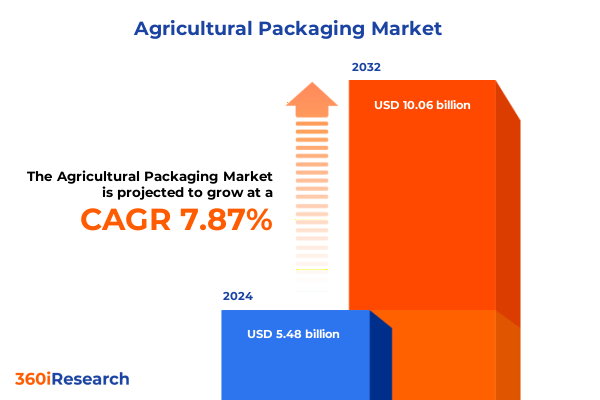

The Agricultural Packaging Market size was estimated at USD 5.91 billion in 2025 and expected to reach USD 6.35 billion in 2026, at a CAGR of 7.89% to reach USD 10.06 billion by 2032.

Unveiling the dynamic evolution of agricultural packaging shaped by sustainability imperatives, technological breakthroughs, and shifting global trade policies

Agricultural packaging serves as the critical interface between farm and market, ensuring the integrity, quality, and traceability of produce from field to consumer. As global agricultural supply chains become more complex, packaging not only protects products but also communicates vital information about origin, handling, and safety. Innovations in materials and design now enable extended shelf life, reduced spoilage, and enhanced brand differentiation. Amid rising consumer expectations for transparency and sustainability, packaging has evolved from a mere container to a key strategic asset that drives value across the entire agrifood ecosystem.

Exploring the transformative forces redefining the agricultural packaging landscape from sustainability mandates to digital integration and material innovation

The agricultural packaging landscape is undergoing transformative shifts driven by environmental regulations, consumer demand for greener solutions, and technological integration. Regulatory frameworks such as California’s mandate for recyclable or compostable packaging by 2032 exemplify how legislation is accelerating the adoption of sustainable materials and design principles. Concurrently, digital innovations-from QR codes offering real-time traceability to embedded sensors monitoring temperature and moisture-are redefining how stakeholders manage product quality and supply chain transparency.

Moreover, industry consolidation is reshaping competitive dynamics. The announced merger of Amcor and Berry Global to create a packaging powerhouse with projected synergies of $650 million highlights how leading firms are combining scale with R&D capabilities to address rising costs and regulatory pressures. This convergence of sustainability mandates, digitalization, and strategic partnerships is setting a new course for the agricultural packaging sector, demanding agility and innovation from all market participants.

Assessing the cumulative impact of the United States’ 2025 tariff adjustments on steel, aluminum, and polymer inputs critical to agricultural packaging

In early 2025, the United States reinstated 25 percent Section 232 tariffs on steel and aluminum imports and expanded coverage to key downstream products as of March 12, 2025, closing previous exemptions and streamlining exclusion processes. This action aimed to strengthen domestic metal industries but also elevated input costs for packaging manufacturers reliant on aluminum foil laminates and steel drums. On June 4, the administration further raised these tariffs to 50 percent, with certain U.K. imports retaining a 25 percent rate under pending bilateral agreements, intensifying pressure on metal-based packaging segments.

Simultaneously, the Office of the U.S. Trade Representative extended certain exclusions from China Section 301 tariffs through August 31, 2025, ensuring continuity for select polymer imports such as PET films and flexible packaging resins vital to the agricultural sector. Collectively, these tariff adjustments have reshaped supply chain strategies, prompting manufacturers to seek alternative feedstocks, diversify supplier bases, and pass through increased material costs to end users.

Examining segmentation insights to understand how material, packaging type, application, end user, and channels are transforming agricultural packaging

Examining segmentation insights to understand how material choices influence performance and sustainability in agricultural packaging reveals distinct dynamics. Among glass, metal, paper & paperboard, and plastic, glass bottles and jars excel in reuse cycles and inertness but face logistical weight challenges. Metal categories such as aluminum containers and steel drums offer high barrier protection and recyclability, yet they are directly impacted by recent tariff increases. Paper & paperboard formats-including cartons, corrugated board, and paper bags-strike a balance between recyclability and cost efficiency, driving their adoption for dry goods and single-use applications. Meanwhile, diverse plastic subsegments like PET, polyethylene, polypropylene, polystyrene, and PVC continue to dominate flexible and rigid formats due to their versatility and low weight.

Packaging types further differentiate market dynamics. Flexible packaging innovations such as liners, films, and spouted pouches provide resource efficiency and enhanced shelf life. Rigid formats including drums, barrels, crates, and pallets facilitate bulk transport and storage, especially for fertilizers and chemicals. Semi-rigid solutions like lidded containers and trays offer a middle ground, balancing protection with lightness. Application segments span bakery, dairy, fertilizers, fruits & vegetables, grains, meat, and seafood, each with unique preservation requirements and material compatibility considerations. The fruits & vegetables category, covering dried, fresh, and frozen products, relies heavily on modified atmosphere packaging and breathable materials to maintain quality. Distribution channels, whether offline or online, influence package design by prioritizing durability for long-haul transport or lightweight formats for e-commerce. Across end users-cooperatives, distributors, farmers, processors, exporters, and retailers-packaging solutions must adapt to distinct handling, storage, and branding needs.

This comprehensive research report categorizes the Agricultural Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Packaging Material

- Packaging Type

- Application

- End User

- Distribution Channel

Exploring insights from the Americas, EMEA, and Asia-Pacific to uncover regional nuances driving growth and innovation in agricultural packaging

Exploring insights from the Americas, EMEA, and Asia-Pacific to uncover regional nuances driving growth and innovation in agricultural packaging highlights diverse market drivers. In the Americas, a mature regulatory environment and advanced recycling infrastructure support widespread adoption of recyclable and compostable solutions, while strong e-commerce growth is accelerating lightweight flexible formats. Europe, the Middle East & Africa (EMEA) face stringent EU packaging regulations such as the Packaging and Packaging Waste Regulation, compelling manufacturers to integrate reusable transport packaging and achieve ambitious recycling targets. In contrast, Africa’s informal distribution networks emphasize robust and reusable rigid formats that can withstand challenging logistics.

Asia-Pacific exhibits rapid market expansion fueled by rising middle-class populations and government incentives for sustainable materials. Countries such as China and India are incentivizing bio-based plastics and recycled content, driving innovation in plant-based film resins and water-soluble coatings. Meanwhile, Australia and Japan prioritize digital traceability solutions, deploying QR codes and blockchain platforms to ensure food safety and provenance. These regional distinctions underscore the importance of tailored packaging strategies that align with local regulations, infrastructure capabilities, and consumer preferences.

This comprehensive research report examines key regions that drive the evolution of the Agricultural Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating how leading packaging companies are shaping the agricultural sector through innovation, sustainability initiatives, and strategic partnerships

Leading packaging companies are responding to sector demands with strategic investments in sustainability and digitalization. Amcor’s recognition by the Flexible Packaging Association for its silver award-winning vacuum packaging and recyclable film innovations illustrates the value of material science breakthroughs that reduce waste and enhance barrier performance. Its modular solutions for meat exports and spouted pouches demonstrate how right-sized designs and integrated printing can lower costs while improving traceability.

Berry Global, meanwhile, has accelerated its circular economy initiatives, increasing post-consumer resin purchases by 43 percent year-over-year and exceeding Scope 1 and 2 emission reduction targets ahead of schedule, showcasing how commitment to CleanStream® recycling technology and renewable energy partnerships can deliver both environmental impact and operational efficiency. Tetra Pak continues to pioneer digital ecosystems and plant-based packaging innovations, with North American brands adopting sugarcane-derived plastics and digital automation to boost overall equipment effectiveness by up to 20 percent, reflecting the strategic role of automation in driving productivity and sustainability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Agricultural Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amcor plc

- Anderson Packaging

- BAG Corporation

- Bischof + Klein

- Bulk Lift International

- Constantia Flexibles Group GmbH

- DS Smith Plc

- FlexPack FIBC

- Greif Inc

- Huhtamaki Oyj

- International Paper Co

- LC Packaging International

- Mondi Group

- NNZ Group

- NPP Group

- Pactiv Evergreen

- ProAmpac LLC

- RKW Group

- Silgan Holdings Inc

- Smurfit WestRock Plc

- Sonoco Products Company

- Tetra Pak International SA

- Uflex Ltd

- Western Packaging

Strategic recommendations for industry leaders to drive innovation, sustainability, and competitive advantage in agricultural packaging markets

To capitalize on emerging opportunities, industry leaders should prioritize cross-functional collaboration between R&D, operations, and sustainability teams. Integrating smart packaging technologies-including embedded sensors for freshness monitoring and QR-based traceability-can enhance supply chain visibility and reduce spoilage, aligning with consumer demand for transparency. Manufacturers should also pursue material diversification strategies, blending paper & paperboard and bio-based polymers to mitigate the volatility of metal tariffs and plastic resin costs.

In parallel, forging partnerships with logistics providers and recycling innovators can create end-to-end circular systems that capture value from returned packaging while satisfying regulatory mandates. Companies must invest in digital platforms that model total cost of ownership, enabling dynamic scenario planning for tariff fluctuations, raw material availability, and sustainability targets. Finally, by engaging directly with growers and distributors to co-develop customized packaging solutions, firms can strengthen relationships across the value chain and differentiate through tailored service offerings.

Detailing the robust research methodology used to analyze agricultural packaging, incorporating primary and secondary data enriched by expert interviews

The insights presented in this report derive from a mixed-methods approach combining extensive secondary research and targeted primary data collection. Industry literature, regulatory filings, and press releases provided foundational context on material trends, tariff developments, and technological advancements. These findings were enriched through in-depth interviews with packaging engineers, procurement specialists, and sustainability officers across multiple geographies. Data triangulation ensured consistency between qualitative insights and documented case studies, while expert validation workshops refined the final analysis. By systematically integrating diverse data sources, this methodology delivers a robust and actionable understanding of the agricultural packaging landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Agricultural Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Agricultural Packaging Market, by Packaging Material

- Agricultural Packaging Market, by Packaging Type

- Agricultural Packaging Market, by Application

- Agricultural Packaging Market, by End User

- Agricultural Packaging Market, by Distribution Channel

- Agricultural Packaging Market, by Region

- Agricultural Packaging Market, by Group

- Agricultural Packaging Market, by Country

- United States Agricultural Packaging Market

- China Agricultural Packaging Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing the key takeaways on agricultural packaging evolution, strategic drivers, and future outlook for informed decision-making in the sector

The agricultural packaging sector is at a pivotal juncture where sustainability imperatives, digital innovation, and evolving trade policies converge to reshape how products are protected, presented, and transported. Key drivers include rising environmental regulations, consumer demand for transparency, and strategic consolidation among leading firms. Material segmentation reveals an ongoing balance between high-barrier metal formats and lightweight, recyclable paper and plastic solutions. Regional dynamics further underscore the necessity of tailored approaches to align with local regulations, infrastructure, and consumer preferences.

Moving forward, companies that embrace integrated strategies-prioritizing material innovation, digital traceability, and circular partnerships-will be best positioned to navigate tariff uncertainties and deliver differentiated value. By fostering collaboration across the value chain and maintaining agility in response to policy shifts, stakeholders can unlock new efficiencies, reduce waste, and sustain competitive advantage in the rapidly evolving agricultural packaging market.

Engage with Associate Director Ketan Rohom to secure your comprehensive agricultural packaging market research report and elevate your strategic positioning

For more detailed insights and to secure your comprehensive agricultural packaging market research report, please reach out directly to Associate Director Ketan Rohom. With a deep understanding of industry trends and strategic expertise, Ketan can guide you through the report’s findings, tailor solutions to your organization’s needs, and help you leverage these insights for competitive advantage. Contact Ketan to elevate your strategic positioning, inform your investment decisions, and unlock actionable intelligence that drives growth and resilience in the evolving agricultural packaging landscape.

- How big is the Agricultural Packaging Market?

- What is the Agricultural Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?