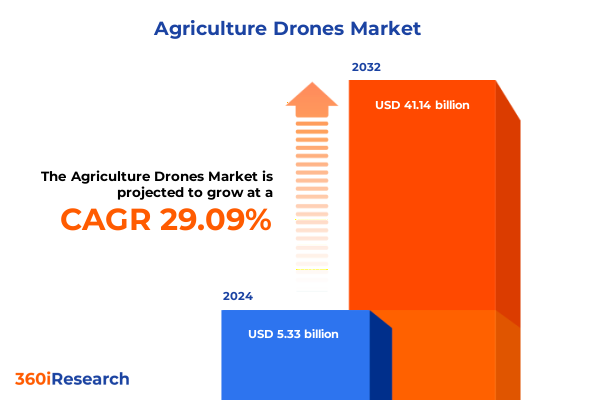

The Agriculture Drones Market size was estimated at USD 6.89 billion in 2025 and expected to reach USD 8.77 billion in 2026, at a CAGR of 29.08% to reach USD 41.14 billion by 2032.

Unveiling the Frontier of Precision Agriculture Powered by Advanced Unmanned Aerial Systems Transforming Crop Health Monitoring

The advent of unmanned aerial vehicles in precision agriculture marks a pivotal shift in how food production systems operate, bringing together advanced sensing capabilities and data-driven decision-making mechanisms. In recent years, an estimated 400,000 agricultural drones have been deployed globally, reflecting a remarkable 90% increase in operational units since 2020, with applications spanning crop spraying, field mapping, and targeted input management. This surge underscores a growing recognition of drones as indispensable tools that enhance sustainability by optimizing water usage and reducing chemical runoff. Moreover, amidst a capital landscape that saw venture funding decline by 3.6% in the first quarter of 2025, investors still channeled $1.82 billion into precision agriculture technologies, highlighting confidence in aerial solutions to address labor shortages and yield challenges.

Against this backdrop of technological momentum and financial reorientation, the present report delves into the dynamic intersection of drone hardware, software, services, and policy drivers that are reshaping global farming practices. It examines how evolving regulatory frameworks, shifting tariff regimes, and regional nuances converge to influence market trajectories. Through a combination of primary interviews with industry executives, secondary data analysis, and case study evaluations, this research offers an authoritative foundation for stakeholders seeking to harness UAV innovations for strategic growth. As the agricultural sector stands on the cusp of widespread drone integration, this introduction lays the groundwork for understanding the critical forces propelling this transformation.

Charting the Disruption Trail as Autonomous Drone Technologies Reshape Agricultural Practices and Data-Driven Decision-Making Landscapes

Drone technology in agriculture has advanced far beyond basic remote sensing, giving rise to a new era of autonomous farm management and real-time analytics that drive operational efficiency. Central to this transformation is the seamless integration of artificial intelligence and machine learning algorithms into flight planning and data interpretation modules. AI-powered drones now execute complex field surveys autonomously, detecting subtle crop stress indicators through multispectral imaging and delivering predictive insights that enable preemptive interventions. Furthermore, the practical implementation of swarm technologies allows coordinated fleets of UAVs to survey vast tracts of farmland simultaneously, reducing mission times from days to mere hours and ensuring comprehensive area coverage without manual oversight.

Simultaneously, the agricultural drone market is witnessing substantial convergence with Internet of Things ecosystems and edge computing architectures. Drones equipped with advanced sensors transmit high-resolution imagery directly to cloud-based management platforms, where data fusion with ground-level information from soil moisture probes and weather stations informs automated irrigation schedules and variable-rate input applications. This holistic approach supports sustainable resource allocation while enhancing crop yields. Additionally, recent enhancements in beyond line of sight flight permissions, granted by civil aviation authorities in multiple jurisdictions, are expanding operational envelopes and enabling long-range missions that were previously constrained by visual line of sight requirements. Collectively, these technological leaps and regulatory adaptations are redefining precision agriculture’s potential, positioning drones as integral components of next-generation smart farming infrastructures.

Assessing the Cumulative Repercussions of Recent United States Tariff Adjustments on Agricultural Drone Supply Chains and Cost Structures

The tariff environment governing agricultural drone imports into the United States has evolved into a complex, multi-layered framework that significantly influences cost structures across the supply chain. Drones imported from China, which comprise a substantial portion of U.S. commercial UAV fleets, remain subject to a cumulative duty of 170%. This composite rate originates from an initial 25% tariff imposed under Section 301 of the Trade Act in 2018, followed by additional 10% levies under Executive Order 14195 in February 2025 and a further 10% penalty in March targeting fentanyl-related trade concerns, culminating in a 125% reciprocal tariff enacted in April 2025. The exclusion of drones from broader electronics tariff exemptions underscores ongoing national security imperatives and the strategic aim to fortify domestic manufacturing capabilities.

As a result, importers face duty-related cost multipliers that can more than double the landed price of mainstream platforms, compelling many OEMs and integrators to reevaluate their sourcing strategies. Some have initiated partial onshoring of component assembly, while others are forging alliances with allied-country manufacturers to mitigate trade exposure. Concurrently, the U.S. Department of Commerce’s Section 232 national security investigation into drone imports, launched in July 2025, signals potential for further protective measures that could reshape market access and stimulate investment in domestic production lines. Ultimately, the cumulative impact of these tariff actions is driving stakeholders to optimize supply chains, reassess total cost of ownership, and explore alternative vendor partnerships to maintain competitive positioning.

Deciphering the Intricate Layers of Market Segmentation to Illuminate Growth Pathways Across Platform, Component, Payload and Beyond

A nuanced examination of market segmentation reveals critical insights into how different product types, functional components, operational parameters, end user categories, and use cases are contributing to the sector’s evolution. Platform typologies bifurcate into fixed wing configurations prized for long endurance applications, hybrid designs that balance range with vertical takeoff flexibility, and multi rotor systems optimized for precision tasks in confined airspace. Each category addresses distinct operational profiles and shapes adoption trends among diverse agricultural stakeholders. Moreover, dissecting component-level dynamics underscores the importance of hardware subsystems such as batteries that determine flight time, structural frames that influence payload capacity, navigation units that ensure positional accuracy, and propulsion mechanisms that dictate energy efficiency. Alongside this, a spectrum of services-ranging from rigorous maintenance and repair programs to specialized training and consulting offerings-fortifies end user capabilities. Software suites likewise segment into data analytics platforms for interpreting aerial insights, fleet management tools for coordinating multiple UAVs, and flight planning applications that streamline mission execution.

Payload differentiation further stratifies the market, spanning LiDAR sensors capable of generating detailed topographic models, multispectral cameras that detect crop health variances, optical imaging systems for high-resolution field mapping, spray booms engineered for precise agrochemical delivery, and thermal arrays used in irrigation management and livestock monitoring. Transmission technologies bifurcate into line of sight links facilitating short-range data transfer and beyond line of sight networks enabling extended operations. Operational range profiles categorize systems as short, medium, or long range according to their mission radius, while application segments encompass critical tasks such as crop health monitoring, targeted spraying, soil condition assessments, irrigation scheduling, and livestock oversight. Finally, end users range from large-scale commercial farms with capital-intensive operations to small and medium agricultural enterprises seeking cost-effective productivity enhancements, as well as research institutions probing innovative use cases. Together, these segmentation lenses illuminate growth opportunities and competitive hotspots across the agricultural drone ecosystem.

This comprehensive research report categorizes the Agriculture Drones market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform Type

- Component

- Payload

- Transmission Technology

- Flight Range

- Application

- End User

Unraveling Geographic Nuances and Demand Drivers to Highlight Regional Variations in Agricultural Drone Adoption and Applications

Regional market dynamics in the Americas, Europe, Middle East & Africa, and Asia-Pacific illustrate how geographic factors and policy environments shape the trajectory of agricultural drone adoption. In the Americas, robust investment cycles and expansive farmland footprints have driven UAV uptake for large-scale crop management and irrigation optimization. Despite a slight contraction in overall AgTech funding, precision agriculture transactions totaled $1.82 billion in the past year, reaffirming the region’s strategic emphasis on automation to address labor constraints and resource stewardship. Furthermore, supportive frameworks in Canada’s Prairie provinces have fostered pilot programs that integrate drones into commodity crop rotations, reinforcing their role in yield enhancement.

Across Europe, Middle East & Africa, evolving regulatory architectures have gradually lowered barriers for drone operations in agriculture. The European Union’s certification pathways and member state–level Pre-Defined Risk Assessment protocols have standardized safety requirements, enabling broader commercial deployment. Notably, Spain’s expedited digital approval platform and several Horizon Europe research initiatives are testing UAV-based spraying and imaging solutions under diverse climatic conditions, driving operational efficiencies and promoting sustainable practices in arid and temperate zones. At the same time, Middle Eastern nations are piloting drone-enabled irrigation management in water-scarce environments, while African agricultural cooperatives leverage UAVs for pest surveillance and post-harvest monitoring in key export regions.

The Asia-Pacific region stands out as the most rapidly expanding market, underpinned by large-scale policy support, government subsidies for smart farming equipment, and significant investments in digital agriculture platforms. In China, Japan, and Australia, drone integration has become integral to modern agrarian strategies-from rice paddy analysis to vineyard canopy management-driven by labor shortages and climate resilience imperatives. For instance, in Japan, technology-driven approaches to aging farm labor have accelerated UAV adoption for targeted spraying and crop diagnostics, while in Australia, pilots coordinate drone fleets to manage vast ranchlands and viticultural estates with enhanced precision and lower environmental impact.

This comprehensive research report examines key regions that drive the evolution of the Agriculture Drones market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Emerging Innovators That Are Steering Technological Advancements and Strategic Partnerships in the Agricultural Drone Sphere

A coterie of established manufacturers and innovative entrants are shaping the competitive contours of the agricultural drone sector. DJI Agriculture retains a commanding presence in the United States and global markets, with estimates indicating it supplies over half of America’s commercial UAV units, a testament to its expansive product portfolio and integrated ecosystem offerings. Meanwhile, precision farming pioneers such as PrecisionHawk and senseFly have concentrated on specialized analytics platforms and high-resolution sensor payloads, carving out niches in topographic mapping and yield prediction. Major equipment conglomerates including John Deere and Trimble have accelerated their automation roadmaps through strategic acquisitions and co-development agreements that embed UAV capabilities into holistic farm management solutions.

Emerging players are also exerting competitive pressure by targeting unaddressed market segments. AgEagle Aerial Systems, for instance, has focused on lightweight, payload-agnostic airframes tailored for smallholder environments, while Yamaha Motor has leveraged its engine expertise to produce durable spray drones designed for rugged terrain operations. On the software front, companies such as DroneDeploy and Raptor Maps differentiate through user-centric interfaces and advanced anomaly detection algorithms. Collectively, this diversified ecosystem of hardware innovators, software developers, and full-service providers is fostering a vibrant landscape of collaboration and competition, driving continuous enhancement of operational capabilities and cost efficiencies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Agriculture Drones market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3D Robotics, Inc.

- Aerosight Technologies Private Limited

- AeroVironment, Inc.

- AgEagle Aerial Systems Inc.

- BRINC Drones, Inc.

- Delair SAS

- Dhaksha Unmanned Systems Private Limited

- DroneDeploy, Inc.

- Dronelink, Inc.

- FlyPix AI GmbH

- General Aeronautics Private Limited

- ideaForge Technology Limited

- IoTechWorld Avigation Private Limited

- Marut Dronetech Private Limited

- Microdrones GmbH

- Paras Aerospace Private Limited

- Parrot S.A.

- Skylark Drones Private Limited

- SZ DJI Technology Co., Ltd.

- Thanos Technologies Private Limited

Charting Actionable Strategies and Innovative Tactics to Empower Stakeholders and Enhance Competitive Positioning in the Agriculture Drone Ecosystem

Industry participants seeking to capitalize on drone-driven precision agriculture must align their strategies with evolving technology trajectories and regulatory shifts. First and foremost, stakeholders should invest in open architecture platforms that facilitate interoperability between UAVs, ground sensors, and agronomic software solutions to maximize the value of end-to-end data streams. In parallel, forging partnerships with component suppliers in allied geographies can mitigate tariff exposure and secure critical parts such as lithium-ion batteries and advanced navigation modules. Cultivating robust maintenance networks and operator training curricula will also be essential to ensure high fleet utilization rates and regulatory compliance across diverse markets.

Moreover, organizations should proactively engage with policymakers and standard-setting bodies to shape pragmatic drone use frameworks that balance safety imperatives with operational scalability. By participating in industry consortia and contributing to risk assessment working groups, companies can accelerate the harmonization of beyond line of sight and automated flight approvals. Finally, harnessing advanced analytics to quantify sustainability benefits-such as reductions in water usage, chemical inputs, and greenhouse gas emissions-can strengthen value propositions with both agricultural producers and institutional investors. Through these targeted actions, industry leaders can fortify their competitive positioning and drive widespread adoption of precision UAV solutions.

Elucidating the Rigorous and Transparent Research Framework Combining Primary Interviews and Secondary Data to Ensure Analytical Integrity

The methodology underpinning this report integrates both primary and secondary research to ensure comprehensive and unbiased insights. Primary research comprised in-depth interviews with a curated panel of over thirty executives spanning drone OEMs, software developers, service providers, regulatory authorities, and agricultural producers. These discussions informed qualitative assessments of technology adoption barriers, value chain dynamics, and forward-looking innovation priorities.

Secondary research encompassed systematic analysis of peer-reviewed journals, conference proceedings in unmanned systems and agronomy, government publications on UAV regulations and tariff measures, and financial disclosures of publicly traded firms active in precision agriculture. Supplementary data points were sourced from technology consortium white papers, policy briefs, and open-source intelligence signals. Triangulation of quantitative indicators-such as drone unit shipments, sensor cost trajectories, and capital funding flows-ensured analytical rigor. Throughout the process, findings were validated via cross-verification with industry experts and feedback loops, ensuring that conclusions rest on a robust evidentiary foundation and reflect the state of the market as of mid-2025.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Agriculture Drones market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Agriculture Drones Market, by Platform Type

- Agriculture Drones Market, by Component

- Agriculture Drones Market, by Payload

- Agriculture Drones Market, by Transmission Technology

- Agriculture Drones Market, by Flight Range

- Agriculture Drones Market, by Application

- Agriculture Drones Market, by End User

- Agriculture Drones Market, by Region

- Agriculture Drones Market, by Group

- Agriculture Drones Market, by Country

- United States Agriculture Drones Market

- China Agriculture Drones Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Synthesizing Core Findings and Forward-Looking Perspectives to Illuminate the Next Evolutionary Phases of Drone-Enabled Precision Agriculture

This comprehensive analysis of the agricultural drone domain synthesizes key trends, tariff impacts, segmentation dynamics, regional variations, and competitive strategies to chart a clear vision for the sector’s evolution. The interplay between advanced sensing payloads, AI-driven analytics, and shifting policy landscapes underscores the transformative potential of UAVs to enhance sustainability, productivity, and resilience in modern agriculture. As demonstrated, segmentation insights reveal differentiated opportunities across platform configurations, component ecosystems, and application domains, while regional profiles highlight how localized conditions and regulatory frameworks modulate adoption pathways.

Looking ahead, emerging technologies-such as fully autonomous drone swarms, digital twin integration, and blockchain-anchored traceability-are poised to redefine conventional agronomic paradigms. Moreover, the cumulative effects of tariff structures and national security investigations are likely to further incentivize onshore manufacturing and allied-country partnerships, reshaping global supply chains. By engaging proactively with these trends and leveraging strategic collaborations, industry participants can unlock new value propositions and accelerate the arrival of a truly data-driven, drone-enabled agricultural revolution.

Connect with Ketan Rohom to Access the Comprehensive Market Intelligence Report and Unlock Strategic Insights to Propel Agriculture Drone Technology Investments

To obtain the full market intelligence report and gain unrestricted access to granular data, proprietary analyses, and in-depth company profiles, industry stakeholders are encouraged to connect directly with Ketan Rohom, the Associate Director of Sales & Marketing. Leveraging his expertise in agricultural technology markets, Ketan can guide you through tailored research offerings that align with your strategic objectives. Engage in a personalized briefing to explore custom data services, competitive benchmarking, and strategic consulting solutions designed to accelerate your drone adoption roadmap. Reach out today to secure your competitive edge in the rapidly evolving precision agriculture landscape.

- How big is the Agriculture Drones Market?

- What is the Agriculture Drones Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?