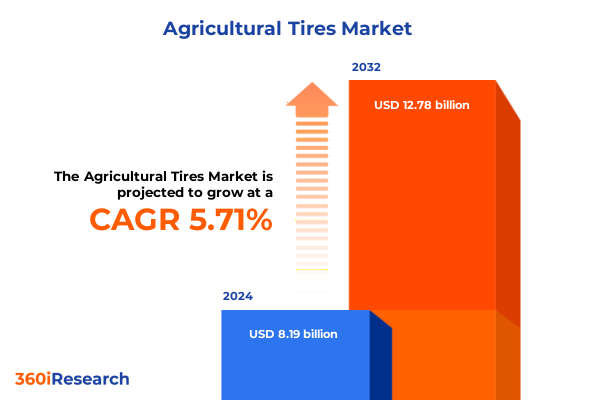

The Agricultural Tires Market size was estimated at USD 8.67 billion in 2025 and expected to reach USD 9.17 billion in 2026, at a CAGR of 5.70% to reach USD 12.78 billion by 2032.

Framing the Essential Role and Strategic Importance of Agricultural Tires in Driving Mechanization, Soil Health Preservation, and Sustainable Crop Production

Today’s agricultural operations rely on advanced tire technologies to sustain high-performance mechanization, efficient soil management, and long-term land stewardship. Agricultural tires must offer exceptional traction to handle heavy loads and uneven terrain while simultaneously minimizing soil compaction to preserve crop health and yield potential. Over recent years, radial constructions have emerged as a predominant choice for modern farming equipment, owing to their flexible sidewalls and larger footprints that help reduce ground pressure and fuel consumption. At the same time, bias ply variants continue to serve niche applications where pronounced sidewall rigidity is necessary to navigate uneven surfaces or to support implements requiring lateral stability.

Exploring How Technological Innovations and Sustainable Practices Are Redefining the Agricultural Tire Landscape for Enhanced Performance and Efficiency

The agricultural tire market is being reshaped by the integration of digital and sensor technologies that elevate performance monitoring from reactive to proactive. Embedded IoT sensors now transmit real-time data on pressure, temperature, and wear, enabling cloud-based platforms to predict maintenance needs and preempt tire failures, reducing costly equipment downtime by identifying issues before they escalate. Coupled with artificial intelligence algorithms, these insights empower farmers and fleet managers to optimize inflation levels, adjust compaction parameters, and tailor operational schedules based on field conditions.

Parallel to digitalization, material science innovations are driving a shift toward eco-friendly compounds and circular practices. Manufacturers are experimenting with bio-based rubbers and recycled feedstocks to lower the carbon footprint of tire production, while retreading and remanufacturing initiatives extend tire lifecycles and reduce waste streams. These sustainable efforts align with broader farm decarbonization goals and the push for resource efficiency in agricultural value chains.

Finally, strategic partnerships among tire producers, equipment OEMs, and technology firms are forging new solutions that seamlessly integrate smart tires with autonomous tractors and precision planters. By collaborating on embedded sensor standards and data-sharing protocols, these alliances are laying the groundwork for fully automated farming workflows in which tires play an active role in agronomic decision-making.

Assessing the Aggregate Effects of Recent U.S. Trade Measures and Tariffs on Agricultural Tire Supply Chains and Production Economics

In 2024 and into 2025, the United States Trade Representative’s review of Section 301 tariffs reaffirmed existing duties on rubber and vehicle parts, even though agricultural tires were not singled out for new levies. As a result, tire importers continue to navigate the persistent 25 percent duties on many Chinese-origin components, requiring manufacturers to either absorb costs or pass them on in the form of higher equipment prices.

Concurrently, Section 232 tariffs on steel and aluminum-essential raw materials for steel-belted radial tires and tubular rim fabrication-were reinstated and elevated to 50 percent effective June 4, 2025. This dramatic rise in metal input costs has placed renewed pressure on tire producers, prompting them to evaluate alternative alloy sources and adjust procurement strategies to maintain margin stability.

These combined trade measures are accelerating supply chain adaptations, including the reshoring of certain manufacturing processes and the diversification of upstream suppliers in North America and Europe. In parallel, inventory management practices are being refined to buffer against duty volatility, while strategic collaborations with domestic steel mills are emerging to secure more predictable pricing and supply assurances.

Uncovering Segmentation Dynamics Across Application, Product Type, Distribution Channels, Ply Rating, and Rim Size in the Agricultural Tire Market

The agricultural tire market’s application segmentation spans a wide spectrum of machinery, encompassing combines, implements, irrigation equipment, sprayers, and tractors, each demanding unique design considerations. Combines and implements rely on both bias ply and radial constructions to optimize traction and flotation, with radial variants further differentiated by tube-type and tubeless configurations to suit diverse operational environments. Irrigation equipment and sprayers share these design dichotomies, where sidewall flexibility and footprint geometry directly impact soil preservation and field accessibility. Tractors, as the backbone of farm mechanization, require robust radial tires that balance load-bearing capacity with minimal compaction, and their adoption of tube-type versus tubeless radial options reflects regional service infrastructures and performance preferences.

In terms of product type segmentation, bias tires remain valued for their cost-effective durability in secondary applications, while solid tires excel in non-pneumatic use cases such as skid steer loaders. Radial constructions dominate high-speed, heavy-duty scenarios, and the choice between tube-type and tubeless builds depends on maintenance capabilities and puncture risk tolerance in the field.

The distribution channel segmentation distinguishes original equipment manufacturer (OEM) supply from the aftermarket, where dealers, distributors, and e-commerce platforms cater to a wide range of user requirements. Aftermarket channels are further stratified by service model, with dealers offering installation and maintenance support, distributors providing inventory depth, and e-commerce channels enabling rapid replenishment.

Ply rating segmentation divides offerings into two-to-four, six-to-eight, and ten-to-sixteen ply categories to address varying load capacities and stability demands. Rim size segmentation covers tires for rim diameters below 30 inches, spans of 30 to 45 inches, and those exceeding 45 inches to match the full spectrum of farm vehicle classes.

This comprehensive research report categorizes the Agricultural Tires market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Product Type

- Distribution Channel

- Rim Size

Analyzing Regional Agricultural Tire Trends and Drivers Across the Americas, Europe Middle East & Africa, and the Expanding Asia-Pacific Markets

Across the Americas, mechanization levels continue to rise alongside the adoption of smart agriculture practices, driving demand for advanced radial tires with predictive maintenance capabilities and low soil compaction designs. In North America, precision-ag platforms integrate seamlessly with sensor-equipped agricultural tires, while South America’s large-scale grain and sugarcane operations prioritize high-flotation radial solutions to maximize coverage and minimize downtime.

In Europe, the Middle East, and Africa, increasing regulatory focus on environmental sustainability and soil health is prompting farmers to seek low-compaction tire solutions and to participate in retreading programs. European producers leverage local manufacturing expertise to develop premium, eco-friendly compounds that comply with stringent emissions and waste directives, while African agribusinesses balance performance with cost constraints in emerging markets.

The Asia-Pacific region is witnessing rapid mechanization driven by government support for modernization in India and China. Local manufacturers and global tier-one players are expanding production capacity to serve these burgeoning markets, with a growing emphasis on cost-effective radial and bias ply tires tailored to smallholder and large commercial operations. As farm sizes increase and yield intensification accelerates, the demand for durable, high-traction tires that uphold soil conservation principles continues to strengthen.

This comprehensive research report examines key regions that drive the evolution of the Agricultural Tires market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Innovations by Leading Agricultural Tire Manufacturers to Secure Competitive Advantage and Market Leadership

Leading agricultural tire manufacturers are executing diverse strategies to secure competitive positions and address evolving farm needs. Michelin has inaugurated its COSMOS fabrication line in Troyes, featuring a groundbreaking machine optimized for large-format tires, and has partnered with Beontag to embed RFID traceability on every new tire, enhancing lifecycle management and regulatory compliance.

Titan International reinforced its domestic strengths by expanding Goodyear licensing rights into the farm segment while highlighting the scalability of its U.S. production footprint, positioning itself to capitalize on reshoring trends and to mitigate tariff exposures. BKT remains at the forefront of the Industry 4.0 transition, channeling R&D efforts into smart tire integration, biodegradable rubber trials, and customizable tread patterns that meet precision farming standards.

Trelleborg Tires debuted its ART1000 rubber track and TM150 CFO sprayer tire at Agrishow 2025, responding to high-horsepower demands and cyclic field operations, while simultaneously launching a digital Premium Care Portal to streamline warranty and technical support for European contractors. Bridgestone enhanced its Bridgestone Ag tractor lineup with triple-defense tread compounds and Involute lug technology, delivering prolonged wear life and efficient traction for heavy on-road and field use cases.

This comprehensive research report delivers an in-depth overview of the principal market players in the Agricultural Tires market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apollo Tyres Ltd

- Balkrishna Industries Limited

- Bridgestone Corporation

- CEAT Ltd

- Continental AG

- Cooper Tire & Rubber Company

- Goodyear Tire & Rubber Co

- GRI Tires Global Rubber Industries

- Hankook Tire & Technology

- JK Tyre & Industries Ltd

- Magna Tyres Group

- Maxam Tire International

- Michelin

- Mitas as

- MRF Limited

- Nokian Tyres plc

- Petlas Tire Industry

- Pirelli & C SpA

- Prometeon Tyre Group

- Specialty Tires of America

- Sumitomo Rubber Industries Ltd

- Titan International Inc

- Trelleborg AB

Formulating Strategic and Operational Recommendations to Empower Industry Leaders in Navigating Market Complexities and Driving Growth in Agricultural Tires

To navigate the complexities of trade policy and input cost volatility, industry leaders should pursue strategic supplier diversification by establishing relationships with upstream producers in North America and Europe while preserving access to cost-effective sources in Asia. Embracing digital tire management platforms will enable predictive maintenance, extending tire lifecycles and reducing unplanned downtime through data-driven decision-making.

Investing in eco-friendly material R&D and circular economy practices, such as retreading and bio-based compound adoption, will not only align with emerging sustainability mandates but also strengthen brand positioning among environmentally conscious customers. Collaborative innovation with ag equipment OEMs can foster the development of integrated solutions that embed sensor frameworks at the design stage, reducing aftermarket retrofits and enhancing value exchange in equipment leasing models.

Expanding omnichannel distribution strategies-including enhanced e-commerce platforms, dealer network training, and digital marketing initiatives-will allow companies to better serve both OEM and aftermarket segments. Proactively monitoring policy developments and engaging in advocacy through industry associations will ensure foresight to potential tariff or regulatory shifts, enabling companies to adjust procurement, pricing, and inventory strategies ahead of market disruptions.

Detailing the Comprehensive Multi-Method Research Approach Combining Primary Interviews and Secondary Data Analysis for Robust Agricultural Tire Insights

This analysis was conducted using a multi-method research design that began with an extensive review of technical literature, industry whitepapers, and press releases from leading tire manufacturers and relevant trade bodies. Secondary data collection encompassed regulatory filings, tariff announcements, and company disclosures to map trade policy impacts and raw material cost trends.

In parallel, primary interviews were held with subject matter experts including equipment OEM engineers, tire technologists, and agricultural fleet managers to validate emerging trends and to capture firsthand operational insights. A structured survey of distribution channel stakeholders provided clarity on service models and purchasing behaviors across dealer, distributor, and e-commerce networks.

Segmentation analyses were developed through cross-referencing machine application categories, product type classifications, and dimension-specific criteria, ensuring a precise representation of market dynamics without quantitative forecasting. All findings were peer reviewed by an independent panel of agronomy and supply chain specialists to confirm accuracy and to mitigate potential biases.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Agricultural Tires market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Agricultural Tires Market, by Application

- Agricultural Tires Market, by Product Type

- Agricultural Tires Market, by Distribution Channel

- Agricultural Tires Market, by Rim Size

- Agricultural Tires Market, by Region

- Agricultural Tires Market, by Group

- Agricultural Tires Market, by Country

- United States Agricultural Tires Market

- China Agricultural Tires Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing Core Findings on Technological, Regulatory, and Market Trends to Illuminate the Future Pathways of the Agricultural Tire Industry

Innovations in digitalization and material science are reshaping the agricultural tire market, transforming tires from passive components into proactive data sources that support precision farming and predictive maintenance. Sustainability imperatives are fueling the adoption of bio-based compounds and retreading as industry standards rather than niche offerings.

At the same time, trade policies-particularly Section 301 and Section 232 tariffs-continue to influence raw material costs and import strategies, prompting a reorientation toward domestic manufacturing and diversified sourcing. Comprehensive segmentation analyses highlight the nuanced needs of each machinery category, product type, and distribution model, underscoring the importance of tailored strategies for different user cohorts.

Regional market dynamics reveal distinct drivers in the Americas, EMEA, and Asia-Pacific, where mechanization trajectories and regulatory frameworks dictate localized approaches. Leading companies have responded with strategic investments, partnerships, and digital service platforms, setting benchmarks for competitive advantage. By integrating these insights, industry participants can align their portfolios, supply chains, and customer engagement models to capitalize on growth opportunities in a rapidly evolving agricultural landscape.

Connect with Ketan Rohom to Secure Your In-Depth Agricultural Tire Market Research Report and Gain Critical Insights for Strategic Decision-Making

To secure comprehensive insights into the agricultural tire market and inform your strategic decisions, engage directly with Ketan Rohom, Associate Director of Sales & Marketing. By partnering with him, you gain tailored access to in-depth analyses, competitive benchmarking, and expert guidance on key industry trends. His expertise ensures you receive the precise data and strategic recommendations needed to optimize investments in tire technologies, supply chain resilience, and regional market pursuits. Reach out today to purchase the full market research report and equip your organization with the actionable intelligence required to thrive in the evolving agricultural tire landscape.

- How big is the Agricultural Tires Market?

- What is the Agricultural Tires Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?