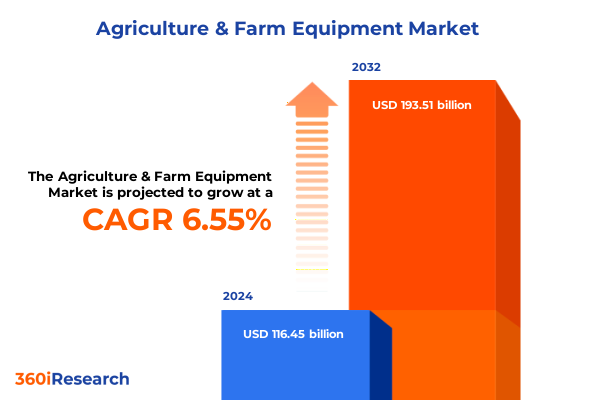

The Agriculture & Farm Equipment Market size was estimated at USD 123.15 billion in 2025 and expected to reach USD 130.23 billion in 2026, at a CAGR of 6.66% to reach USD 193.51 billion by 2032.

Unveiling the Driving Forces Propelling the Agricultural Machinery Market Through Technological Innovation, Sustainability Mandates, and Global Policy Shifts

The global agriculture equipment landscape is at an inflection point, driven by escalating pressure to produce more with fewer resources. Mechanization has become indispensable as labor shortages intensify and sustainability mandates grow more stringent. Tractors, harvesters, and specialized implements are no longer mere tools; they have evolved into data-driven platforms equipped with GPS, IoT connectivity, and AI-powered analytics that enable farmers to make informed, precision-oriented decisions. The Food and Agriculture Organization reported nearly 28 million tractors in operation worldwide as of 2022, underscoring the critical role of mechanization in ensuring food security across diverse geographies. Moreover, in the United States, tractors are utilized on approximately 85% of farms, reducing labor hours per acre by 50% compared to manual methods, according to the U.S. Department of Agriculture.

Furthermore, the convergence of emerging technologies and policy dynamics is reshaping market fundamentals. Autonomous tractors unveiled at CES 2025 demonstrated fully driverless tilling and planting capabilities, illustrating the sector’s transition from incremental automation to fully autonomous operations. Simultaneously, trade tensions and reciprocal tariffs have injected uncertainty into supply chains, prompting leading manufacturers to reassess production footprints and inventory strategies. Against this backdrop, understanding both technological innovation and geopolitical headwinds is paramount for stakeholders aiming to navigate the rapidly evolving agriculture equipment market.

How Cutting-Edge Automation Technologies and Sustainable Practices Are Revolutionizing Agricultural Equipment Performance and Farmer Productivity

The agriculture equipment sector is undergoing transformative shifts propelled by advancements in automation and digitalization. Major manufacturers are embedding AI and machine-learning algorithms into their fleets, enabling autonomous field operations that address chronic labor shortages. Deere & Co.’s new autonomous tractor lineup integrates advanced computer vision and multiple sensor arrays to navigate complex terrains without human intervention, reflecting a strategic pivot toward full autonomy in heavy machinery. Likewise, the U.S. AgTech investment slowdown in Q1 2025 has not deterred precision farming, with robotics and smart field equipment attracting substantial venture interest despite broader capital headwinds.

Sustainability and electrification are emerging as equally powerful forces. Electric tractors and hybrid harvesters are gaining traction, supported by incentives and environmental regulations. Solectrac’s electric tractor sales surged by 30% in North America during 2023, while Yanmar’s remote-operated electric tractor saw a 15% uptake in Japan’s demonstration farms, illustrating a gradual but clear shift toward low-emission machinery. Additionally, digital service models-such as equipment leasing, farming-as-a-service, and pay-per-hectare contracts-are reshaping ownership paradigms, allowing farmers to access state-of-the-art technologies without bearing full capital costs.

Navigating the Complex Aftermath of 2025 United States Tariff Policies Impacting Farm Equipment Supply Chains and Cost Structures

The imposition of multiple U.S. tariff measures in 2025 has introduced a new layer of complexity into agricultural machinery economics. A 25% duty on imported steel and aluminum, coupled with retaliatory tariffs from trading partners, has raised production costs for core components integral to tractors and harvesters. The Farm Equipment Manufacturers Association described this policy mix as a “perfect storm,” warning that it will disrupt North American supply chains and elevate end-user prices. In response, AGCO has temporarily stationed certain finished products outside U.S. borders to mitigate tariff exposure, even as parts shipments remain unaffected.

Manufacturers are absorbing significant tariff-related expenses. Deere & Co. disclosed a $500 million tariff impact for 2025 and incurred $100 million in the second quarter alone, underscoring the financial strain these levies impose. Meanwhile, equipment dealers anticipate passing on the incremental costs to farmers, which could dampen purchase volumes for both new and used machinery. Trade experts caution that prolonged uncertainty may drive buyers toward alternative suppliers outside the United States, potentially eroding American manufacturers’ competitive edge and affecting tens of thousands of family-sustaining jobs on both sides of the border.

Deciphering Market Dynamics Through Detailed Segmentation by Equipment Categories, Power Ranges, Operation Modes, and Application Verticals

Market segmentation offers critical insights into evolving equipment preferences and usage patterns. When viewed through the lens of machinery categories, tractors continue to anchor farm operations, but specialized harvesting machines-such as combine, forage, and multi-crop harvesters-are experiencing increased adoption in high-yield cereal and grain regions. Similarly, the baling equipment segment, encompassing round and square balers, is pivotal in livestock-focused geographies. Across horsepower tiers, less versatile sub-40 horsepower units rely on simplicity, while mid-range tractors (40–100 horsepower) dominate general-purpose tasks, and high-power machines (100–500 and above) fuel large-scale row crop production.

Power source is another defining axis: diesel remains the workhorse fuel, yet electric tractors and petrol-powered utility units are carving niche applications in specialty farming. Operation modes vary between PTO-driven implements for tillage and seeding, self-propelled sprayers for large acreage operations, and towed implements for users requiring flexibility. Mechanization levels range from manual attachments to semi-automatic planters and fully automatic smart seeders, aligning with operators’ labor availability. Finally, application domains-spanning crop farming, horticulture, and livestock-entail tailored configurations: nutrient applicators in vegetable and fruit fields, greenhouse-optimized equipment, and ranch-scale feed-pushing robots for dairy and poultry operations.

This comprehensive research report categorizes the Agriculture & Farm Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Horsepower Range

- Power Source

- Operation Mode

- Mechanization Level

- Application

Regional Disparities in Agricultural Equipment Adoption Reflecting Economic Realities, Policy Frameworks, and Climatic Challenges Across the Globe

Regional markets exhibit distinct trajectories driven by economic structures, regulatory frameworks, and climatic realities. In the Americas, large-scale grain producers in the U.S. and Canada are accelerating adoption of fully autonomous platforms and precision seeding systems, driven by farm sizes exceeding 400 acres and supported by government subsidy programs for advanced technologies. Conversely, smallholder and specialty crop farmers increasingly leverage equipment rental services to access advanced tractors and sprayers on a pay-as-needed basis, reflecting a shift toward flexible, service-based models.

Europe, Middle East & Africa present a mixed picture. EU machinery emissions standards under Stage V and the impending Carbon Border Adjustment Mechanism are prompting manufacturers to invest in low-emission engines and electric prototypes, while farmers lobby for regulatory relief amid rising input costs and protests over environmental rules. In sub-Saharan markets, mechanization remains nascent, constrained by infrastructure gaps, but pilot projects deploying compact, low-cost implements and solar-charged electric tractors are positioning the region for incremental growth.

Asia-Pacific stands at the forefront of adoption in several segments. India’s agricultural universities are retrofitting legacy tractors with AI-enabled auto-steer kits to drive precision planting in rice and wheat belts, and China’s National Machinery Park is field-testing autonomous combine harvesters to bolster yields under labor constraints. Government incentives and large-scale production capabilities further cement the region’s role as both a major consumer and increasingly a technology innovator in the global agriculture equipment arena.

This comprehensive research report examines key regions that drive the evolution of the Agriculture & Farm Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Insights into Competitive Strategies and Innovation Pipelines of Leading Global Agricultural Equipment Manufacturers Driving Industry Transformation

Leading original equipment manufacturers are realigning innovation pipelines and strategic investments to sustain competitive advantage. Deere & Co. continues to expand its autonomy kits and electric machinery portfolio, building on its CES introductions, while leveraging captive finance channels to smooth customers’ transition to advanced assets. AGCO is enhancing its global footprint through targeted distribution alliances, temporarily deferring U.S. imports to navigate tariff volatility and optimizing localized production hubs in Europe and Latin America.

CNH Industrial and Kubota are doubling down on precision agriculture integration, embedding IoT-enabled sensors and variable-rate technology across product lines to reduce input waste and improve yield consistency. Meanwhile, Mahindra’s e-Kaali tractor series has surpassed 10,000 unit sales within six months of its launch, buoyed by government subsidy schemes and a burgeoning electric tractor ecosystem in Asia-Pacific. Emerging disruptors such as Monarch Tractor are capturing niche segments with fully electric, AI-driven platforms optimized for specialty farming and solar asset management, attracting strategic partnerships with regional co-operatives and rental providers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Agriculture & Farm Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGCO Corporation

- Alamo Group Inc.

- Bucher Industries AG

- Caterpillar Inc.

- CLAAS KGaA mbH

- CNH Industrial N.V.

- Deere & Company

- Doosan Group

- GRIMME Landmaschinenfabrik GmbH & Co. KG

- Hitachi Construction Machinery Co., Ltd.

- Iseki & Co., Ltd.

- JC Bamford Excavators Ltd.

- Kubota Corporation

- LEMKEN GmbH & Co. KG

- Lindsay Corporation

- Mahindra & Mahindra Limited

- Maschinenfabrik Bernard KRONE GmbH & Co.KG

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- PÖTTINGER Landtechnik GmbH

- SDF Group

- Valmont Industries, Inc.

- Väderstad Group

- Weichai Lovol Intelligent Agricultural Technology Co., Ltd.

- Yanmar Holdings Co., Ltd.

Strategic Imperatives for Industry Leaders to Harness Technological Advancements, Navigate Trade Risks, and Unlock Sustainable Growth Opportunities

To capitalize on emergent opportunities and mitigate evolving risks, industry leaders should prioritize several strategic imperatives. First, accelerating modular automation development-via retrofit kits and platform-agnostic autonomy bundles-will broaden adoption across diverse user segments and geographies, offsetting capital constraints among smaller operators. Second, forging public-private partnerships to co-invest in charging infrastructure and testing corridors will underpin the viability of electric and hybrid machinery, smoothing regulatory compliance under tightening emissions standards.

Additionally, embedding data-driven agronomic services into equipment offerings can deepen customer loyalty and create recurring revenue streams, particularly when tied to pay-per-output or subscription-based models. Companies should also diversify supply chains by establishing regional manufacturing hubs and flexible warehousing to navigate tariff volatility and safeguard parts availability. Finally, ongoing engagement with policymakers to shape trade negotiations and environmental mandates will be critical; active advocacy can help ensure balanced regulations that support innovation while maintaining market access.

Comprehensive Research Methodology Utilizing Structured Primary Interviews, Rigorous Secondary Data Analysis, and Robust Segmentation Frameworks

This study employs a structured mixed-methods approach, integrating both primary and secondary research to ensure analytical rigor. Secondary data were collected from authoritative government sources, industry associations, and reputable news agencies to map macroeconomic trends, policy developments, and technology adoption patterns. Complementing this, over 25 in-depth interviews were conducted with senior executives at OEMs, equipment dealers, and agricultural cooperatives to capture qualitative insights into strategic priorities and operational challenges.

Quantitative data were triangulated through cross-validation of industry reports, trade statistics, and financial disclosures to construct a granular segmentation framework spanning equipment type, horsepower range, power source, operation mode, mechanization level, and application. Advanced analytical models-including scenario planning and sensitivity analysis-were deployed to assess the impact of tariff scenarios and technology diffusion rates. Findings were further peer-reviewed by subject matter experts to ensure integrity and relevance, resulting in a robust foundation for actionable recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Agriculture & Farm Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Agriculture & Farm Equipment Market, by Equipment Type

- Agriculture & Farm Equipment Market, by Horsepower Range

- Agriculture & Farm Equipment Market, by Power Source

- Agriculture & Farm Equipment Market, by Operation Mode

- Agriculture & Farm Equipment Market, by Mechanization Level

- Agriculture & Farm Equipment Market, by Application

- Agriculture & Farm Equipment Market, by Region

- Agriculture & Farm Equipment Market, by Group

- Agriculture & Farm Equipment Market, by Country

- United States Agriculture & Farm Equipment Market

- China Agriculture & Farm Equipment Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Final Reflections on Evolving Trends Shaping the Agricultural Machinery Market Toward a Resilient and Sustainable Future

The convergence of automation, electrification, and evolving trade policies underscores a pivotal transformation in the agricultural machinery sector. Market leaders that align R&D investments with sustainability targets and modular automation solutions will be best positioned to seize growth in mature and emerging markets. Meanwhile, agility in supply chain management and active participation in policy discourse can help navigate the complexities introduced by tariff measures and emissions regulations.

Ultimately, stakeholders who adopt a holistic approach-integrating product innovation, service-based offerings, and strategic geographic diversification-will build resilience against market volatility. As the sector accelerates toward data-centric, low-emission operations, embracing these multidimensional trends is imperative for fostering sustainable productivity gains and securing long-term competitive advantage.

Engage Directly with Associate Director Ketan Rohom to Secure Your Definitive Agriculture Equipment Market Report and Accelerate Your Strategic Decisions

To explore the comprehensive insights and strategic analyses detailed in this report, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. He can guide you through the report’s depth, demonstrate how these findings address your organizational priorities, and facilitate seamless access to the full research deliverable. Your next competitive move in the agriculture equipment sector begins with a conversation-reach out today to secure this definitive resource.

- How big is the Agriculture & Farm Equipment Market?

- What is the Agriculture & Farm Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?