relationships with regional resin suppliers and diversify their raw material portfolios.

Over time, the tariffs catalyzed a gradual realignment of trade flows, with manufacturers in countries not subject to U.S. duties gaining incremental export opportunities. At the same time, the U.S. government’s parallel support for research in bio-based polymers and in-line film recycling technologies helped offset some of the frictions by fostering alternative materials development. Stakeholders across the value chain witnessed shifts in lead times, margin structures, and competitiveness, highlighting the importance of adaptive supply chain risk management and forward-looking procurement strategies in a period of sustained policy-driven volatility.

Revealing Actionable Insights from Comprehensive Segmentation Across Film Type, Polymer Composition, Thickness, Application, and Sales Channels

A nuanced understanding of market segmentation is vital for identifying growth pockets and tailoring product offerings. From a film type perspective, geomembrane films designed for lining and containment applications exhibit distinct performance criteria compared to greenhouse films used to modulate light and temperature for high-value crops. Mulch films, which suppress weeds and retain soil moisture, cater to broad-acre row crops, while silage films must balance tensile strength with oxygen barrier properties to preserve fodder.

Polymer type differentiation further refines this landscape. Products formulated with ethylene vinyl acetate deliver elasticity and impact resistance for demanding environments, whereas films based on polybutylene adipate terephthalate offer a biodegradable alternative that alleviates disposal challenges. Polypropylene remains a workhorse for cost-sensitive applications, providing a favorable balance of mechanical stiffness and clarity.

Film thickness segmentation-whether below 100 microns for lightweight mulch applications, within a mid-range band of 100 to 150 microns for greenhouse environments, or above 150 microns for robust geomembrane and silage requirements-drives considerations around durability and material consumption. Application-based insights reveal that crop protection films extend beyond basic mulching to include specialized cover crop solutions; greenhouse films now span hoop house to tunnel configurations; silage coverings vary between bale wraps and storage bags; and water management roles encompass both drip irrigation and general irrigation films. Sales channel analysis highlights the strategic roles of direct sales relationships for large-scale growers, distributor networks for regional penetration, and online retail avenues that cater to smaller farms and specialty applications.

This comprehensive research report categorizes the Agricultural Films market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Polymer Type

- Film Thickness

- Application

- Sales Channel

Mapping Regional Variations in Agricultural Film Demand and Adoption Trends Across the Americas, Europe, Middle East & Africa, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping demand drivers and adoption rates for agricultural films. In the Americas, producers benefit from well-established infrastructure, extensive row-crop operations, and growing regulatory momentum toward sustainable plastic use, creating fertile ground for innovative biodegradable films and recycling initiatives. Meanwhile, Europe, the Middle East, and Africa exhibit diverse market maturity levels, with Western European nations leading in high-performance greenhouse coverings and circular economy pilots, and emerging markets in the Middle East and North Africa rapidly scaling irrigation film applications to optimize scarce water resources.

Asia-Pacific presents one of the most dynamic growth environments, as varied climatic zones and intensive horticultural practices fuel demand for advanced greenhouse films, mulch systems adapted to rice paddies, and silage solutions in livestock-intensive regions. Government programs across Australia and parts of Southeast Asia incentivize plastic replacement with eco-friendly materials, driving both local production and imports of next-generation agricultural films. These regional insights underscore the importance of tailoring value propositions and partnerships to local agronomic conditions, regulatory contexts, and supply chain infrastructures.

This comprehensive research report examines key regions that drive the evolution of the Agricultural Films market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Approaches and Competitive Positioning of Leading Agricultural Film Manufacturers to Identify Market Leadership and Innovation Drivers

Leading manufacturers and suppliers are leveraging distinctive capabilities to capture market opportunities and address evolving customer expectations. Established film producers are extending their portfolios to include biodegradable and UV-stabilized options, integrating in-house polymer compounding and extrusion capacity to ensure consistent quality. Strategic acquisitions of specialty resin innovators have enabled several firms to secure proprietary formulations that deliver differentiated performance, such as enhanced light diffusion and anti-condensation properties for greenhouse environments.

At the same time, smaller agile players are forging partnerships with agritech startups to incorporate sensor technology into films, offering integrated solutions that blend physical protection with digital agronomy. Collaborations with agricultural cooperatives and research institutions have become more common, enabling co-development of site-specific film applications validated through field trials. Additionally, sales and distribution strategies are evolving as digital platforms and direct-to-farm engagements gain traction, reducing lead times and enhancing customer support. Collectively, these competitive maneuvers highlight a market where both scale and specialization are essential for leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Agricultural Films market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ab Rani Plast Oy

- Achilles Corporation

- Agriplast Protected Cultivation Private Limited

- Agripolyane

- Armando Alvarez, S.A.

- Barbier Group

- BASF SE

- Berry Global Inc.

- Celanese Corporation

- Coveris Management GmbH

- Dow Inc.

- EcoPoly Solutions

- Exxon Mobil Corporation

- Ginegar Plastic Products Ltd.

- Imaflex Inc.

- Kuraray Co., Ltd

- LyondellBasell Industries N.V

- Mitsui Chemicals Inc.

- Novamont S.p.A.

- Plastik V Sdn. Bhd.

- Plastika Kritic S.A.

- POLIFILM GmbH

- Polyplex Corporation Limited

- Polythene UK Ltd.

- RKW Group

- Solvay S.A.

- Trioworld Industrier AB

- Viaflex

Formulating Actionable Strategic Recommendations to Drive Growth, Sustainability, and Resilience for Industry Leaders in the Agricultural Film Sector

To navigate a rapidly changing environment, industry leaders should prioritize investments in sustainable polymer research, focusing on bio-based feedstocks and enhanced end-of-life solutions such as compostability and recyclability. Establishing circular partnerships with resin producers, waste management firms, and agricultural cooperatives can mitigate regulatory risks and reinforce brand reputation. In parallel, integrating digital agronomy tools into film offerings-whether through embedded sensors or mobile-enabled crop monitoring services-can create new revenue streams and deepen customer relationships.

Operationally, firms must enhance supply chain resilience by diversifying raw material sources and developing localized compounding capabilities to buffer against geopolitical disruptions and tariff volatility. Collaborative field trials, conducted in partnership with growers and research bodies across key regions, will accelerate product validation and demonstrate tangible benefits in yield enhancement, resource efficiency, and environmental impact. Finally, adopting a customer-centric sales strategy-blending direct field support with value-added digital platforms-will be essential to differentiate offerings and foster long-term loyalty.

Detailing a Robust and Transparent Research Methodology Emphasizing Data Collection, Validation Processes, and Analytical Rigor Supporting Report Findings

Our research methodology combines rigorous primary and secondary data collection to ensure comprehensive and balanced insights. Primary research comprised in-depth interviews with senior executives from leading film manufacturers, polymer suppliers, agricultural cooperatives, and regulatory bodies, complemented by field visits to production facilities and greenhouse operations. These interactions provided firsthand perspectives on production processes, innovation pipelines, and regional market dynamics.

Secondary research involved systematic analysis of policy documents, technical journals, and reputable industry publications, alongside review of patent databases and trade association reports. Data validation processes included triangulation across multiple sources and peer review by subject-matter experts. Quantitative inputs were cross-checked with operational benchmarks to uphold consistency, while qualitative findings were contextualized within broader agronomic and environmental trends. This multi-layered approach ensures that all conclusions and recommendations are grounded in verifiable evidence and reflect the latest industry developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Agricultural Films market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Agricultural Films Market, by Type

- Agricultural Films Market, by Polymer Type

- Agricultural Films Market, by Film Thickness

- Agricultural Films Market, by Application

- Agricultural Films Market, by Sales Channel

- Agricultural Films Market, by Region

- Agricultural Films Market, by Group

- Agricultural Films Market, by Country

- United States Agricultural Films Market

- China Agricultural Films Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Insights Highlighting Key Takeaways, Industry Outlook, and Strategic Imperatives for Stakeholders in the Agricultural Film Market

In closing, agricultural films stand at the intersection of technological innovation and sustainable agriculture, offering transformative opportunities for crop protection, resource management, and yield optimization. The industry’s trajectory will be shaped by continued advancements in polymer science, evolving regulatory frameworks that favor eco-friendly materials, and the integration of digital agronomy tools. Leaders who proactively adapt to these trends-through strategic partnerships, circular economy initiatives, and customer-centric solutions-will be best positioned to capture value in an increasingly competitive landscape.

As the market evolves, stakeholders must remain vigilant to supply chain disruptions, tariff adjustments, and regional policy shifts, leveraging data-driven insights to inform investment decisions. By championing innovation, fostering collaboration across the value chain, and aligning product development with sustainability imperatives, organizations can secure both economic growth and environmental stewardship. These strategic imperatives will define the next generation of agricultural film solutions, ensuring resilience and success for growers, manufacturers, and the broader food system.

Prompting Decision-Makers to Connect with Ketan Rohom, Associate Director of Sales & Marketing, to Access Comprehensive Agricultural Film Market Research Insights

For those seeking a deeper understanding of how agricultural films are redefining crop protection, greenhouse management, and water conservation, our comprehensive market research report provides unparalleled insight and actionable intelligence. Connect with Ketan Rohom, Associate Director of Sales & Marketing at our firm, to explore detailed analysis, competitor benchmarking, and strategic guidance tailored to your organization’s goals. Don’t miss the opportunity to leverage our rigorous research and expert recommendations to stay ahead in an evolving market landscape. Reach out today to secure your copy and empower your decision-making with the latest trends and future-ready strategies.

- How big is the Agricultural Films Market?

- What is the Agricultural Films Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?