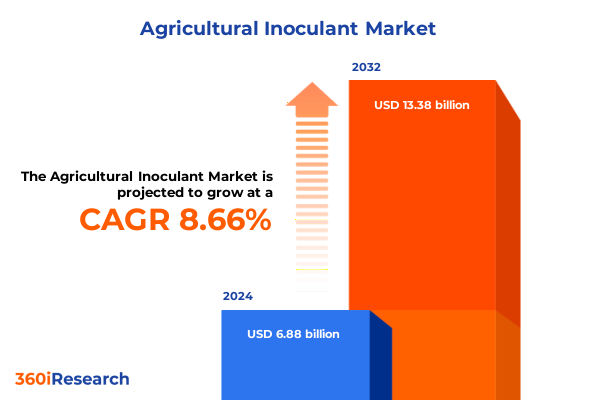

The Agricultural Inoculant Market size was estimated at USD 7.42 billion in 2025 and expected to reach USD 8.00 billion in 2026, at a CAGR of 8.79% to reach USD 13.38 billion by 2032.

A concise and strategic introduction to why agricultural inoculants are transitioning from niche innovation to essential biological tools for modern crop systems

The agricultural inoculant landscape is at an inflection point where biological science, regulatory change, and commercial scaling converge to redefine how growers approach soil health and nutrient management. Microbial solutions-ranging from nitrogen‑fixing bacteria to mycorrhizal fungi and beneficial Trichoderma strains-are moving from niche trial use into mainstream agronomic toolkits as growers seek resilience against climate variability and pressure to reduce synthetic inputs. This transition is being driven by better biological formulations, improved delivery systems, and an expanding evidence base that links inoculants to enhanced nutrient availability and plant stress tolerance, making them relevant across row crops, high‑value horticulture, pulses, and turf applications. The result is a complex but opportunity‑rich environment for product developers, input distributors, and strategic buyers.

Industry participants must now reconcile three simultaneous realities: first, product efficacy is increasingly supported by reproducible field trials and peer‑reviewed science; second, regulatory frameworks are tightening and clarifying definitions for biostimulants and bioinputs in major jurisdictions; and third, commercial players are investing in manufacturing and supply chains to scale biological production. Taken together, these forces are shortening the path from laboratory discovery to on‑farm adoption, while raising the bar for product claims, registration evidence, and quality control.

How scientific breakthroughs, regulatory clarity, manufacturing investments, and changing go‑to‑market channels are reshaping the inoculant industry landscape

The past three years have seen a rapid acceleration of transformative shifts that affect product development, distribution, and on‑farm adoption of inoculants. Analytical advances in microbiome science and strain optimization now allow developers to tune consortia for specific crop environments and stress profiles, improving repeatability in the field. Formulation science has matured so that liquid, powder, and granule carriers preserve viability longer and integrate with seed treatments and precision application systems, enabling broader compatibility with existing farm workflows.

Parallel to technical progress, regulatory and policy movements are reshaping commercial incentives. Several jurisdictions have moved to define and harmonize biostimulant and fertiliser categories, reducing ambiguity and making cross‑border trade easier for compliant products. Procurement practices among large food and retail supply chains increasingly reward verified sustainability performance, pushing growers to test biological alternatives. Distribution channels are also diversifying: while traditional agronomy distributors remain central for row‑crop scale, online sales and direct manufacturer programs are growing for specialty crops and smaller farms, creating multiple pathways to market. These combined shifts are not incremental; they are restructuring competitive dynamics, enlarging the addressable opportunity for firms that can couple robust science with compliant, scalable manufacturing and efficient go‑to‑market approaches. For stakeholders who understand these inflection points, there are clear routes to outpace competitors and capture early adopter loyalty.

An evidence‑based synthesis of how the 2025 tariff actions disrupted input sourcing, triggered regional production shifts, and reshaped procurement priorities across agricultural supply chains

The tariff actions implemented and announced in 2025 have created measurable friction across agricultural supply chains, affecting input costs, logistics and trade flows for biological and conventional inputs alike. Broad additional duties on goods from select trading partners raised uncertainty about the landed cost of imported carriers, fermentation inputs, packaging materials and some specialty chemistries used in formulation and preservation. Policy updates also introduced temporary carve‑outs and compliance windows tied to regional trade agreements, which created a confusing short‑term environment for supply planners and procurement teams.

Beyond direct cost effects, the tariffs triggered retaliatory measures from trading partners and prompted legal and political challenges that have added operational risk. These dynamics have incentivized several manufacturers to accelerate regionalization of production, invest in domestic fermentation and quality‑control capacity, and re‑optimize inventory strategies to preserve supply continuity. For commercial teams, the key implications are practical: sourcing strategies must now incorporate tariff exposure scenarios, contract terms should be revisited for landed‑cost protections, and product roadmaps need contingency options for raw‑material substitutions or localized manufacturing. The net impact is a renewed focus on resilience over lowest‑cost sourcing, and on near‑term operational agility to manage policy volatility. These observations are corroborated by official proclamations and customs guidance that implemented additional ad valorem duties and related administrative changes during 2025, creating both immediate and ripple effects across agricultural inputs and trade relationships.

Actionable segmentation insights explaining how type, crop, formulation, end use, application method, and sales channel determine product fit, adoption speed, and go‑to‑market tactics

Segmentation analysis reveals distinct commercialization and adoption dynamics for each product, crop, formulation, end use, application method, and sales channel. By type, bacterial inoculants such as Rhizobium, Azospirillum and Azotobacter show strong alignment with legume and row‑crop systems where symbiotic nitrogen fixation or root growth promotion delivers visible agronomic value; fungal solutions such as mycorrhizae (both ectomycorrhizae and endomycorrhizae) and fungal biocontrol agents like Trichoderma are proving particularly effective in horticultural, turf and soil‑health oriented applications where root architecture and nutrient uptake reliability matter most. Crop segmentation highlights that cereals and grains, fruits and vegetables, pulses and oilseeds, and turf and ornamentals each present different ROI horizons and product fit: inoculants for high‑value vegetables and turf must deliver rapid, repeatable outcomes at smaller scale, while row‑crop adoption depends on consistent return across broad geographies.

Formulation choices-granules, liquids and powders-drive logistics, shelf life and compatibility with on‑farm application practices. Liquid and seed‑coating compatible formulations tend to promote easier adoption where equipment integration is mature, whereas granules and powders remain relevant where storage stability and low‑temperature distribution logistics are limiting factors. End‑use segmentation shows conventional and organic farming customers pursue biologicals for different reasons: organic growers often use inoculants as core fertility tools, while conventional producers typically integrate biologicals into an input stack as targeted efficiency enhancers. Application method-foliar spray, seed treatment, and soil treatment-determines product development priorities because adhesion, survival and colonization performance requirements change with delivery. Finally, sales‑channel segmentation between direct, distributor and online pathways reveals a bifurcated route to market where scale players rely on distributor relationships and national agronomy networks, while niche crops and specialty products increasingly leverage direct or digital channels for margin capture and customer education.

This comprehensive research report categorizes the Agricultural Inoculant market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Crop

- Formulation

- End Use

- Application Method

- Sales Channel

Regional contrasts and strategic implications for inoculant market entry and scale across the Americas, Europe Middle East & Africa, and Asia‑Pacific jurisdictions

Regional dynamics are driving differentiated adoption patterns and regulatory approaches in the Americas, Europe/Middle East & Africa, and Asia‑Pacific, creating distinct strategic implications for market entry and scale. In the Americas, policy uncertainty around trade and tariffs has prompted many manufacturers to prioritize North American manufacturing and distribution resilience, while innovative growers in parts of the United States, Canada and Brazil are piloting integrated biological packages to reduce synthetic inputs and manage soil health risk. The development of domestic production capacity is increasingly a commercial imperative to avoid tariff exposure and transport volatility. Evidence of coordinated regulatory review and federal interest in biotechnology oversight has also influenced how companies plan evidence packages and registration timelines.

In Europe, harmonized fertiliser and biostimulant frameworks and recent updates to the EU fertilising products regulation have reduced regulatory ambiguity and created clearer pathways for CE‑marked products. These changes have driven faster market access for compliant microbial products, but they also impose stricter documentation, labelling and contaminant thresholds that raise compliance costs for new entrants and for producers that seek pan‑European distribution. The result is a market that rewards regulatory maturity and quality assurance systems.

Asia‑Pacific exhibits rapid policy‑driven growth where national programs in countries such as India and China actively promote biofertilizer and biopesticide adoption as part of broader fertilizer‑reduction or green‑growth targets. These programs couple subsidies, strain development initiatives and streamlined registration processes to encourage domestic production and adoption. However, country‑level heterogeneity in quality standards, registration timelines, and infrastructure means that success requires local partnerships, adaptable formulations and an understanding of government procurement or subsidy mechanisms.

This comprehensive research report examines key regions that drive the evolution of the Agricultural Inoculant market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key company actions and competitive posture insights showing why manufacturing scale, consortium products, and distribution partnerships determine market leadership

Leading agribusiness, biotechnology and ingredient‑specialist companies are investing to secure positions across the inoculant value chain-research, strain development, formulation science, and manufacturing scale. Large diversified crop‑input firms are expanding biological portfolios through both organic R&D and targeted facility investments to ensure manufacturing capacity and quality control for fermentation‑based products. At the same time, specialist bioag and microbial companies are commercializing multi‑active inoculant stacks and formulation platforms that combine multiple microbial modes of action to broaden product reliability across more variable field conditions. These strategic moves reflect a market logic where breadth of crop coverage and reproducible field performance materially influence adoption by commercial growers.

Capital allocation trends show company leaders prioritizing fermentation capacity, advanced analytics for trial design, and distribution partnerships that shorten the path to on‑farm proof. Investment in fermentation and bioproduction infrastructure has been publicly announced by major players seeking to scale biological manufacturing and to reduce exposure to volatile global logistics and tariff risk. Similarly, commercial rollouts of next‑generation inoculant products that integrate strain consortia and formulation innovations are now a primary differentiator in commercial conversations with distributors and progressive grower networks. These dynamics favor companies that can combine regulatory operational maturity with demonstrable field performance and channel execution.

This comprehensive research report delivers an in-depth overview of the principal market players in the Agricultural Inoculant market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agrauxine by Lesaffre

- BASF SE

- Bayer AG

- BrettYoung

- Corteva Agriscience

- DuPont de Nemours, Inc.

- Kemin Industries, Inc

- Lallemand Inc.

- Lavie Bio Ltd. by Evogene Ltd.

- MBFi Microbial Biological Fertilizers International

- Novonesis Group

- Precision Laboratories, LLC

- Provita Supplements GmbH

- Queensland Agricultural Seeds

- Rizobacter Argentina S.A.

- Soil Technologies Corporation

- TERRAMAX, INC.

- Valent BioSciences LLC

- Verdesian Life Sciences LLC

- XiteBio Technologies Inc.

Practical, high‑impact recommendations for manufacturers, distributors, and strategic buyers to turn biological innovation into repeatable commercial advantage

Industry leaders should treat the current period as a time to invest in evidence, resilience and commercial alignment rather than merely seek short‑term cost reductions. First, prioritize investment in rigorous, geo‑diverse field trials and third‑party validation that test products across soil types, climates and interaction with common seed treatments; such evidence accelerates adoption and reduces buyer hesitation. Second, fortify supply‑chain resilience through regional manufacturing investments or secure contract manufacturing agreements to mitigate tariff and logistics risks. Third, strengthen regulatory and compliance capabilities by aligning dossiers to evolving definitions for biostimulants, fertilising products and microbial inputs and by engaging proactively with regulators where harmonization is emerging.

Commercial execution should combine a two‑track distribution strategy: maintain deep relationships with legacy distributors for scale row‑crop penetration while investing in direct and digital channels to capture specialty and high‑value segments where margin and data capture justify a closer customer relationship. Finally, prioritize portfolio architecture that emphasizes formulation compatibility with seed treatments and precision applications, because practical fit with farm workflows is a decisive factor in adoption. Collectively, these recommendations help firms convert science into repeatable commercial outcomes while insulating operations from policy and trade volatility.

A transparent description of the research sources, evidence‑triangulation approach, and analytical methods used to produce the inoculant market intelligence

This research synthesized publicly available regulatory texts, peer‑reviewed scientific literature, official government statements, company disclosures and specialist trade reporting to create a multi‑disciplinary view of the inoculant landscape. Primary inputs included regulatory proclamations and customs guidance that documented 2025 tariff actions and their implementation windows; peer‑reviewed reviews and technical papers describing microbial modes of action and recent advances in formulation and delivery science; and press releases and company announcements that signal strategic investments in manufacturing and product launches. Sources were cross‑checked to ensure that policy descriptions, scientific claims, and commercial announcements were corroborated across at least two independent, reputable references.

Analytical methods combined qualitative synthesis and triangulation-mapping regulatory changes against supply‑chain reactions and company investment behaviour-and structured expert interviews with practitioners (conducted under confidentiality) to validate interpretation of trial evidence, distribution dynamics and manufacturing prioritization. Where regulatory texts were definitive, they were used as the authoritative source; where scientific evidence was evolving, emphasis was placed on peer‑reviewed meta‑analyses and systematic reviews. The final deliverable includes an evidence trace for all material assertions, anonymized primary interview summaries, and an appendix describing search terms, inclusion criteria, and the timeline of regulatory events referenced in the analysis. This methodology preserves reproducibility and supports client requests for deeper drill‑downs into any analytical layer.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Agricultural Inoculant market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Agricultural Inoculant Market, by Type

- Agricultural Inoculant Market, by Crop

- Agricultural Inoculant Market, by Formulation

- Agricultural Inoculant Market, by End Use

- Agricultural Inoculant Market, by Application Method

- Agricultural Inoculant Market, by Sales Channel

- Agricultural Inoculant Market, by Region

- Agricultural Inoculant Market, by Group

- Agricultural Inoculant Market, by Country

- United States Agricultural Inoculant Market

- China Agricultural Inoculant Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Clear, strategic conclusions that synthesize scientific progress, regulatory pressure, tariff risk and commercial levers shaping the future of inoculant adoption

In summary, agricultural inoculants are transitioning from experimental adjuncts to strategic components of sustainable crop nutrition and crop‑health toolkits. Scientific advances and better formulations are improving field reliability, while regulatory clarity in multiple jurisdictions is reducing market ambiguity, albeit with new compliance requirements. Tariff shocks and trade policy volatility in 2025 have increased the urgency of regional manufacturing and supply‑chain resilience, elevating operational risk management to a strategic priority. Commercial success will accrue to organizations that combine rigorous field evidence, manufacturing scale, and a dual‑channel go‑to‑market approach that addresses both row‑crop scale and high‑value specialty demand.

The path forward is pragmatic: invest in reproducible, location‑specific evidence; build redundancy into sourcing and manufacturing; and align portfolio design to practical application compatibility. Firms that adopt this playbook can turn present disruption into a durable competitive edge and accelerate the adoption curve for biologicals across diverse cropping systems.

Immediate next steps to acquire the comprehensive agricultural inoculant market report and arrange a tailored briefing with the Associate Director of Sales and Marketing

To obtain a full, detailed market research report that translates these findings into executable commercial intelligence, please reach out to Ketan Rohom, Associate Director, Sales & Marketing. He will arrange access to the complete report package, including in-depth company profiles, methodology appendices, raw data tables, and customized licensing options that support procurement, portfolio, and go‑to‑market decisions. Contacting Ketan will also enable a short briefing call tailored to your priority crops, formulation preferences, or regional focus so you can rapidly translate high-level conclusions into operational next steps.

Act now to secure priority access and a tailored briefing that aligns the report’s insights with your commercial timeline and decision milestones. Ketan can coordinate expedited delivery options and walk you through how bespoke add‑ons such as primary‑data breakdowns, competitor landscaping, or custom scenario modeling are priced and delivered. This direct engagement is the fastest route to convert strategic insight into measurable action.

- How big is the Agricultural Inoculant Market?

- What is the Agricultural Inoculant Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?