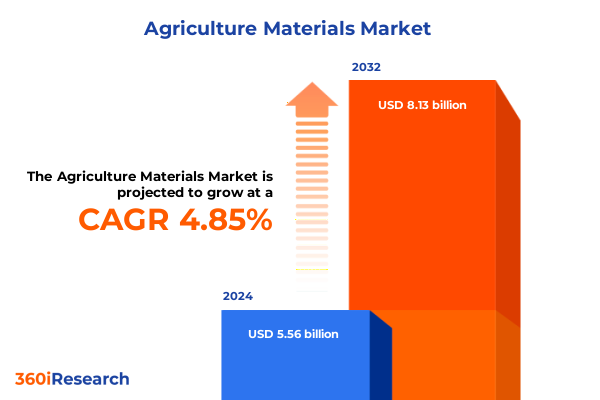

The Agriculture Materials Market size was estimated at USD 5.83 billion in 2025 and expected to reach USD 6.07 billion in 2026, at a CAGR of 4.85% to reach USD 8.13 billion by 2032.

Revolutionizing Agricultural Inputs: A Comprehensive Introduction to Emerging Trends and Sustainable Innovations Shaping the Industry

Agricultural materials form the backbone of global food security and economic stability, underpinning the production of essential crops that feed billions. With mounting pressures from climate volatility, resource constraints, and evolving regulatory environments, the way farmers source and apply inputs is increasingly complex. Innovations in seed genetics, crop protection chemistries, and soil health amendments are converging with digital technologies to redefine agronomic practices. As a result, stakeholders across the value chain-from input manufacturers to distributors and end users-must navigate a rapidly shifting landscape characterized by sustainability targets, supply chain disruptions, and technological adoption hurdles. The convergence of these forces makes it critical to understand the forces reshaping agricultural inputs and their implications for productivity, cost structures, and environmental footprints.

Transformative Shifts in the Agricultural Landscape Redefining Sustainability, Productivity, and Supply Chain Resilience Across Global Farming Systems

The agriculture sector is witnessing profound transformations driven by sustainability mandates, digitalization, and supply chain realignment. First, eco-friendly biological solutions are moving from niche experiments to mainstream tools as growers seek to reduce dependence on synthetic chemistries. Renewed regulatory scrutiny in major markets has accelerated the adoption of microbial and plant-derived crop protection agents alongside integrated pest management frameworks. Second, precision agriculture technologies-fueled by artificial intelligence, satellite imagery, and sensor networks-are enabling unprecedented levels of input optimization. Recent advances in soil carbon monitoring and automated data analytics are not only enhancing crop health assessments but also supporting carbon sequestration initiatives. Finally, geopolitical tensions and trade policy shifts are prompting a reconsideration of sourcing strategies. Disruptions in fertilizer supply chains and the threat of import duties are compelling producers and distributors to diversify procurement and localize manufacturing, thereby bolstering resilience against future shocks.

Analyzing the Multifaceted Impact of 2025 United States Tariffs on Agricultural Materials Affecting Costs, Supply Chains, and Farm Profitability Dynamics

United States trade policy in 2025 has introduced new cost drivers and operational challenges for agricultural supply chains. Tariffs on imported potash-a critical source of potassium for plant nutrition-imposed a 25% duty on shipments from Canada, increasing domestic potash prices by over $100 per ton due to import reliance of more than 80%. Meanwhile, an antidumping ruling on key herbicide imports of 2,4-D from China and India has triggered countervailing duties, raising concerns among farm organizations that access to lower-cost generic alternatives could be limited, thereby elevating overall crop protection expenditures. Beyond chemical inputs, tariffs on steel and parts used in agricultural machinery have also inched higher, impacting the cost of equipment purchases and repair, which in turn may slow investment in modern farm technologies.

Uncovering Core Segmentation Insights in Agricultural Materials Across Product Types, Applications, Technologies, Forms, and Distribution Channels Dynamics

Insights into product type segmentation reveal that conventional pesticides continue to dominate input portfolios, with fungicides capturing the lion’s share due to their critical role in disease management across high-value crops. However, biological fungicides are outpacing synthetic variants in growth rates as stringent regulations in both the European Union and the United States drive demand for low-residue, environmentally benign solutions. When examining application segments, cereals such as maize, rice, and wheat absorb the bulk of nutrient and crop protection volumes, underscoring the imperative of maximizing yield under tight agronomic margins. Oilseed and pulse producers, particularly in soybean and rapeseed markets, are increasingly integrating seed treatments and soil conditioners to enhance stress tolerance and nutrient uptake. Looking at technology type, biological approaches-encompassing microbial, botanical, and RNA interference-based products-are gaining traction over conventional chemistries, driven by farmer interest in integrated pest management and long-term soil health objectives. In the context of product form, granular fertilizers maintain a strong presence across large-scale operations due to ease of handling and distribution, while liquid formulations are carving out a niche in precision application platforms that leverage fertigation and foliar delivery methods for rapid nutrient response. Finally, distribution channel analysis highlights that while traditional direct and distributor pathways underpin the industry’s backbone, online procurement has surged-facilitated by digital platforms and pandemic-induced shifts-altering the balance between research-to-order and click-to-deliver models.

This comprehensive research report categorizes the Agriculture Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology Type

- Form

- Application

- Distribution Channel

Illuminating Regional Dynamics in Agricultural Materials Across Americas, Europe Middle East Africa, and Asia-Pacific Highlighting Growth and Risk Profiles

Regional dynamics in the agricultural materials sector exhibit distinct opportunities and challenges across key geographies. In the Americas, robust adoption of precision agriculture technologies and supportive policies in the United States and Canada are fueling investments in digital platforms, yielding agri-tech revenues projected to surpass $18 billion by 2024. At the same time, looming secondary sanctions on Russian fertilizer imports threaten to disrupt supply chains for Brazil and Mexico, underscoring the fragility of reliance on a narrow set of global suppliers. Within Europe, Middle East & Africa, tightening pesticide import standards and emerging EU deforestation regulations are catalyzing demand for certified low-residue inputs, while infrastructure constraints in certain African markets present logistical hurdles for broad-based distribution. In Asia-Pacific, surging demand for higher crop productivity in China, India, and Southeast Asia is driving the uptake of advanced seed varieties and nutrient management solutions, making the region a hotbed for next-generation bio-based and controlled-release technologies.

This comprehensive research report examines key regions that drive the evolution of the Agriculture Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Agricultural Materials Companies’ Strategies, Innovations, and Competitive Approaches Driving Value Creation and Industry Leadership

Leading agricultural materials companies are deploying varied strategies to maintain and expand their market positions. Bayer, for instance, has committed to delivering ten blockbuster crop science innovations over the next decade as part of an R&D pipeline targeting regenerative agriculture and digital integration, reflecting peak sales potential surpassing €32 billion. Syngenta has embraced artificial intelligence across its research, with machine learning facilitating novel active ingredient discovery and delivering field-level soil health analytics via generative AI advisory tools, underscoring a shift toward data-driven agronomy. Corteva’s leadership in herbicide formulations has been tested by anti-dumping duties on 2,4-D, prompting closer collaboration with domestic supply chains to hedge future tariff risks. FMC’s partnership with Optibrium to leverage AI for rapid biopesticide candidate screening exemplifies the drive toward accelerated innovation cycles and precision-targeted solutions. Additionally, BASF and UPL are expanding dual-mode seed treatment portfolios and digital service offerings to enhance seed vigor and input efficiency across diverse crop environments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Agriculture Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGCO Corporation

- Archer-Daniels-Midland Company

- BASF SE

- Bayer AG

- Bunge Limited

- Cargill Incorporated

- CF Industries Holdings Inc.

- CNH Industrial N.V.

- Corteva Agriscience

- Deere & Company

- FMC Corporation

- ICL Group Ltd.

- Jain Irrigation Systems Ltd.

- K+S Aktiengesellschaft

- Kubota Corporation

- Lindsay Corporation

- Nufarm Limited

- Nutrien Ltd.

- Sumitomo Chemical Co. Ltd.

- Syngenta Group

- The Mosaic Company

- UPL Limited

- Wilbur-Ellis Company

- Yara International ASA

Strategic Actionable Recommendations for Industry Leaders to Navigate Volatility, Embrace Innovation, and Secure Competitive Advantage in Agricultural Inputs

Industry leaders must adopt a proactive stance to thrive in a landscape marked by policy shifts, supply chain uncertainties, and escalating sustainability demands. First, companies should diversify supply sources by forging regional manufacturing partnerships and investing in localized production hubs to reduce tariff exposure and logistical bottlenecks. Second, allocating R&D resources toward biological and RNAi-based crop protection chemistries will align portfolios with tightening regulatory standards while meeting grower preferences for eco-friendly alternatives. Third, stakeholders should accelerate digital transformation initiatives by integrating AI-powered decision support systems and IoT-enabled monitoring platforms to optimize input application rates, reduce waste, and deliver verifiable sustainability metrics. Finally, fostering collaborative ecosystems with technology providers, academic institutions, and farmer networks can facilitate knowledge transfer, enhance product adoption, and ensure resilience against disruptive market events.

Outlining the Rigorous Research Methodology Employed to Deliver Comprehensive Analytical Insights into Agricultural Materials and Market Dynamics

This analysis draws upon a structured research methodology combining both qualitative and quantitative techniques to deliver comprehensive insights. Initially, extensive secondary research surveyed publicly available sources, including government reports, regulatory filings, and industry publications, to establish a foundational understanding of current market dynamics. Subsequently, primary interviews were conducted with senior executives, agronomists, and supply chain experts to validate trends, uncover nuanced perspectives, and refine segmentation analyses. Data triangulation methodologies ensured accuracy by cross-referencing multiple data sets, while scenario planning exercises assessed the impacts of geopolitical events and regulatory changes on input costs and availability. Finally, thematic synthesis synthesized findings into strategic narratives, enabling actionable recommendations grounded in empirical evidence and expert consensus.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Agriculture Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Agriculture Materials Market, by Product Type

- Agriculture Materials Market, by Technology Type

- Agriculture Materials Market, by Form

- Agriculture Materials Market, by Application

- Agriculture Materials Market, by Distribution Channel

- Agriculture Materials Market, by Region

- Agriculture Materials Market, by Group

- Agriculture Materials Market, by Country

- United States Agriculture Materials Market

- China Agriculture Materials Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Powerful Conclusion Synthesizing Key Insights on Agricultural Materials Trends, Challenges, and Opportunities for Strategic Decision-Making in Farming

The evolution of agricultural materials is being shaped by an interplay of technological innovation, policy realignments, and shifting agronomic practices. Biological and digital solutions are rising to prominence, offering pathways to sustainable intensification and resilience against disruptions. Tariff implementations in 2025 have underscored the importance of diversified sourcing and localized production, while segmentation and regional analyses highlight varied growth trajectories across product types, applications, and geographies. Leading companies are charting distinct courses through R&D investments, strategic partnerships, and digital platform expansion. As the sector continues to adapt to environmental imperatives and market volatility, decision-makers equipped with rigorous, data-driven insights will be best positioned to capture emerging opportunities and mitigate risks in the dynamic arena of agricultural inputs.

Compelling Call To Action to Engage with Ketan Rohom for Acquiring In-Depth Market Research Report and Unlocking Data-Driven Agricultural Strategies

Are you poised to lead the conversation on the future of agricultural materials and gain a competitive edge with exclusive, data-driven insights? Reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to secure your copy of the comprehensive market research report. Ketan’s expertise in tailoring customized solutions will ensure you receive the most relevant findings and strategic recommendations to inform your organization’s approach to evolving industry dynamics. Contacting Ketan today will enable your team to harness the full spectrum of actionable intelligence and capitalize on emerging opportunities in agricultural inputs.

- How big is the Agriculture Materials Market?

- What is the Agriculture Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?