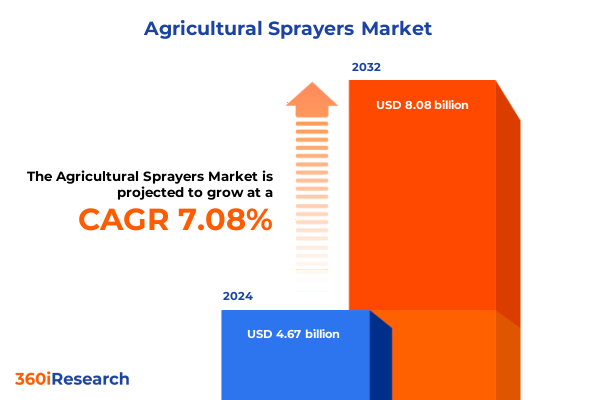

The Agricultural Sprayers Market size was estimated at USD 5.01 billion in 2025 and expected to reach USD 5.33 billion in 2026, at a CAGR of 7.06% to reach USD 8.08 billion by 2032.

Revolutionizing Crop Protection Through Innovative Sprayer Technologies, Data-Driven Precision, and Sustainable Practices Boosting Agricultural Productivity

Modern agriculture relies on precision in every drop applied to crops, and agricultural sprayers stand at the forefront of this evolution. Fueled by an imperative to feed a growing global population while safeguarding natural resources, farming stakeholders are increasingly adopting advanced spraying technologies. Innovations in robotics and automation are delivering real-time data analytics and connectivity that enable targeted applications, reducing chemical waste and environmental impact. Moreover, tightening regulatory requirements around pesticide use and carbon emissions are accelerating demand for smarter, more sustainable solutions that optimize field operations and ensure compliance with stringent sustainability mandates (cite turn0search3).

Amid this backdrop, capital flows and investment patterns are shifting toward strategic ventures in precision farming. Despite a broader slowdown in AgTech funding in early 2025 due to macroeconomic headwinds, automation and robotics sub-segments recorded robust growth, underscoring the vitality of sprayer innovation. Established legacy equipment manufacturers are leveraging partnerships and technology acquisitions to modernize their portfolios, while nimble startups are carving niches with specialized drone and AI-powered platforms. Collectively, these dynamics are reshaping the competitive landscape and setting the stage for a new era of efficiency, compliance, and sustainability in crop protection (cite turn0news12).

Navigating a Paradigm Shift in Agricultural Spraying with Autonomy, Robotics, and Eco-Friendly Solutions Driving Next-Gen Farming Efficiency

Agricultural spraying has transcended traditional broadcast methods, ushering in an era of autonomy and drone-enabled operations. Unmanned aerial systems equipped with advanced navigation and obstacle avoidance capabilities now handle vast swaths of cropland with minimal human intervention. These platforms offer precise, GPS-guided applications that reduce pesticide drift and labor costs while improving coverage uniformity. In parallel, ground-based robotic sprayers, outfitted with LiDAR and multispectral sensors, enable selective weed and pest targeting that was once unimaginable, delivering up to 30% reductions in chemical usage through adaptive spray strategies (cite turn0search2).

Furthermore, precision spraying technologies are being integrated with IoT networks and cloud-based analytics to create closed-loop feedback systems. Sensors mounted on nozzles and booms continuously monitor droplet size, wind speed, and crop health, enabling real-time adjustments to application rates. This convergence of hardware and software empowers decision-makers with actionable insights, optimizing operational efficiency and minimizing resource inputs. As field data collection becomes more granular and predictive algorithms mature, sprayer platforms evolve into holistic crop management tools that seamlessly link application events with agronomic outcomes (cite turn0search0).

Environmental stewardship is equally driving innovation across the sprayer landscape. Manufacturers are designing eco-friendly sprayers with low-drift nozzles, biodegradable components, and electric propulsion options to align with global sustainability targets. These developments not only reduce the carbon footprint of spraying operations but also address community and regulatory concerns around pesticide runoff and soil health. As regulatory bodies increasingly prioritize ecosystem protection, the emphasis on green engineering and circular-economy principles is transforming sprayer R&D, pushing the industry toward a more resilient and responsible future (cite turn0search5).

Assessing the Far-Reaching Consequences of Recent U.S. Tariffs on Agricultural Sprayer Production, Supply Chains, and Market Dynamics in 2025

The introduction of sweeping tariffs on steel and aluminum, along with targeted duties on imported farm equipment, has introduced new cost pressures across the agricultural machinery sector. A 25% levy on steel and aluminum imports increases fabrication expenses for sprayer frames, tanks, and booms, while a baseline tariff on non-compliant vehicles and parts heightens uncertainty across supply chains. As a result, manufacturers and distributors face escalating component costs that are inevitably passed through to end users, dampening purchase intent among cost-sensitive growers (cite turn1search0).

Beyond raw materials, retaliatory measures by trading partners have compounded challenges for U.S. manufacturers. China’s imposition of a 10% tariff on over 50 categories of U.S. farm machinery, including sprayers, has disrupted export channels and strained inventory planning. This reciprocal action has prompted major players like Deere & Co. to reconfigure global production footprints, shifting certain builds closer to North American assembly lines under the USMCA framework. Deere’s executive leadership has disclosed over $100 million in tariff-related expenses already incurred, with forecasts indicating a cumulative impact of up to $500 million by the end of 2025. The combined effect of these policy shifts underscores the critical need for agile sourcing strategies, diversified supplier networks, and proactive cost management initiatives (cite turn1news14 and turn1news12).

Unveiling Four-Pronged Market Segmentation Insights Across Propulsion, Sprayer Type, Application Fields, and Capacity Tiers Shaping Industry Strategies

To fully understand the agricultural sprayer market, it is essential to explore its segmentation across multiple dimensions. First, propulsion options range from lightweight backpack units-available in both manual and battery-powered formats-to larger mounted configurations, self-propelled machines, and towed trailed sprayers. This diversity enables equipment selection tailored to farm size, terrain, and operator preference. Second, product types include airblast, boom, handheld, and mist sprayers, with the boom category further delineated by center pivot, foldable, and in-row designs that optimize coverage for row crops and specialty plantings.

Moreover, application segments span field crops, greenhouse operations, and vegetable or herb cultivation, reflecting distinct agronomic requirements and regulatory environments. Field crop operations demand high-capacity, long-reach solutions, while greenhouse and horticultural settings prioritize precision, low-drift technologies to protect sensitive environments. Finally, capacity tiers-up to 2,000 liters, 2,000 to 4,000 liters, and above 4,000 liters-ensure that sprayer configurations align with operational scale, refill cycles, and logistical constraints. These segmentation insights chart clear avenues for product customization, targeted marketing, and strategic investment across the sprayer ecosystem.

This comprehensive research report categorizes the Agricultural Sprayers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Propulsion

- Type

- Capacity

- Application

Decoding Regional Dynamics: How the Americas, EMEA, and Asia-Pacific Are Shaping Agricultural Sprayer Adoption, Innovation, and Growth Trajectories

In the Americas, robust adoption of advanced spraying technologies coexists with headwinds from volatile capital availability and trade policy uncertainties. While the U.S. AgTech sector experienced a downturn in venture funding in early 2025, the precision farming sub-segment, driven by labor shortages and automation interest, attracted significant investment. Farmers are increasingly deploying autonomous sprayers and drone systems to offset workforce gaps and improve input efficiency. However, lingering concerns about tariff-induced price hikes continue to temper large-ticket equipment purchases, fostering demand for rental and service-based business models among small and medium-sized growers (cite turn0news12).

Europe, the Middle East, and Africa (EMEA) prioritize environmental compliance and innovation in sprayer design. Stricter regulations on pesticide drift and chemical residues have accelerated the uptake of eco-friendly sprayers equipped with low-emission nozzles, precision control systems, and electric or hybrid propulsion. Manufacturers in Germany, France, and Italy are leading product development, collaborating with research institutes to benchmark best practices for minimizing ecological impact. This region’s emphasis on sustainability and circular-economy principles is fostering a new generation of sprayers engineered for maximal resource conservation (cite turn0search5).

Asia-Pacific stands out as the fastest-growing geography, propelled by government subsidies, mechanization drives, and labor demographics. China’s ambitious goal of 75% agricultural mechanization by 2025 has prompted central and provincial authorities to underwrite equipment purchases, spurring demand for both conventional and UAV-based sprayers. India’s agricultural mechanization subsidies similarly incentivize small and marginal farmers to adopt battery-powered and low-cost handheld models. Meanwhile, Japan leverages its advanced robotics ecosystem to perfect high-precision, automated spraying platforms. Collectively, these initiatives are constructing a vibrant, innovation-led landscape across Asia-Pacific (cite turn3search0).

This comprehensive research report examines key regions that drive the evolution of the Agricultural Sprayers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Agricultural Sprayer Manufacturers and Emerging Innovators Driving Technological Advances, Market Positioning, and Strategic Growth

John Deere & Co. remains the preeminent force in the agricultural sprayer domain, leveraging its extensive product portfolio and global distribution network. Faced with over $500 million in anticipated tariff impacts for 2025, the company is optimizing its manufacturing footprint by expanding U.S. assembly operations and pursuing USMCA-compliant supply chains. Concurrently, Deere is accelerating its precision ag roadmap through strategic partnerships in robotics and software analytics, ensuring that its sprayer platforms deliver seamless integration with farm management systems (cite turn1news12).

AGCO and CNH Industrial are intensifying their focus on modular and scalable sprayer solutions. Both OEMs have introduced center-pivot and foldable boom designs that cater to diverse crop architectures and acreage profiles. AGCO’s investments in electric propulsion and tele-operation capabilities are positioning it as a leader in low-emission sprayer technologies, while CNH is capitalizing on AI-driven nozzle control systems to enhance spray accuracy and reduce drift. These efforts underscore a broader industry drive toward differentiated offerings that meet emerging regulatory and sustainability demands (cite turn0search5).

Emerging innovators such as Monarch Tractor and leading drone manufacturers are reshaping the competitive landscape. Monarch’s autonomous sprayer modules, initially piloted in dairy and solar farm applications, demonstrate the potential of robotics for niche market deployment. Concurrently, global drone leaders are refining UAV spraying solutions with advanced obstacle sensing and swarm coordination, enabling single-operator control over expansive acreages. This influx of specialized players is stimulating a wave of co-development initiatives, accelerators, and pilot programs aimed at fast-tracking next-generation sprayer technologies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Agricultural Sprayers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ag Spray Equipment, Inc.

- AGCO Corporation

- Amazone Ltd.

- Berthoud S.A.S.

- Boston Crop Sprayers Ltd.

- Bucher Industries AG

- CNH Industrial N.V.

- Demco Manufacturing Co.

- Hardi International A/S

- Househam Sprayers Ltd.

- John Deere Limited

- Kubota Corporation

- Kuhn S.A.

- M.T. Equipment Sales Ltd.

- Miller-St. Nazianz, Inc.

- STAHLY GmbH & Co. KG

- TeeJet Technologies

- Titan International, Inc.

Actionable Strategies for Industry Leaders to Capitalize on Technology Trends, Mitigate Trade Risks, and Drive Sustainable Growth in the Sprayer Market

Industry leaders must prioritize investment in automation and precision technologies to stay ahead of dynamic agronomic and regulatory demands. By integrating AI-powered robotics, variable-rate nozzles, and real-time agronomic feedback loops into their sprayer portfolios, companies can deliver measurable efficiency gains and environmental benefits. Cultivating partnerships with software providers and research institutions will accelerate product roadmaps and foster differentiated solutions.

In parallel, firms should adopt a proactive approach to supply chain diversification. Expanding sourcing beyond traditional steel and aluminum suppliers and establishing dual-sourcing agreements can mitigate tariff-induced cost volatility. Furthermore, reshoring or near-shoring critical assembly operations under favorable trade agreements will enhance resilience against future policy shifts.

A robust sustainability strategy is essential for long-term competitiveness. Manufacturers should champion eco-friendly design principles, including low-drift nozzle development, biodegradable materials, and electric propulsion. Engaging with regulatory bodies and certification programs early in the R&D cycle will streamline market approvals and strengthen customer trust.

Finally, offering service-based models such as equipment-as-a-service and pay-per-use spraying programs can unlock new revenue streams and lower adoption barriers for smallholder operators. Developing comprehensive after-sales support networks, including remote diagnostics and precision calibration services, will enhance customer retention and reinforce brand loyalty.

Rigorous Research Methodology Employing Primary Interviews, Secondary Data Analysis, and Multi-Source Validation for Comprehensive Market Insights

This research employs a multi-tiered methodology combining primary and secondary data sources to ensure the highest level of accuracy and objectivity. Primary research involved structured interviews with industry executives, agronomists, and equipment dealers across major geographies. These insights provided granular perspectives on emerging technologies, regulatory impacts, and end-user preferences.

Secondary data was sourced from government trade statistics, regulatory filings, technical journals, and validated market intelligence reports. Rigorous data triangulation techniques were applied to reconcile discrepancies and validate trends across multiple sources. Quantitative inputs were cross-referenced with in-field field trials and pilot program results to ensure practical relevance and market applicability.

Segmentation frameworks were constructed based on propulsion, type, application, and capacity, enabling targeted analysis of each market slice. Regional dynamics were assessed using country-level mechanization indices, subsidy program reviews, and import/export data. Competitive mapping leveraged company disclosures, patent filings, and strategic partnership announcements. Collectively, this structured approach provides a comprehensive and transparent view of the agricultural sprayer market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Agricultural Sprayers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Agricultural Sprayers Market, by Propulsion

- Agricultural Sprayers Market, by Type

- Agricultural Sprayers Market, by Capacity

- Agricultural Sprayers Market, by Application

- Agricultural Sprayers Market, by Region

- Agricultural Sprayers Market, by Group

- Agricultural Sprayers Market, by Country

- United States Agricultural Sprayers Market

- China Agricultural Sprayers Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings to Illuminate Future Directions for Agricultural Sprayer Innovation, Sustainability, and Competitive Excellence

The agricultural sprayers landscape is transforming at an unprecedented pace, driven by the convergence of automation, data analytics, and sustainability imperatives. As stakeholders navigate evolving regulatory frameworks and trade policy uncertainties, the emphasis on precision, efficiency, and environmental stewardship has never been greater. The interplay of advanced propulsion options, specialized boom configurations, and capacity tiers offers a rich tapestry of opportunities for tailored product development and market differentiation.

Looking ahead, the industry’s trajectory will hinge on its ability to integrate cutting-edge technologies while maintaining cost-effective supply chains. Companies that embrace digital twin simulations, AI-enhanced spray control, and modular hardware architectures will be best positioned to capture growing demand across diverse geographies. By aligning growth strategies with the needs of both large-scale operations and emerging smallholder segments, industry leaders can drive sustainable adoption and reinforce the foundational role of agricultural sprayers in global food security.

Unlock In-Depth Market Research on Agricultural Sprayers Today by Engaging with Ketan Rohom for Strategic Sales and Marketing Insights

To access the comprehensive market research report on agricultural sprayers, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan is ready to guide you through the detailed findings, customized insights, and strategic frameworks designed to empower your organization. Engage with Ketan to discover how this report can illuminate market opportunities, streamline investment decisions, and support your growth initiatives in the evolving agricultural sprayer landscape. Your next step toward informed decision-making starts with a conversation with Ketan Rohom.

- How big is the Agricultural Sprayers Market?

- What is the Agricultural Sprayers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?