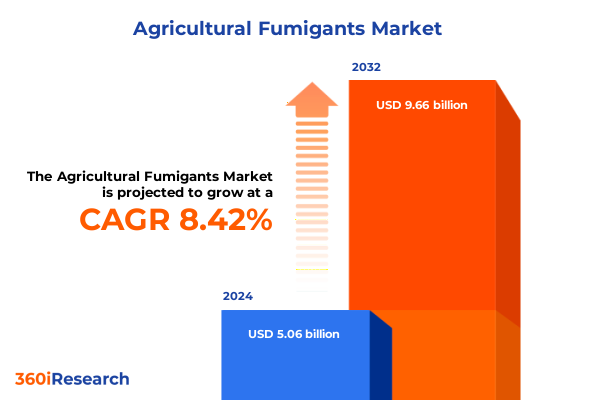

The Agricultural Fumigants Market size was estimated at USD 5.48 billion in 2025 and expected to reach USD 5.91 billion in 2026, at a CAGR of 8.44% to reach USD 9.66 billion by 2032.

Unveiling the Critical Role of Agricultural Fumigants in Safeguarding Crop Yields and Addressing Emerging Environmental and Regulatory Challenges

Agricultural fumigants have long served as a cornerstone in protecting global crop production from the devastating impacts of soil-borne pathogens, stored-product pests, and structural infestations. From early reliance on synthetic chemicals like methyl bromide to modern integration of advanced formulations, the industry has continuously evolved to meet escalating demands for crop safety and yield optimization. Fumigants not only safeguard harvest quality during post-harvest storage but also enhance soil health by suppressing nematodes and fungi, thereby ensuring that farmers can deliver consistent, high-value produce to markets around the world.

In recent years, the convergence of heightened environmental awareness and stringent regulatory frameworks has prompted a paradigm shift for fumigant deployment. Policymakers are prioritizing ozone layer protection and reducing greenhouse gas emissions, while growers face ever-stricter application guidelines for both worker safety and ecological integrity. At the same time, emerging discoveries in microbial and plant-based biofumigants are challenging the dominance of conventional mixtures and synthetics. As stakeholder expectations realign around sustainability and resilience, a nuanced understanding of fumigant types, formulations, and application strategies becomes imperative for decision-makers seeking to balance efficacy with environmental stewardship.

Charting the Transformative Shifts in Agricultural Fumigant Practices Driven by Technological Innovation and Policy Reform

Over the past decade, the agricultural fumigant arena has experienced transformative shifts driven by breakthroughs in formulation science and progressive policy reforms. The phase-out of methyl bromide under global agreements sparked accelerated innovation in metam sodium alternatives and granular delivery systems. These technological strides have delivered more targeted soil treatments with reduced off-gassing, while enhanced gas formulations now claim faster diffusion rates and deeper penetration across varied soil types. This evolution has enabled growers to tailor interventions more precisely, minimizing non-target impacts and shortening re-entry intervals for field personnel.

Concurrently, regulatory bodies worldwide have recalibrated fumigant usage guidelines, imposing tiered application thresholds and mandating comprehensive safety assessments. Such policy reform has compelled manufacturers to invest in next-generation biofumigants, including microbial agents and plant-derived extracts, which can complement or partially replace traditional chemicals. Alongside this, precision delivery methods-ranging from soil injection rigs equipped with GPS mapping to structural fumigation drones-have reduced active ingredient consumption while maintaining control efficacy. The interplay of these technological innovations and regulatory adaptations underscores a pivotal era of adaptation, positioning the fumigant sector for sustainable growth through efficiency and environmental consciousness.

Analyzing the Cumulative Impact of United States Agricultural Fumigant Tariff Adjustments in 2025 on Supply Chains and Pricing Pressures

In early 2025, the United States implemented a revised tariff structure targeting key raw materials and formulated fumigant imports, reshaping cost dynamics across the supply chain. These adjustments have disproportionately affected Chloropicrin precursors and certain synthetic chemical blends, as duty rates climbed in response to ongoing trade negotiations and domestic manufacturing incentives. As a result, leading producers have reassessed their procurement strategies, exploring regional sourcing partnerships and in-country production to mitigate rising import expenses.

The cumulative impact on end users has become increasingly pronounced, with distributors passing incremental cost pressures along to agricultural cooperatives and commodity handlers. Faced with this new tariff environment, many stakeholders have accelerated adoption of domestically produced biofumigant alternatives that remain tariff-exempt or benefit from local manufacturing incentives. While the immediate consequence has been a modest uptick in per-unit treatment costs, longer-term effects are emerging in the form of strengthened domestic R&D pipelines and more resilient supply networks. These shifts highlight the importance of strategic tariff management and adaptive sourcing to maintain access to critical fumigant solutions.

Revealing Key Segmentation Insights across Fumigant Types, Formulations, Application Methods, Crop Categories, and Technological Innovations

Insight into fumigant type segmentation reveals that Chloropicrin, Metam Sodium, and the legacy presence of Methyl Bromide continue to define strategic product portfolios. While Chloropicrin maintains a strong position for structural applications and soil pests, metam sodium’s versatility across liquid soil treatments has attracted renewed interest among large-scale grain producers. Despite its reduced usage, methyl bromide persists in niche post-harvest applications where no direct substitute yet matches its fumigant potency.

Formulation segmentation underscores divergent demands for gas, granule, liquid, and tablet formats. Gas formulations excel in rapid, homogeneous dispersion for high-value stored commodities, whereas granules have captured interest for ease of handling and lower volatility in on-field soil treatments. Liquid formulations remain ubiquitous, largely due to their compatibility with existing irrigation and injection equipment, while fumigant tablets are carving out a distinct niche in targeted post-harvest chambers.

Turning to application methods, grain treatment and post-harvest treatment dominate usage among commercial handlers, though soil treatment grows steadily in regions with strict export quality standards. Structural fumigation, catering to storage facilities and infrastructure, continues to demand specialized expertise and regulatory compliance. Deep-diving into crop segmentation reveals Fruits And Vegetables as the fastest adopters of biofumigant blends, followed by Grains And Cereals where conventional mixtures still prevail, and Ornamentals where value-driven end markets prioritize minimal residual chemistries.

Technological segmentation has emerged as a critical lens, with biofumigants-especially microbial agents and plant extracts-gaining traction for their lower environmental footprint and compatibility with integrated pest management protocols. Conventional offerings, composed of synthetic chemicals and strategic mixtures, maintain their dominance in high-intensity applications but face mounting scrutiny regarding worker safety and environmental impact. This multi-dimensional segmentation insight provides a roadmap for aligning product development, regulatory strategy, and market positioning.

This comprehensive research report categorizes the Agricultural Fumigants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fumigant Type

- Formulation Type

- Application Method

- Crop Type

- Technology

- Sales Channel

Uncovering Regional Dynamics and Demand Drivers for Agricultural Fumigants in the Americas, EMEA, and Asia-Pacific Territories

Across the Americas, demand for agricultural fumigants is closely tied to expansive grain and oilseed production, with North America leading in research funding for biofumigant development and Canada expanding metam sodium usage under zero-export residue initiatives. Latin American markets have prioritized cost-effective conventional chemicals to support large-scale sugarcane and citrus operations, although Brazil and Argentina have begun piloting plant extract solutions to meet stringent EU import requirements. Trade agreements within the region are fostering collaborative frameworks to harmonize safety standards and streamline fumigant approvals.

In the Europe, Middle East & Africa region, fumigant landscapes vary dramatically. The EU enforces rigorous application protocols and maintains near-zero tolerance for methyl bromide, driving innovation in granular and liquid alternatives. Meanwhile, Middle Eastern grain silos increasingly rely on chloropicrin blends for disinfestation, and African exporters are evaluating portable fumigation chambers to secure access to high-value Mediterranean markets. Across the region, drought-induced soil degradation has spurred interest in microbial biofumigants that can improve soil health while controlling pests.

Asia-Pacific stands out for its diverse crop mix, from rice paddies in Southeast Asia to orchard farms in Australia. China continues to invest heavily in synthetic chemical research but is gradually unlocking regulatory pathways for microbial agents. India has scaled pilot programs for plant extract fumigants to address stringent pesticide residue limits in export-bound spices. In Oceania, Australia and New Zealand leverage advanced gas monitoring technologies to optimize fumigant applications under strict environmental stewardship guidelines. This regional mosaic underscores the need for tailored approaches that reflect local regulatory landscapes, crop profiles, and sustainability objectives.

This comprehensive research report examines key regions that drive the evolution of the Agricultural Fumigants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Assessing Leading Agricultural Fumigant Manufacturers and Strategic Collaborations Shaping Competitive Landscapes and Market Strategies

Global manufacturers are reshaping their portfolios through a blend of organic growth and strategic partnerships. Leading chemical producers have aligned their R&D pipelines toward next-generation biofumigant platforms, securing access to proprietary microbial strains and plant-derived actives. In parallel, specialty agri-inputs companies have forged alliances with biotech startups, integrating digital soil health diagnostics with targeted fumigant applications. These collaborations reflect a broader trend toward converging chemical and biological science to meet evolving efficacy requirements.

Merger and acquisition activity has intensified as legacy players seek to broaden their geographic footprint and augment their technology stack. Recent deals have seen synthetic chemical powerhouses acquiring microbial inoculant firms, while agritech innovators have secured capital infusions to accelerate field trials. Such consolidation has created more diversified product portfolios, enabling companies to offer bundled solutions that combine fumigants, soil amendments, and crop protection advisories. These strategic moves are catalyzing a more competitive landscape where the ability to deliver end-to-end solutions distinguishes market leaders.

This comprehensive research report delivers an in-depth overview of the principal market players in the Agricultural Fumigants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AMVAC Chemical Corporation

- Arkema SA

- BASF SE

- Bayer AG

- DEGESCH America, Inc.

- Douglas Products

- Dow Chemical Company

- Eastman Chemical Company

- FMC Corporation

- Imaflex Inc.

- Imtrade CropScience

- Intertek Group PLC

- Lanxess AG

- Nippon Chemical Industrial Co.,Ltd.

- Novozymes A/S

- Nufarm Limited

- Rentokil Initial PLC

- Royal Agro Organic Pvt. Ltd.

- Solvay S.A.

- Syngenta Crop Protection AG

- Tessenderlo Group

- Trinity Manufacturing, Inc.

- UPL Limited

Implementing Actionable Recommendations for Industry Leaders to Drive Sustainable Growth and Innovation in Agricultural Fumigant Practices

Industry leaders should prioritize investment in biofumigant R&D to respond proactively to tightening environmental regulations and customer demand for sustainable solutions. By establishing dedicated innovation hubs, companies can expedite the screening of microbial agents and plant extracts, reducing time-to-market for lower-impact alternatives. Concurrently, enhancing digital integration-such as embedding soil moisture and pest detection sensors into application equipment-will optimize active ingredient placement and minimize overall chemical usage.

Supply chain resilience can be fortified through diversified sourcing strategies that couple domestic production of key intermediates with strategic partnerships in emerging markets. Collaboration with policymakers to harmonize safety standards and streamline registration processes will further accelerate technology adoption. Finally, embedding integrated pest management principles into product stewardship programs will build trust with end users and create new value propositions, positioning companies to capture growth as growers demand both performance and ecological responsibility.

Detailing Rigorous Multi-Source Research Methodology Integrating Qualitative Expertise and Quantitative Analysis for Comprehensive Agricultural Fumigant Insights

This analysis synthesizes insights from a robust, multi-source research methodology that combines quantitative data aggregation with qualitative expert assessment. The process began with a thorough review of peer-reviewed journals, regulatory filings, and technical white papers to compile an exhaustive database of fumigant compositions, usage patterns, and environmental impact metrics. These data points served as the foundation for trend analysis and cross-segmentation mapping.

To enrich the quantitative framework, in-depth interviews were conducted with agronomists, soil scientists, formulation experts, and regulatory officials across major producing regions. Their firsthand perspectives provided critical context on application challenges, adoption barriers, and emerging best practices. Additionally, proprietary case studies were evaluated to benchmark operational efficiencies and assess commercial scalability. Triangulating these diverse inputs through rigorous validation protocols ensured the findings present an accurate, actionable portrait of the agricultural fumigant landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Agricultural Fumigants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Agricultural Fumigants Market, by Fumigant Type

- Agricultural Fumigants Market, by Formulation Type

- Agricultural Fumigants Market, by Application Method

- Agricultural Fumigants Market, by Crop Type

- Agricultural Fumigants Market, by Technology

- Agricultural Fumigants Market, by Sales Channel

- Agricultural Fumigants Market, by Region

- Agricultural Fumigants Market, by Group

- Agricultural Fumigants Market, by Country

- United States Agricultural Fumigants Market

- China Agricultural Fumigants Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesis of Agricultural Fumigant Market Dynamics Highlighting Challenges, Opportunities, and Pathways to Enhanced Sustainable Crop Protection

The agricultural fumigant ecosystem is navigating a complex intersection of efficacy demands, environmental imperatives, and evolving trade dynamics. Traditional chemistries remain essential for high-intensity pest control, yet biofumigants are rapidly gaining acceptance as viable, lower-impact substitutes. The interplay between tariff adjustments, regulatory reforms, and segmentation-specific drivers will continue to reshape supply chains and pricing structures.

Moving forward, success will hinge on the ability to integrate advanced formulation technologies, agile sourcing strategies, and collaborative innovation models. By aligning product development with the nuanced needs of different crop categories, application methods, and regional market conditions, stakeholders can unlock new pathways to sustainable crop protection. Ultimately, the future of agricultural fumigants lies in balancing performance with environmental stewardship and economic resilience.

Connect with Associate Director Ketan Rohom to Secure Exclusive Access to In-Depth Agricultural Fumigant Market Research and Strategic Insights

For a deeper dive into comprehensive agricultural fumigant analysis and to unlock tailored solutions that drive both efficacy and profitability, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. He can guide you through the key insights and strategic recommendations outlined in the report, ensuring you leverage the full spectrum of actionable intelligence to stay ahead in a competitive and rapidly evolving landscape. Engage now to secure your competitive edge and transform your approach to crop protection with expert-level guidance and bespoke support.

- How big is the Agricultural Fumigants Market?

- What is the Agricultural Fumigants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?