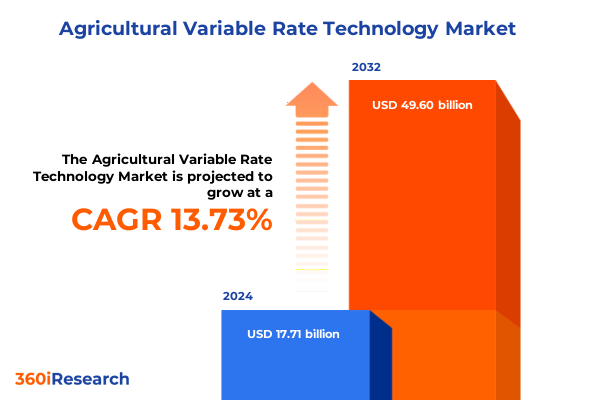

The Agricultural Variable Rate Technology Market size was estimated at USD 20.10 billion in 2025 and expected to reach USD 22.82 billion in 2026, at a CAGR of 13.77% to reach USD 49.60 billion by 2032.

Unveiling the Pivotal Role of Variable Rate Technology in Revolutionizing Modern Agriculture Practices and Sustainability

Variable Rate Technology (VRT) represents a cornerstone advancement in precision agriculture, enabling site-specific management of resources and inputs within individual management zones. By leveraging real-time field data and creating detailed application maps, VRT systems allow precise modulation of water, nutrients, and crop protection chemicals. This targeted approach addresses inherent spatial variability in soil fertility, moisture levels, and pest pressure, driving more resilient, productive and sustainable farming practices.

Over the past decade, VRT adoption has accelerated across major row crops in the United States, reflecting its growing appeal to farmers aiming to optimize input efficiency. According to the USDA Agricultural Resource Management Survey, variable rate application in fertilizer and lime expanded from 8% to 28.2% of planted acres between 2016 and 2019, while seeding rate modulation grew from 9% to 25.3%, and pesticide applications rose from 3.9% to 8.6% of acreage within that period. These shifts underscore how growers are increasingly integrating VRT into core operations to enhance profitability and manage risk.

Recent technological breakthroughs in artificial intelligence and sensor platforms have further enriched the VRT landscape, equipping systems with advanced analytics and automated feedback loops. Machine learning algorithms can now analyze multispectral imagery and soil sensor data to generate dynamic prescription maps, while next-generation sensors on equipment monitor application rates with centimeter-level accuracy. This integration of AI and sensor networks is dramatically reducing operational complexity and boosting user confidence in precision prescriptions.

The economic and environmental advantages of adopting VRT extend beyond yield improvements. By applying fertilizers and pesticides only where needed, growers achieve substantial reductions in input expenses, lowering both direct costs and potential crop damage. Meanwhile, the reduction of chemical runoff and nutrient leaching contributes to healthier soils and cleaner waterways. Farms harnessing VRT report notable gains in traceability and regulatory compliance, as every variable-rate application is digitally documented within comprehensive farm management platforms.

Embracing Digitalization Artificial Intelligence and Sustainable Innovations That Are Redefining Precision Agriculture Through Variable Rate Technology Adoption

The precision agriculture landscape is undergoing transformative shifts as digitalization, cloud computing and connectivity reshape traditional farming paradigms. Cloud-based farm management platforms consolidate field data, satellite imagery and machine telemetry into unified dashboards. This convergence of data streams enables growers to drive actionable insights from predictive analytics and optimize variable rate prescriptions across diverse environments, from irrigated row crops to specialty horticulture fields.

Simultaneously, the proliferation of Internet of Things networks and edge computing is decentralizing decision-making processes. Smart sensors and controllers embedded on applicators and planters now process complex algorithms in real time, automating rate adjustments without relying on manual intervention. These innovations are accelerating the transition from map-based VRT systems to sensor-based implementations, where in-field measurements of canopy reflectance or soil moisture instantly inform application rates.

Sustainability mandates and environmental stewardship goals are further propelling VRT adoption. Regulatory frameworks increasingly tie subsidy eligibility to demonstrable nutrient management outcomes, making precise input modulation not only an operational advantage but also a compliance imperative. Public and private funding initiatives are supporting regional VRT demonstration projects, fostering knowledge sharing among farmers, extension specialists and technology providers.

Moreover, strategic collaborations between technology integrators, agricultural cooperatives and equipment manufacturers are broadening VRT’s reach. Joint programs are offering customizable subscription models and outcome-based service agreements, easing the financial barrier for smaller operators. As a result, the VRT ecosystem is evolving from standalone hardware offerings toward holistic service architectures that emphasize performance guarantees and continuous optimization.

Analyzing the Comprehensive Effects of Newly Implemented United States Tariffs on Agricultural Inputs Equipment and Technology Adoption

The cumulative impact of new U.S. tariffs in 2025 is reshaping the economics of agricultural technology deployment, particularly for VRT solutions that rely heavily on imported components and inputs. A 25% duty on fertilizer imports from Canada-including potash, ammonium sulfate and nitrogen-has driven per-ton costs up by over $100, intensifying the financial pressure on growers seeking to implement variable rate nutrient management strategies.

Tariffs targeting agricultural machinery, electronic components and precision-ag sensors have compounded these challenges. Equipment assembled with parts sourced from China, Mexico and the EU now faces a 10–25% duty, which invariably raises the list price of critical VRT hardware. The American Farm Bureau warns that these measures risk slowing the pace of VRT adoption by increasing capital expenditures and delaying procurement timelines as farmers re-evaluate supply chain options.

Retaliatory levies on U.S. agricultural exports have also reverberated through input markets. With export markets in China and the EU subjected to duties as high as 84%, cash flows have tightened for many producers, leaving less working capital available for precision technology investments. The 2025 aid package under consideration-potentially exceeding $42 billion-aims to offset these burdens, but as historical precedents demonstrate, such subsidies often favor larger operations and may not fully bridge the gap for mid-sized and small farmers.

In response, industry stakeholders are exploring strategies to mitigate tariff exposure. Localized production of sensors and control units is accelerating, while some technology providers are shifting final assembly to tariff-exempt regions. Concurrently, digital subscription and software-as-a-service models are being promoted to distribute upfront costs over time. These adjustments illustrate how the VRT sector is adapting to a more protectionist trade environment while striving to maintain momentum in sustainable precision farming adoption.

Unveiling Deep Insights from Application Component Crop Type Equipment and Farm Size Segmentation Shaping Variable Rate Technology Outcomes

Deep segmentation analysis reveals how application-focused VRT solutions cater to the nuanced needs of fertilizer, irrigation, lime, pesticide and seed management. Within fertilizer applications, granular systems predominate in regions with established distribution networks, while liquid variable rate setups are preferred in high-value specialty crops. Drip and sprinkler platforms in the irrigation segment reflect distinct water-use priorities, with drip VRT gaining traction in water-scarce zones and sprinkler VRT favored where uniform coverage is critical. In crop protection, fungicide prescriptions are increasingly automated, even as herbicide and insecticide modules follow suit under unified machine control architectures. Seed VRT across corn, soybean and wheat demonstrates particularly strong yield gains, underscoring the effectiveness of tailored seeding rates for primary row crops.

Component segmentation highlights the balance between hardware, software and services. Hardware solutions, encompassing controllers, sensors and rate controllers, continue to anchor value-creation, but rapidly evolving software analytics platforms and ancillary services-such as prescription creation and advisory support-are scaling quickly. These service models enable outcome-driven contracts, wherein providers tie compensation to measurable improvements in input efficiency or yield enhancements.

Crop type segmentation shows distinct VRT adoption patterns. Cereals and grains, including barley, rice and wheat, benefit from expansive acreage and homogenous field conditions that simplify variable rate prescription strategies. Oilseeds such as canola and sunflower have embraced nutrient-focused VRT modules to manage narrow nutrient windows, while pulse crops like chickpea and lentil leverage targeted soil health applications. Row crops including corn and sugar beet exploit high-resolution field mapping to optimize both planting and nutrient applications.

Equipment type segmentation demonstrates that irrigation systems, seeders, sprayers and spreaders each play pivotal roles. Drip and sprinkler irrigation platforms integrate with central VRT controllers, whereas drill and pneumatic seeders feature adjustable metering units. Aerial and boom sprayers incorporate section-control and rate modulation for crop protection, and broadcast and variable rate spreaders deliver precise granular fertilization. Across farm sizes-from large operations with mixed fleets to medium and small farms adopting retrofit kits-segmentation insights underscore the importance of modular, scalable VRT architectures.

This comprehensive research report categorizes the Agricultural Variable Rate Technology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Crop Type

- Equipment Type

- Farm Size

- Application

Examining Diverse Regional Dynamics Across Americas Europe Middle East Africa and Asia Pacific Influencing Variable Rate Technology Adoption Patterns

Regional dynamics play a decisive role in shaping variable rate technology uptake across the Americas, Europe Middle East Africa and Asia-Pacific. In the Americas, the United States leads with strong VRT penetration driven by farm subsidy programs and a robust dealer network. USDA data indicates that over one-third of corn and soybean acres in major Midwest states now utilize VRT for seeding and fertilizer applications, reflecting deep integration of precision methods within large commercial operations. Canadian growers are also ramping up VRT use, buoyed by supportive provincial initiatives and expanding digital infrastructure in the Prairies.

The Europe Middle East Africa region manifests a diverse adoption profile. Western European nations leverage subsidy frameworks under the Common Agricultural Policy to finance technology upgrades, while precision-focused cooperatives in France, Germany and the Netherlands pilot advanced variable rate irrigation and nutrient management protocols. In contrast, markets in Eastern Europe and parts of the Middle East are at earlier stages, with pilot projects emphasizing training and knowledge transfer. African agricultural hubs, although nascent in VRT deployment, are evaluating rotary applicator retrofits and solar-powered sensor networks as cost-effective entry points.

Asia-Pacific is emerging as a high-growth area for VRT innovation. Modern farming technology adoption rates remain lower than GPS guidance in many countries, but sensor-based systems are gaining momentum as national digital agriculture strategies encourage automation. In South Korea, government programs under MAFRA’s smart farm initiatives have bolstered VRT awareness, particularly among younger farmers who are keen to apply data-driven nutrient and pesticide applications. Elsewhere, Australia and New Zealand continue to pilot large-scale VRT irrigation projects, seeking resilience against climatic variability.

This comprehensive research report examines key regions that drive the evolution of the Agricultural Variable Rate Technology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Precision Agriculture Innovators John Deere Trimble AGCO Joint Ventures and Emerging Startups Transforming Variable Rate Technology Solutions

John Deere remains a cornerstone in the VRT landscape by integrating modular precision kits into legacy and new machinery. Its Precision Essentials hardware bundle-comprising universal displays, GNSS receivers and connectivity modems-lowers the barrier for smaller farms to adopt variable rate functionality. Recent sprayer updates, such as the See & Spray™ Select and ExactApply™ improvements, empower operators to reduce input overlap and modulate application rates across multiple nozzle zones, maximizing yield potential while minimizing chemical use.

Trimble’s precision agriculture division has gained a strategic edge through its joint venture with AGCO, consolidating factory-fit and aftermarket VRT solutions under the PTx Trimble brand. This collaboration streamlines delivery of guidance controllers and rate management software across mixed fleets, offering growers compatibility and consistency regardless of equipment make. The NAV-960 guidance controller’s enhanced processing capacity and IonoGuard ionospheric filtering safeguard GNSS signal integrity, ensuring uninterrupted operation during solar disturbances.

Emerging startups are also transforming the VRT space. PTx Trimble’s OutRun autonomous grain cart system extends variable rate control to grain handling and tillage, allowing farmers to retrofit decade-old tractors with autonomy features that optimize input timing and reduce labor dependency. These innovations underscore a broader trend where software and data platforms, rather than hardware alone, are becoming key differentiators in delivering VRT value propositions.

Across the value chain, sensor manufacturers, agronomic advisories and software integrators are collaborating to develop unified ecosystems. By combining prescription modeling, real-time sensor inputs and outcome-based service contracts, these players are collectively shaping a more accessible and performance-oriented VRT market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Agricultural Variable Rate Technology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AG Leader Technology

- AGCO Corporation

- AgJunction Inc. by Kubota Corporation

- AgReliant Genetics, LLC

- Agremo Ltd.

- AGRIVI d.o.o.

- Arable Labs, Inc.

- CaroVail, Inc.

- CNH Industrial N.V.

- Crop Quest, Inc.

- CropX Technologies Ltd.

- Deere & Company

- Hexagon AB

- Linder Equipment Company

- Lindsay Corporation

- Ottawa Coop.

- Premier Crop Systems by Syngenta Ventures Pte Ltd

- SZ Dji Technology Co., Ltd.

- Teejet Technologies

- Telus Agriculture Solutions Inc.

- The Climate Corporation by Monsanto Company

- Topcon Corporation

- Trimble, Inc

- Valmont Industries, Inc

- Yara International ASA

Strategic Actionable Recommendations for Industry Leaders to Navigate Tariff Pressures Digital Transformation and Sustainable Variable Rate Technology Integration

Industry leaders should pursue strategic partnerships that integrate hardware, software and service offerings into coherent VRT solutions. Aligning with precision equipment OEMs and digital platform providers enables seamless data exchange and lowers integration complexity for end users. Collaborative innovation models such as joint ventures or co-development programs can accelerate product enhancements and expand market reach.

Amid trade policy uncertainties, supply chain diversification is critical. Technology providers and distributors must identify alternative component suppliers and consider local assembly to mitigate tariff impacts. Flexible pricing and financing models-including subscription services and pay-per-use contracts-can lower adoption barriers for cash-constrained growers facing input cost pressures.

Investment in farmer engagement and training programs remains essential. Segment-specific educational initiatives-from grain cooperatives to irrigation associations-help close knowledge gaps and build confidence in VRT solutions. Governments and industry bodies should prioritize demonstration trials that showcase economic and environmental outcomes, reinforcing the case for precision resource management.

Lastly, companies must embrace outcome-based business models that link VRT adoption to measurable performance metrics. By offering data-backed guarantees on input efficiency gains or yield improvements, providers can differentiate their offerings and foster long-term customer loyalty. This shift toward value-oriented services will be a defining feature of the next phase of VRT growth.

Detailing a Robust Research Methodology Combining Primary Interviews Secondary Sources and Rigorous Data Triangulation for Variable Rate Technology Analysis

Our research methodology combines rigorous primary and secondary approaches to ensure robust insights. First, we conducted in-depth interviews with key stakeholders across the VRT ecosystem, including equipment manufacturers, agtech service providers, farm cooperatives and leading growers. These qualitative discussions illuminated adoption drivers, pain points and strategic priorities shaping the market.

Concurrently, we performed comprehensive secondary research, sourcing data from government reports, industry associations and peer-reviewed publications. USDA surveys provided quantitative benchmarks on VRT adoption rates, while academic studies offered granular analysis of technology efficacy and economic impacts. Government policy documents and trade reports informed our assessment of tariff influences and regional variation.

Data triangulation was employed to reconcile disparate inputs and validate core findings. We cross-referenced interview insights with published statistics and case study outcomes, ensuring consistency and accuracy. Where data gaps emerged, additional expert consultations and market scans were conducted to refine our understanding and fill informational voids.

Finally, our analytical framework integrated scenario modeling to stress-test VRT adoption outcomes under varying tariff and subsidy conditions. This approach allows stakeholders to appreciate potential trajectories and sensitivities, equipping decision-makers with the foresight needed to navigate an evolving precision agriculture landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Agricultural Variable Rate Technology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Agricultural Variable Rate Technology Market, by Component

- Agricultural Variable Rate Technology Market, by Crop Type

- Agricultural Variable Rate Technology Market, by Equipment Type

- Agricultural Variable Rate Technology Market, by Farm Size

- Agricultural Variable Rate Technology Market, by Application

- Agricultural Variable Rate Technology Market, by Region

- Agricultural Variable Rate Technology Market, by Group

- Agricultural Variable Rate Technology Market, by Country

- United States Agricultural Variable Rate Technology Market

- China Agricultural Variable Rate Technology Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Concluding Reflections on the Transformative Potential Evolution and Future Outlook of Variable Rate Technology in Modern Agriculture Practices

Variable rate technology stands at the forefront of precision agriculture's evolution, enabling resource optimization and environmental stewardship across diverse farming systems. As adoption continues to spread-from large-scale grain operations in North America to emerging pilot projects in EMEA and Asia-Pacific-VRT is proving its capacity to deliver both economic and sustainability gains. The convergence of AI‐driven analytics, advanced sensors and cloud infrastructure is intensifying this momentum, fostering an era of data‐centric farm management.

Challenges remain, notably in balancing the higher upfront costs of VRT hardware with the need for scalable, outcome‐based business models. Tariff pressures and supply chain disruptions have introduced complexity, prompting the development of localized manufacturing and flexible pricing mechanisms. Yet these adaptations underscore the sector's resilience and its commitment to ensuring that precision technologies remain accessible to growers of all scales.

Looking ahead, the integration of autonomy, robotics and advanced machine learning will further refine VRT capabilities. Autonomous sprayers with multi‐zone rate control and autonomous grain carts demonstrate how hardware and software synergy can deliver hands‐off precision, addressing labor constraints and enhancing operational efficiency. Meanwhile, policy frameworks that tie financial incentives to demonstrated input efficiency and environmental outcomes will continue to drive technology uptake.

In sum, variable rate technology is poised for sustained growth as stakeholders coalesce around shared goals of productivity, profitability and sustainability. The next wave of innovation will be defined not only by technical breakthroughs but also by collaborative partnerships and novel service models that amplify the value of precision agriculture solutions.

Connect with Associate Director Sales and Marketing Ketan Rohom to Unlock Exclusive Insights and Secure Your Market Research Report on Variable Rate Technology

Be ready to gain unparalleled insights into variable rate technology by connecting directly with Ketan Rohom, Associate Director of Sales and Marketing. His expertise ensures you receive tailored guidance on how this research can address your strategic needs, equip your organization for evolving agricultural landscapes, and support data-driven decisions. Reach out now to secure your personal briefing and obtain the market research report that will empower your next moves in precision agriculture.

- How big is the Agricultural Variable Rate Technology Market?

- What is the Agricultural Variable Rate Technology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?