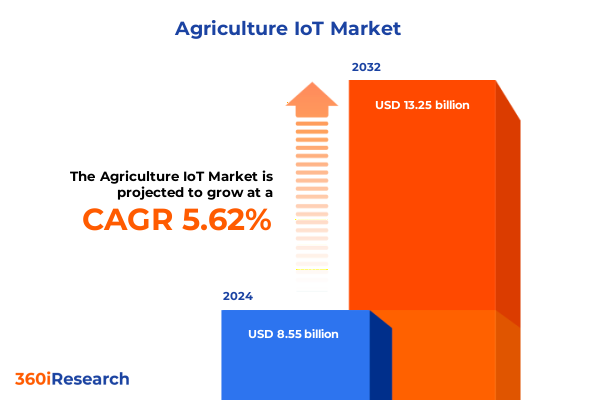

The Agriculture IoT Market size was estimated at USD 9.02 billion in 2025 and expected to reach USD 9.51 billion in 2026, at a CAGR of 5.64% to reach USD 13.25 billion by 2032.

Exploring the Emergence of Intelligent Agriculture Systems That Are Redefining Productivity and Sustainability Across Value Chains and Diverse Agroecological Zones

As the agricultural sector embraces the promise of digital transformation, the integration of Internet of Things solutions is rapidly becoming a cornerstone of modern farming operations. The convergence of sensors, connectivity platforms, and advanced analytics is empowering producers to move from reactive to predictive and prescriptive decision-making. Increasing pressure to maximize yields, enhance resource efficiency, and reduce environmental impact has driven farmers and agribusinesses to adopt instrumentation that can monitor soil moisture, track equipment performance, and oversee crop health in real time. Consequently, a new landscape is emerging in which data serves as both a diagnostic tool and a strategic asset.

From precision irrigation systems that determine optimal water application rates, to livestock monitoring networks that alert managers to deviations in animal behavior, today’s intelligent agriculture systems are fostering more resilient and adaptive value chains. Moreover, the proliferation of cloud computing and edge processing enables seamless data collection across remote fields and greenhouses, while advanced machine learning algorithms provide actionable insights on nutrient management, pest outbreaks, and yield forecasting. This shift toward a sensor-driven, connectivity-enabled ecosystem highlights a fundamental redefinition of traditional farming, in which technology and agronomy coalesce to drive sustainable productivity gains.

Unveiling Disruptive Technological Advances and Strategic Shifts That Are Transforming the Agricultural Internet of Things Landscape at an Unprecedented Pace

Recent years have witnessed a series of disruptive technological advances that are reshaping the agriculture IoT landscape at an unprecedented pace. Edge computing architectures have matured to handle vast volumes of sensor data directly at the field level, reducing latency and enhancing reliability in operations. Meanwhile, low-power wide-area network protocols, satellite mesh topologies, and next-generation cellular standards have broadened the geographical reach of connectivity, ensuring even remote plots remain seamlessly integrated into centralized management platforms. This has facilitated a shift away from siloed, farm-level deployments toward scalable, integrated solutions spanning multiple asset types and environmental conditions.

In parallel, the evolution of data analytics has progressed from retrospective reporting to real-time anomaly detection and AI-driven predictive modeling. Agritech vendors are embedding machine vision and deep learning into greenhouse automation systems, enabling autonomous disease identification and targeted interventions. On the services front, subscription-based analytics models and managed IoT services are lowering the barriers to entry for smaller producers, democratizing access to sophisticated farm management tools. Taken together, these strategic shifts are driving convergence across hardware, software, and services, fostering more holistic offerings that align with farmers’ operational workflows and risk management priorities.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Policies on Cross-Border Supply Chains, Component Costs, and Farm-Level Adoption Dynamics

The introduction of revised tariff measures in early 2025 has imposed additional duties on a range of imported electronic components and connectivity modules critical to agriculture IoT systems. These levies have affected hardware manufacturers that rely on cross-border supply chains for specialized silicon sensors, cellular modems, and satellite transceivers. As a result, component costs have risen, prompting equipment providers to recalibrate pricing models or seek alternative sourcing strategies. This dynamic has had a cascading impact on adoption rates among cost-sensitive farmers and agribusinesses operating on thin margins.

Moreover, the elevated duties have accelerated conversations around nearshoring and domestic assembly for certain IoT components, giving rise to emerging partnerships between local electronics firms and global agritech vendors. While this realignment promises greater supply chain resiliency in the long run, it has also introduced short-term volatility in lead times and inventory management. From a user perspective, higher up-front hardware prices have shifted more focus onto software and service revenues, as providers look to preserve margin by bundling analytics subscriptions with equipment sales. Collectively, these developments underscore how policy shifts can ripple across the entire ecosystem-from chip fabricators to cloud platform operators-ultimately influencing the pace and scale of digital adoption in the fields.

Analyzing Core Components, Connectivity Technologies, and Specialized Application Segments to Reveal Nuanced Patterns Driving Agriculture IoT Implementation

Understanding market behavior requires an examination of the foundational building blocks, the connectivity mediums they employ, and the targeted applications that drive value creation. On the component front, instrumentation hardware such as environmental sensors, actuators, and gateway devices represents the physical interface to the farm environment; software platforms serve as the command center for data visualization, reporting, and AI-driven recommendations; and professional services encompass installation, integration, training, and ongoing support commitments. Taken together, these elements form an interoperable stack where each layer contributes to the overall proposition.

Equally critical is the technology that links these components to centralized management systems. Cellular networks have long provided reliable coverage in populated agricultural regions, while satellite connectivity ensures continuity in remote or topographically challenging areas. The coexistence and complementarity of these mediums allow solution providers to tailor offerings to specific geographic and operational requirements. Lastly, the true value of the IoT is realized through application-specific use cases. The greenhouse environment benefits from modular automation suites that regulate temperature, humidity, and nutrient delivery; efficient irrigation management systems leverage soil and weather sensors to conserve water while optimizing field hydration; livestock monitoring solutions track behavior patterns, health status, and location through submodules dedicated to behavior, health, and positional data; and precision farming tools encompass both crop observation and soil analysis capabilities that empower agronomists to scout fields, assess nutrient levels, and deploy interventions with pinpoint accuracy. By synthesizing insights across these component, connectivity, and application dimensions, stakeholders can pinpoint the most impactful areas for investment and deployment.

This comprehensive research report categorizes the Agriculture IoT market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Connectivity Technology

- Application

Uncovering Regional Dynamics and Market Drivers Across the Americas, Europe Middle East Africa, and Asia-Pacific That Shape the Global Agriculture IoT Ecosystem

Regional variations in climate, land use, regulatory frameworks, and infrastructure maturity have shaped the trajectory of agriculture IoT adoption around the world. In the Americas, a blend of large-scale commercial farms and smaller specialty operations has driven demand for flexible platforms that can scale across heterogeneous environments. Investments in precision tillage and variable-rate equipment have been complemented by proliferating software-as-a-service models, reflecting a willingness to embrace subscription-based analytics for yield optimization.

Across Europe, Middle East, and Africa, regulatory incentives around water conservation and carbon reporting have spurred uptake of connectivity-enabled irrigation controls and greenhouse management suites. Fragmented landholdings in parts of Europe contrast with large pastoral systems in regions of the Middle East and Africa, requiring adaptive business models and modular technology configurations. Meanwhile, government-led digital agriculture initiatives and rural connectivity programs are bolstering satellite partnerships and public–private collaborations.

In Asia-Pacific, rapid advancements in mobile broadband combined with burgeoning investments in smart agriculture have fueled experimentation with drone-based crop scouting, AI-driven pest detection, and hybrid IoT architectures. High-growth markets in Southeast Asia and Oceania are adopting joint financing schemes to facilitate smallerholder access, while Australia’s extensive grain belt is pioneering remote asset monitoring for machinery fleets. The interplay of diverse agricultural practices and connectivity landscapes underscores the need for regionally tailored approaches that align with local priorities and resource constraints.

This comprehensive research report examines key regions that drive the evolution of the Agriculture IoT market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating the Strategic Positioning, Innovation Focus, and Collaborative Initiatives of Leading Players Driving Growth in the Agriculture IoT Sector

Leading providers in the agriculture IoT domain are differentiating through end-to-end offerings, strategic alliances, and capabilities in data science. Established equipment manufacturers have enhanced their traditional machinery portfolios by embedding sensor arrays and telematics modules directly into tractors, planters, and irrigation pivots. These integrations are augmented with cloud-based analytics dashboards and mobile apps, enabling agronomists and field technicians to glean insights on operational performance and system health.

Pure-play technology firms are focusing on software innovation, catering to niche use cases such as automated greenhouse climate control, livestock health tracking, and soil nutrient modeling. Many have adopted platform-agnostic architectures to ensure interoperability with third-party sensors and gateways, fostering ecosystems that bring together hardware vendors, connectivity providers, and analytics specialists. Partnerships between satellite network operators and agritech companies have expanded coverage in underserved regions, while collaborations with academic institutions are advancing research in machine vision, predictive disease modeling, and robotics.

In addition, a wave of startup entrants is challenging incumbents by offering modular, low-cost sensor kits paired with open-source analytics tools. These innovators are cultivating developer communities and leveraging crowdsourced data to refine algorithms and reduce time to market. The competitive landscape is thus coalescing around hybrid strategies that balance proprietary value propositions with ecosystem-oriented platforms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Agriculture IoT market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Ag Leader Technology

- AGCO Corporation

- Deere & Company

- Delaval, Inc.

- GEA Group AG

- Hexagon AB

- Hitachi, Ltd.

- Raven Industries, Inc.

- SemiosBIO Technologies Inc.

- Topcon Positioning Systems, Inc.

- Trimble Water

- XAG

Formulating Targeted Strategic Actions and Investment Priorities to Empower Industry Leaders to Capitalize on Opportunities and Mitigate Emerging Risks

To capitalize on the evolving agriculture IoT frontier, industry leaders should prioritize a blend of portfolio diversification and partnership-driven expansion. Allocating resources toward integrated solution development that combines hardware robustness, software sophistication, and managed services can create stickier customer relationships and recurring revenue streams. Furthermore, forging alliances with connectivity providers will ensure seamless coverage across disparate geographies while unlocking new monetization models based on data throughput and service levels.

Simultaneously, executives should invest in advanced analytics capabilities, including machine learning and edge intelligence, to differentiate offerings through real-time decision support and predictive alerts. This requires building multidisciplinary teams that can translate agronomic expertise into algorithmic frameworks, as well as establishing data governance practices that address privacy, security, and interoperability. On the commercial front, flexible pricing models-such as outcome-based contracts and tiered subscription packages-will help overcome reluctance among price-sensitive adopters and align vendor success with farm-level performance improvements.

Finally, monitoring policy developments and actively engaging in industry associations will enable companies to anticipate regulatory shifts, such as incentive programs for carbon footprint tracking or water usage reporting. By adopting this multipronged approach, leaders can mitigate risks associated with supply chain uncertainty, differentiate through value-added services, and position their organizations to seize emerging opportunities in the smart agriculture realm.

Detailing the Rigorous Research Methods, Data Sources, and Analytical Frameworks Employed to Deliver a Comprehensive and Unbiased Market Study

This analysis is grounded in a comprehensive research framework that integrates primary interviews, secondary data aggregation, and rigorous qualitative and quantitative assessment techniques. Primary engagements included in-depth discussions with farm operators, agribusiness executives, technology vendors, and connectivity service providers, ensuring that diverse stakeholder perspectives informed the narrative. Secondary inputs were derived from technical white papers, government publications, industry consortium reports, and peer-reviewed journals to capture macroeconomic trends, policy developments, and technological advancements.

Researchers employed a structured triangulation approach to validate insights across multiple sources, minimizing bias and enhancing reliability. Component-level evaluations were supported by vendor product catalogs and patent analyses, while connectivity assessments leveraged publicly available network coverage maps and spectrum allocation studies. Application-specific use cases were benchmarked through case study reviews and field trial outcomes. Finally, regional dynamics were contextualized using geopolitical research, agricultural census data, and regulatory frameworks to reflect localized drivers and constraints. The methodology underscores a commitment to transparency, replicability, and analytical rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Agriculture IoT market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Agriculture IoT Market, by Component

- Agriculture IoT Market, by Connectivity Technology

- Agriculture IoT Market, by Application

- Agriculture IoT Market, by Region

- Agriculture IoT Market, by Group

- Agriculture IoT Market, by Country

- United States Agriculture IoT Market

- China Agriculture IoT Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 954 ]

Summarizing Key Insights, Strategic Imperatives, and Forward-Looking Observations to Inform Decision-Making in the Evolving Agriculture Internet of Things Domain

The convergence of digital technologies with traditional farming practices has ushered in a new era of intelligent agriculture that is defined by data-driven decision-making, operational resilience, and enhanced sustainability. This report’s insights into transformative shifts, tariff impacts, segmentation dynamics, regional nuances, and competitive strategies collectively underscore the profound opportunities and challenges that lie ahead. As stakeholders navigate a marketplace characterized by evolving policies, emerging connectivity paradigms, and intensifying competitive forces, a holistic understanding of the IoT ecosystem is essential to unlocking value.

Looking forward, the ongoing maturation of edge computing, advanced analytics, and network architectures promises to deepen the integration of autonomous systems and robotics into core agricultural workflows. Simultaneously, the imperative to demonstrate environmental stewardship and compliance with evolving regulatory mandates will elevate the role of digital traceability and carbon accounting within IoT platforms. Ultimately, those organizations that can harmonize technological innovation with agronomic expertise and customer-centric service delivery will stand at the forefront of the smart farming revolution.

Engaging with Ketan Rohom to Secure Access to an In-Depth Market Research Report Offering Critical Analysis and Actionable Intelligence for Stakeholders

For a deeper dive into the insights, trends, and strategic imperatives outlined in this report, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore how this analysis can inform your next moves. By securing access to the complete market research study, you will equip your organization with granular data, comparative benchmarks, and forward-looking perspectives tailored to the agriculture IoT space. Reach out to Ketan today to arrange a personalized briefing on the report’s findings, request supplemental data sets, and discuss bespoke consulting engagements. Empower your team with the actionable intelligence needed to accelerate innovation, optimize operational efficiency, and strengthen your positioning in a rapidly evolving market.

- How big is the Agriculture IoT Market?

- What is the Agriculture IoT Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?